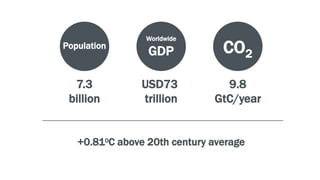

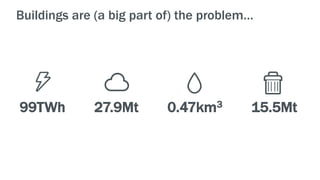

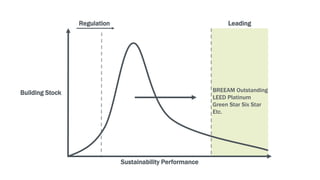

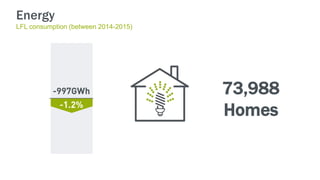

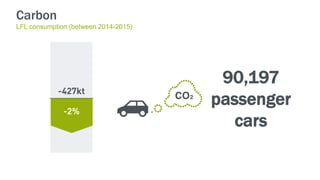

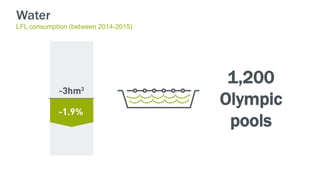

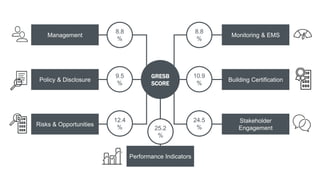

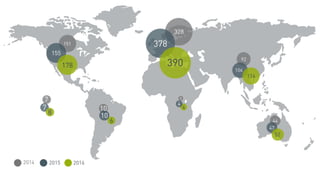

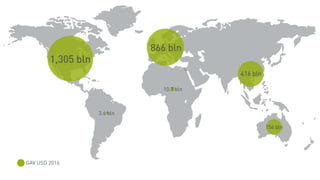

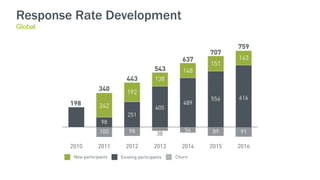

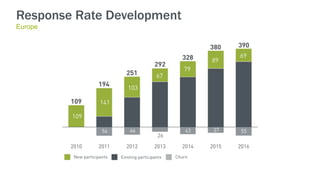

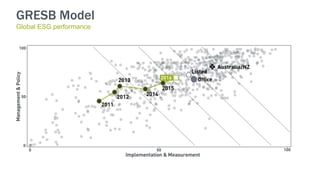

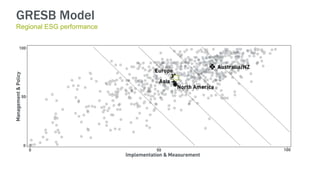

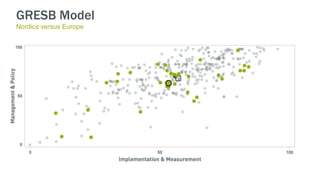

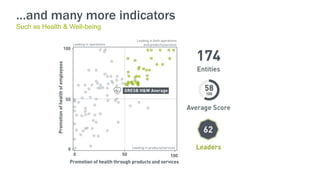

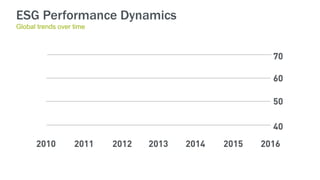

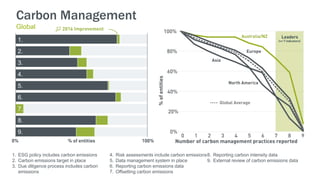

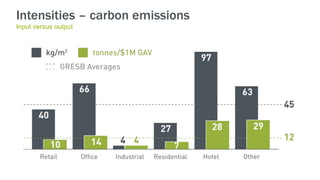

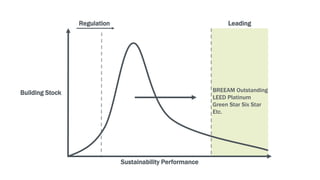

The document discusses global financial assets and investment management across various organizations, emphasizing the significance of sustainability in real estate and environmental investment practices. It highlights the importance of greenhouse gas emissions tracking, carbon management policies, and the GRESB performance assessment for real estate portfolios. Furthermore, it identifies trends in asset management that prioritize sustainability and examines the financial impact of adopting environmentally responsible practices.