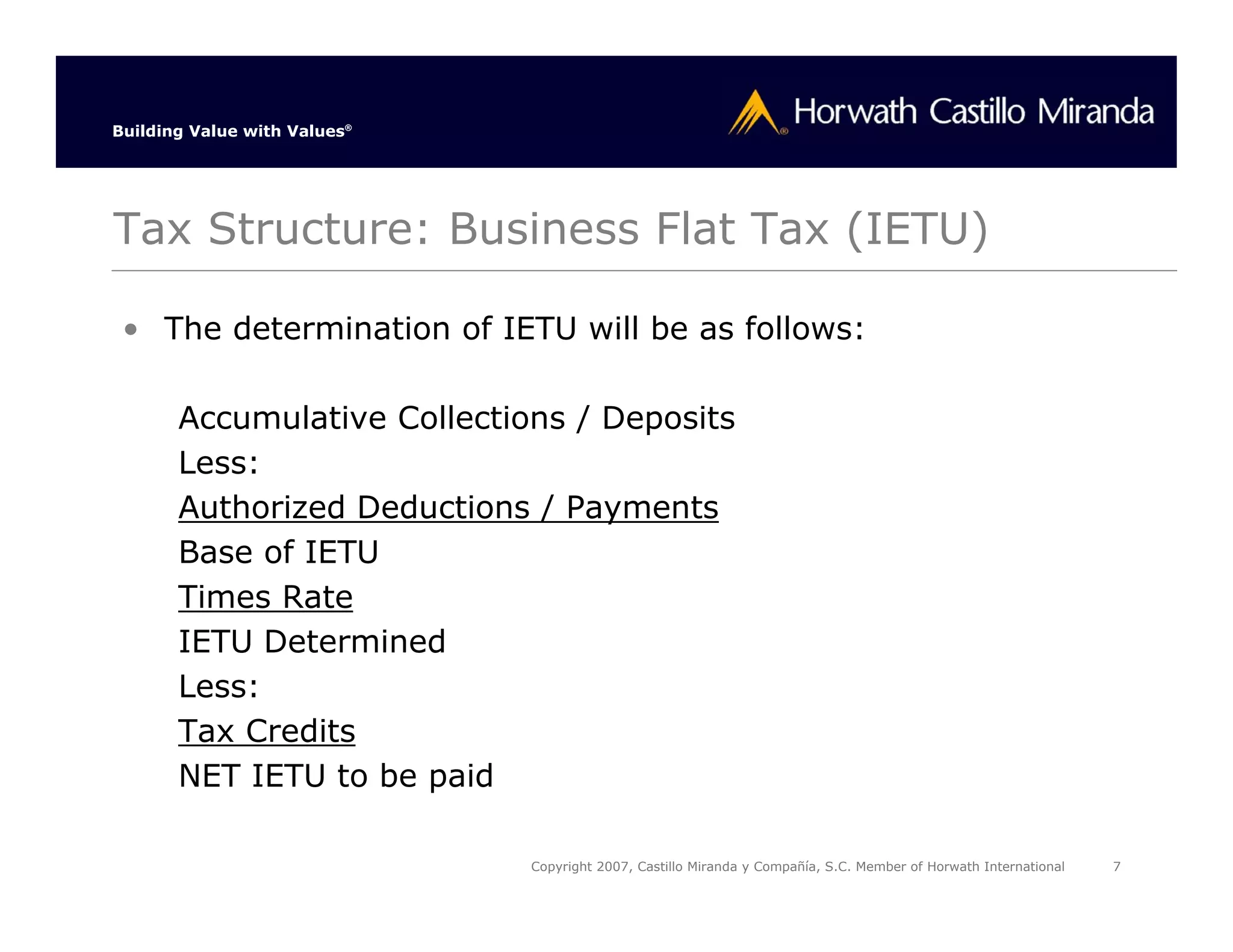

The document summarizes key aspects of Mexico's tax structure. It discusses several taxes including corporate income tax (ISR), a flat business tax (IETU), value added tax (VAT), and payroll taxes. It provides details on tax rates, calculations, deductions, and requirements. The document also covers accounting considerations, import/export incentives, and concludes with recommendations for foreign companies operating in Mexico.