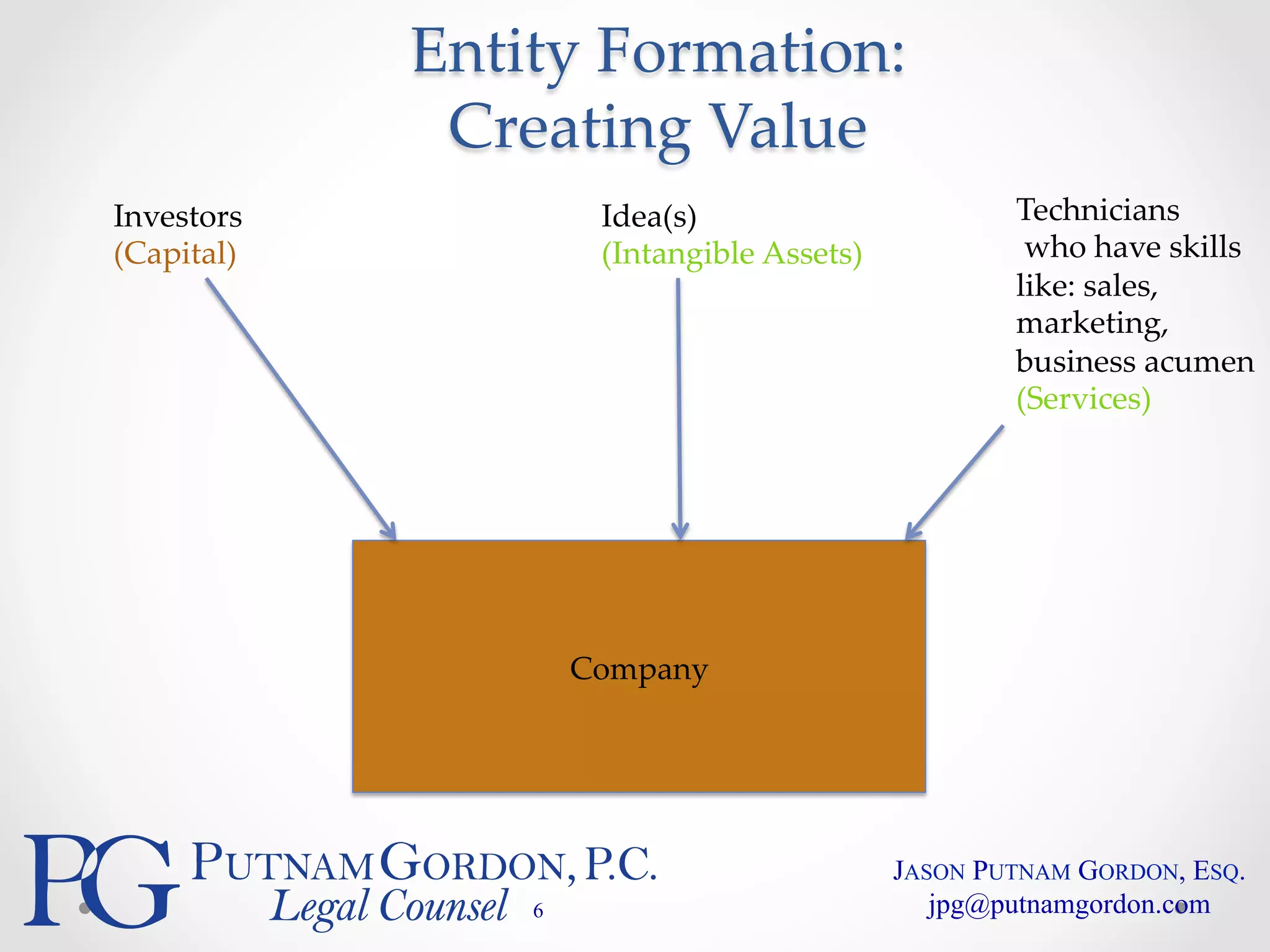

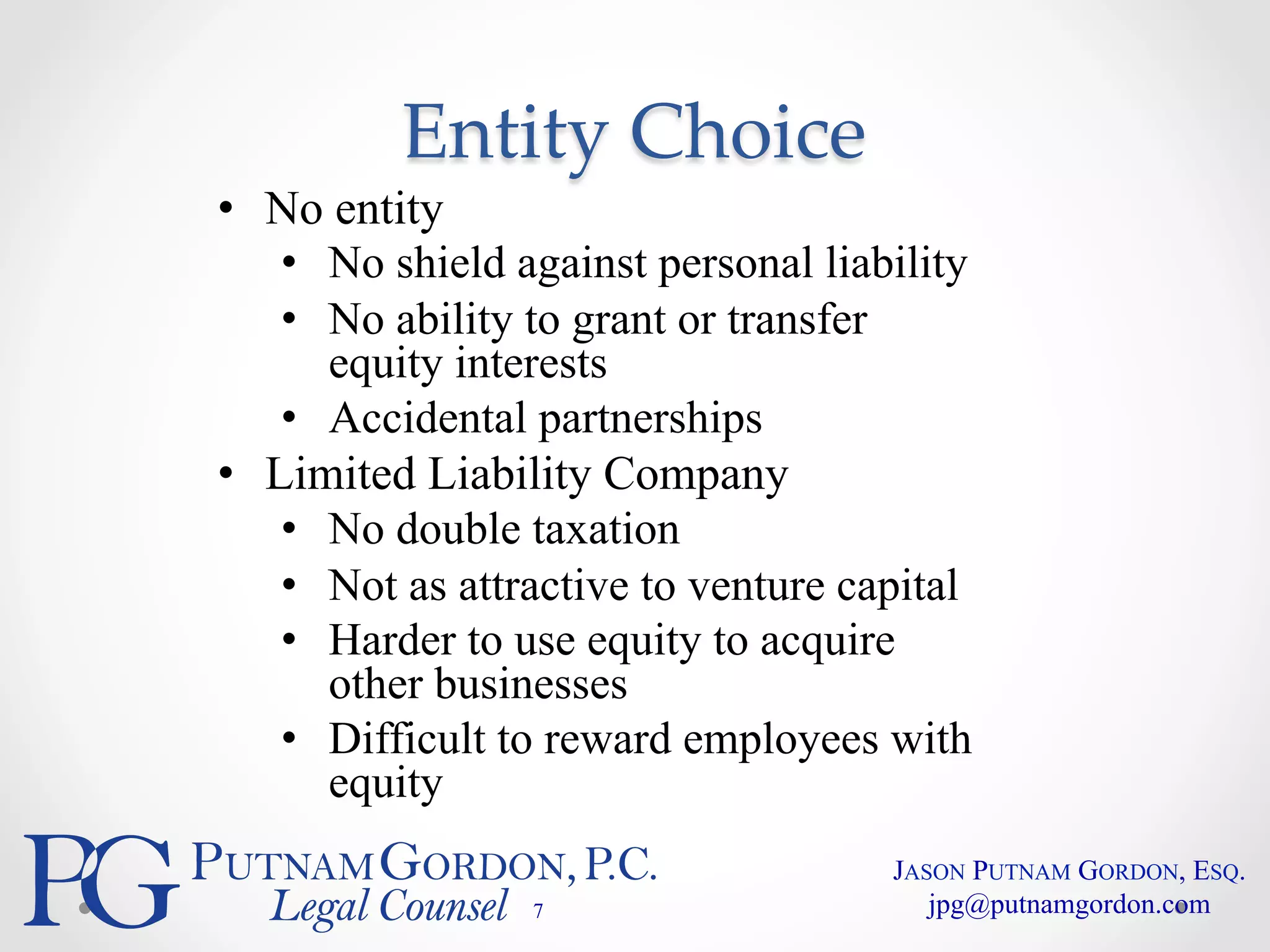

This document discusses entity formation and intellectual property protection for startups considering an initial public offering (IPO). It addresses choosing an entity structure like an LLC or corporation, initial ownership considerations around founder equity and vesting, and other common issues like hiring employees and financing options. The document also stresses the importance of intellectual property assignment agreements and trade secret protection for founders, employees, and third party intellectual property.