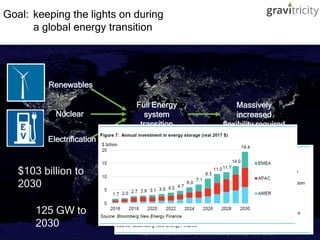

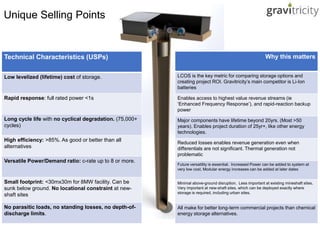

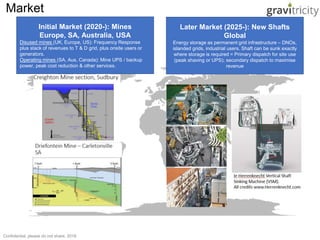

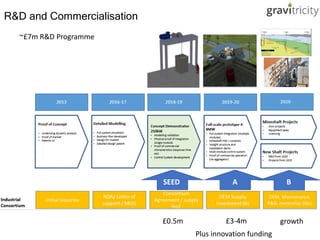

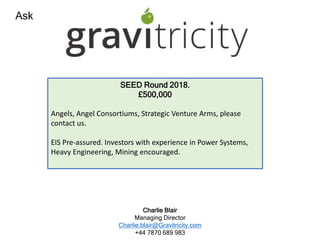

Gravitricity is developing a gravity-based energy storage system using disused mine shafts. The system can provide rapid, durable, and low-cost grid-scale energy storage to support the global transition to renewable energy. Gravitricity is raising £500,000 to fund a 250kW demonstration project and expand their team to develop a 4MW prototype. They are seeking this seed funding from angel investors and strategic partners to unlock £650,000 in UK government innovation funding and advance their gravity-based storage technology.