How to Amend/Correct/Rectify in Gst Returns

•

0 likes•114 views

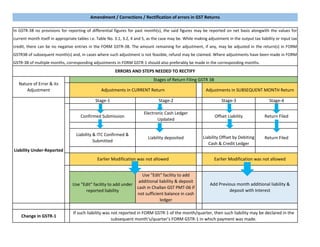

1) The document outlines the stages and processes for filing GST returns and rectifying errors in previous returns. It discusses four stages of return filing and the options for adjusting liability and ITC in the current or subsequent month's returns. 2) Errors like under-reporting, over-reporting, or wrong reporting of liability and ITC can be rectified by making adjustments in the current return using the "Edit" facility or in subsequent month's returns. Negative entries are not allowed so remaining balances may be claimed as a refund. 3) Amendments can also be made by filing Table 9 of the subsequent month/quarter's GSTR-1 if the error also affected the original GSTR-1. The

Report

Share

Report

Share

Download to read offline

Recommended

PPT on New GST Return System

The document provides an overview of the new proposed GST return system in India, which aims to simplify and streamline the process. Key aspects include:

- Introducing new forms like ANX-1 for outward supplies and ANX-2 for inward supplies that will replace the current GSTR forms.

- Providing three return filing options - Normal, Sahaj and Sugam - based on annual turnover, with quarterly or monthly filing frequency.

- Allowing real-time uploading of invoices on the portal and acceptance/rejection by recipients, as well as viewing suppliers' return filing status.

- Autopopulating 70-80% of return fields to reduce compliance burden while facilitating

Recap on GSTR 9

This document provides information and clarifications regarding the filing of annual GST returns for financial years 2017-18 and 2018-19. It discusses the due dates for filing annual returns and reconciliation statements which have been extended. It provides guidance for field officers on actions to ensure compliance with filing requirements. It also clarifies common questions around auto-population of returns, use of primary data sources, reporting of input tax credit, and information to be included in various tables of the annual return.

Functional Workflow and Related Queries regarding GST System

Functional Workflow and Related Queries regarding GST System covers :

• New Features in revised Model GST Law

• GSTR 1

– Happy Path

– Invoice, Invoice Upload

– Amendment

– Credit Note

– Advance received and liability without invoice declaration

– Unhappy Path

• GSTR 2A

– Before submission

– After Submission

• GSTR 2

– Acceptance

– Rejection

– Modification

– Addition

– Keep Pending

• GSTR 1A

• GSTR 3

• Mismatch Report and addition of Output Tax

– ITC Credit

– Reduction in Output Liability

– Mismatched supplies with E-Commerce Vendor

• Scenarios

• Challan

• Invoice Reference Number

Critical compliance for rectification of errors pertaining to fy 17 18 to be ...

Critical compliance for rectification of errors/omissions pertaining to Financial Year 2017-18 to be taken care in the GSTR-1 return for the month of September 2018

Gst returns

This document provides information about GST returns in India. It defines what a GST return is and details that are required to file returns such as purchases, sales, debit/credit notes, output and input tax credits. It outlines the different types of GST returns like GSTR-1, GSTR-3B, GSTR-9, etc. and provides details on what information is included in each return. It also discusses late filing fees and interest charges for late/delayed GST returns and extensions provided for return filing due dates during COVID-19. In the end, it briefly introduces the new proposed GST return system with simplified return forms.

New format of Gst returns from 1st April 2019

1) GST returns must generally be filed monthly by the 20th of the following month, except for small taxpayers, composition dealers, and other specified persons.

2) Small taxpayers have the option to file returns quarterly with monthly tax payments, claiming input tax credit on a self-declaration basis.

3) Suppliers can continuously upload invoices until the 10th of the next month, and recipients can claim input tax credit on invoices uploaded by that date.

Resolution of Common issues of GSTR 3B, GSTR 1 and TRAN 1 - Shared by GST Sev...

Resolution of Common issues of GSTR 3B, GSTR 1 and TRAN 1 - Shared by GST Sev...GST Seva Kendra, Tirchirapalli GST and C.Ex Commissionerate

Key Steps and Issues in filing GSTR 3B, GSTR 1 and TRAN 1 presented by Shashi Bhushan Singh VP, GSTN - Shared by GST Seva Kendra, Tiruchirapalli GST CommissionerateGST - Refunds Procedure and Compliance.pdf

The document summarizes the key points regarding GST refunds in India. It discusses the various types of refunds available under GST such as refund of unutilized input tax credit accumulated due to exports/SEZ supplies, inverted duty structure, etc. It provides details on the refund procedure including relevant dates, forms to be used, documents required and points to be noted. The summary also highlights the key changes introduced in the revised refund guidelines issued by CBIC in March 2020 regarding bunching of refund claims across financial years and restriction on input tax credit refund merely due to GST rate changes.

Recommended

PPT on New GST Return System

The document provides an overview of the new proposed GST return system in India, which aims to simplify and streamline the process. Key aspects include:

- Introducing new forms like ANX-1 for outward supplies and ANX-2 for inward supplies that will replace the current GSTR forms.

- Providing three return filing options - Normal, Sahaj and Sugam - based on annual turnover, with quarterly or monthly filing frequency.

- Allowing real-time uploading of invoices on the portal and acceptance/rejection by recipients, as well as viewing suppliers' return filing status.

- Autopopulating 70-80% of return fields to reduce compliance burden while facilitating

Recap on GSTR 9

This document provides information and clarifications regarding the filing of annual GST returns for financial years 2017-18 and 2018-19. It discusses the due dates for filing annual returns and reconciliation statements which have been extended. It provides guidance for field officers on actions to ensure compliance with filing requirements. It also clarifies common questions around auto-population of returns, use of primary data sources, reporting of input tax credit, and information to be included in various tables of the annual return.

Functional Workflow and Related Queries regarding GST System

Functional Workflow and Related Queries regarding GST System covers :

• New Features in revised Model GST Law

• GSTR 1

– Happy Path

– Invoice, Invoice Upload

– Amendment

– Credit Note

– Advance received and liability without invoice declaration

– Unhappy Path

• GSTR 2A

– Before submission

– After Submission

• GSTR 2

– Acceptance

– Rejection

– Modification

– Addition

– Keep Pending

• GSTR 1A

• GSTR 3

• Mismatch Report and addition of Output Tax

– ITC Credit

– Reduction in Output Liability

– Mismatched supplies with E-Commerce Vendor

• Scenarios

• Challan

• Invoice Reference Number

Critical compliance for rectification of errors pertaining to fy 17 18 to be ...

Critical compliance for rectification of errors/omissions pertaining to Financial Year 2017-18 to be taken care in the GSTR-1 return for the month of September 2018

Gst returns

This document provides information about GST returns in India. It defines what a GST return is and details that are required to file returns such as purchases, sales, debit/credit notes, output and input tax credits. It outlines the different types of GST returns like GSTR-1, GSTR-3B, GSTR-9, etc. and provides details on what information is included in each return. It also discusses late filing fees and interest charges for late/delayed GST returns and extensions provided for return filing due dates during COVID-19. In the end, it briefly introduces the new proposed GST return system with simplified return forms.

New format of Gst returns from 1st April 2019

1) GST returns must generally be filed monthly by the 20th of the following month, except for small taxpayers, composition dealers, and other specified persons.

2) Small taxpayers have the option to file returns quarterly with monthly tax payments, claiming input tax credit on a self-declaration basis.

3) Suppliers can continuously upload invoices until the 10th of the next month, and recipients can claim input tax credit on invoices uploaded by that date.

Resolution of Common issues of GSTR 3B, GSTR 1 and TRAN 1 - Shared by GST Sev...

Resolution of Common issues of GSTR 3B, GSTR 1 and TRAN 1 - Shared by GST Sev...GST Seva Kendra, Tirchirapalli GST and C.Ex Commissionerate

Key Steps and Issues in filing GSTR 3B, GSTR 1 and TRAN 1 presented by Shashi Bhushan Singh VP, GSTN - Shared by GST Seva Kendra, Tiruchirapalli GST CommissionerateGST - Refunds Procedure and Compliance.pdf

The document summarizes the key points regarding GST refunds in India. It discusses the various types of refunds available under GST such as refund of unutilized input tax credit accumulated due to exports/SEZ supplies, inverted duty structure, etc. It provides details on the refund procedure including relevant dates, forms to be used, documents required and points to be noted. The summary also highlights the key changes introduced in the revised refund guidelines issued by CBIC in March 2020 regarding bunching of refund claims across financial years and restriction on input tax credit refund merely due to GST rate changes.

Final return on_gst

1) A registered person is required to file periodic returns with details of outward supplies, inward supplies, input tax credit, and tax payable. Different returns include GSTR-1, GSTR-2, GSTR-3, and an annual return.

2) The first return filed after registration must include transaction details from the date of liability to register until the end of the month registration was granted.

3) Non-resident foreign taxpayers must file GSTR-5 within seven days of the expiry of their registration period in India.

GST update 27th july 2018

This document provides a summary and analysis of recommendations from the 28th GST Council meeting and subsequent notifications. Key points include:

1) A simplified return process was recommended involving a single monthly return filing with invoices uploaded continuously by buyers and sellers.

2) Taxpayers with up to Rs. 5 crore turnover will have the option to file quarterly returns with monthly tax payments. Simplified 'Sahaj' and 'Sugam' returns are introduced.

3) Several goods saw rationalization of tax rates in various notifications. Inverted duty refunds will now be allowed for textile sectors.

4) The rate of tax on canteen services provided in factories, schools, etc.

How to file gst return online in india

Check out the steps to follow while filing GST return online, Shared by SAGInfotech. GST Software - https://saginfotech.com/gst-software.aspx

Presentation on Returns in GST India (Janardhana Gouda)

Overview of Returns in GST, steps to file returns in GST India, Number of returns in GST, Due date for filing returns in GST India, Late Filing Fee in GST, Procedure to File Returns in GST etc.

Overview of filing return under GST

GST returns must be filed by taxpayers on a regular basis to report tax liabilities and claims. There are multiple GST return forms depending on the taxpayer category. Taxpayers must self-assess tax obligations and file monthly, quarterly, or annual returns reporting details of outward and inward supplies, input tax credit, tax payable, and tax paid. Input tax credit claims are matched against supplier returns and any discrepancies can result in credits being denied or reversed. Late fees may apply for failure to submit required returns by the due date.

2709172005 user manual combined

This document provides instructions for creating, submitting, and filing outward supply details in Form GSTR-1 in India. It outlines the following steps: 1) Log in and navigate to the GSTR-1 page, 2) Generate a GSTR-1 summary, 3) Enter details in various sections like invoices, credit/debit notes, exports, etc., 4) Preview and submit GSTR-1, 5) File GSTR-1 with a digital signature. It then provides detailed guidance on entering invoice details for B2B and B2C supplies.

Gst Alert 10 : Changes in registration and return filing norms

The document summarizes recent changes made to key GST rules in India that will impact how taxpayers avail credits and comply. Key changes include:

1) Stricter registration processes requiring Aadhaar authentication and increased processing times from 3 to 7 or 30 days.

2) Increased powers for officers to suspend or cancel registrations for violations like incorrect credit claims or return filing discrepancies.

3) Restrictions on input tax credit claims to 105% of the amount in GSTR 2B from January 2021.

4) Tighter return filing rules preventing filing if earlier returns are not filed and restrictions on using credits if returns are not filed.

5) A new rule restricting the use of

GST Alert 10 Changes in Registration and Return filing norms

The document summarizes recent changes made to key GST rules in India that will impact how taxpayers avail credits and comply. Key changes include:

1) Stricter registration processes requiring Aadhaar authentication and increased processing times from 3 to 7 or 30 days.

2) Increased powers for officers to suspend or cancel registrations for violations like incorrect credit claims or return filing discrepancies.

3) Restrictions on input tax credit claims to 105% of the amount in GSTR 2B from January 2021.

4) Tighter return filing rules preventing filing if earlier returns are not filed and restrictions on using credits if returns are not filed.

5) A new rule restricting the use of

Returns

This document provides an overview of the key GST return forms and processes in India. It discusses the various monthly, annual and other periodic returns that must be filed, including GSTR-1 for outward supplies, GSTR-2 for inward supplies, and GSTR-3 for the consolidated monthly return. It outlines the returns due dates and details to be provided. It also summarizes the process for matching inward and outward supplies between buyer and seller, communicating discrepancies, and rectifying errors. Finally, it briefly discusses the first return, final return, annual return, and penalties for non-compliance.

PPT on GSTR 9C

With the introduction of the concept of GST Audit, it is important to know and taken int consideration various facts that is needed before we conduct GST Audit. In this presentation, we have covered the concept of filing of GSTR 9C, its applicability and various other topics that one should take care of. The presentation also covers an example of GSTR 9C based upon a hypothetical case. The PPT is a one shot compilation of various topics associated with GSTR 9C - GST Audit.

Amended Resident Income Tax Return Instructions

This document provides instructions for completing Form 80-170, the Mississippi Resident Amended Individual Income Tax Return for 2008. Key points include:

- Form 80-170 is used to amend a previously filed 2008 Mississippi individual income tax return.

- The amended return should include all information from the original filing in addition to an explanation of any changes.

- Line items should be completed based on amounts from the original return unless being amended, in which case the box next to the line number should be shaded.

- Supporting documents like W-2s and schedules must be attached along with an explanation of any amended amounts.

Tax Audit - Changes in form 3CD - August 2014

The Indian tax authorities have amended the tax audit report format recently. The changes are drastic and cast a huge responsibility on the already burdened tax auditors. The changes are discussed in this presentation.

The Revised Guidance Note on Tax Audit issued by ICAI has also been considered while preparing this presentation.

Only the new clauses or the amended clauses have been considered. The clauses that have not undergone any change have not been considered.

GSTR-3B: Filing, Rules, and Reconciliations | Academy Tax4wealth

GSTR-3B is a monthly summary return form under the GST. GSTR-3B serves as a summary statement of a taxpayer & outward supplies, inward supplies are liable to reverse charge, input tax credit claimed, and tax liability for a particular tax period.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/e-invoicing

Improvements in GSTR-1 filing - TaxGyata

A revamped & enhanced version of GSTR-1/IFF is being made available on the GST Portal to improve the taxpayer experience.

Read more: https://www.taxgyata.com/ap/improvements-in-gstr-1-filing/

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credit, and reconciliations to ensure all transactions are recorded properly.

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credits, and reconciliations to ensure all transactions are recorded properly.

3CD and 3CB by CA Rajesh Condoor

The document discusses guidance related to Form 3CB and Form 3CD for tax audits based on new guidance notes. Some key points discussed include:

- Details that should be reported in Form 3CB for persons required to get tax audits but not other audits.

- Information to be provided in various clauses of Form 3CD, including names of partners/members, nature of business, books of accounts maintained, accounting methods used, details of depreciation claimed.

- Treatment of items like VAT, capital assets converted to stock, other income items in the tax audit reporting forms.

The document provides explanation and guidance on correctly filling various clauses of Form 3CB and Form 3CD for tax audit

IAS-08 (Ammara Qasim).pptx

This document summarizes the key aspects of IAS 8 regarding accounting policies, changes in accounting policies, accounting estimates, and errors. It discusses how accounting policies are determined, the requirements for consistency and changes in policies, the treatment of estimates and errors, and disclosure requirements. A change in policy is applied retrospectively while a change in estimate is recognized prospectively. Prior period errors are corrected by restating comparative amounts or adjusting opening balances, with disclosure of corrections.

GSTR gggggggggggggggggggggggggggggg.pptx

GSTR-9 is the annual return to be filed by registered taxpayers under GST. It consolidates the information furnished in monthly/quarterly returns filed during the year. It consists of details of supplies made and received under different tax heads. All registered taxpayers must file GSTR-9 by 31st December of the subsequent financial year. GSTR-9 has 6 parts with 19 tables seeking details of outward and inward supplies, input tax credit claimed, taxes paid, transactions declared in returns filed for the previous financial year and other information like late fee payable. It helps in reconciliation and analysis of information reported in regular returns filed during the year.

Issues in e filing of tax audit reports for ay 2014-15

The format of the tax audit report that an Indian tax auditor issues has undergone considerable changes in July, 2014. The e-filing of the same also throws up multiple challenges. This presentation deals with some of the important issues that an auditor is likely to face while electronically filing the tax audit report.

Daily Newsletter 23.10.2020

“The greater our knowledge increases, the greater our ignorance unfolds.”- Good Morning, attached today's newsletter 23.10.2020.

Daily Newsletter 22.10.2020

“Sharing your knowledge with others does not make you less important.”- Good morning attached today's newsletter 22.10.2020

More Related Content

Similar to How to Amend/Correct/Rectify in Gst Returns

Final return on_gst

1) A registered person is required to file periodic returns with details of outward supplies, inward supplies, input tax credit, and tax payable. Different returns include GSTR-1, GSTR-2, GSTR-3, and an annual return.

2) The first return filed after registration must include transaction details from the date of liability to register until the end of the month registration was granted.

3) Non-resident foreign taxpayers must file GSTR-5 within seven days of the expiry of their registration period in India.

GST update 27th july 2018

This document provides a summary and analysis of recommendations from the 28th GST Council meeting and subsequent notifications. Key points include:

1) A simplified return process was recommended involving a single monthly return filing with invoices uploaded continuously by buyers and sellers.

2) Taxpayers with up to Rs. 5 crore turnover will have the option to file quarterly returns with monthly tax payments. Simplified 'Sahaj' and 'Sugam' returns are introduced.

3) Several goods saw rationalization of tax rates in various notifications. Inverted duty refunds will now be allowed for textile sectors.

4) The rate of tax on canteen services provided in factories, schools, etc.

How to file gst return online in india

Check out the steps to follow while filing GST return online, Shared by SAGInfotech. GST Software - https://saginfotech.com/gst-software.aspx

Presentation on Returns in GST India (Janardhana Gouda)

Overview of Returns in GST, steps to file returns in GST India, Number of returns in GST, Due date for filing returns in GST India, Late Filing Fee in GST, Procedure to File Returns in GST etc.

Overview of filing return under GST

GST returns must be filed by taxpayers on a regular basis to report tax liabilities and claims. There are multiple GST return forms depending on the taxpayer category. Taxpayers must self-assess tax obligations and file monthly, quarterly, or annual returns reporting details of outward and inward supplies, input tax credit, tax payable, and tax paid. Input tax credit claims are matched against supplier returns and any discrepancies can result in credits being denied or reversed. Late fees may apply for failure to submit required returns by the due date.

2709172005 user manual combined

This document provides instructions for creating, submitting, and filing outward supply details in Form GSTR-1 in India. It outlines the following steps: 1) Log in and navigate to the GSTR-1 page, 2) Generate a GSTR-1 summary, 3) Enter details in various sections like invoices, credit/debit notes, exports, etc., 4) Preview and submit GSTR-1, 5) File GSTR-1 with a digital signature. It then provides detailed guidance on entering invoice details for B2B and B2C supplies.

Gst Alert 10 : Changes in registration and return filing norms

The document summarizes recent changes made to key GST rules in India that will impact how taxpayers avail credits and comply. Key changes include:

1) Stricter registration processes requiring Aadhaar authentication and increased processing times from 3 to 7 or 30 days.

2) Increased powers for officers to suspend or cancel registrations for violations like incorrect credit claims or return filing discrepancies.

3) Restrictions on input tax credit claims to 105% of the amount in GSTR 2B from January 2021.

4) Tighter return filing rules preventing filing if earlier returns are not filed and restrictions on using credits if returns are not filed.

5) A new rule restricting the use of

GST Alert 10 Changes in Registration and Return filing norms

The document summarizes recent changes made to key GST rules in India that will impact how taxpayers avail credits and comply. Key changes include:

1) Stricter registration processes requiring Aadhaar authentication and increased processing times from 3 to 7 or 30 days.

2) Increased powers for officers to suspend or cancel registrations for violations like incorrect credit claims or return filing discrepancies.

3) Restrictions on input tax credit claims to 105% of the amount in GSTR 2B from January 2021.

4) Tighter return filing rules preventing filing if earlier returns are not filed and restrictions on using credits if returns are not filed.

5) A new rule restricting the use of

Returns

This document provides an overview of the key GST return forms and processes in India. It discusses the various monthly, annual and other periodic returns that must be filed, including GSTR-1 for outward supplies, GSTR-2 for inward supplies, and GSTR-3 for the consolidated monthly return. It outlines the returns due dates and details to be provided. It also summarizes the process for matching inward and outward supplies between buyer and seller, communicating discrepancies, and rectifying errors. Finally, it briefly discusses the first return, final return, annual return, and penalties for non-compliance.

PPT on GSTR 9C

With the introduction of the concept of GST Audit, it is important to know and taken int consideration various facts that is needed before we conduct GST Audit. In this presentation, we have covered the concept of filing of GSTR 9C, its applicability and various other topics that one should take care of. The presentation also covers an example of GSTR 9C based upon a hypothetical case. The PPT is a one shot compilation of various topics associated with GSTR 9C - GST Audit.

Amended Resident Income Tax Return Instructions

This document provides instructions for completing Form 80-170, the Mississippi Resident Amended Individual Income Tax Return for 2008. Key points include:

- Form 80-170 is used to amend a previously filed 2008 Mississippi individual income tax return.

- The amended return should include all information from the original filing in addition to an explanation of any changes.

- Line items should be completed based on amounts from the original return unless being amended, in which case the box next to the line number should be shaded.

- Supporting documents like W-2s and schedules must be attached along with an explanation of any amended amounts.

Tax Audit - Changes in form 3CD - August 2014

The Indian tax authorities have amended the tax audit report format recently. The changes are drastic and cast a huge responsibility on the already burdened tax auditors. The changes are discussed in this presentation.

The Revised Guidance Note on Tax Audit issued by ICAI has also been considered while preparing this presentation.

Only the new clauses or the amended clauses have been considered. The clauses that have not undergone any change have not been considered.

GSTR-3B: Filing, Rules, and Reconciliations | Academy Tax4wealth

GSTR-3B is a monthly summary return form under the GST. GSTR-3B serves as a summary statement of a taxpayer & outward supplies, inward supplies are liable to reverse charge, input tax credit claimed, and tax liability for a particular tax period.

For more information, visit us at:-

https://academy.tax4wealth.com/blog/e-invoicing

Improvements in GSTR-1 filing - TaxGyata

A revamped & enhanced version of GSTR-1/IFF is being made available on the GST Portal to improve the taxpayer experience.

Read more: https://www.taxgyata.com/ap/improvements-in-gstr-1-filing/

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credit, and reconciliations to ensure all transactions are recorded properly.

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credits, and reconciliations to ensure all transactions are recorded properly.

3CD and 3CB by CA Rajesh Condoor

The document discusses guidance related to Form 3CB and Form 3CD for tax audits based on new guidance notes. Some key points discussed include:

- Details that should be reported in Form 3CB for persons required to get tax audits but not other audits.

- Information to be provided in various clauses of Form 3CD, including names of partners/members, nature of business, books of accounts maintained, accounting methods used, details of depreciation claimed.

- Treatment of items like VAT, capital assets converted to stock, other income items in the tax audit reporting forms.

The document provides explanation and guidance on correctly filling various clauses of Form 3CB and Form 3CD for tax audit

IAS-08 (Ammara Qasim).pptx

This document summarizes the key aspects of IAS 8 regarding accounting policies, changes in accounting policies, accounting estimates, and errors. It discusses how accounting policies are determined, the requirements for consistency and changes in policies, the treatment of estimates and errors, and disclosure requirements. A change in policy is applied retrospectively while a change in estimate is recognized prospectively. Prior period errors are corrected by restating comparative amounts or adjusting opening balances, with disclosure of corrections.

GSTR gggggggggggggggggggggggggggggg.pptx

GSTR-9 is the annual return to be filed by registered taxpayers under GST. It consolidates the information furnished in monthly/quarterly returns filed during the year. It consists of details of supplies made and received under different tax heads. All registered taxpayers must file GSTR-9 by 31st December of the subsequent financial year. GSTR-9 has 6 parts with 19 tables seeking details of outward and inward supplies, input tax credit claimed, taxes paid, transactions declared in returns filed for the previous financial year and other information like late fee payable. It helps in reconciliation and analysis of information reported in regular returns filed during the year.

Issues in e filing of tax audit reports for ay 2014-15

The format of the tax audit report that an Indian tax auditor issues has undergone considerable changes in July, 2014. The e-filing of the same also throws up multiple challenges. This presentation deals with some of the important issues that an auditor is likely to face while electronically filing the tax audit report.

Similar to How to Amend/Correct/Rectify in Gst Returns (20)

Presentation on Returns in GST India (Janardhana Gouda)

Presentation on Returns in GST India (Janardhana Gouda)

Gst Alert 10 : Changes in registration and return filing norms

Gst Alert 10 : Changes in registration and return filing norms

GST Alert 10 Changes in Registration and Return filing norms

GST Alert 10 Changes in Registration and Return filing norms

GSTR-3B: Filing, Rules, and Reconciliations | Academy Tax4wealth

GSTR-3B: Filing, Rules, and Reconciliations | Academy Tax4wealth

Issues in e filing of tax audit reports for ay 2014-15

Issues in e filing of tax audit reports for ay 2014-15

More from CA PRADEEP GOYAL

Daily Newsletter 23.10.2020

“The greater our knowledge increases, the greater our ignorance unfolds.”- Good Morning, attached today's newsletter 23.10.2020.

Daily Newsletter 22.10.2020

“Sharing your knowledge with others does not make you less important.”- Good morning attached today's newsletter 22.10.2020

Daily Newsletter 20.10.2020

“Be a lifelong student. The more you learn, the more you earn and more self-confidence you will have.” Good morning, attached today's newsletter 20.10.2020. Good day ahead.

Daily Newsletter 17.10.2020

"Without knowledge action is useless and knowledge without action is futile"- Good morning, attached today's newsletter 17.10.2020. Have a great weekend.

Daily Newsletter 14.10.2020

The beautiful thing about learning is that nobody can take it away from you.” Good Morning , attached today's newsletter 14.10.2020

Daily Newsletter 13.10.2020

"Knowledge is like money: to be of value it must circulate, and in circulating it can increase in quantity and, hopefully, in value"- Hi attached today's Newsletter 13.10.2020. Good Day ahead.

Daily Newsletter 09.10.2020

This daily newsletter provides legal updates from various authorities like AAAR, NCLT, NCLAT and High Courts/Supreme Court on topics like GST, insolvency and corporate laws. It also includes announcements from ICAI and ICSI on examinations, webinars, and other programs. Regulatory updates from RBI, SEBI on revised FAQs on insider trading regulations and inter-scheme transfers are also included. Reports on MSME loans under credit guarantee scheme touching Rs. 1.87 lakh crores benefiting 50.7 lakh MSMEs and extension of interest subvention scheme for MSME loans are part of the economic and finance news.

Daily Newsletter 07.10.2020

“Knowledge is a weapon. I intend to be formidably armed.” Good Morning, Attached today's newsletter 07.10.2020.

Daily Newsletter 02.10.2020

This daily newsletter provides updates on Indian tax laws, corporate laws, and economic policies. It summarizes recent notifications on e-invoicing requirements being relaxed until October 31st for certain businesses. It also summarizes GST revenue collection amounts for September 2020. Additionally, it announces upcoming training events and links to papers on insolvency and bankruptcy laws in India.

Daily Newsletter 01.10.2020

The document is a newsletter providing updates on various legal, regulatory and economic topics. It summarizes recent notifications, circulars, and amendments related to GST, income tax, insolvency and bankruptcy code and other topics. It also provides brief summaries of recent court judgments. The key updates include amendments to CGST Act 2017, extension of various GST compliance deadlines, updates on tax refunds and changes to the insolvency examination syllabus.

Daily Newsletter 30.09.2020

“That knowledge which purifies the mind and heart alone is true knowledge, all else is only a negation of knowledge.” Hi Good morning, attached today's Newsletter 30.09.2020. Good Day ahead.

Daily Newsletter 29.09.2020

“Education is the ability to listen to almost anything without losing your temper or self-confidence.” Hi good morning, attached today's newsletter 29.09.2020

Daily Newsletter dated 26.09,2020

“Be a lifelong student. The more you learn, the more you earn and more self-confidence you will have.” Good morning, attached today's newsletter 26.09.2002

Daily Newsletter 25.09.2020

In today’s environment, hoarding knowledge ultimately erodes your power. If you know something very important, the way to get power is by actually sharing it.- Good morning attached today's newsletter 25.09.2020.

Daily Newsletter 23.09.2020

“Knowledge is learning something every day. Wisdom is letting go of something every day.” Good morning, today's newsletter 23.09.2020

Daily Newsletter 17.09.2020

Knowledge is always changing. For the moment, the best approach to managing it is one that keeps things moving along while keeping options open. Good morning attached today's Newsletter 19.09.2020.

Daily Newsletter 17.09.2020

“Knowledge is like a garden; if it is not cultivated, it cannot be harvested.” Hi Good morning, attached today's newsletter dated 17.09.2020. have a great day ahead

Daily Newsletter 12.09.2020

"Live as if you were to die tomorrow. Learn as if you were to live forever.” Good Morning, attached today's Newsletter 12.09.2020.

Daily Newsletter 11.09.2020

The more extensive a man’s knowledge of what has been done, the greater will be his power

of knowing what to do"- Good Morning, attached today's newsletter 11.09.2020. Have a great weekend.

Daily Newsletter 03.09.2020

This document is a daily newsletter covering topics related to indirect taxes, direct taxes, corporate law, insolvency and bankruptcy, SEBI updates, MSME related updates, RBI updates, and economy and finance. It provides summaries of recent notifications, circulars, press releases, and legal updates. It also summarizes some news articles related to the covered topics. The newsletter is intended to keep professionals updated on recent changes and developments.

More from CA PRADEEP GOYAL (20)

Recently uploaded

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Denis is a dynamic and results-driven Chief Information Officer (CIO) with a distinguished career spanning information systems analysis and technical project management. With a proven track record of spearheading the design and delivery of cutting-edge Information Management solutions, he has consistently elevated business operations, streamlined reporting functions, and maximized process efficiency.

Certified as an ISO/IEC 27001: Information Security Management Systems (ISMS) Lead Implementer, Data Protection Officer, and Cyber Risks Analyst, Denis brings a heightened focus on data security, privacy, and cyber resilience to every endeavor.

His expertise extends across a diverse spectrum of reporting, database, and web development applications, underpinned by an exceptional grasp of data storage and virtualization technologies. His proficiency in application testing, database administration, and data cleansing ensures seamless execution of complex projects.

What sets Denis apart is his comprehensive understanding of Business and Systems Analysis technologies, honed through involvement in all phases of the Software Development Lifecycle (SDLC). From meticulous requirements gathering to precise analysis, innovative design, rigorous development, thorough testing, and successful implementation, he has consistently delivered exceptional results.

Throughout his career, he has taken on multifaceted roles, from leading technical project management teams to owning solutions that drive operational excellence. His conscientious and proactive approach is unwavering, whether he is working independently or collaboratively within a team. His ability to connect with colleagues on a personal level underscores his commitment to fostering a harmonious and productive workplace environment.

Date: May 29, 2024

Tags: Information Security, ISO/IEC 27001, ISO/IEC 42001, Artificial Intelligence, GDPR

-------------------------------------------------------------------------------

Find out more about ISO training and certification services

Training: ISO/IEC 27001 Information Security Management System - EN | PECB

ISO/IEC 42001 Artificial Intelligence Management System - EN | PECB

General Data Protection Regulation (GDPR) - Training Courses - EN | PECB

Webinars: https://pecb.com/webinars

Article: https://pecb.com/article

-------------------------------------------------------------------------------

For more information about PECB:

Website: https://pecb.com/

LinkedIn: https://www.linkedin.com/company/pecb/

Facebook: https://www.facebook.com/PECBInternational/

Slideshare: http://www.slideshare.net/PECBCERTIFICATION

Hindi varnamala | hindi alphabet PPT.pdf

हिंदी वर्णमाला पीपीटी, hindi alphabet PPT presentation, hindi varnamala PPT, Hindi Varnamala pdf, हिंदी स्वर, हिंदी व्यंजन, sikhiye hindi varnmala, dr. mulla adam ali, hindi language and literature, hindi alphabet with drawing, hindi alphabet pdf, hindi varnamala for childrens, hindi language, hindi varnamala practice for kids, https://www.drmullaadamali.com

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptxMohd Adib Abd Muin, Senior Lecturer at Universiti Utara Malaysia

This slide is special for master students (MIBS & MIFB) in UUM. Also useful for readers who are interested in the topic of contemporary Islamic banking.

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

This Dissertation explores the particular circumstances of Mirzapur, a region located in the

core of India. Mirzapur, with its varied terrains and abundant biodiversity, offers an optimal

environment for investigating the changes in vegetation cover dynamics. Our study utilizes

advanced technologies such as GIS (Geographic Information Systems) and Remote sensing to

analyze the transformations that have taken place over the course of a decade.

The complex relationship between human activities and the environment has been the focus

of extensive research and worry. As the global community grapples with swift urbanization,

population expansion, and economic progress, the effects on natural ecosystems are becoming

more evident. A crucial element of this impact is the alteration of vegetation cover, which plays a

significant role in maintaining the ecological equilibrium of our planet.Land serves as the foundation for all human activities and provides the necessary materials for

these activities. As the most crucial natural resource, its utilization by humans results in different

'Land uses,' which are determined by both human activities and the physical characteristics of the

land.

The utilization of land is impacted by human needs and environmental factors. In countries

like India, rapid population growth and the emphasis on extensive resource exploitation can lead

to significant land degradation, adversely affecting the region's land cover.

Therefore, human intervention has significantly influenced land use patterns over many

centuries, evolving its structure over time and space. In the present era, these changes have

accelerated due to factors such as agriculture and urbanization. Information regarding land use and

cover is essential for various planning and management tasks related to the Earth's surface,

providing crucial environmental data for scientific, resource management, policy purposes, and

diverse human activities.

Accurate understanding of land use and cover is imperative for the development planning

of any area. Consequently, a wide range of professionals, including earth system scientists, land

and water managers, and urban planners, are interested in obtaining data on land use and cover

changes, conversion trends, and other related patterns. The spatial dimensions of land use and

cover support policymakers and scientists in making well-informed decisions, as alterations in

these patterns indicate shifts in economic and social conditions. Monitoring such changes with the

help of Advanced technologies like Remote Sensing and Geographic Information Systems is

crucial for coordinated efforts across different administrative levels. Advanced technologies like

Remote Sensing and Geographic Information Systems

9

Changes in vegetation cover refer to variations in the distribution, composition, and overall

structure of plant communities across different temporal and spatial scales. These changes can

occur natural.

Pengantar Penggunaan Flutter - Dart programming language1.pptx

Pengantar Penggunaan Flutter - Dart programming language1.pptx

Community pharmacy- Social and preventive pharmacy UNIT 5

Covered community pharmacy topic of the subject Social and preventive pharmacy for Diploma and Bachelor of pharmacy

The History of Stoke Newington Street Names

Presented at the Stoke Newington Literary Festival on 9th June 2024

www.StokeNewingtonHistory.com

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

Natural birth techniques - Mrs.Akanksha Trivedi Rama UniversityAkanksha trivedi rama nursing college kanpur.

Natural birth techniques are various type such as/ water birth , alexender method, hypnosis, bradley method, lamaze method etcHow to Fix the Import Error in the Odoo 17

An import error occurs when a program fails to import a module or library, disrupting its execution. In languages like Python, this issue arises when the specified module cannot be found or accessed, hindering the program's functionality. Resolving import errors is crucial for maintaining smooth software operation and uninterrupted development processes.

How to Setup Warehouse & Location in Odoo 17 Inventory

In this slide, we'll explore how to set up warehouses and locations in Odoo 17 Inventory. This will help us manage our stock effectively, track inventory levels, and streamline warehouse operations.

How to Manage Your Lost Opportunities in Odoo 17 CRM

Odoo 17 CRM allows us to track why we lose sales opportunities with "Lost Reasons." This helps analyze our sales process and identify areas for improvement. Here's how to configure lost reasons in Odoo 17 CRM

Advanced Java[Extra Concepts, Not Difficult].docx![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Advanced Java[Extra Concepts, Not Difficult].docx](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This is part 2 of my Java Learning Journey. This contains Hashing, ArrayList, LinkedList, Date and Time Classes, Calendar Class and more.

Main Java[All of the Base Concepts}.docx

This is part 1 of my Java Learning Journey. This Contains Custom methods, classes, constructors, packages, multithreading , try- catch block, finally block and more.

Recently uploaded (20)

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

ISO/IEC 27001, ISO/IEC 42001, and GDPR: Best Practices for Implementation and...

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

Chapter 4 - Islamic Financial Institutions in Malaysia.pptx

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

LAND USE LAND COVER AND NDVI OF MIRZAPUR DISTRICT, UP

Pengantar Penggunaan Flutter - Dart programming language1.pptx

Pengantar Penggunaan Flutter - Dart programming language1.pptx

Digital Artefact 1 - Tiny Home Environmental Design

Digital Artefact 1 - Tiny Home Environmental Design

Community pharmacy- Social and preventive pharmacy UNIT 5

Community pharmacy- Social and preventive pharmacy UNIT 5

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

Natural birth techniques - Mrs.Akanksha Trivedi Rama University

How to Setup Warehouse & Location in Odoo 17 Inventory

How to Setup Warehouse & Location in Odoo 17 Inventory

Pride Month Slides 2024 David Douglas School District

Pride Month Slides 2024 David Douglas School District

How to Manage Your Lost Opportunities in Odoo 17 CRM

How to Manage Your Lost Opportunities in Odoo 17 CRM

How to Amend/Correct/Rectify in Gst Returns

- 1. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to add under reported liability Use "Edit" facility to add additional liability & deposit cash in Challan GST PMT-06 if not sufficient balance in cash ledger Change in GSTR-1 If such liability was not reported in FORM GSTR-1 of the month/quarter, then such liability may be declared in the subsequent month’s/quarter’s FORM GSTR-1 in which payment was made. Liability Under-Reported Earlier Modification was not allowed Earlier Modification was not allowed Add Previous month additional liability & deposit with Interest Amendment / Corrections / Rectification of errors in GST Returns In GSTR-3B no provisions for reporting of differential figures for past month(s), the said figures may be reported on net basis alongwith the values for current month itself in appropriate tables i.e. Table No. 3.1, 3.2, 4 and 5, as the case may be. While making adjustment in the output tax liability or input tax credit, there can be no negative entries in the FORM GSTR-3B. The amount remaining for adjustment, if any, may be adjusted in the return(s) in FORM GSTR3B of subsequent month(s) and, in cases where such adjustment is not feasible, refund may be claimed. Where adjustments have been made in FORM GSTR-3B of multiple months, corresponding adjustments in FORM GSTR-1 should also preferably be made in the corresponding months. ERRORS AND STEPS NEEDED TO RECTIFY Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return

- 2. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to reduce over reported liability Use "Edit" facility to reduce over-reported liability, offset correct liability with cash ledger and apply for extra amount as refund or carry forward for future liability. Change in GSTR-1 Where the liability was over reported in the month’s / quarter’s FORM GSTR-1 also, then such liability may be amended through amendments under Table 9 of FORM GSTR-1 Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return Liability Over-Reported Earlier Modification was not allowed Earlier Modification was not allowed Liability may be adjusted in return of subsequent month(s) or refund may be claimed where adjustment is not feasible

- 3. Stage-1 Stage-2 Stage-3 Stage-4 Confirmed Submission Electronic Cash Ledger Updated Offset Liability Return Filed Liability & ITC Confirmed & Submitted Liability deposited Liability Offset by Debiting Cash & Credit Ledger Return Filed Use "Edit" facility to rectify wrong liability reported Use “Edit” facility to rectify wrongly reported liability and cash ledger may be debited to offset new liability, where sufficient balances are not available in the credit ledger. Remaining balance, if any may be either claimed as refund or used to offset future liabilities Change in GSTR-1 (Source: Circular No. 26/26/2017-GST Dated 29 December 2017 issued by GST Policy Wing of CBEC: F.No.349/164/2017/-GST) File for amendments by filling Table 9 of the subsequent month’s / quarter’s FORM GSTR-1. Same process for Under-Reported ITC, Over-Reported ITC and Wrong Reported ITC be adopted Liability wrongly Reported Earlier Modification was not allowed Earlier Modification was not allowed Unreported liability may be added in the next month‟s return with interest, if applicable. Also, adjustment may be made in return of subsequent month(s) or refund may be claimed where adjustment is not feasible Nature of Error & its Adjustment Stages of Return Filing GSTR 3B Adjustments in CURRENT Return Adjustments in SUBSEQUENT MONTH Return