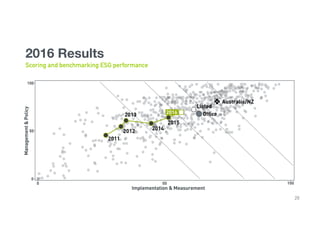

The document summarizes the results of the 2016 GRESB assessment. Some key points:

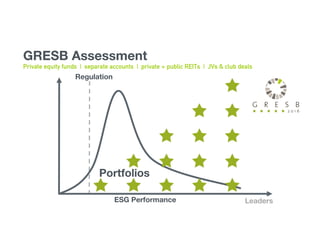

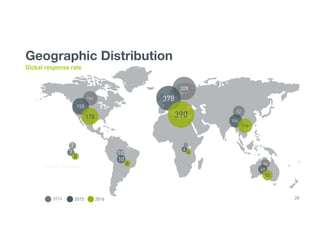

- GRESB assesses the ESG performance of over 750 real estate entities across 63 countries, representing over $4 trillion in assets under management.

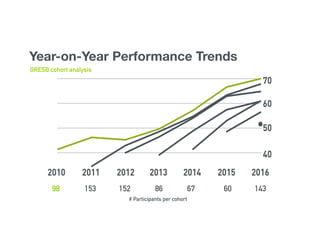

- Participation in the GRESB assessment has grown significantly each year, with North American participation nearly doubling from 2013 to 2016.

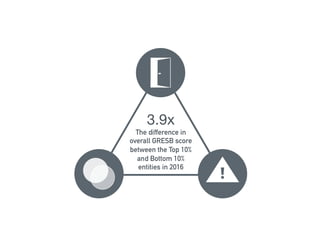

- Research has found a correlation between higher GRESB scores and higher returns, with the top 10% of entities outperforming the bottom 10% by 2.75-3.9% annually.

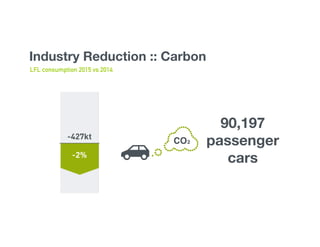

- The 2016 GRESB cohort improved their sustainability performance over the previous year, reducing energy, carbon, water and waste impacts

![April 1, 2017 GRESB assessment opens

until June 15 Deadline for Response Check request

June 30 [end of 2Q17] GRESB assessment closes

July + August Data validation + analysis

September Release Scorecards | Benchmark Reports

November + December Assessment review + revisions

January 2018 GRESB IT preparation

April 1 2018 assessment opens

Predictable annual cycle

21

2017 Timeline](https://image.slidesharecdn.com/gresb2016results-naiopdc-nov2016-161121123758/85/GRESB-2016-Results-Event-NAIOP-Washington-DC-22-320.jpg)

![Investment Capital

Assets under management [$B]](https://image.slidesharecdn.com/gresb2016results-naiopdc-nov2016-161121123758/85/GRESB-2016-Results-Event-NAIOP-Washington-DC-28-320.jpg)