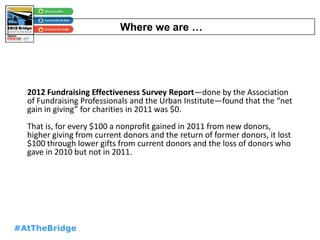

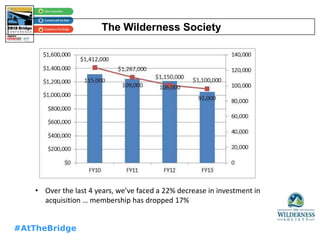

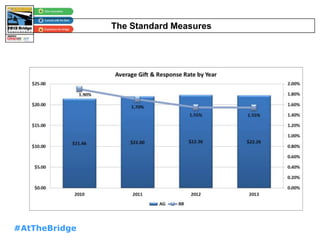

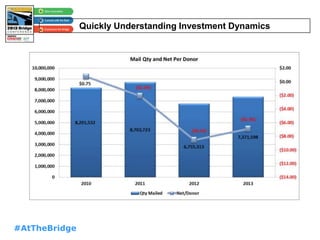

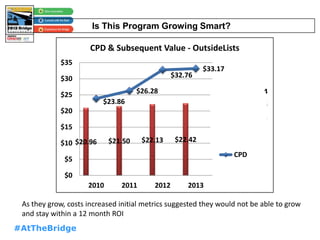

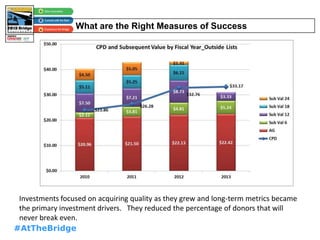

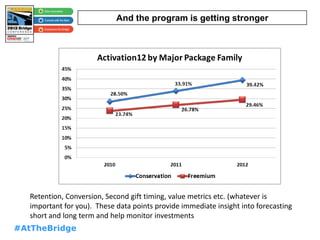

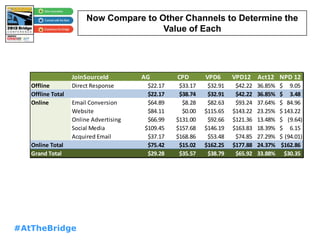

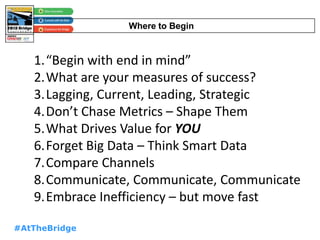

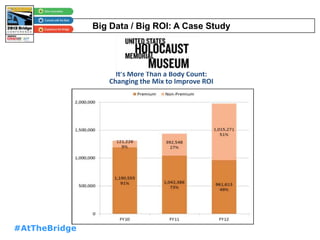

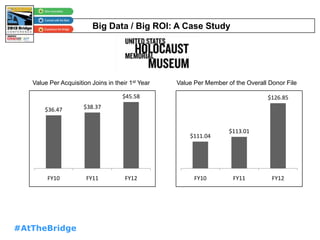

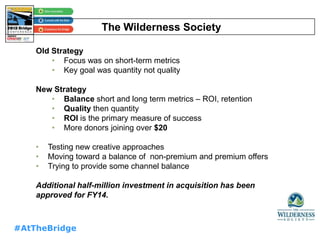

The document discusses how The Wilderness Society improved their donor acquisition strategy and return on investment (ROI) through the use of big data. They shifted from a focus on short-term metrics and quantity over quality to balancing both short and long-term metrics with ROI as the primary measure of success. This included testing new creative approaches, balancing premium and non-premium offers, and increasing investment in acquisition which led to acquiring higher value donors and improved retention rates while maintaining ROI goals.