GST - Basics

•Download as PPTX, PDF•

1 like•119 views

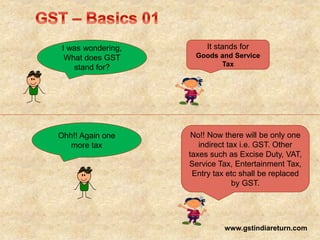

GST stands for Goods and Services Tax, which will replace existing indirect taxes such as VAT, service tax, etc. GST is payable on the supply of goods or services and will be collected by the supplier from the customer. There are three types of GST - CGST, SGST, and IGST. CGST and SGST apply to intrastate supplies while IGST applies to interstate supplies. Registered businesses can claim a credit for GST paid on inputs against the GST charged on outputs, subject to certain conditions. The threshold for mandatory GST registration is an aggregate turnover of Rs. 20 lakhs annually, except in North Eastern states where it is Rs. 10 lakhs.

Report

Share

Report

Share

Recommended

GST WORKSHOP FOR BUSINESS AND TRADERS

To get a crisp and clear understanding of the basic structure of GST. Go through these slides.

PPT on GST _ Goods & Service tax by top gst experts

https://www.topgstexperts.com/ppt-on-gst_-prepared-presented-by-top-gst-experts/

Top GST Experts have taken a Small Seminar on GST on 9th April at Mumbai_ Please find the PPT attached herewith for your handy reference.

Recommended

GST WORKSHOP FOR BUSINESS AND TRADERS

To get a crisp and clear understanding of the basic structure of GST. Go through these slides.

PPT on GST _ Goods & Service tax by top gst experts

https://www.topgstexperts.com/ppt-on-gst_-prepared-presented-by-top-gst-experts/

Top GST Experts have taken a Small Seminar on GST on 9th April at Mumbai_ Please find the PPT attached herewith for your handy reference.

A Beginners Guide to GST 2017

A simple presentation on GST.

Only relevant points helpful for beginners have been covered.

Goods and service act - A Basic Overview

An Brief understanding about the Goods and Service tax - India

Analyse how will gst impact your business

Vramaratnam is one of the best business consultants in Chennai.It gives you an indepth analysis of the impact of GST on propertry sales and capital gains tax.

Understanding practical aspects of gst

This PPT will give you the basic idea of the GST Law. It covers some practical aspects like registration and returns.

GST Registration Requirements

For quick service click: https://enterslice.com/gst-registration

GET FREE CONSULTANCY

Helpline: +91 9069142028

Email: info@enterslice.com

Website: www.enterslice.com

GST Registration application submission online through FORM GST REG – 02.

Gst in india

GST In India An Overview and Impact.

Types of Taxes Covered in CGST, SGST, IGST

Benefits for Government and Customer

GDP growth rate

Many more to find in PPT

GST PRESENTATION

I CA Gaurav Kumar Mishra published my GST Presentation. 1st presentation on this.You can contact me on +91-8108763725

An Overview of GST in India

Get an overview of GST in India. Know the basic definition of GST, taxes subsumed under it and how it basically works in India. Know the significance of GST tool.

Understanding GST(overview) presentation

In this Presentation we will discuss GST for businessman and consumer, Transitional Provision under GST, Input Tax credit carried forward in GST.

~GSTの基礎知識・最新動向・ 日系企業及びJV企業における影響と備え~

~GSTの基礎知識・最新動向・日系企業及びJV企業における影響と備え~ ※フェアコンサルティング・日本国公認会計士・岩瀬雄一による日本語による解説、スクリーンにおける表示があります。

More Related Content

What's hot

A Beginners Guide to GST 2017

A simple presentation on GST.

Only relevant points helpful for beginners have been covered.

Goods and service act - A Basic Overview

An Brief understanding about the Goods and Service tax - India

Analyse how will gst impact your business

Vramaratnam is one of the best business consultants in Chennai.It gives you an indepth analysis of the impact of GST on propertry sales and capital gains tax.

Understanding practical aspects of gst

This PPT will give you the basic idea of the GST Law. It covers some practical aspects like registration and returns.

GST Registration Requirements

For quick service click: https://enterslice.com/gst-registration

GET FREE CONSULTANCY

Helpline: +91 9069142028

Email: info@enterslice.com

Website: www.enterslice.com

GST Registration application submission online through FORM GST REG – 02.

Gst in india

GST In India An Overview and Impact.

Types of Taxes Covered in CGST, SGST, IGST

Benefits for Government and Customer

GDP growth rate

Many more to find in PPT

GST PRESENTATION

I CA Gaurav Kumar Mishra published my GST Presentation. 1st presentation on this.You can contact me on +91-8108763725

An Overview of GST in India

Get an overview of GST in India. Know the basic definition of GST, taxes subsumed under it and how it basically works in India. Know the significance of GST tool.

Understanding GST(overview) presentation

In this Presentation we will discuss GST for businessman and consumer, Transitional Provision under GST, Input Tax credit carried forward in GST.

What's hot (19)

Viewers also liked

~GSTの基礎知識・最新動向・ 日系企業及びJV企業における影響と備え~

~GSTの基礎知識・最新動向・日系企業及びJV企業における影響と備え~ ※フェアコンサルティング・日本国公認会計士・岩瀬雄一による日本語による解説、スクリーンにおける表示があります。

Impact of GST - Manufacturing Sector

Jhunjhunwala Advisors presents our Impact of GST- Manufacturing Sector for all our clients and fellow professionals.

GST on manufacturing sector

How will be the impact of GST on manufacturing industry?

“The government also realizes that becoming a manufacturing hub will need several strategic reforms to simplify manufacturing in India. One of the proposed reforms, in line with Make in India, is the implementation of the Goods and Services Tax (GST). “

Impact & Implications of GST on Real Estate & Construction Sector

Impact, Issues & Implications of GST on Real Estate & Construction Sector

Firework Poetic Devices Activity

Using Katy Perry's song "Firework" find the poetic devices. Great activity for secondary students. Grades 6 and up.

Goods and Services Tax (GST) : Roll-out, Impact & Preparedness

Goods and Services Tax (GST) : Roll-out, Impact & Preparedness. Focus on Japanese subsidiaries/ JVs in India.

GST in India

The latest tax reform in India is the introduction of GST as a single unified indirect tax. In this presentation we have presented the overview of GST and it's implications as to how it will impact the users in different levels.

GST Power Point Presentation

A Power Point Presentation on likely frame work on the Goods & Services scheduled to be implemented in India From 1st April,2010..

Viewers also liked (20)

Impact & Implications of GST on Real Estate & Construction Sector

Impact & Implications of GST on Real Estate & Construction Sector

Goods and Services Tax (GST) : Roll-out, Impact & Preparedness

Goods and Services Tax (GST) : Roll-out, Impact & Preparedness

Similar to GST - Basics

Why GST?

This presentation highlights the reason for bringing GST and how GST will be different from the present tax structure. The video also brings out the complexities in the present tax structure and how under GST these complications will be removed.

Note: The above presentation is only for informational purposes and is based upon Model GST Law and other information available on the internet. This does not constitute any sort of legal advice or opinion.

GST explained for non tax professionals

Have you had trouble making sense of the hundreds of articles on the Goods and Service Tax? We did too. We realized that we could not make sense of GST because we did not understand the basics. So we studied many documents and met a lot of experts to understand the logic of GST.

We are very happy to share that understanding with you. You can learn about Input Tax credit, what changes with GST, how many taxes are going away and what does it all mean for industry and government. What is more, all this has been communicated using simple examples and easy language.

If you find this presentation useful, please do share it on Email, FaceBook, Twitter and other social media.

GST.pptx

Meaning of GST, VAT Vs. GST, Direct Tax, Indirect Tax, Types of GST, Input Tax, ITC Set off, Rate Slabs of GST, Export, Import etc.

GST Law & Accounts Classes

As everyone know that our country has recently taken a bold step to eliminate the all indirect taxes levied at different level by different government under the leadership of our energetic PM.

Therefore I have the view that Industry will take time to get settle down since yet some of the part of country engaged into strikes/ deadlocks.

Therefore to overcome that situation we have a detail & summarized presentation on the subject for beginners and every efforts have been put in to make it easy to understand.

Gst And its Impacts Project

This slideshow is all about the GST and its impacts which had taken place after The implementation.

GST In india - Goods & Services Tax

In this presentation, I tried to explain the term GST in brief.

If you have any query related to it, please ask, comment and contact. Don't forget to share.

Similar to GST - Basics (20)

Recently uploaded

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Have you ever heard that user-generated content or video testimonials can take your brand to the next level? We will explore how you can effectively use video testimonials to leverage and boost your sales, content strategy, and increase your CRM data.🤯

We will dig deeper into:

1. How to capture video testimonials that convert from your audience 🎥

2. How to leverage your testimonials to boost your sales 💲

3. How you can capture more CRM data to understand your audience better through video testimonials. 📊

Premium MEAN Stack Development Solutions for Modern Businesses

Stay ahead of the curve with our premium MEAN Stack Development Solutions. Our expert developers utilize MongoDB, Express.js, AngularJS, and Node.js to create modern and responsive web applications. Trust us for cutting-edge solutions that drive your business growth and success.

Know more: https://www.synapseindia.com/technology/mean-stack-development-company.html

Memorandum Of Association Constitution of Company.ppt

www.seribangash.com

A Memorandum of Association (MOA) is a legal document that outlines the fundamental principles and objectives upon which a company operates. It serves as the company's charter or constitution and defines the scope of its activities. Here's a detailed note on the MOA:

Contents of Memorandum of Association:

Name Clause: This clause states the name of the company, which should end with words like "Limited" or "Ltd." for a public limited company and "Private Limited" or "Pvt. Ltd." for a private limited company.

https://seribangash.com/article-of-association-is-legal-doc-of-company/

Registered Office Clause: It specifies the location where the company's registered office is situated. This office is where all official communications and notices are sent.

Objective Clause: This clause delineates the main objectives for which the company is formed. It's important to define these objectives clearly, as the company cannot undertake activities beyond those mentioned in this clause.

www.seribangash.com

Liability Clause: It outlines the extent of liability of the company's members. In the case of companies limited by shares, the liability of members is limited to the amount unpaid on their shares. For companies limited by guarantee, members' liability is limited to the amount they undertake to contribute if the company is wound up.

https://seribangash.com/promotors-is-person-conceived-formation-company/

Capital Clause: This clause specifies the authorized capital of the company, i.e., the maximum amount of share capital the company is authorized to issue. It also mentions the division of this capital into shares and their respective nominal value.

Association Clause: It simply states that the subscribers wish to form a company and agree to become members of it, in accordance with the terms of the MOA.

Importance of Memorandum of Association:

Legal Requirement: The MOA is a legal requirement for the formation of a company. It must be filed with the Registrar of Companies during the incorporation process.

Constitutional Document: It serves as the company's constitutional document, defining its scope, powers, and limitations.

Protection of Members: It protects the interests of the company's members by clearly defining the objectives and limiting their liability.

External Communication: It provides clarity to external parties, such as investors, creditors, and regulatory authorities, regarding the company's objectives and powers.

https://seribangash.com/difference-public-and-private-company-law/

Binding Authority: The company and its members are bound by the provisions of the MOA. Any action taken beyond its scope may be considered ultra vires (beyond the powers) of the company and therefore void.

Amendment of MOA:

While the MOA lays down the company's fundamental principles, it is not entirely immutable. It can be amended, but only under specific circumstances and in compliance with legal procedures. Amendments typically require shareholder

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to make small projects with small budgets profitable for the company (UA)

Kyiv PMDay 2024 Summer

Website – www.pmday.org

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

Sustainability: Balancing the Environment, Equity & Economy

[Note: This is a partial preview. To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

Sustainability has become an increasingly critical topic as the world recognizes the need to protect our planet and its resources for future generations. Sustainability means meeting our current needs without compromising the ability of future generations to meet theirs. It involves long-term planning and consideration of the consequences of our actions. The goal is to create strategies that ensure the long-term viability of People, Planet, and Profit.

Leading companies such as Nike, Toyota, and Siemens are prioritizing sustainable innovation in their business models, setting an example for others to follow. In this Sustainability training presentation, you will learn key concepts, principles, and practices of sustainability applicable across industries. This training aims to create awareness and educate employees, senior executives, consultants, and other key stakeholders, including investors, policymakers, and supply chain partners, on the importance and implementation of sustainability.

LEARNING OBJECTIVES

1. Develop a comprehensive understanding of the fundamental principles and concepts that form the foundation of sustainability within corporate environments.

2. Explore the sustainability implementation model, focusing on effective measures and reporting strategies to track and communicate sustainability efforts.

3. Identify and define best practices and critical success factors essential for achieving sustainability goals within organizations.

CONTENTS

1. Introduction and Key Concepts of Sustainability

2. Principles and Practices of Sustainability

3. Measures and Reporting in Sustainability

4. Sustainability Implementation & Best Practices

To download the complete presentation, visit: https://www.oeconsulting.com.sg/training-presentations

VAT Registration Outlined In UAE: Benefits and Requirements

Vat Registration is a legal obligation for businesses meeting the threshold requirement, helping companies avoid fines and ramifications. Contact now!

https://viralsocialtrends.com/vat-registration-outlined-in-uae/

RMD24 | Debunking the non-endemic revenue myth Marvin Vacquier Droop | First ...

Marvin neemt je in deze presentatie mee in de voordelen van non-endemic advertising op retail media netwerken. Hij brengt ook de uitdagingen in beeld die de markt op dit moment heeft op het gebied van retail media voor niet-leveranciers.

Retail media wordt gezien als het nieuwe advertising-medium en ook mediabureaus richten massaal retail media-afdelingen op. Merken die niet in de betreffende winkel liggen staan ook nog niet in de rij om op de retail media netwerken te adverteren. Marvin belicht de uitdagingen die er zijn om echt aansluiting te vinden op die markt van non-endemic advertising.

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection -Introduction to Social Dreaming

#Systems Psychodynamics

#Innovation

#Creativity

#Consultancy

#Coaching

What are the main advantages of using HR recruiter services.pdf

HR recruiter services offer top talents to companies according to their specific needs. They handle all recruitment tasks from job posting to onboarding and help companies concentrate on their business growth. With their expertise and years of experience, they streamline the hiring process and save time and resources for the company.

Putting the SPARK into Virtual Training.pptx

This 60-minute webinar, sponsored by Adobe, was delivered for the Training Mag Network. It explored the five elements of SPARK: Storytelling, Purpose, Action, Relationships, and Kudos. Knowing how to tell a well-structured story is key to building long-term memory. Stating a clear purpose that doesn't take away from the discovery learning process is critical. Ensuring that people move from theory to practical application is imperative. Creating strong social learning is the key to commitment and engagement. Validating and affirming participants' comments is the way to create a positive learning environment.

The effects of customers service quality and online reviews on customer loyal...

The effects of customers service quality and online reviews on customer loyal...balatucanapplelovely

Research Cracking the Workplace Discipline Code Main.pptx

Cultivating and maintaining discipline within teams is a critical differentiator for successful organisations.

Forward-thinking leaders and business managers understand the impact that discipline has on organisational success. A disciplined workforce operates with clarity, focus, and a shared understanding of expectations, ultimately driving better results, optimising productivity, and facilitating seamless collaboration.

Although discipline is not a one-size-fits-all approach, it can help create a work environment that encourages personal growth and accountability rather than solely relying on punitive measures.

In this deck, you will learn the significance of workplace discipline for organisational success. You’ll also learn

• Four (4) workplace discipline methods you should consider

• The best and most practical approach to implementing workplace discipline.

• Three (3) key tips to maintain a disciplined workplace.

5 Things You Need To Know Before Hiring a Videographer

Dive into this presentation to discover the 5 things you need to know before hiring a videographer in Toronto.

Recently uploaded (20)

LA HUG - Video Testimonials with Chynna Morgan - June 2024

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Premium MEAN Stack Development Solutions for Modern Businesses

Premium MEAN Stack Development Solutions for Modern Businesses

Memorandum Of Association Constitution of Company.ppt

Memorandum Of Association Constitution of Company.ppt

The Influence of Marketing Strategy and Market Competition on Business Perfor...

The Influence of Marketing Strategy and Market Competition on Business Perfor...

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to ma...

Sustainability: Balancing the Environment, Equity & Economy

Sustainability: Balancing the Environment, Equity & Economy

VAT Registration Outlined In UAE: Benefits and Requirements

VAT Registration Outlined In UAE: Benefits and Requirements

RMD24 | Debunking the non-endemic revenue myth Marvin Vacquier Droop | First ...

RMD24 | Debunking the non-endemic revenue myth Marvin Vacquier Droop | First ...

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection with Social Dreaming

What are the main advantages of using HR recruiter services.pdf

What are the main advantages of using HR recruiter services.pdf

The effects of customers service quality and online reviews on customer loyal...

The effects of customers service quality and online reviews on customer loyal...

5 Things You Need To Know Before Hiring a Videographer

5 Things You Need To Know Before Hiring a Videographer

GST - Basics

- 1. www.gstindiareturn.com I was wondering, What does GST stand for? It stands for Goods and Service Tax Ohh!! Again one more tax No!! Now there will be only one indirect tax i.e. GST. Other taxes such as Excise Duty, VAT, Service Tax, Entertainment Tax, Entry tax etc shall be replaced by GST.

- 2. www.gstindiareturn.co m So, when do we need to pay GST??? GST would be applicable on “SUPPLY” of goods or services. Supply includes - Sale, transfer, barter, exchange, license, rental, lease or disposal made for a consideration in the course or furtherance of business

- 3. www.gstindiareturn.co m Who will be liable to pay GST?? GST will be charged by the supplier on the value of goods and services. The supplier will be required to collect the GST from the Customer and pay to the Government. Government Pay GST by Challan Suppli er Charge GST on the Bill Customer

- 4. www.gstindiareturn.co m But I heard that there are three taxes and not one?? Is there only one GST??? You are partially correct. There is only one GST. However, there are three types of GST – Central GST (CGST), State GST (SGST) and Integrated GST (IGST). GST Intrastate Supply (within the state) CGST SGST Interstate Supply (outside the state) IGST

- 5. www.gstindiareturn.co m Ohh!! So there are 3 types of GST. But I am not sure how will it work. Ok!! I will explain you with a simple example. Example – A : Intrastate Supply (Supply within the state) Supply of Goods/Services Rs. 100 CGST @10% Rs. 10* SGST @ 10% Rs. 10* Example – B : Interstate Supply (Supply outside the state) Supply of Goods/Services Rs. 100 IGST @ 20% Rs. 20* . *rates are taken for example

- 6. www.gstindiareturn.co m At what rate GST will be levied?? There are broadly 4 rates of GST – 5%, 12%, 18% and 28% • Rate for Common Use Items5% • Standard Rate for goods and services12% & 18% • Rate for Luxury Items28%

- 7. www.gstindiareturn.co m Hmm!!! Can we take the credit of the tax paid on inputs and utilize the same for payment of output GST?? Yes, a registered person can take the credit of the tax paid on inputs purchased by it and further, it can utilize the credit for the payment of output GST. I will explain it with a simple example. Example – B has purchased the goods from A and paid GST of Rs. 20. B will take the credit of Rs. 20. When B will sell the goods further, he will charge Rs. 28 from its customer but remit Rs. 8 (Rs.28 minus Rs.20) to Govt. by utilizing input tax credit of Rs. 20. A - Seller • Cost of Goods Rs.100 • CGST @10% Rs. 10 • SGST @ 10% Rs. 10 B - Purchaser • Cost of Goods Rs 120 • Profit Rs. 20 • CGST @10% Rs. 14 • SGST @ 10% Rs. 14 • Input Tax Credit (Rs.

- 8. www.gstindiareturn.co m So, This means GST paid on inputs can be utilized for payment of output GST, without any restrictions?? No, There are conditions for utilization of GST. As I told you earlier, there are three types of GST. So there are certain restrictions on utilization of credit, which is explained in the below chart. IGST IGST CGST SGST CGST CGST IGST SGST SGST IGST > • First with > • Then With > • Then With Order of Utilization

- 9. www.gstindiareturn.co m But what is the threshold limit for registration in GST?? For those with an aggregate turnover below Rs.20 lakhs annually will be exempted from GST. Where as for the north-eastern States, the exemption threshold is Rs.10 lakhs Aggrega te Turnove r 20 Lakhs Mandator y Registrati on in GST

- 10. www.gstindiareturn.co m THANK YOU For any suggestions or queries please feel free to mail us at gstindiareturn@gmail.com