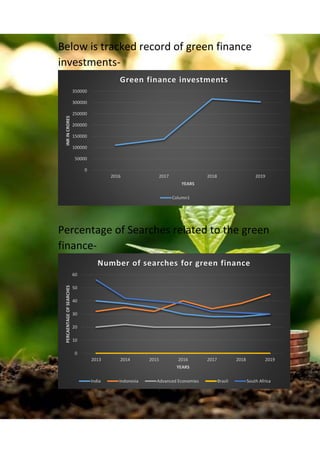

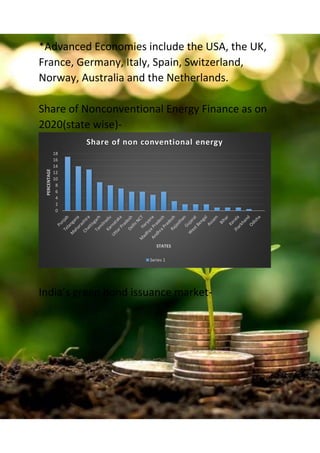

The document discusses green finance, which refers to financial activities and investments that support environmental goals. Green finance aims to increase funding for initiatives that minimize climate impact, support renewable energy, improve energy efficiency, and more. Examples of green finance instruments mentioned include green loans, mortgages, credit cards, banks, and bonds. Adopting green finance can provide competitive advantages and improve reputation for businesses. The document also outlines India's progress in adopting green finance through various policies and programs.