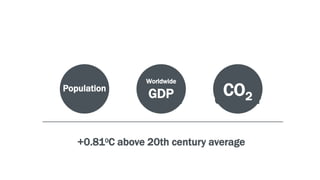

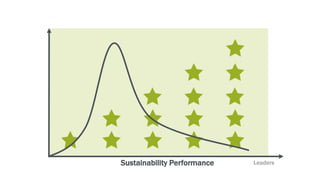

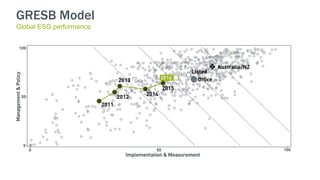

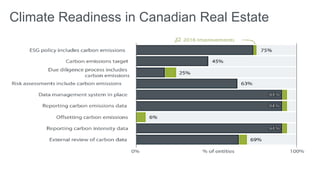

The document discusses sustainability performance in the real estate industry based on GRESB data and assessments. Some key points:

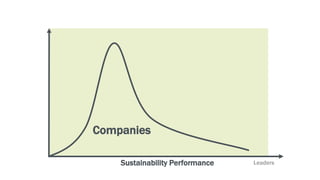

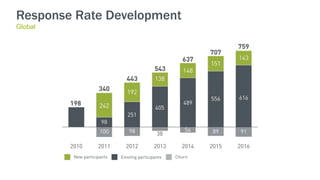

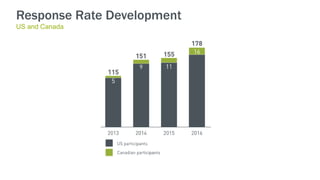

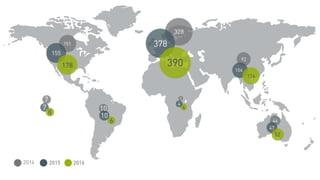

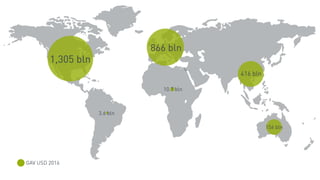

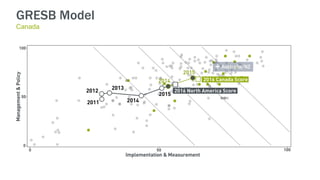

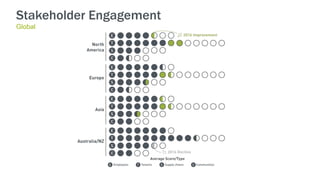

- GRESB provides sustainability benchmarks and assessments for real estate portfolios and companies globally. Over $2.8 trillion in real estate assets are covered by GRESB.

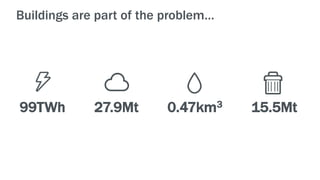

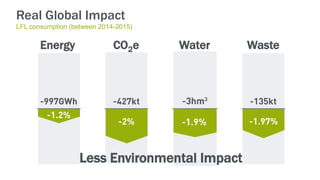

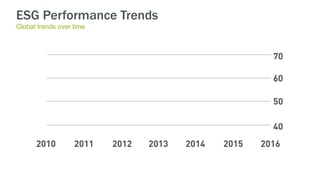

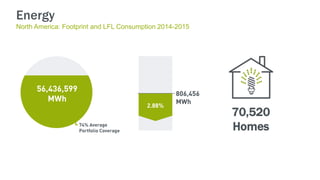

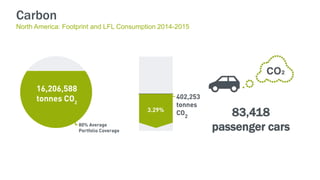

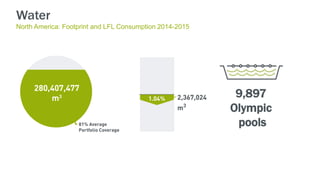

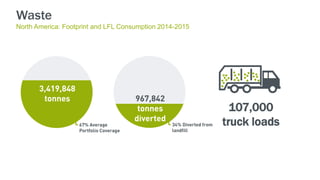

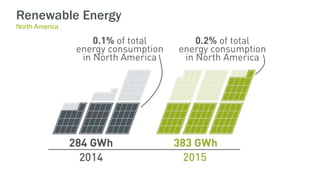

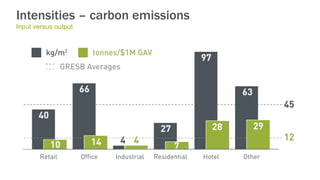

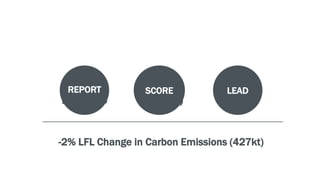

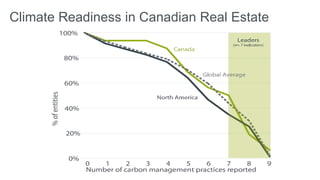

- GRESB data shows trends in energy, emissions, water and waste reduction for participating real estate entities in regions like North America. Higher GRESB scores are also correlated with higher investment returns.

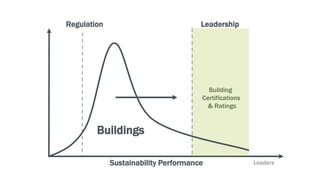

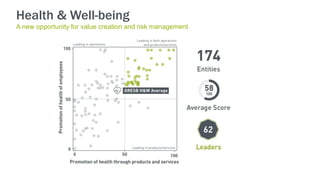

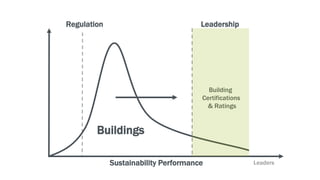

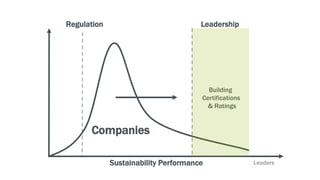

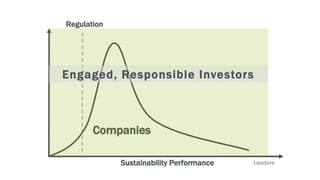

- Issues like climate change initiatives, building certifications and health and well-being are transforming the industry and present both risks and opportunities for real estate investors and companies.

- Continued leadership will be needed