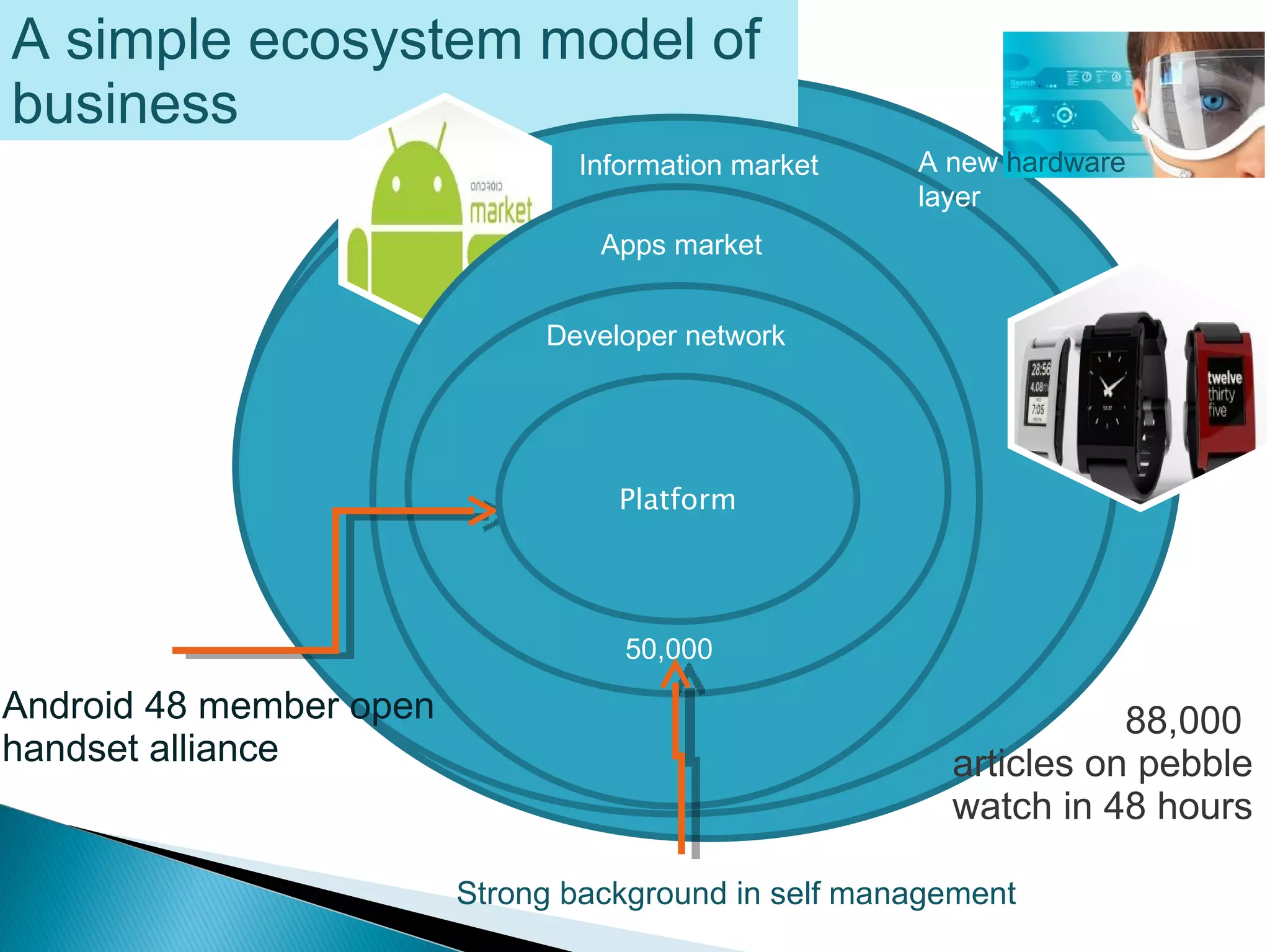

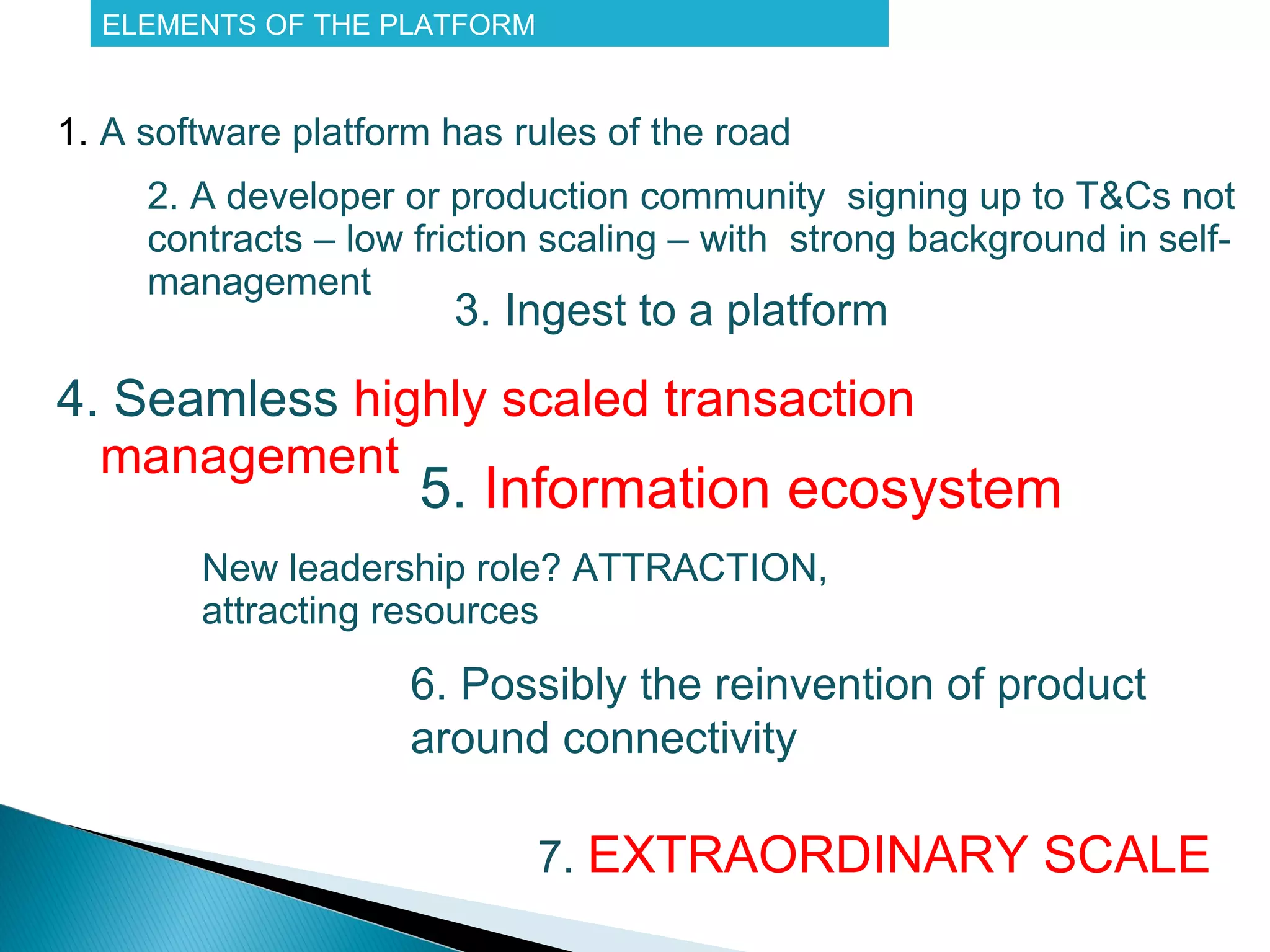

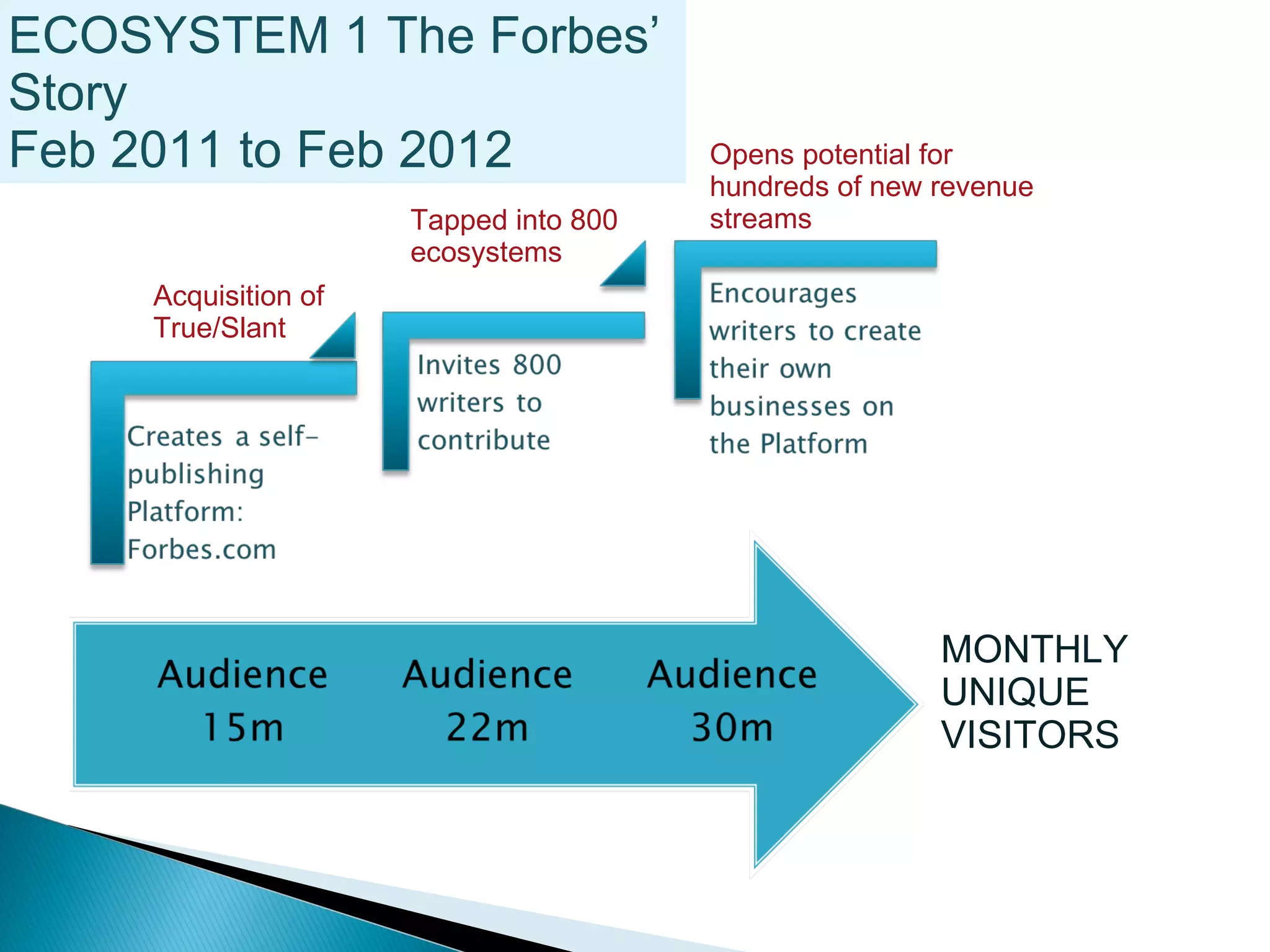

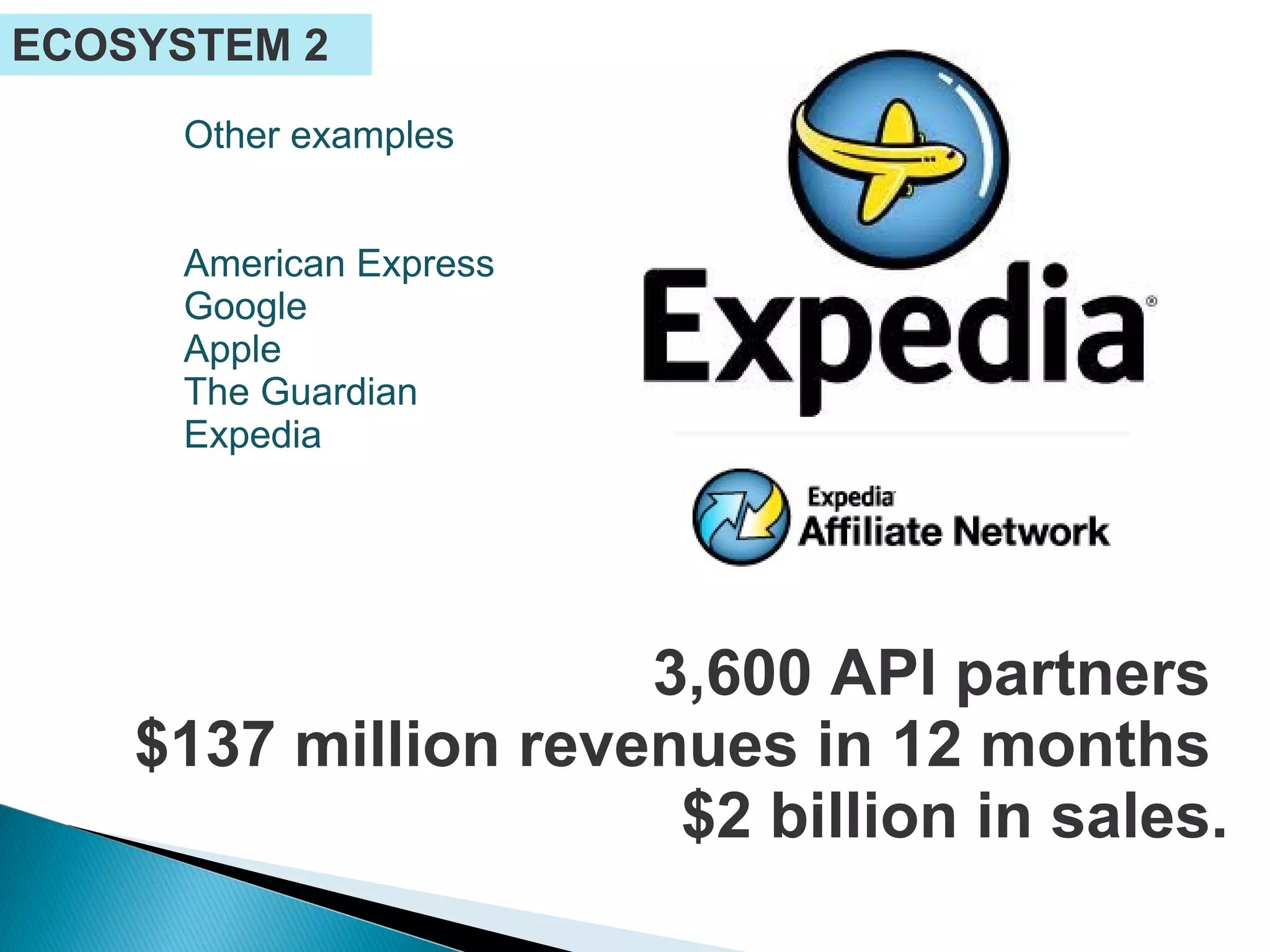

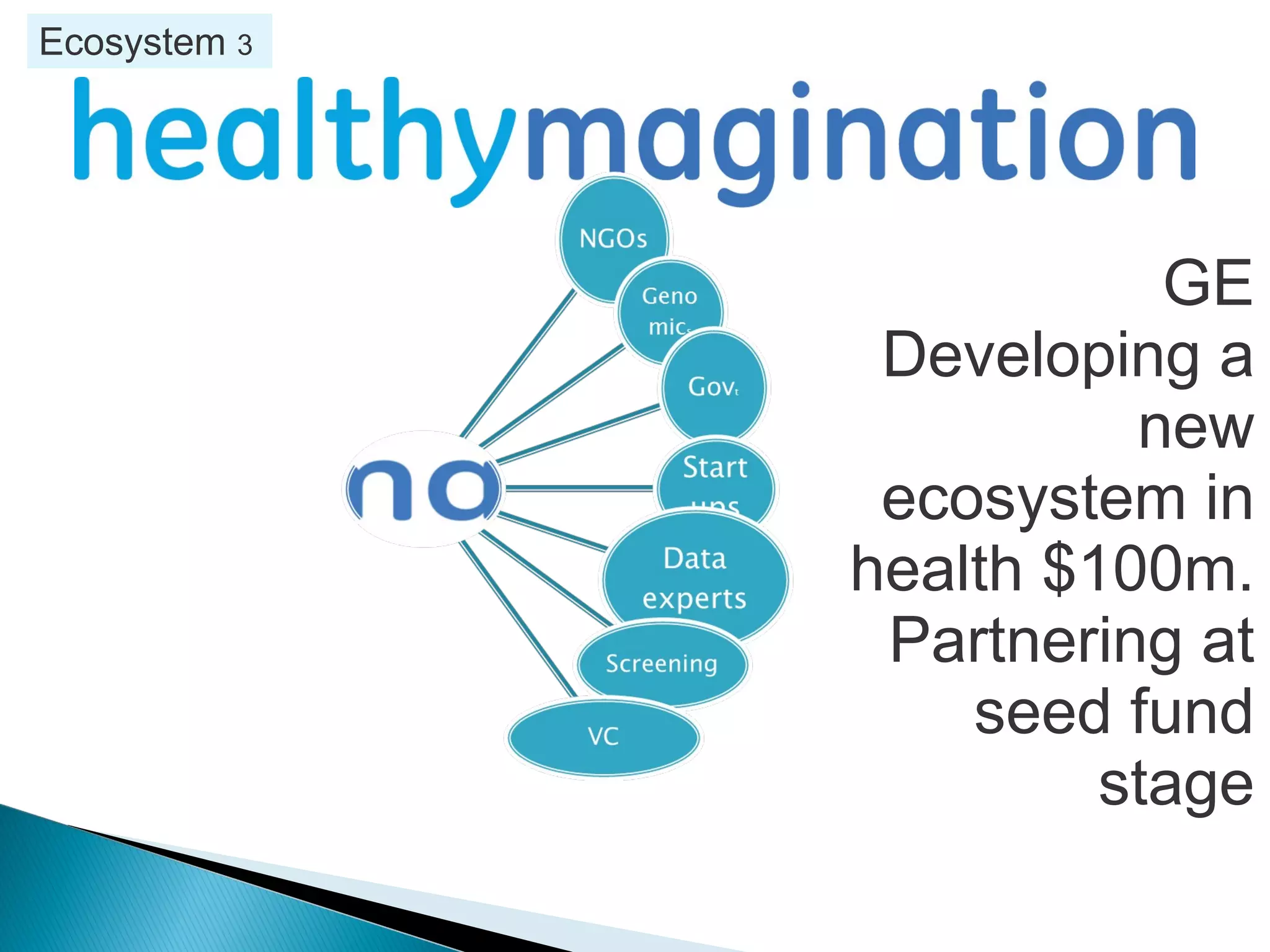

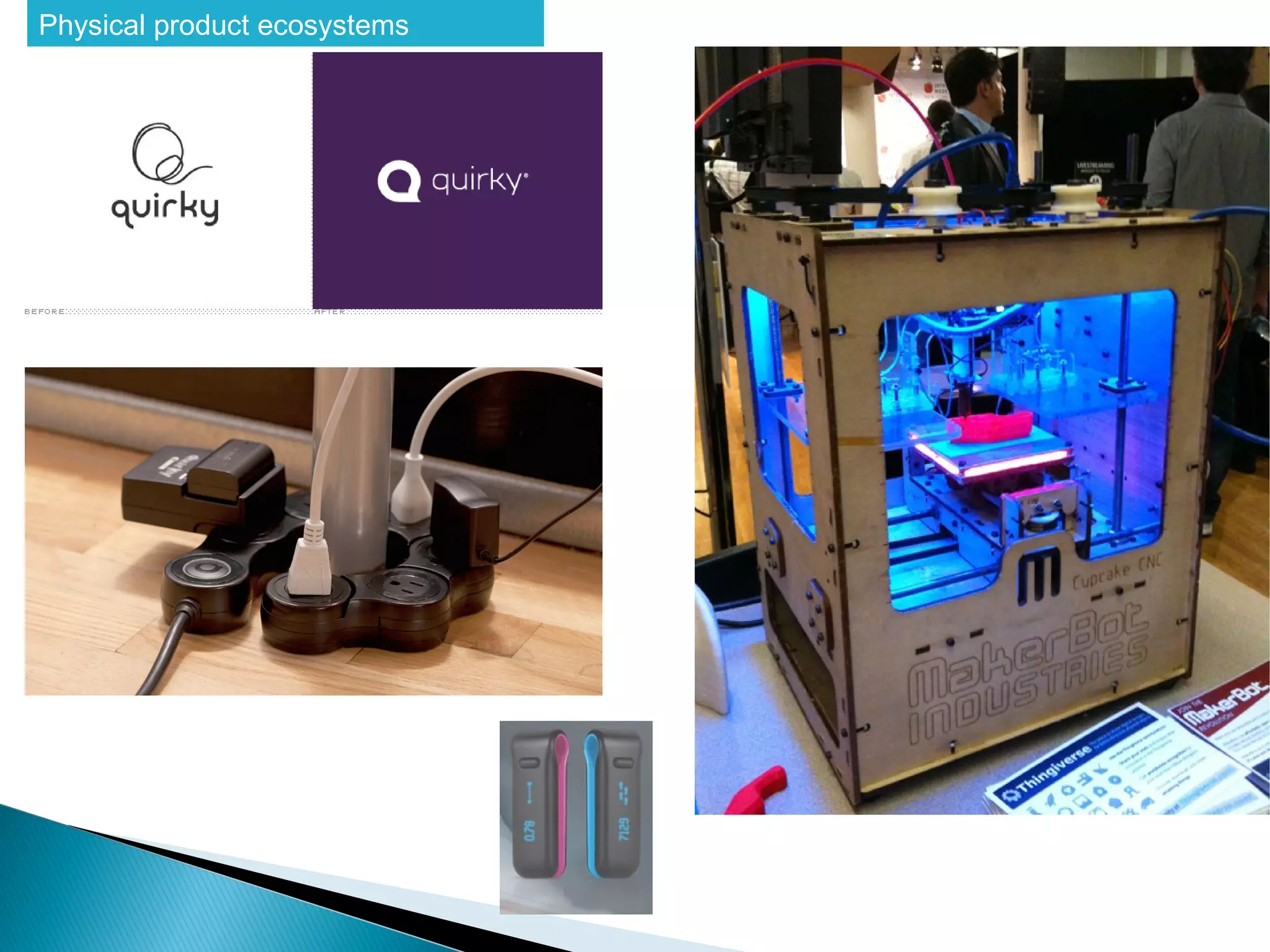

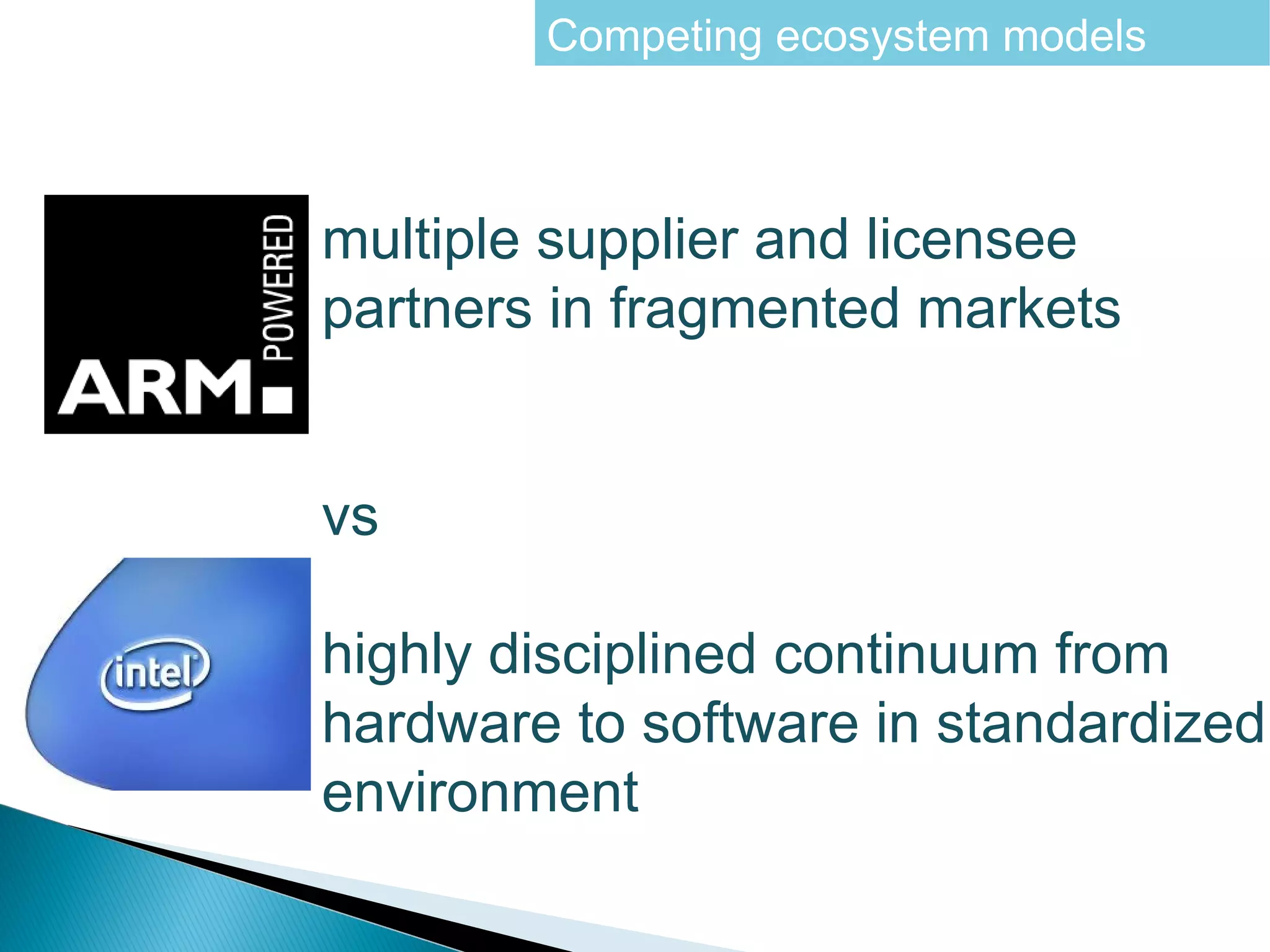

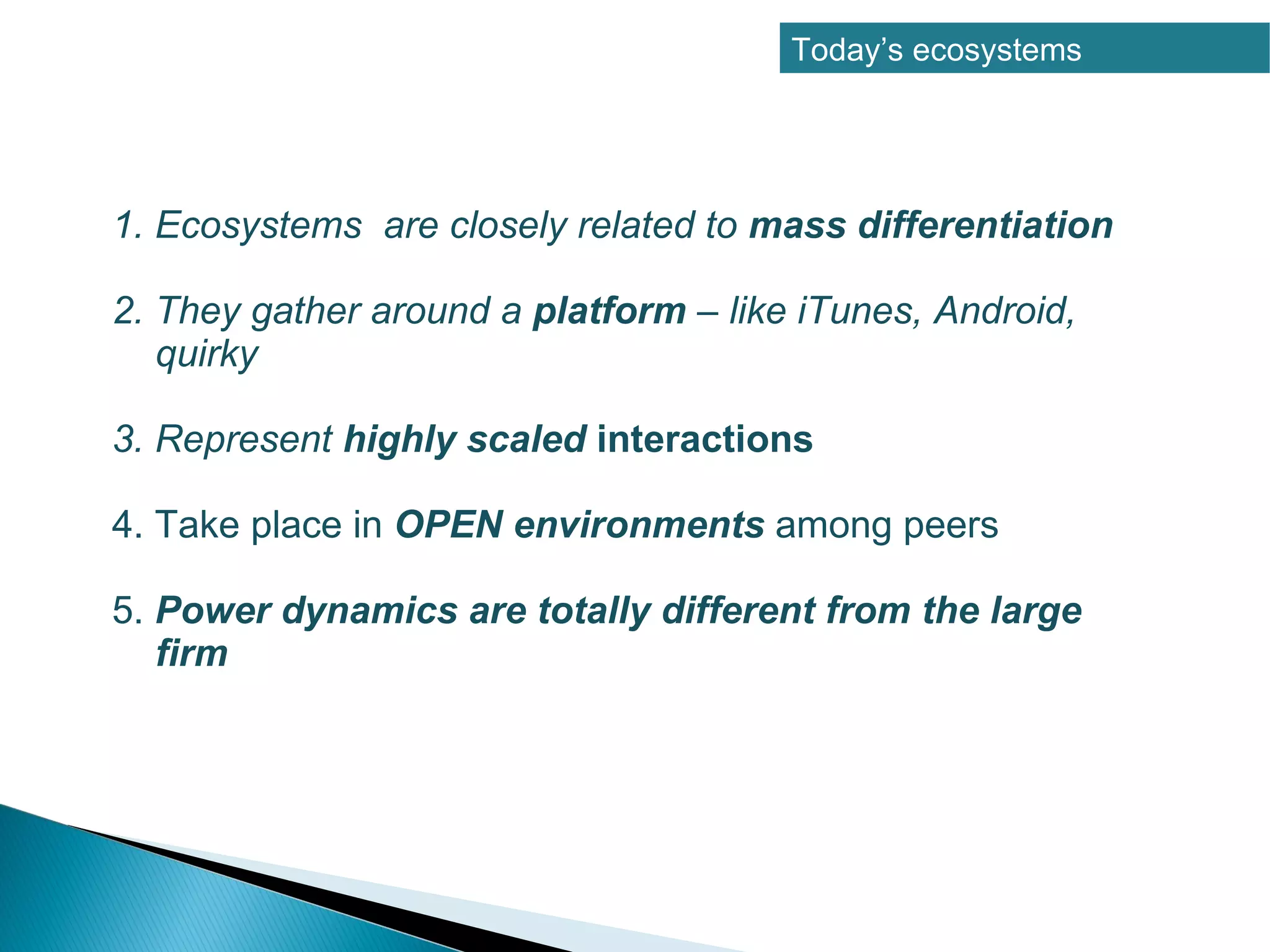

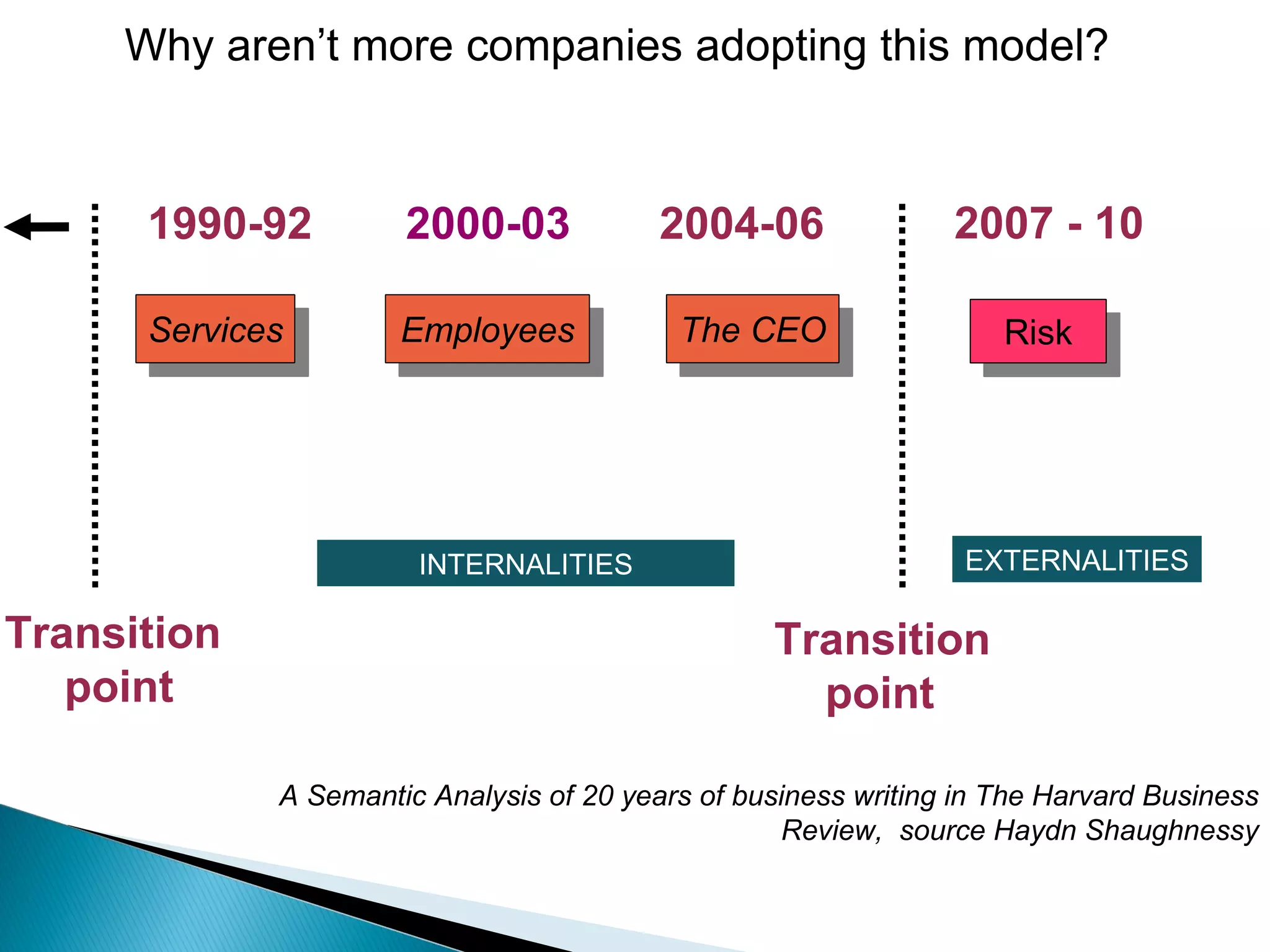

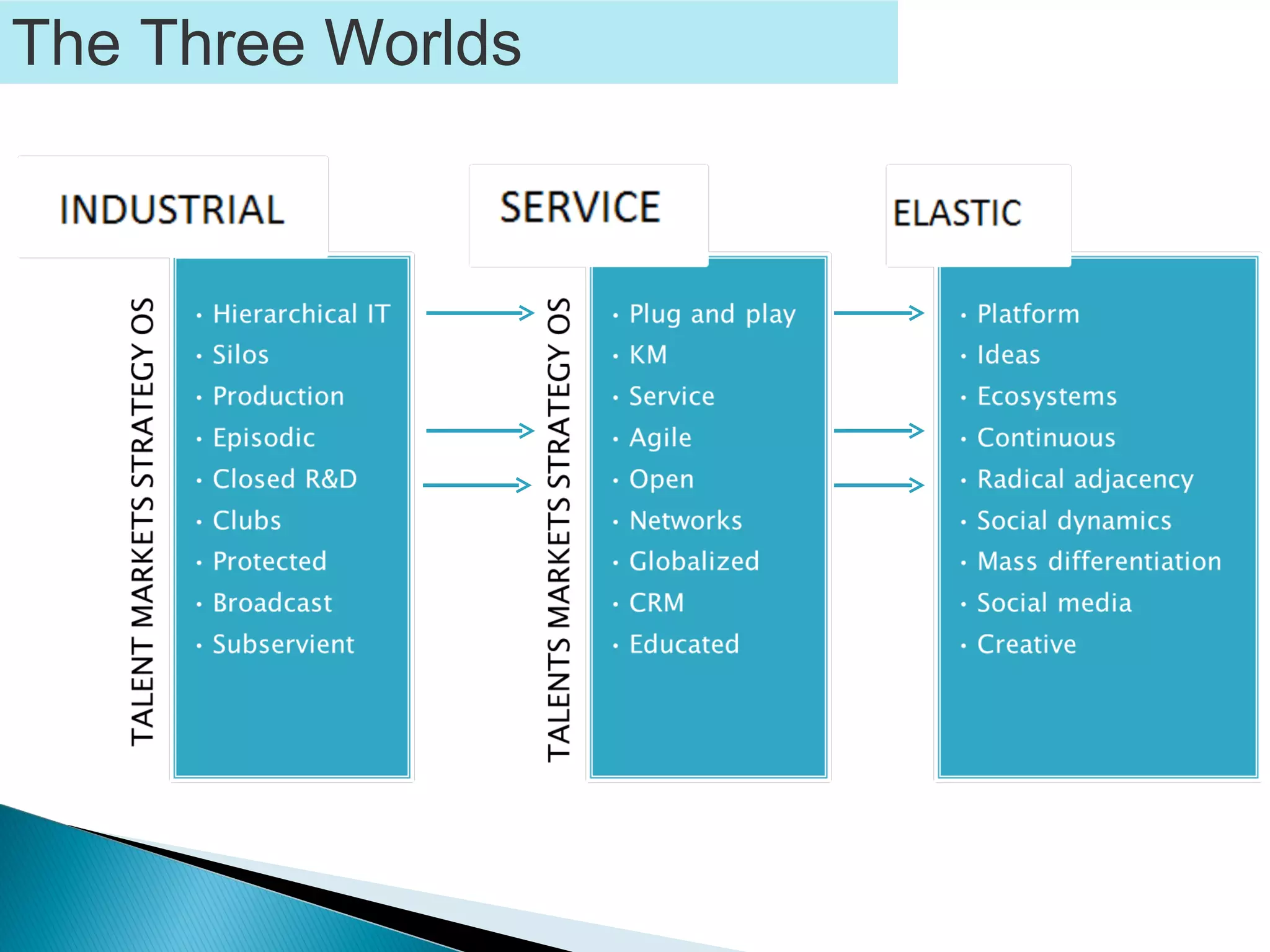

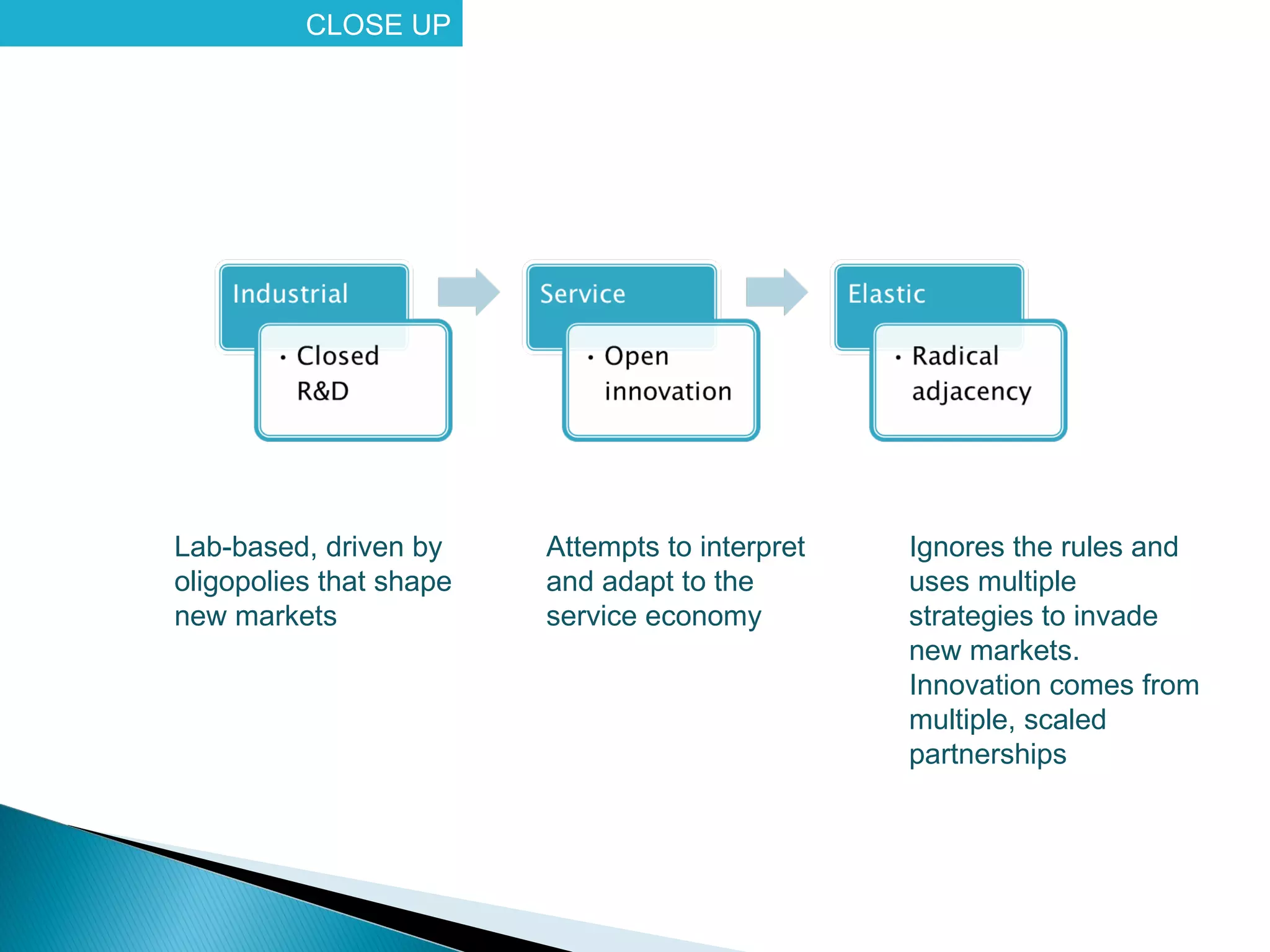

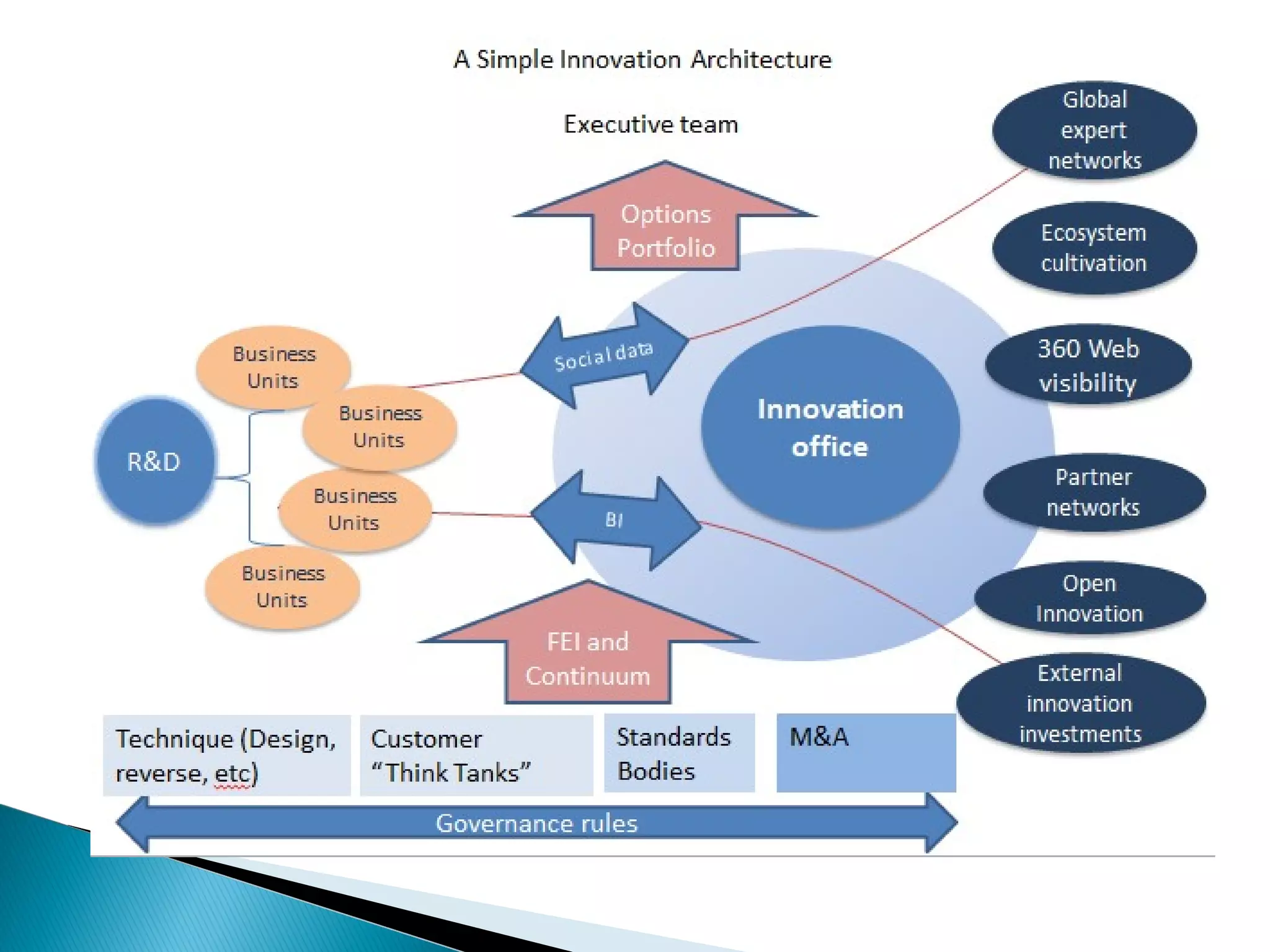

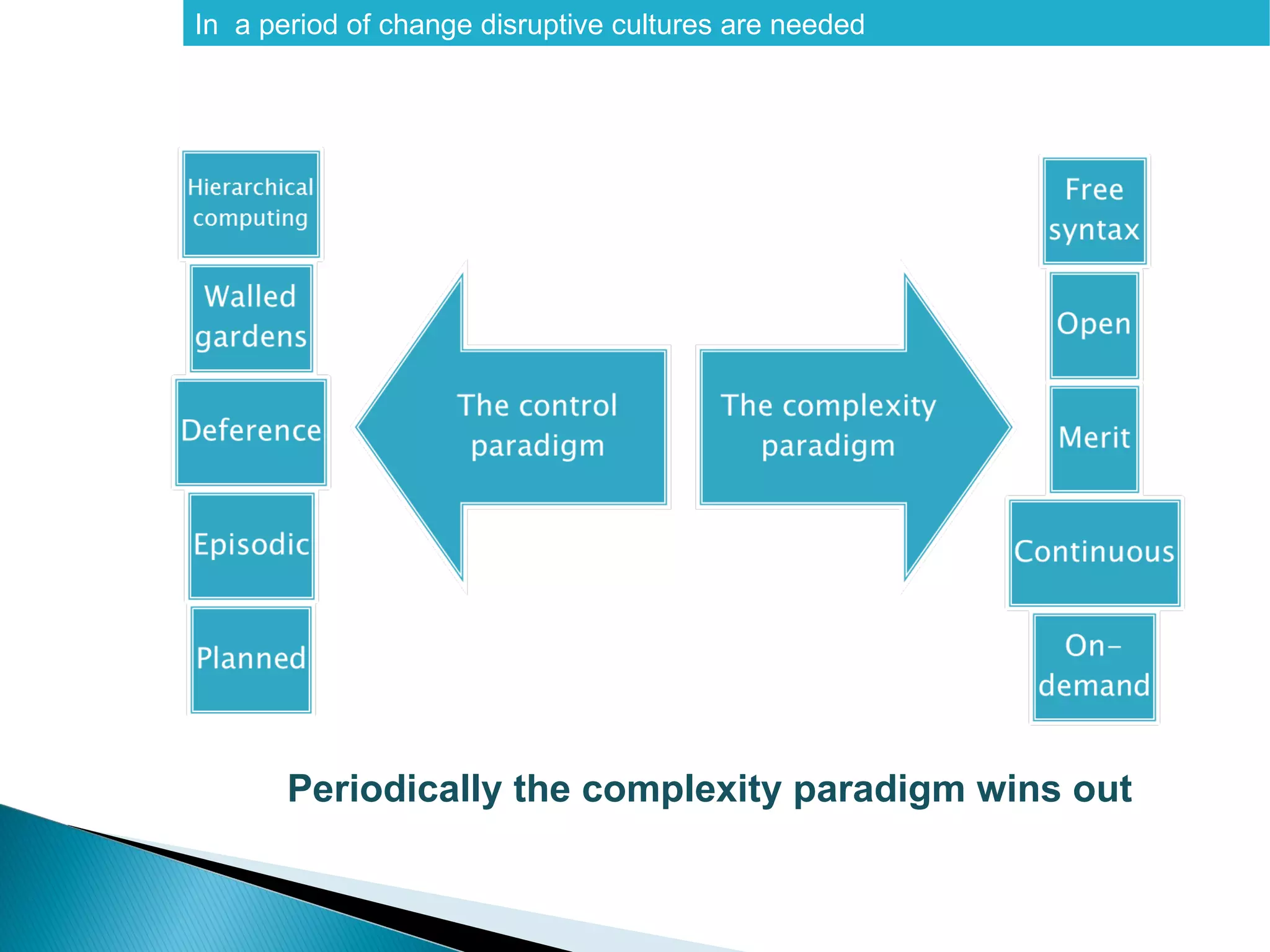

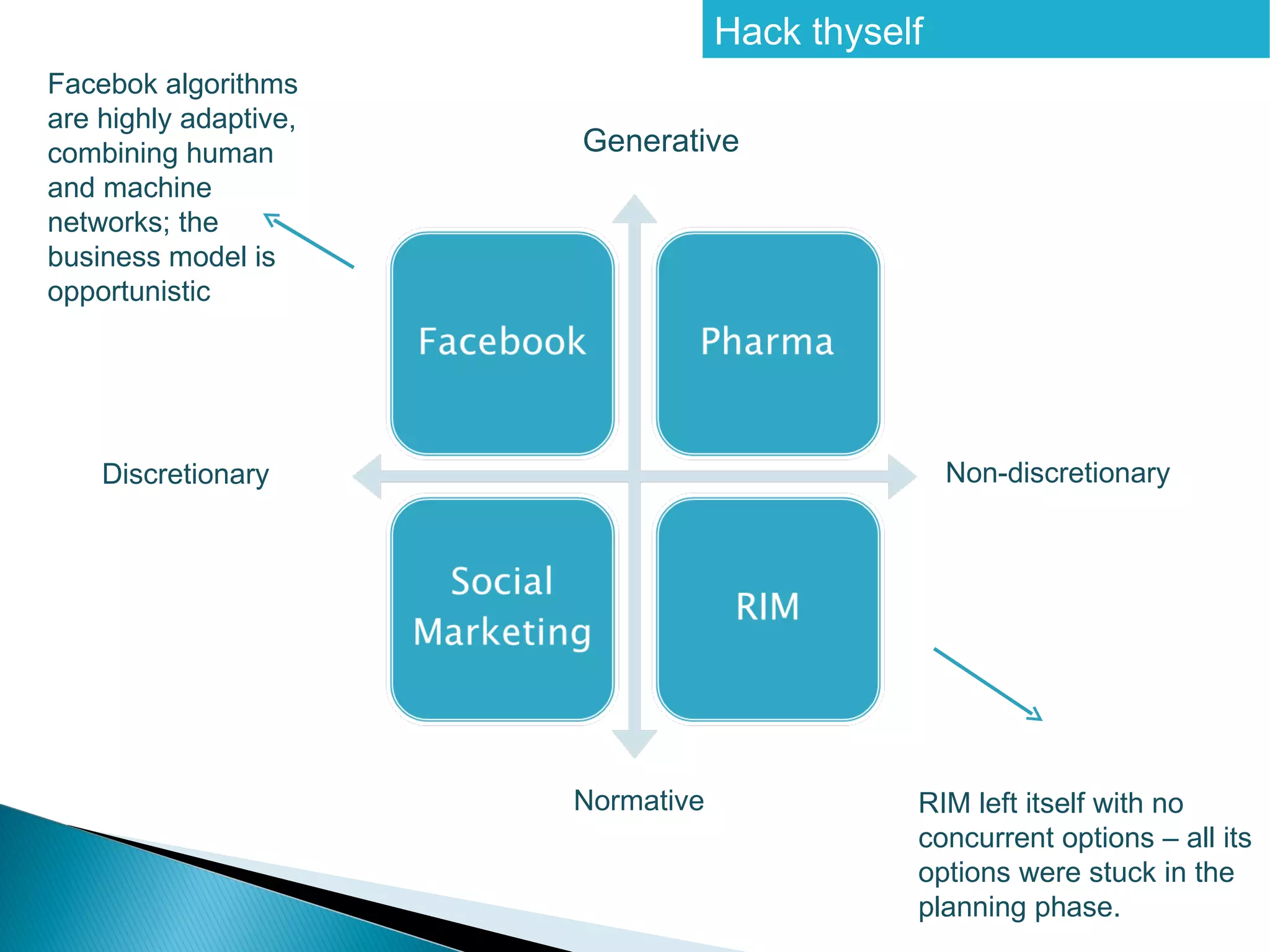

The document summarizes key points from a forum discussion on innovation and business models. [1] Large companies have achieved great success and scale but are now facing limitations to growth. [2] New models like platforms and ecosystems are emerging that enable mass differentiation, serve global markets at low overhead through partnerships, and represent highly scaled interactions. [3] These new models shift power dynamics and require companies to adopt more open and external approaches to innovation.