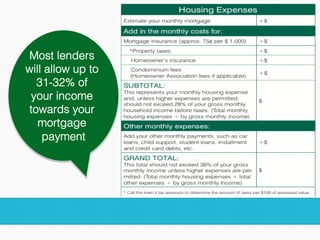

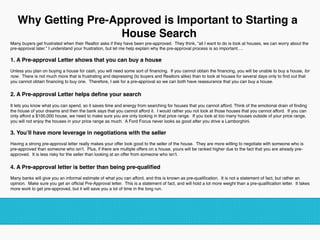

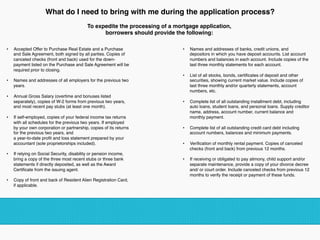

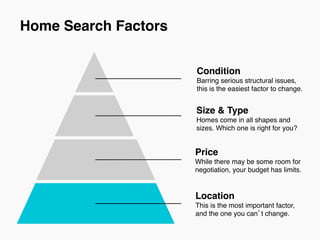

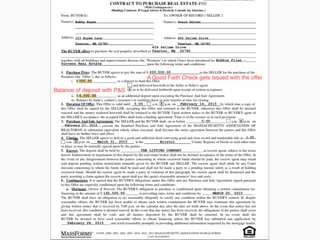

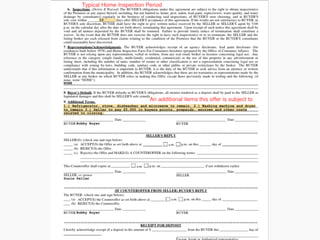

This document is a comprehensive guide on buying a home, covering essential aspects like budgeting for ownership costs, obtaining mortgage pre-approval, and the importance of credit history. It also includes insights on home search factors, types of homes, negotiating offers, and the closing process, emphasizing the significance of location and thorough inspections. Overall, it aims to prepare potential buyers for the responsibilities and decisions involved in purchasing a home.