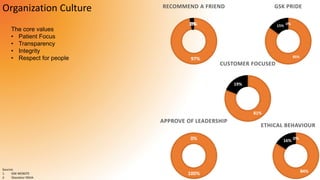

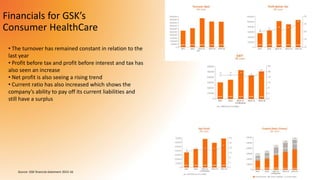

GlaxoSmithKline (GSK) is a major British pharmaceutical company formed in 2000, focusing on improving quality of life through its diverse products, including Horlicks and Nicorette. The company operates with a large workforce and a strong emphasis on patient care, transparency, and ethics, while also facing challenges like competition and patent expirations. GSK continues to innovate and expand its product offerings, especially in the consumer healthcare sector, to meet evolving market demands.