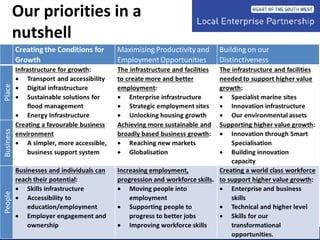

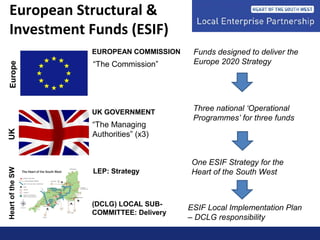

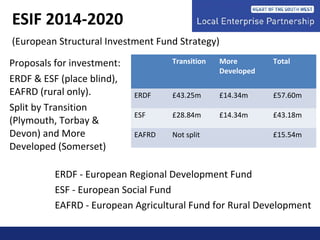

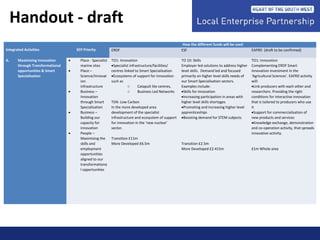

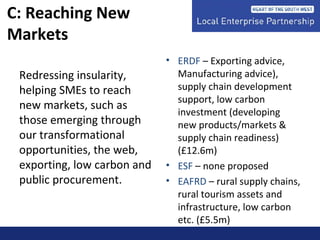

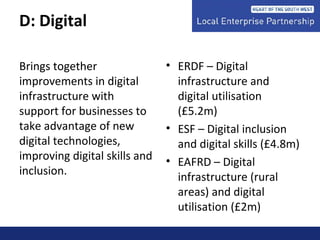

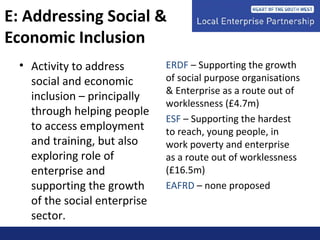

The document outlines an update on the South West Forum event presented by Heidi Hallam, focusing on strategies for transformational economic change through the Heart of the South West Local Enterprise Partnership (LEP) and European Structural and Investment Funds (ESIF). It details funding allocations and investment proposals across various sectors, including innovation, enterprise competitiveness, digital infrastructure, and social inclusion, while emphasizing the need for local partnerships and engagement. Key initiatives include encouraging skills development and supporting SMEs to access new markets and improve overall regional prosperity.