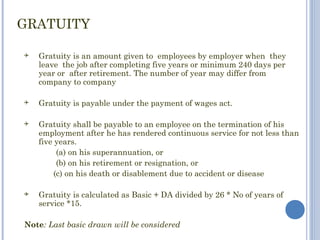

Gratuity is an amount given to employees upon leaving a job after 5+ years or retirement. It is calculated as basic pay + dearness allowance divided by 26 times number of years of service times 15. Gratuity received by employees is taxable as salaries, with an exemption for those covered by the Gratuity Act of the minimum of gratuity received, 15 days salary per year of service (partial years count as full), or Rs. 350,000. The Employees' State Insurance Act provides medical, sickness, maternity, disability and funeral benefits to covered employees, funded by contributions from employers at 4.75% and employees at 1.75% of gross salary up to Rs. 15,000.