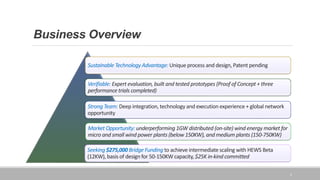

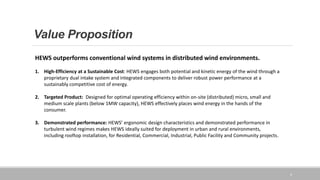

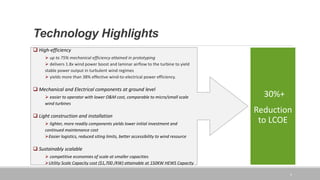

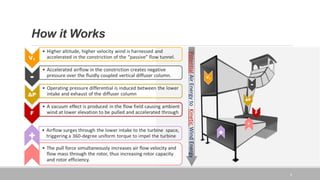

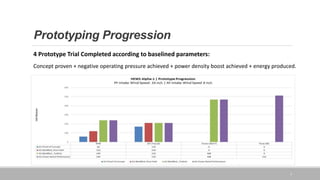

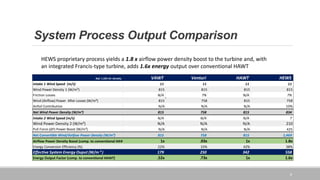

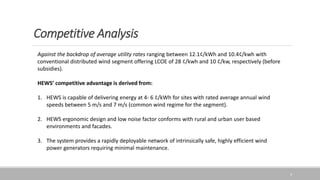

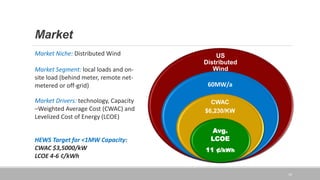

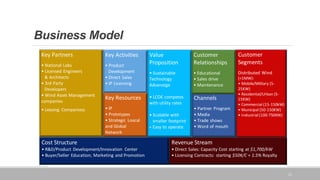

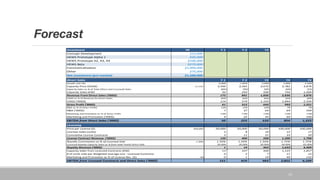

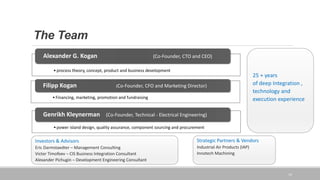

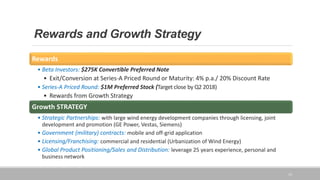

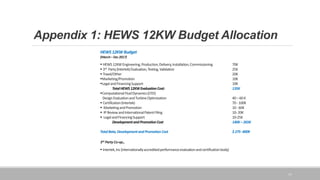

HEWS is developing a next generation bladeless wind generator called HEWS for distributed home and business use. HEWS aims to make wind energy more accessible and cost competitive by achieving higher efficiencies than conventional wind turbines through its unique design that engages both potential and kinetic wind energy. HEWS has completed multiple prototype tests demonstrating its concepts and is seeking $275,000 in funding to build and test a 12kW Beta unit to further optimize the design for commercialization targeting residential, commercial, and industrial applications up to 150kW capacity.