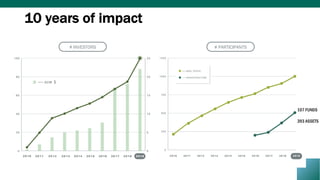

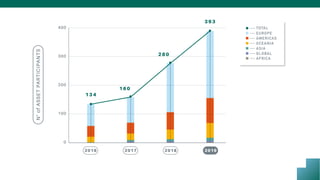

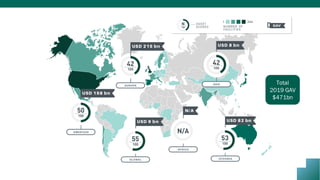

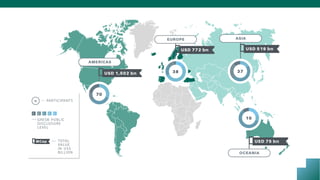

GRESB assesses and benchmarks the environmental, social, and governance (ESG) performance of real asset investments, providing standardized data to capital markets. It represents over $4 trillion in real asset value through the participation of over 100 investor members and the assessment of hundreds of assets and funds. GRESB helps investors integrate ESG factors into investment decisions and engage with general partners and asset managers.