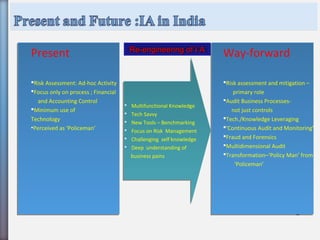

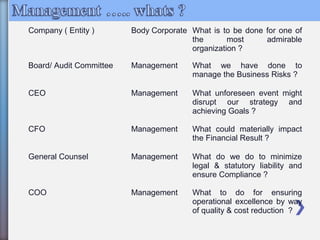

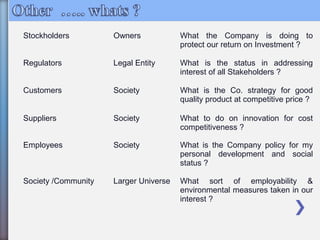

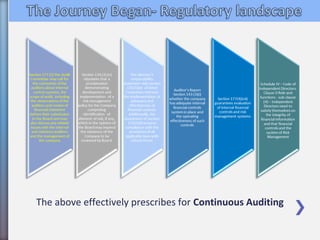

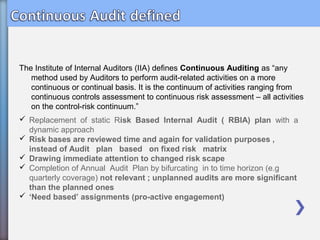

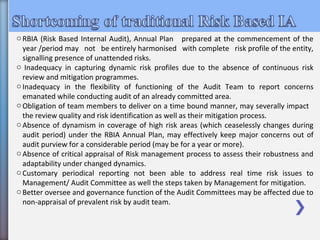

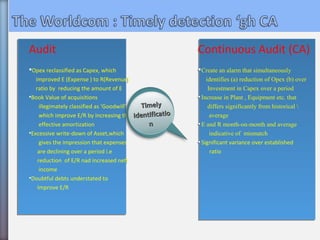

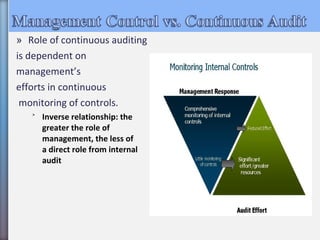

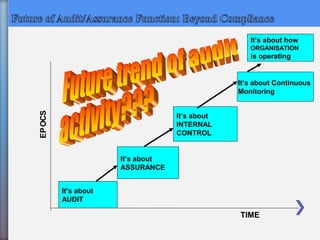

The document discusses internal auditing in the Indian context. It begins with acknowledging those who contributed to the presentation. The discussion then covers various topics related to internal auditing including the meaning of governance, risk and control; the role of internal auditors as collaborators; preparing for continuous auditing; auditing in a changing environment; and moving beyond just compliance. The presentation emphasizes the importance of internal auditors focusing on risk assessment and mitigation, auditing entire business processes, and leveraging technology. It also outlines how the role of internal auditing needs to transform from being perceived as a "policeman" to a "policy man".

![5

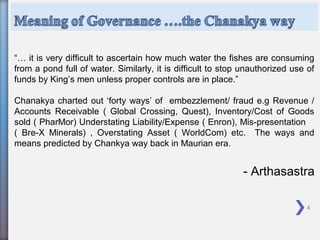

““Corporate governance is concernedCorporate governance is concerned

with holding the balance betweenwith holding the balance between

economic and social goals and betweeneconomic and social goals and between

individual and communal goals…… Theindividual and communal goals…… The

aim is to align as nearly as possible theaim is to align as nearly as possible the

interests of individuals, corporations andinterests of individuals, corporations and

society.”society.”

Sir Adrian Cadbury

Corporate Governance Overview, 1999

[World Bank Report]](https://image.slidesharecdn.com/3b5ac952-b3ea-443f-b7ed-5b06d900c5dc-160924155902/85/GRCICMAI-5-320.jpg)