The document is a company presentation for FlixBus that outlines their business model and growth strategy. Key points include:

- FlixBus operates a nationwide bus network in Germany through partnerships with local bus companies who provide vehicles and drivers.

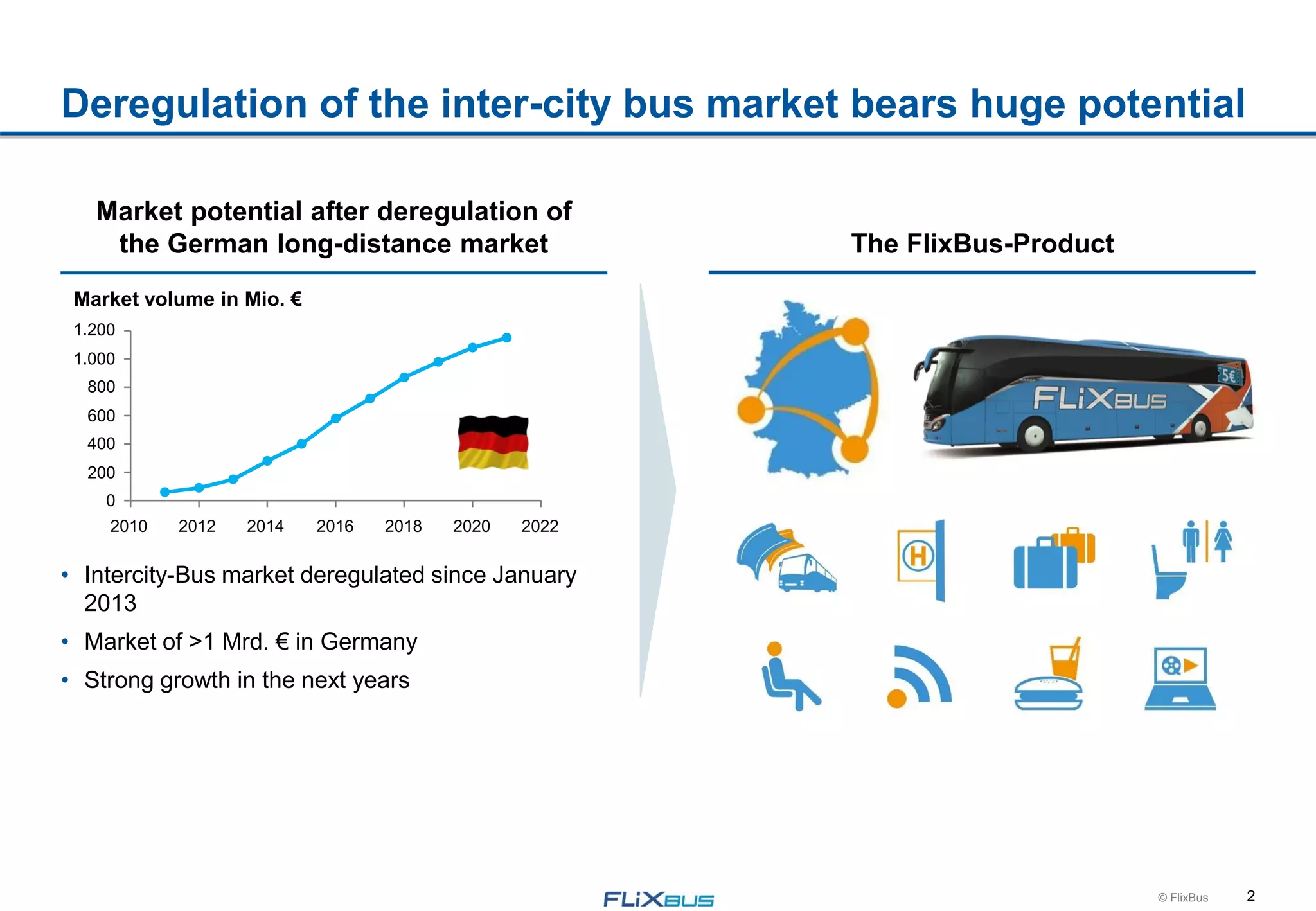

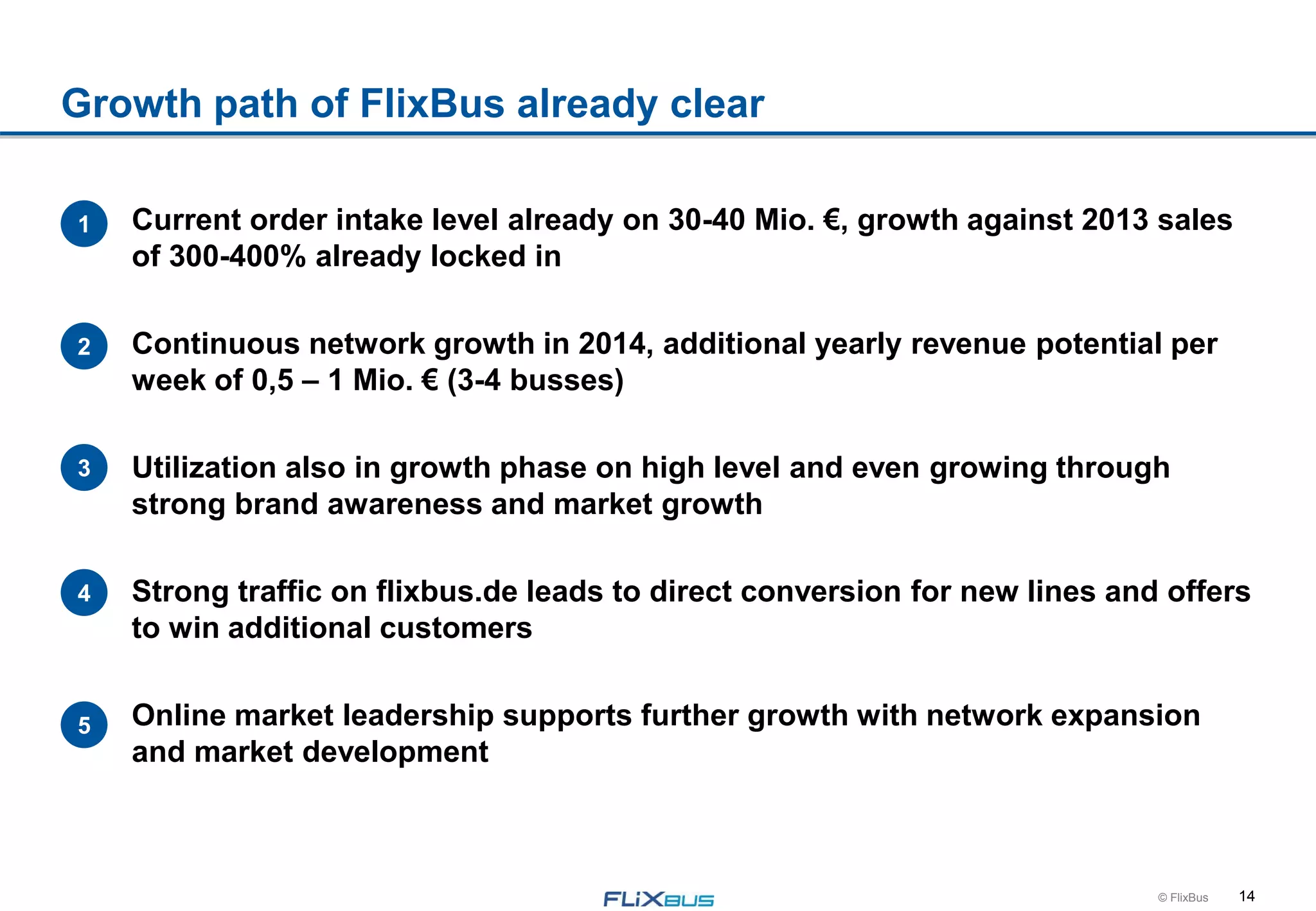

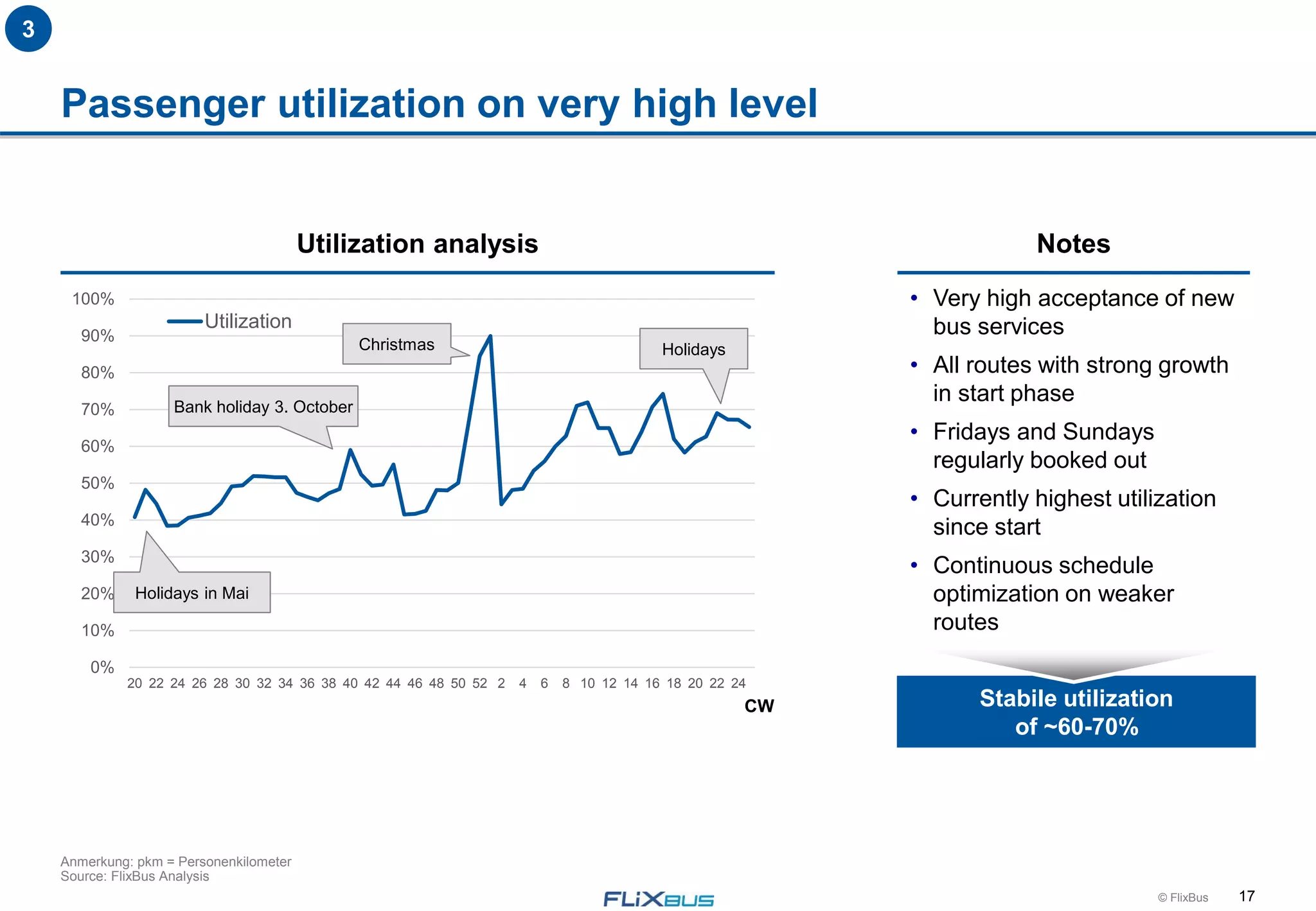

- They have experienced rapid growth since deregulation in 2013, doubling their network and ticket sales every 6 months.

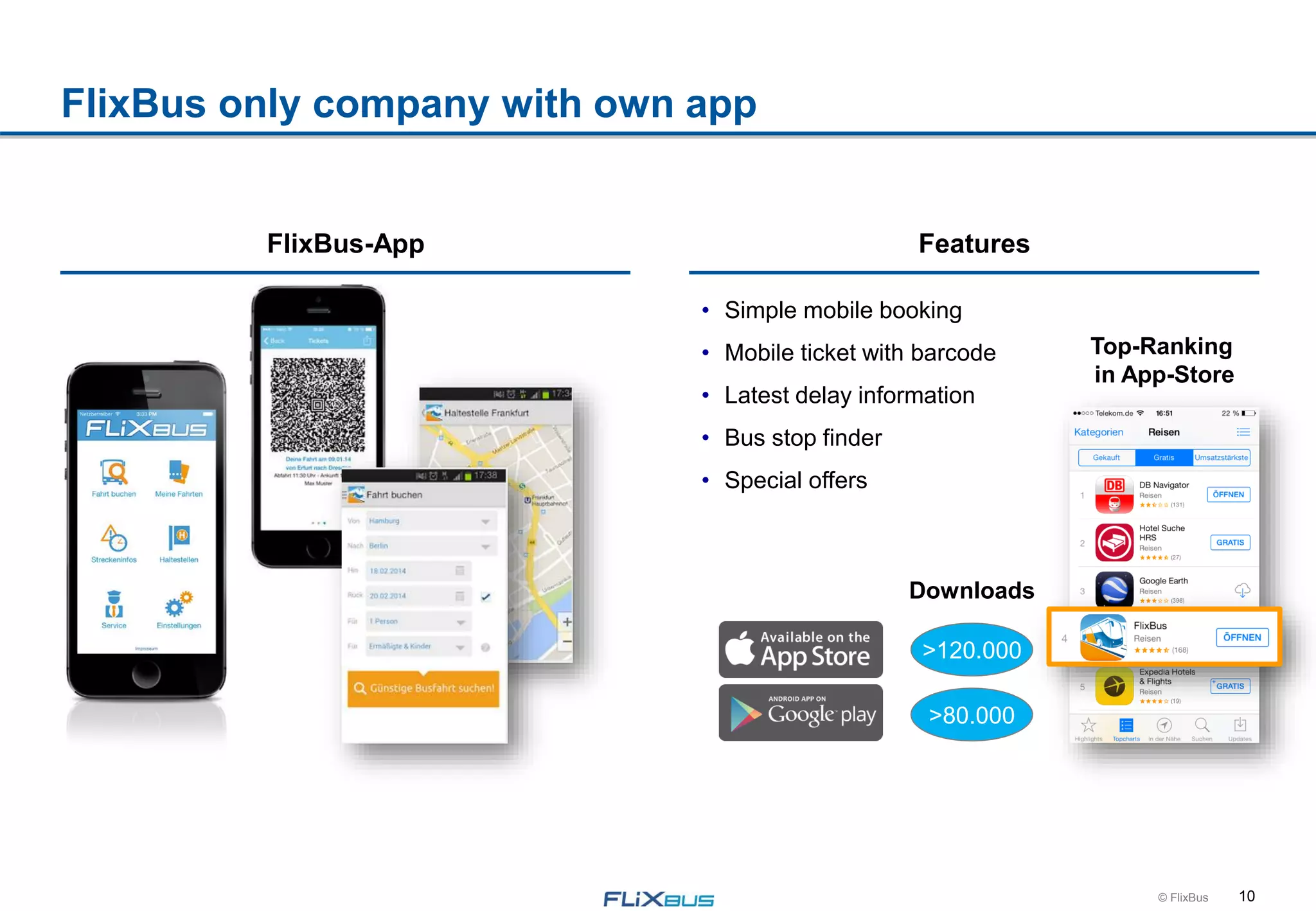

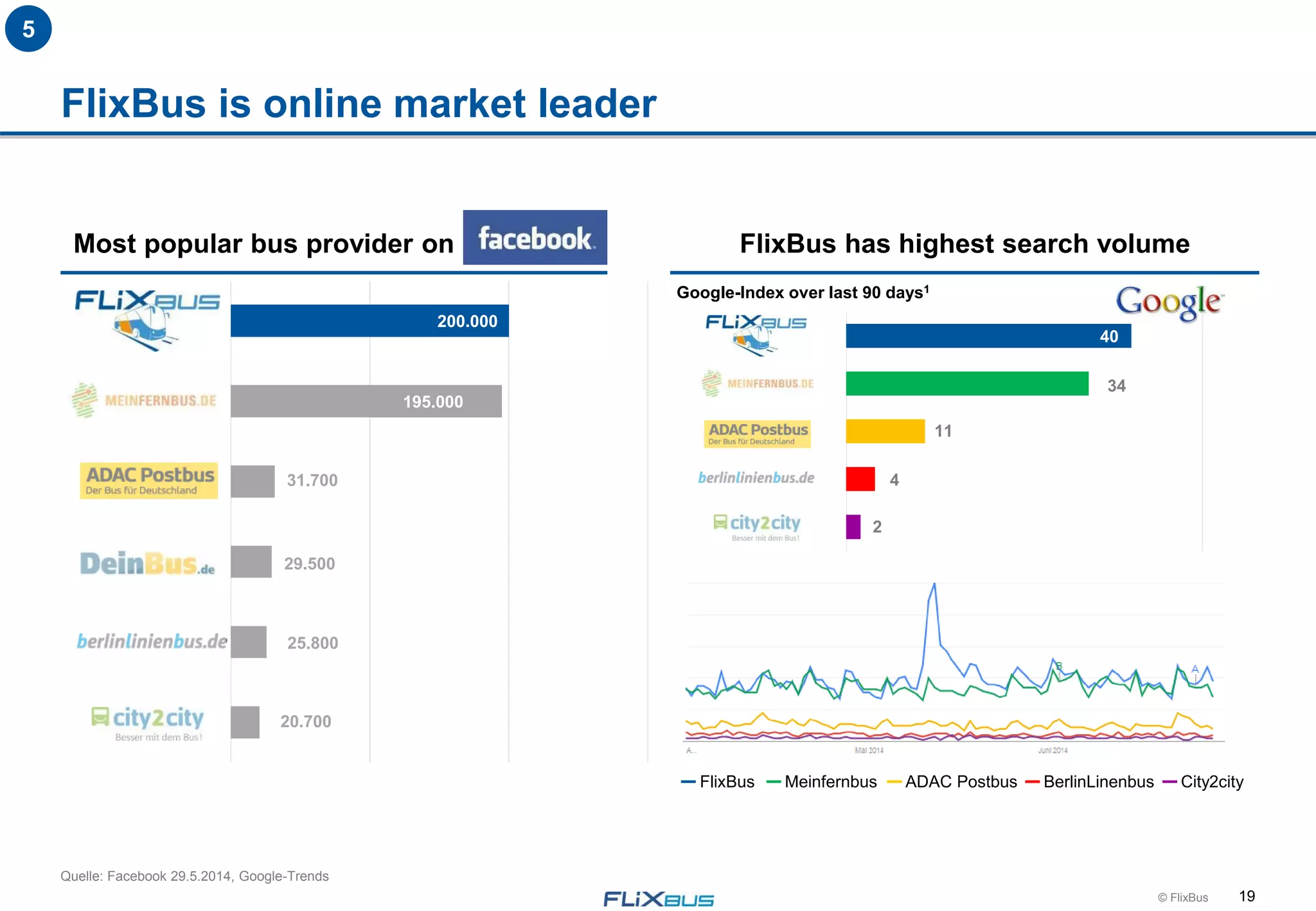

- Their low-cost model, strong marketing including partnerships with Lidl, and high customer satisfaction has led to strong growth and market leadership in Germany.

- Their goal is continued expansion across Germany and into other European countries like Austria, France, Italy and Spain where the bus market remains underdeveloped.