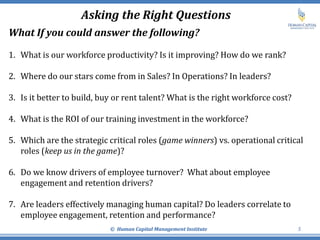

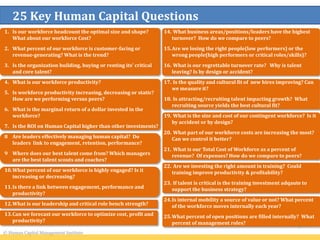

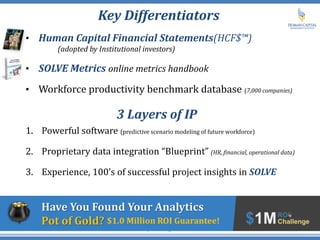

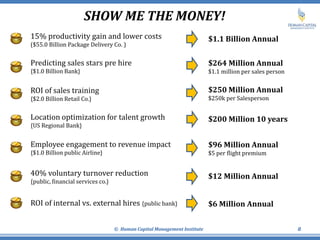

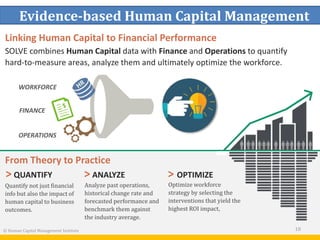

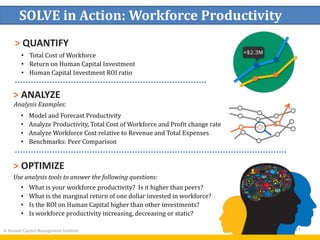

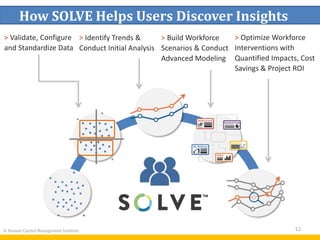

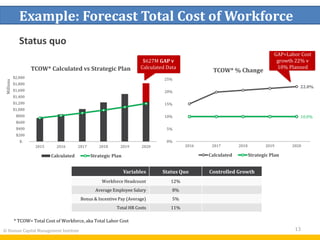

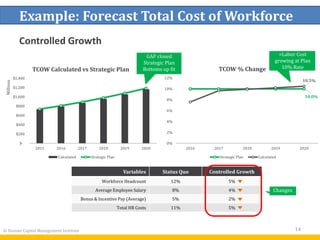

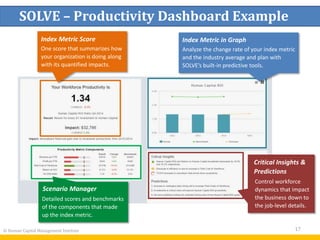

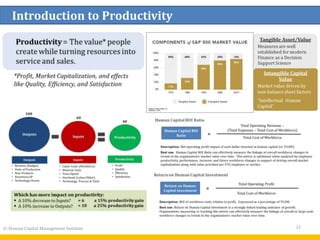

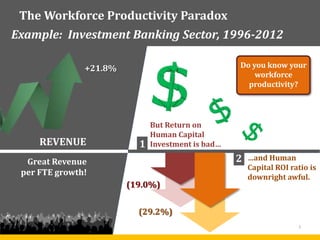

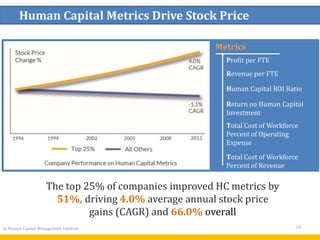

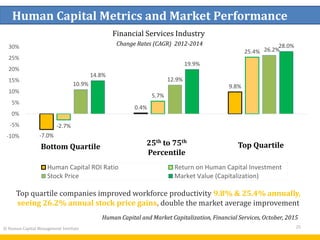

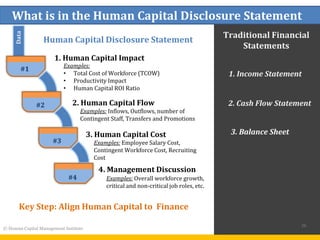

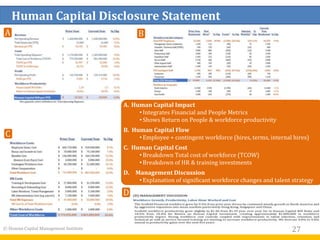

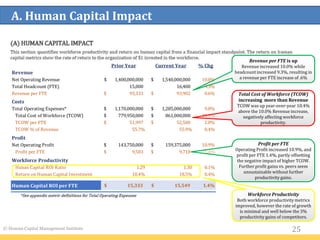

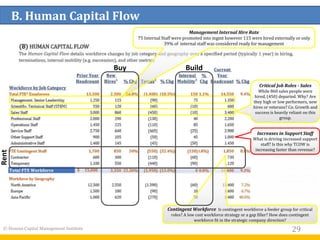

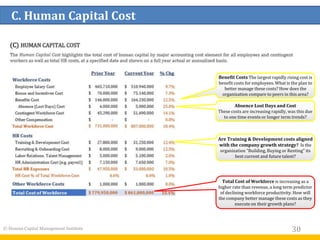

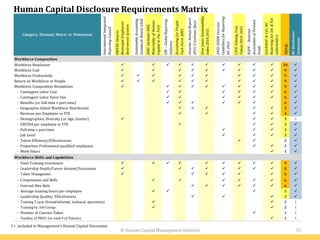

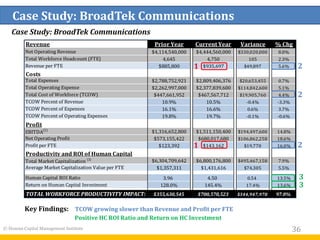

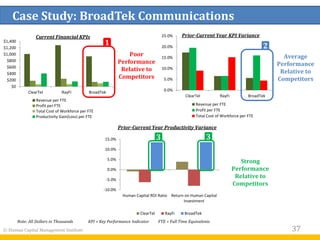

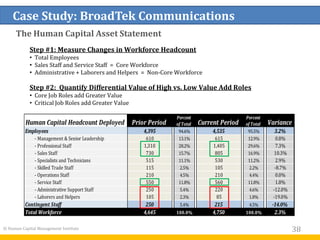

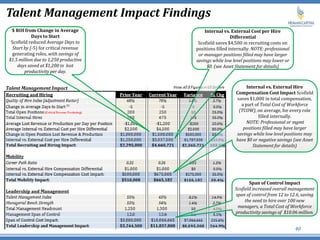

The document provides an introduction and demo of the Human Capital Management Institute (HCMI). HCMI specializes in workforce analytics and measurement to help organizations quantify their investments in human capital. The demo shows how HCMI uses its software tools and proprietary data to analyze workforce productivity, quantify the financial impact of workforce decisions, and optimize the workforce based on scenarios modeled. HCMI also discusses its products and services including dashboards, benchmarks, and training to help users discover insights into areas like productivity, costs, and ROI from their workforce.