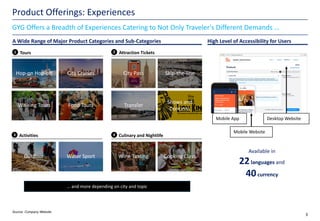

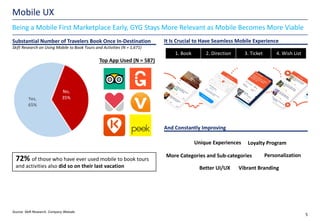

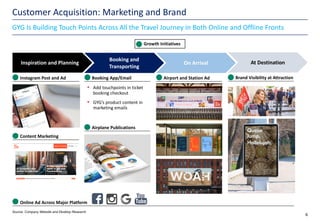

GetYourGuide was founded in 2008 by 4 university students in Zurich and has grown rapidly to become one of Europe's most prominent growth companies. It operates an online platform for travel activities and experiences in over 150 countries. Since its inception, GetYourGuide has raised over $654 million in funding, including a $484 million Series E round in 2019 that valued the company at over $1 billion. GetYourGuide offers a wide range of tourism products and experiences on its platform and has established partnerships with various travel industry players to further scale its business.