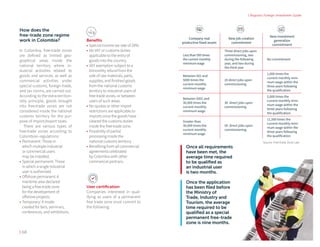

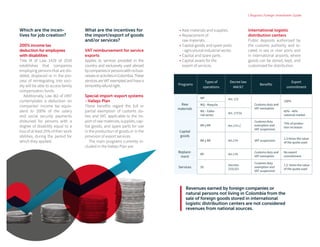

This document summarizes Colombia's free-trade zone regime and various tax incentives available to foreign investors. It discusses how free-trade zones are defined and the different types. Benefits include a 20% income tax rate, no import duties or VAT on goods entering the zones. It also outlines user certification requirements. The document then summarizes Colombia's mega-investment special regime, various income tax exemptions for certain industries, and incentives for job creation and imports/exports.