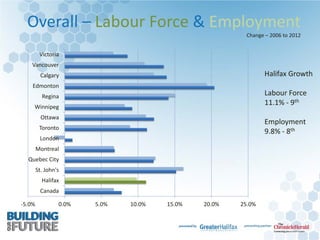

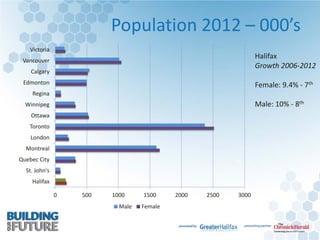

The Halifax Index serves as an economic assessment tool aimed at evaluating economic performance and fostering dialogue for actionable insights. It emphasizes a broad definition of economic progress, focusing on partnerships, workforce stability, and quality of life metrics. The report highlights challenges and strategies for sustainable workforce development, innovation, and community progress in Halifax, positioning it within the context of broader Canadian economic conditions.