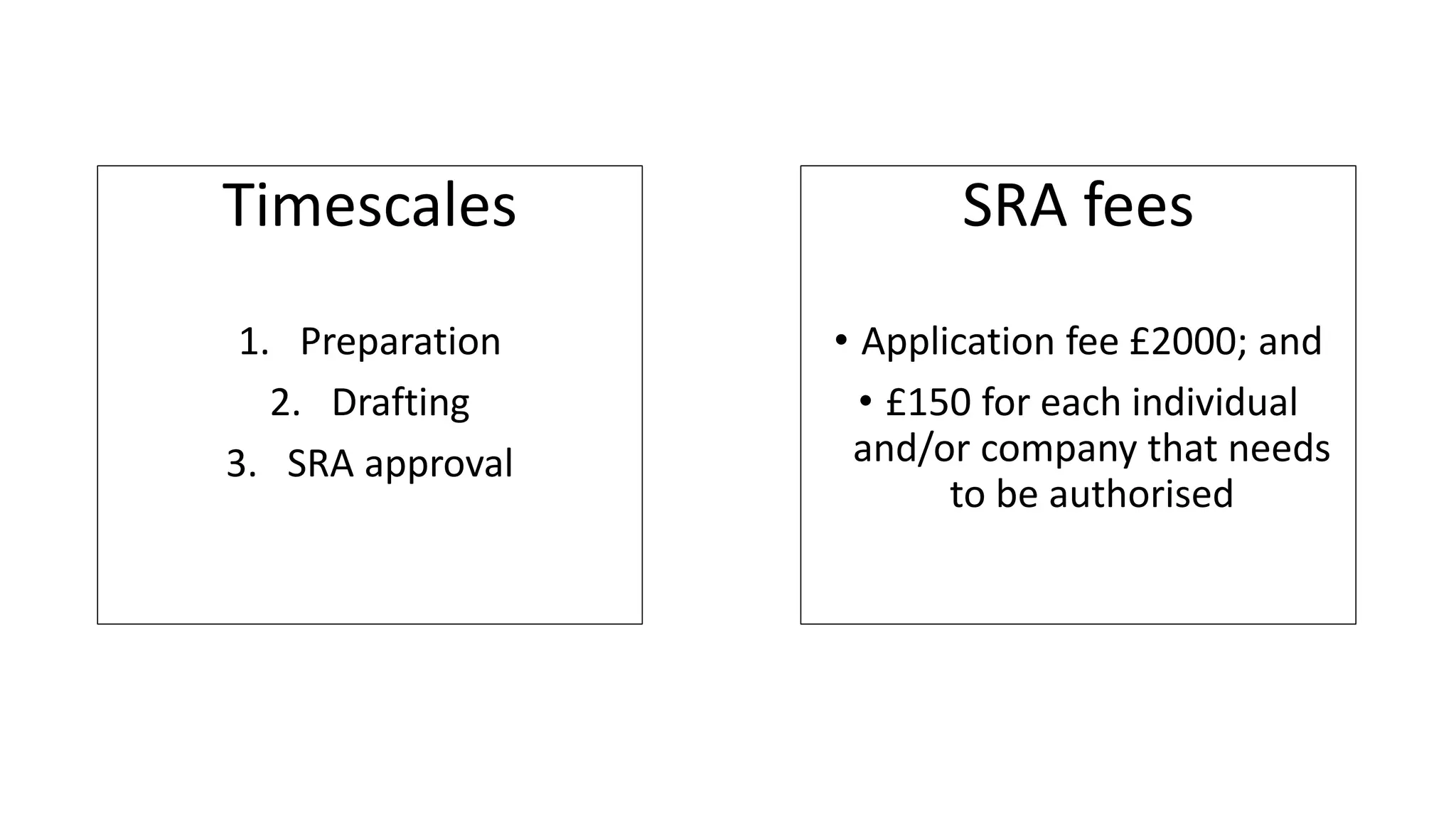

The document outlines the process to apply for an Alternative Business Structure (ABS) license under the Legal Services Act 2007, detailing necessary qualifications, application requirements, and common hurdles. It emphasizes the importance of a solid business plan, comprehensive documentation, and engaging fully with the authorization officer throughout the application process. Additionally, it highlights innovative opportunities and the benefits of compliance outsourcing for legal firms.