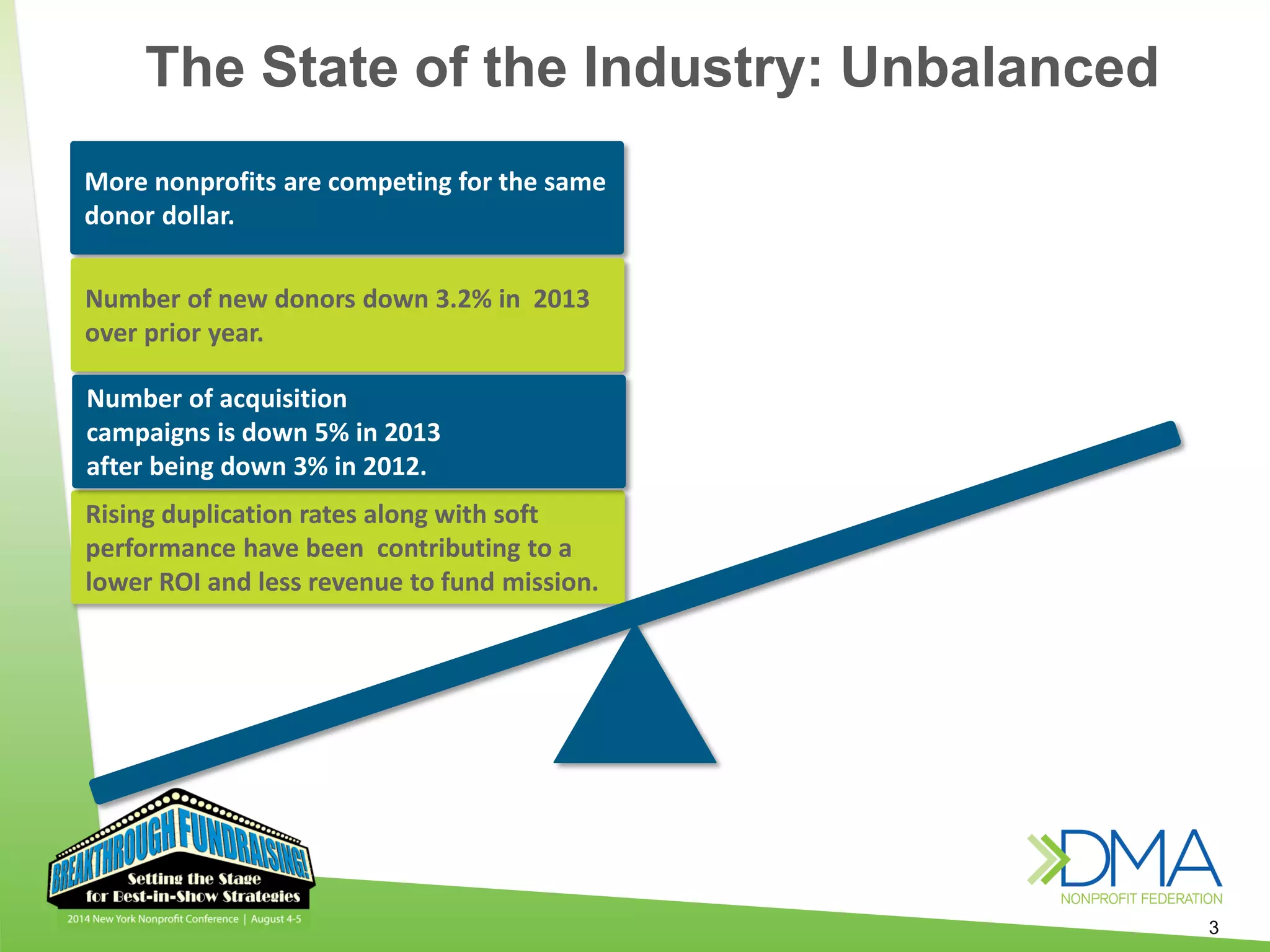

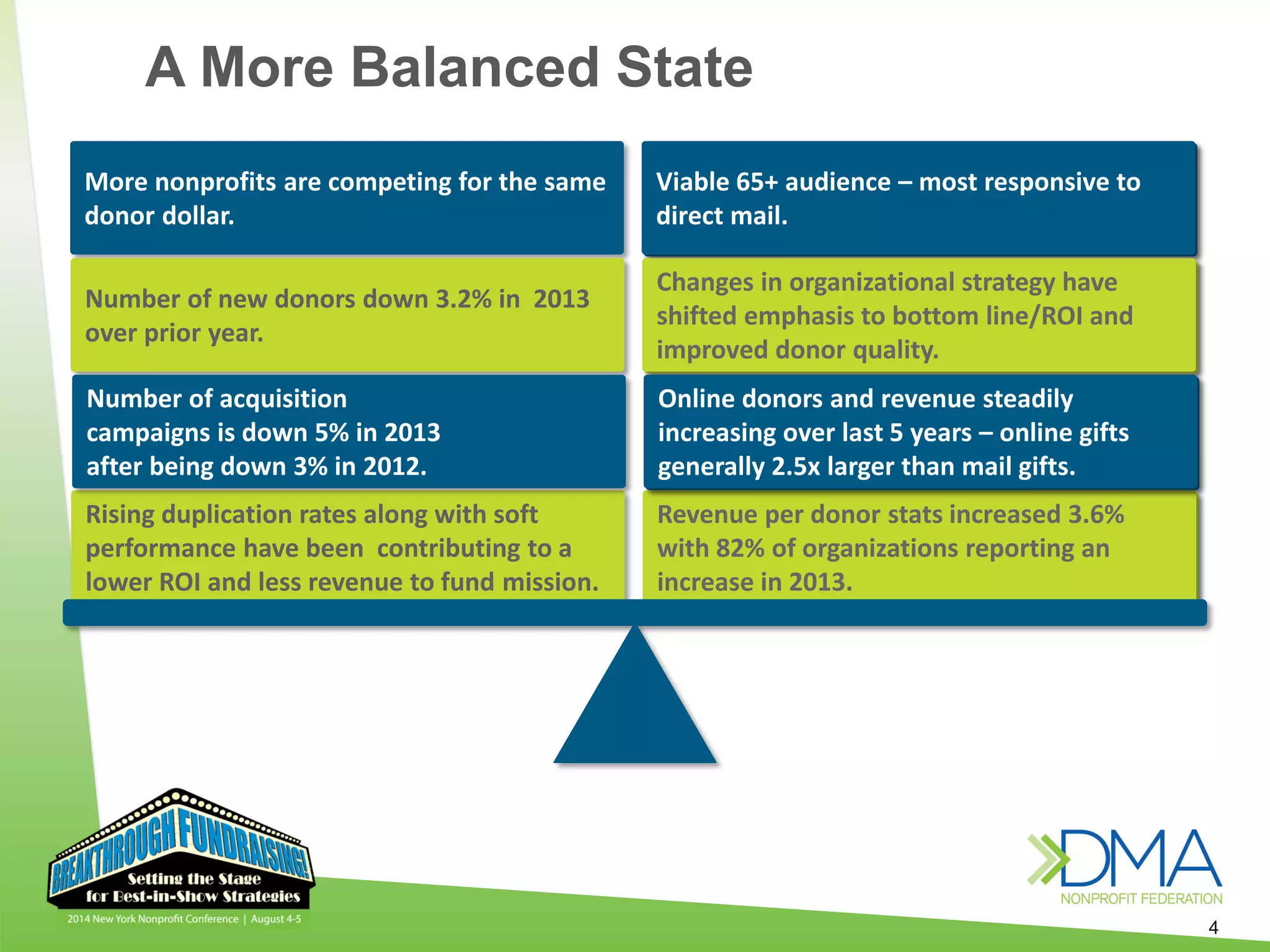

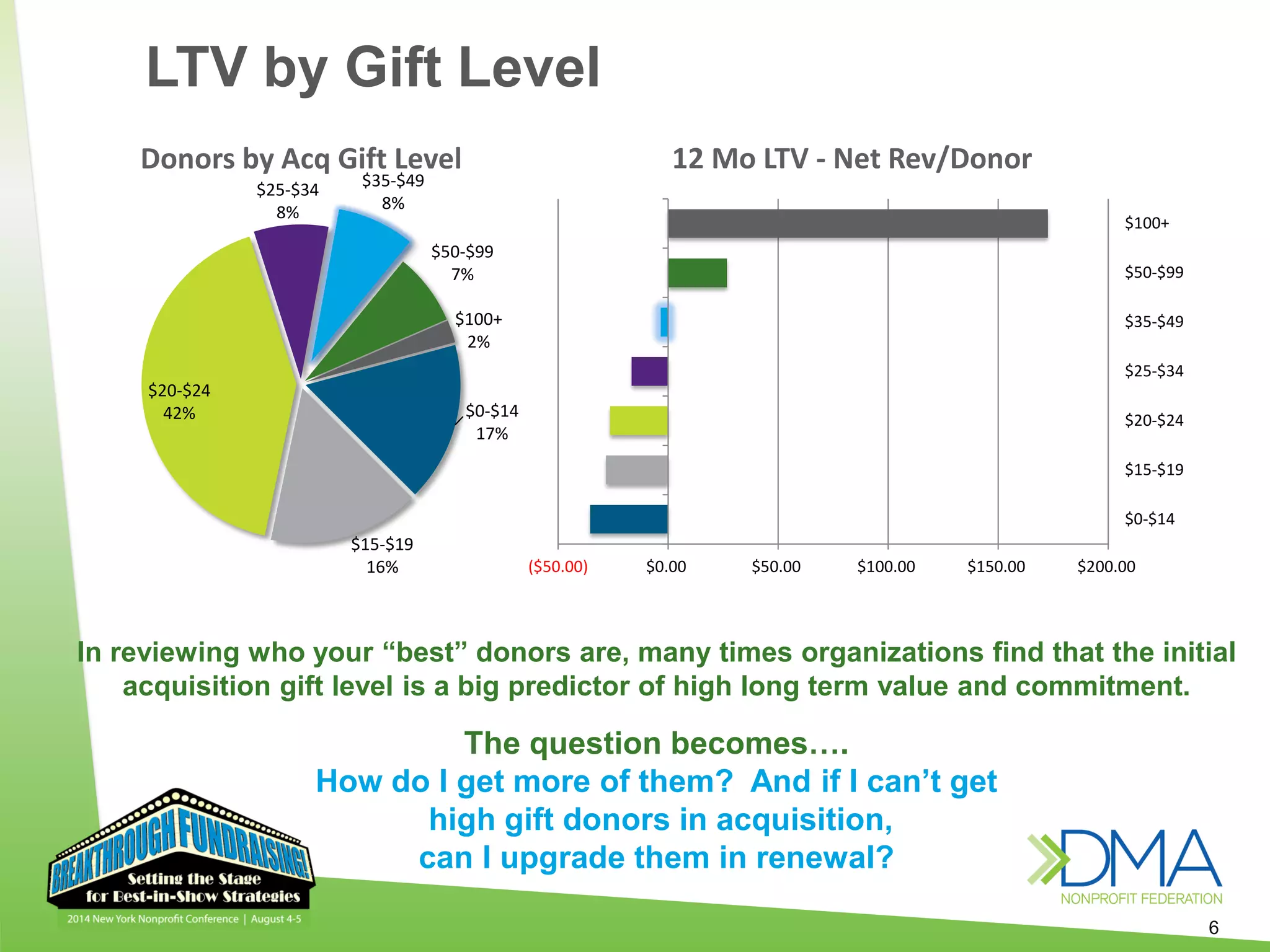

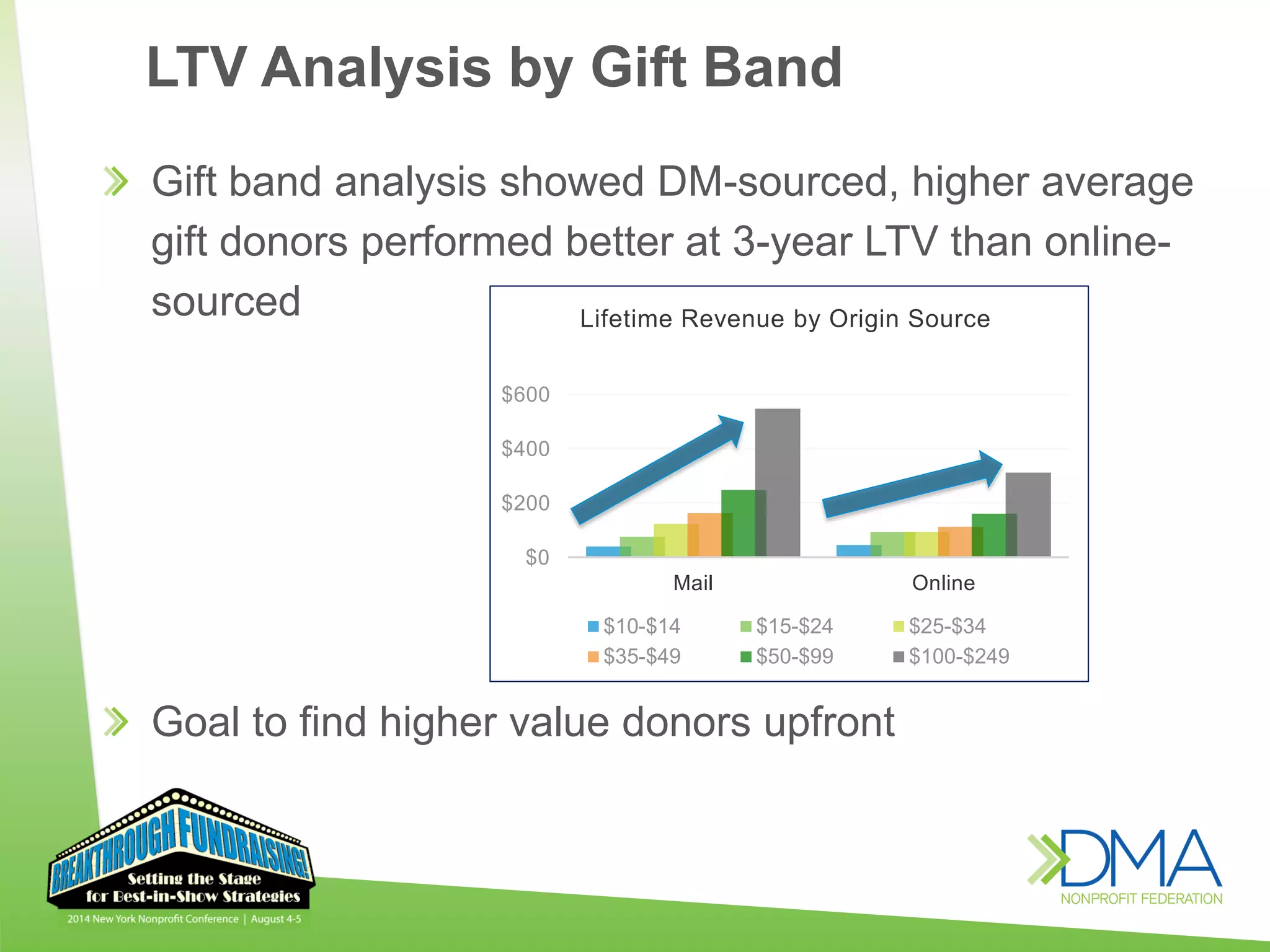

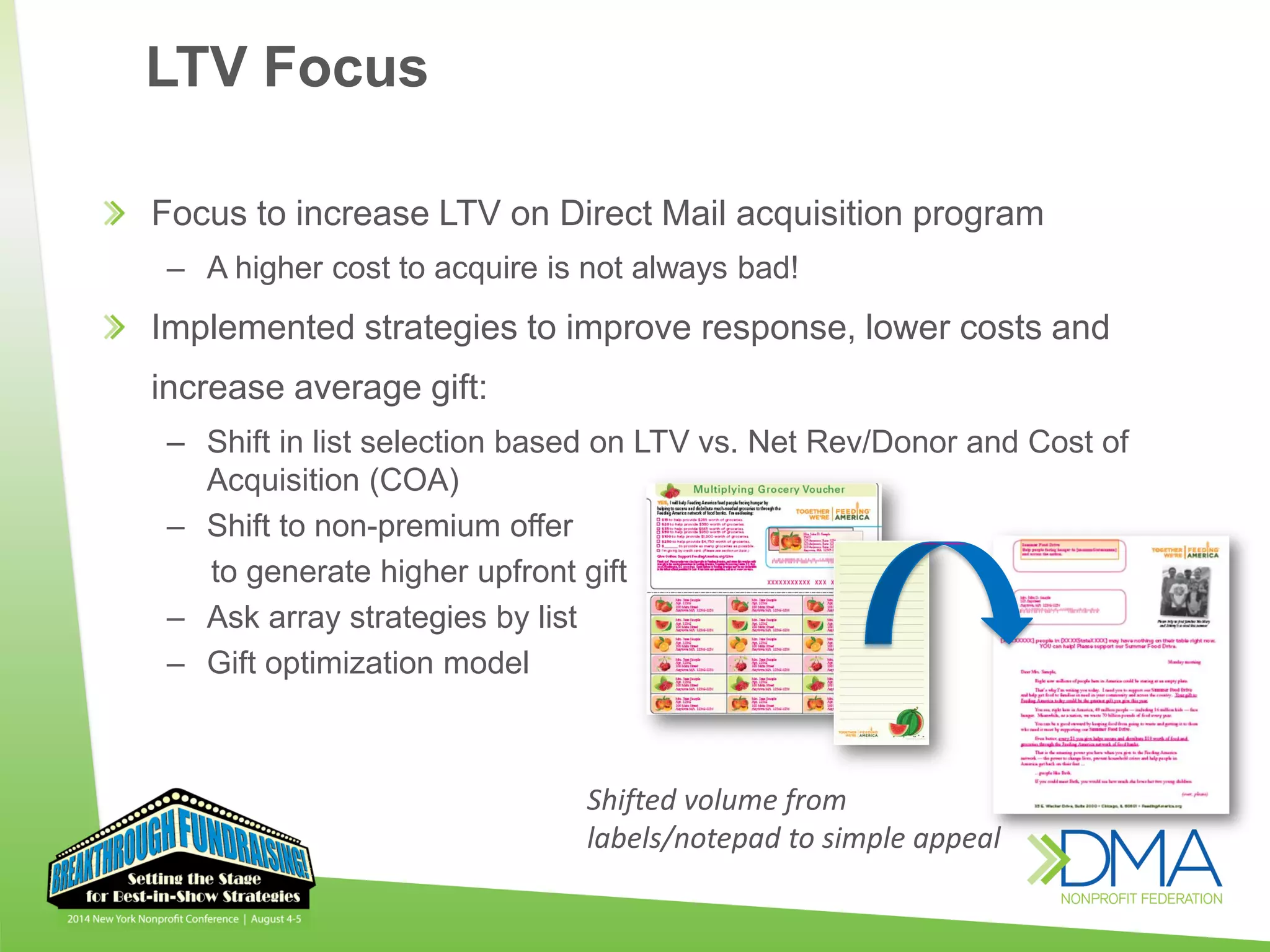

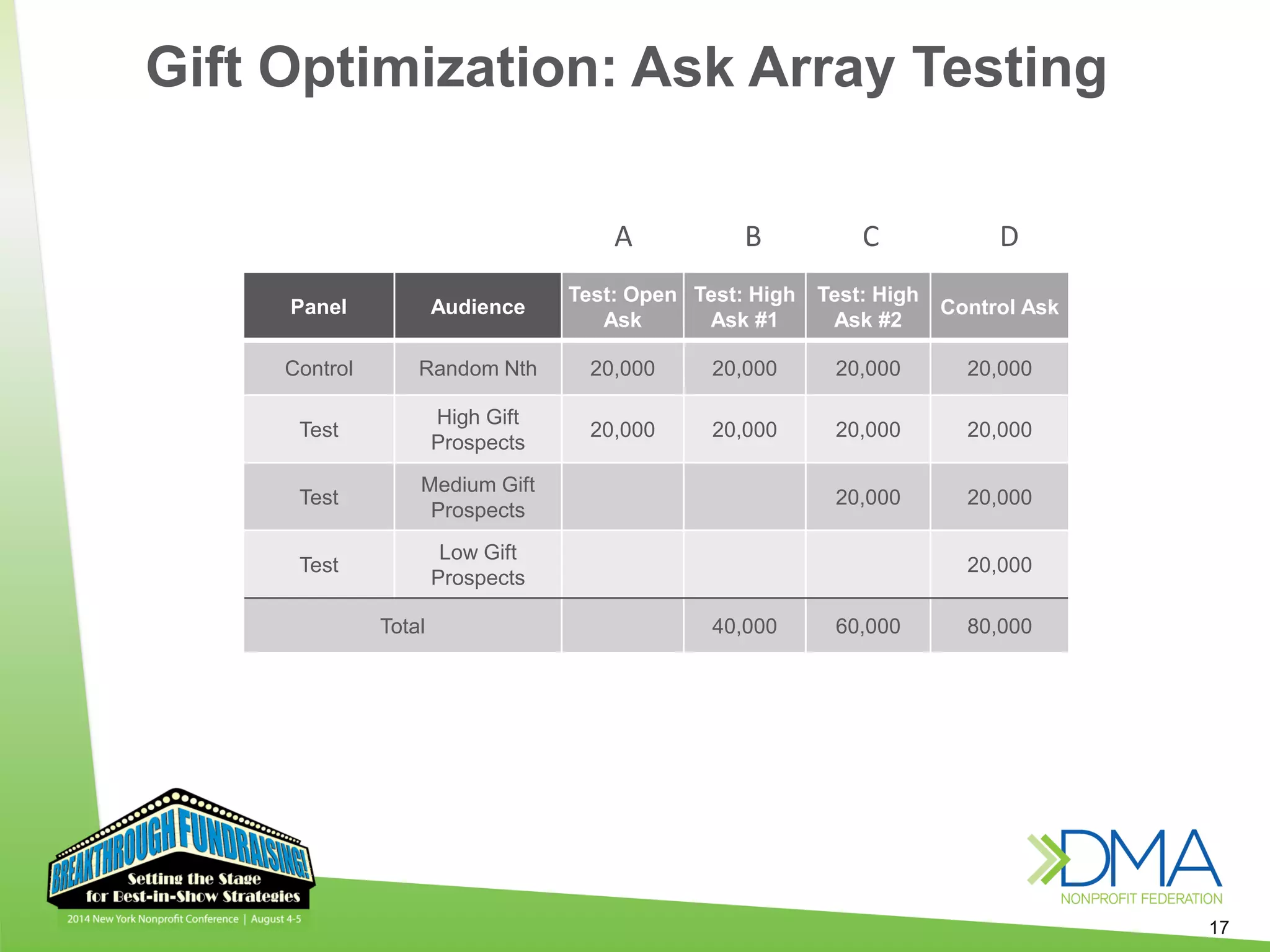

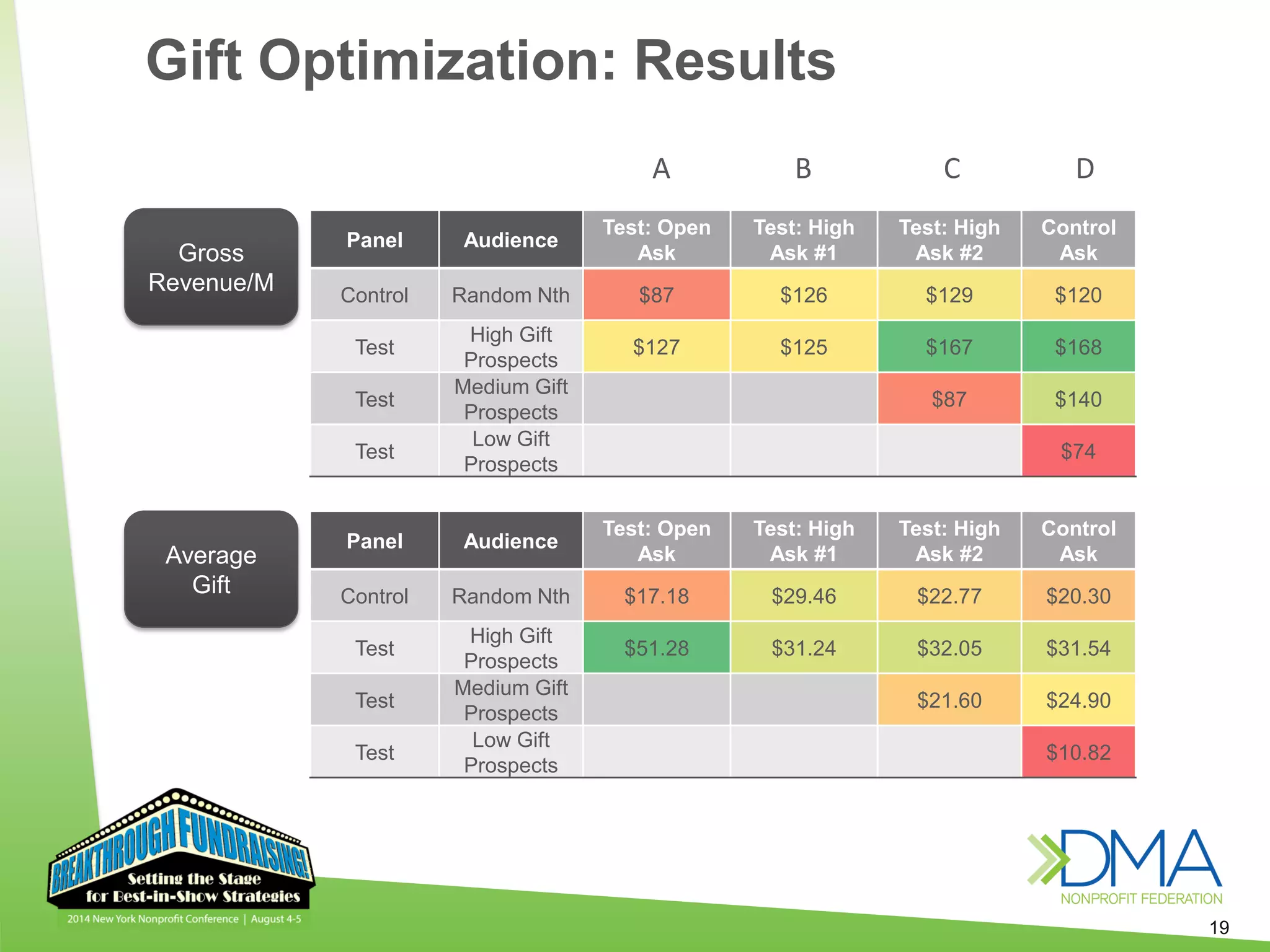

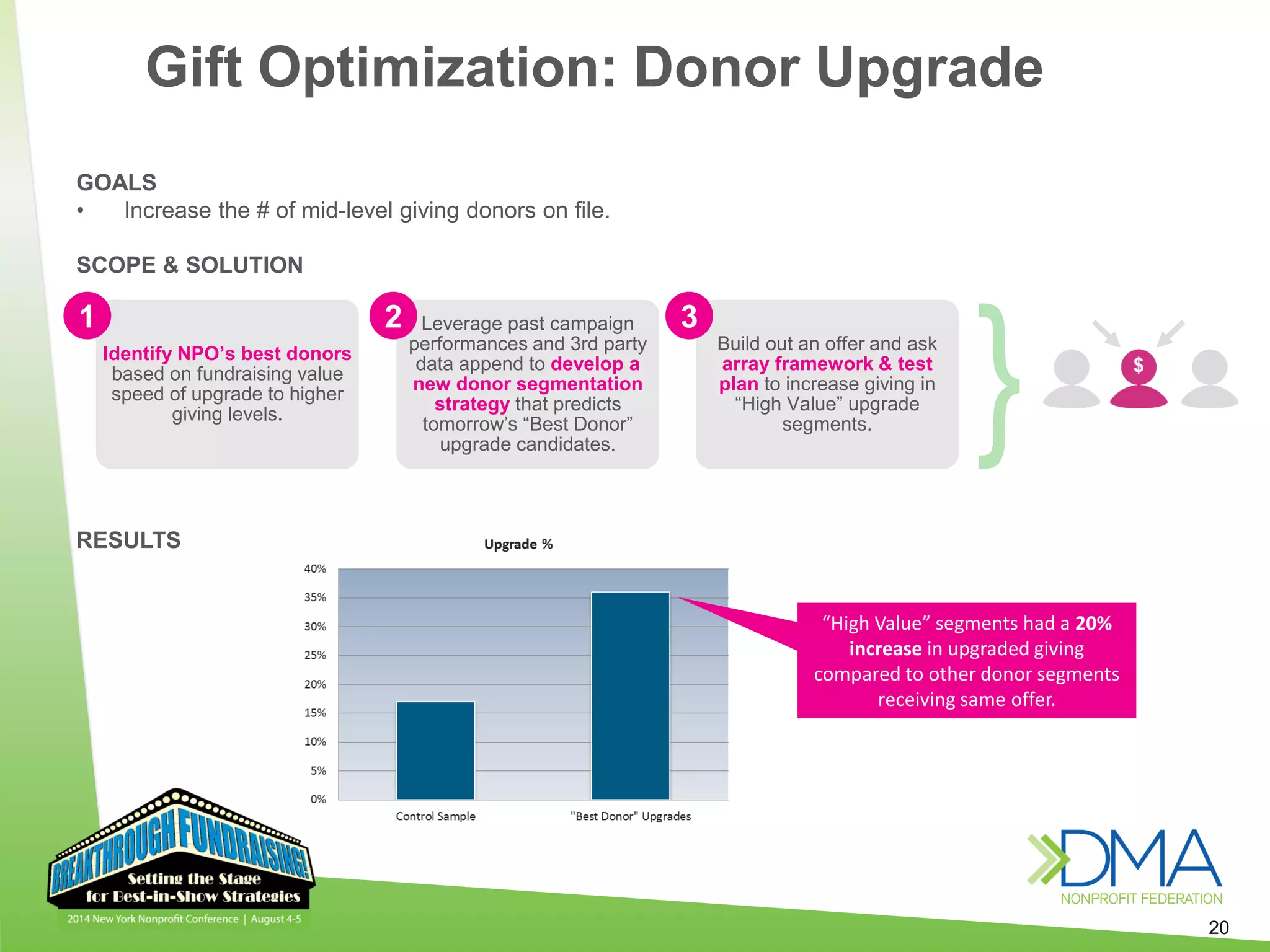

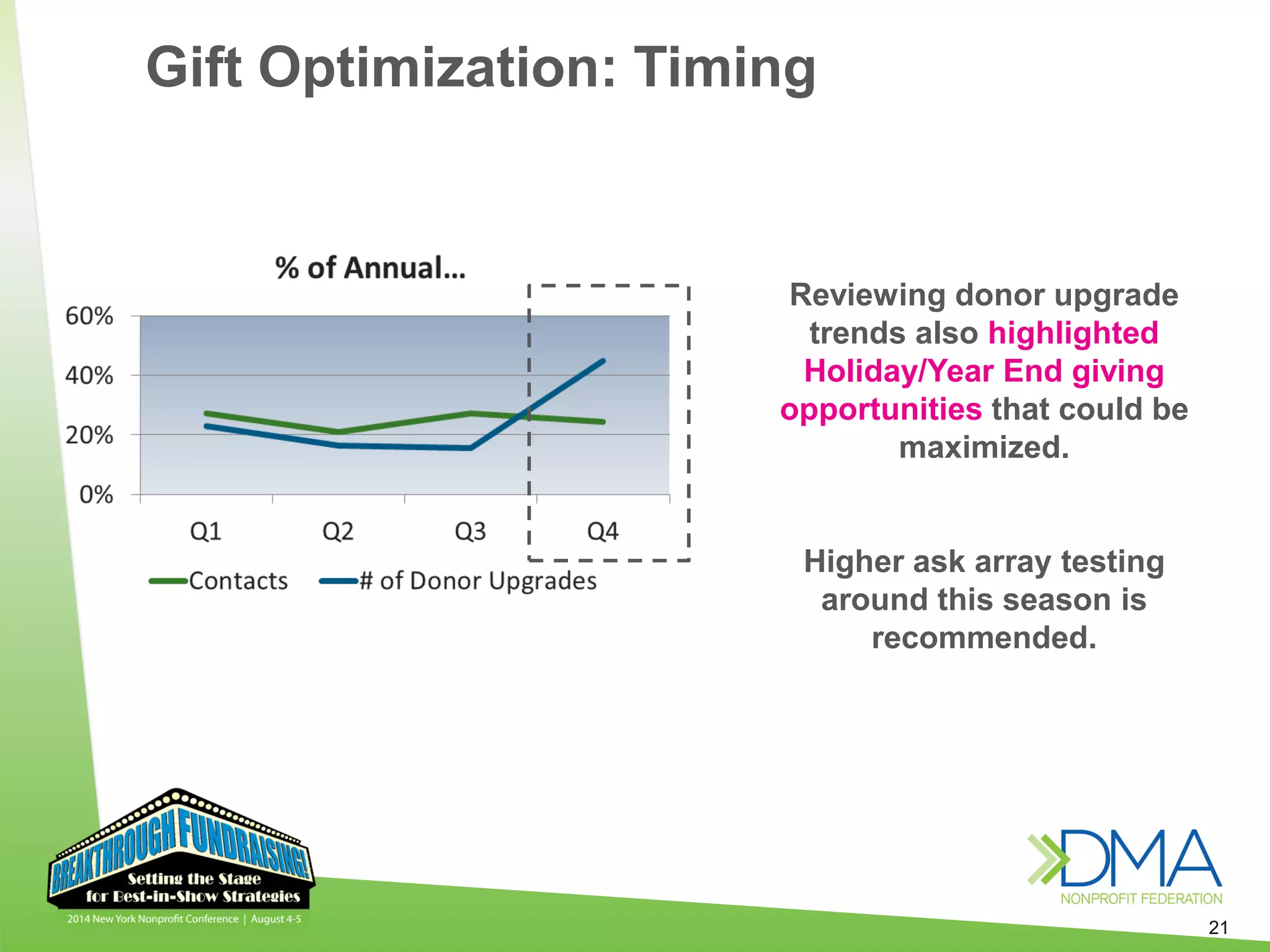

The document discusses strategies for non-profits to optimize gifts and increase long term donor value (LTV). It notes that rising duplication rates and soft performance have lowered return on investment. Test results show targeting higher gift asks to "high gift" donor segments can increase average gift by 20-30% compared to control groups. The presentation recommends audience profiling, gift modeling, and ask array testing to improve acquisition quality and maximize donor potential at different life stages.