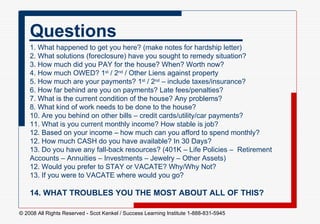

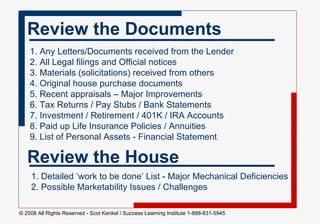

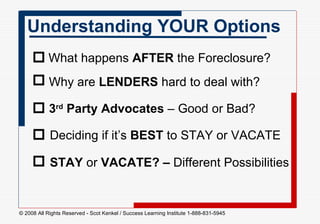

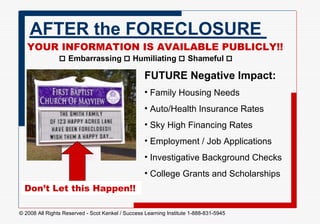

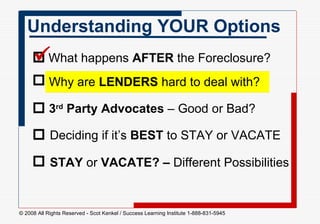

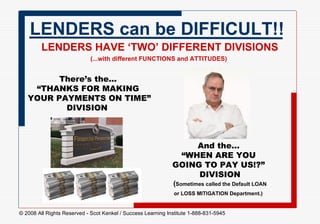

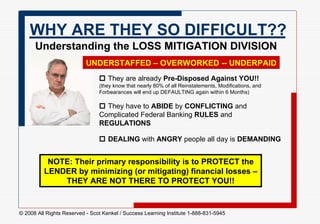

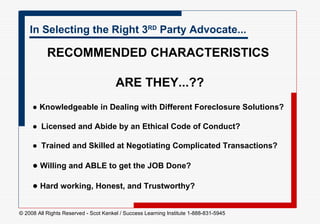

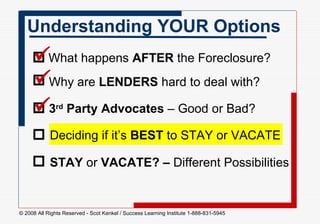

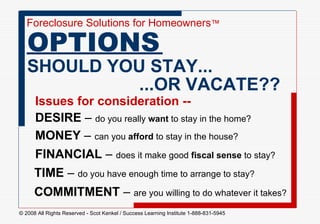

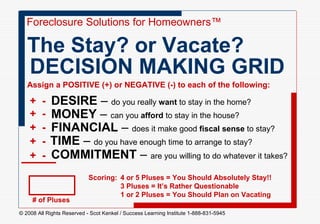

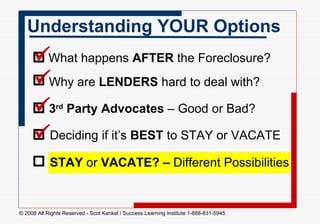

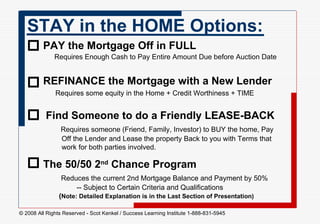

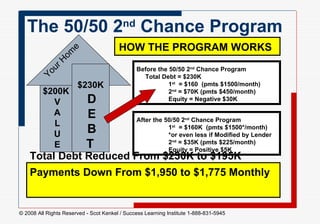

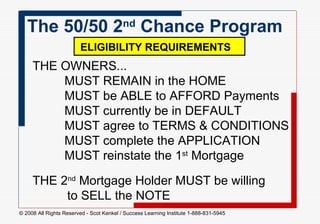

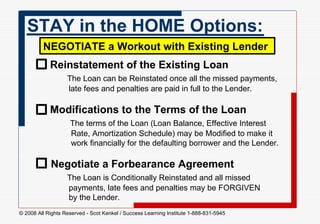

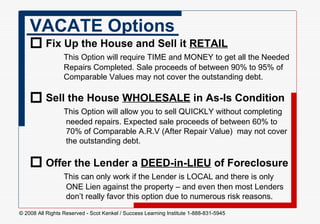

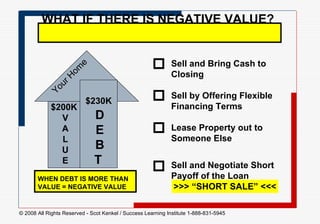

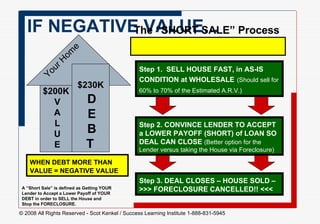

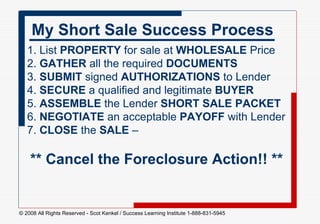

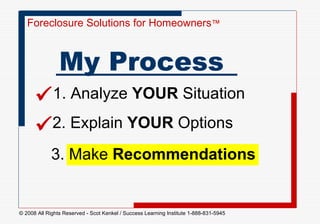

The document outlines the process that a foreclosure solutions specialist named Gary Rossignol uses to help homeowners. It involves 3 steps: 1) Analyzing the homeowner's situation through questions about finances, property details, and hardship. 2) Explaining the homeowner's options to either stay in the home through solutions like loan modifications, or vacate through options like short sales if the home is underwater. 3) Making recommendations on the best option after considering the homeowner's desires, finances, time constraints, and commitment level. It provides details on various stay and vacate options as well as strategies like negotiating with lenders, dealing with third party advocates, and completing a short sale process.