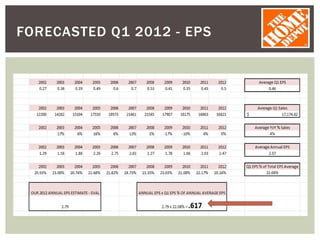

Home Depot is a home improvement retailer that sells building materials and home improvement products. It operates stores throughout the United States, Canada, China, and Mexico. There are three main types of retail customers for Home Depot: do-it-yourself customers, do-it-for-me customers, and professional customers. Home Depot's largest customer category is professional customers, which include home builders and contractors. To forecast Home Depot's quarterly earnings per share, analysts examine historical quarterly EPS trends and Wall Street estimates, as well as key assumptions around sales growth and expenses.