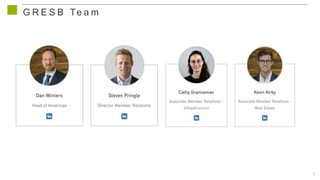

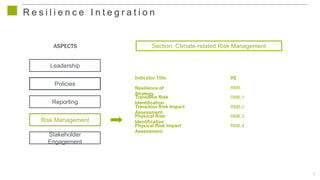

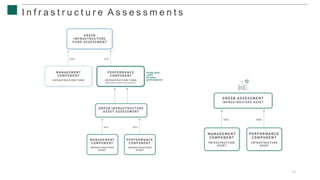

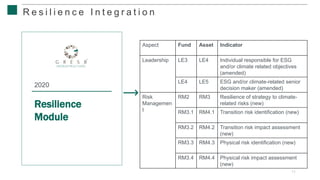

The document outlines the March 2021 live Q&A session on the 2021 real estate assessment conducted by GRESB, emphasizing that the opinions and information presented are reflective of GRESB and not independently verified. It highlights the impacts of COVID-19 on assessments and governance updates, including the establishment of the GRESB Foundation and the focus on ESG strategies moving forward. Additionally, it provides details on assessment resources and upcoming Q&A sessions for further engagement.