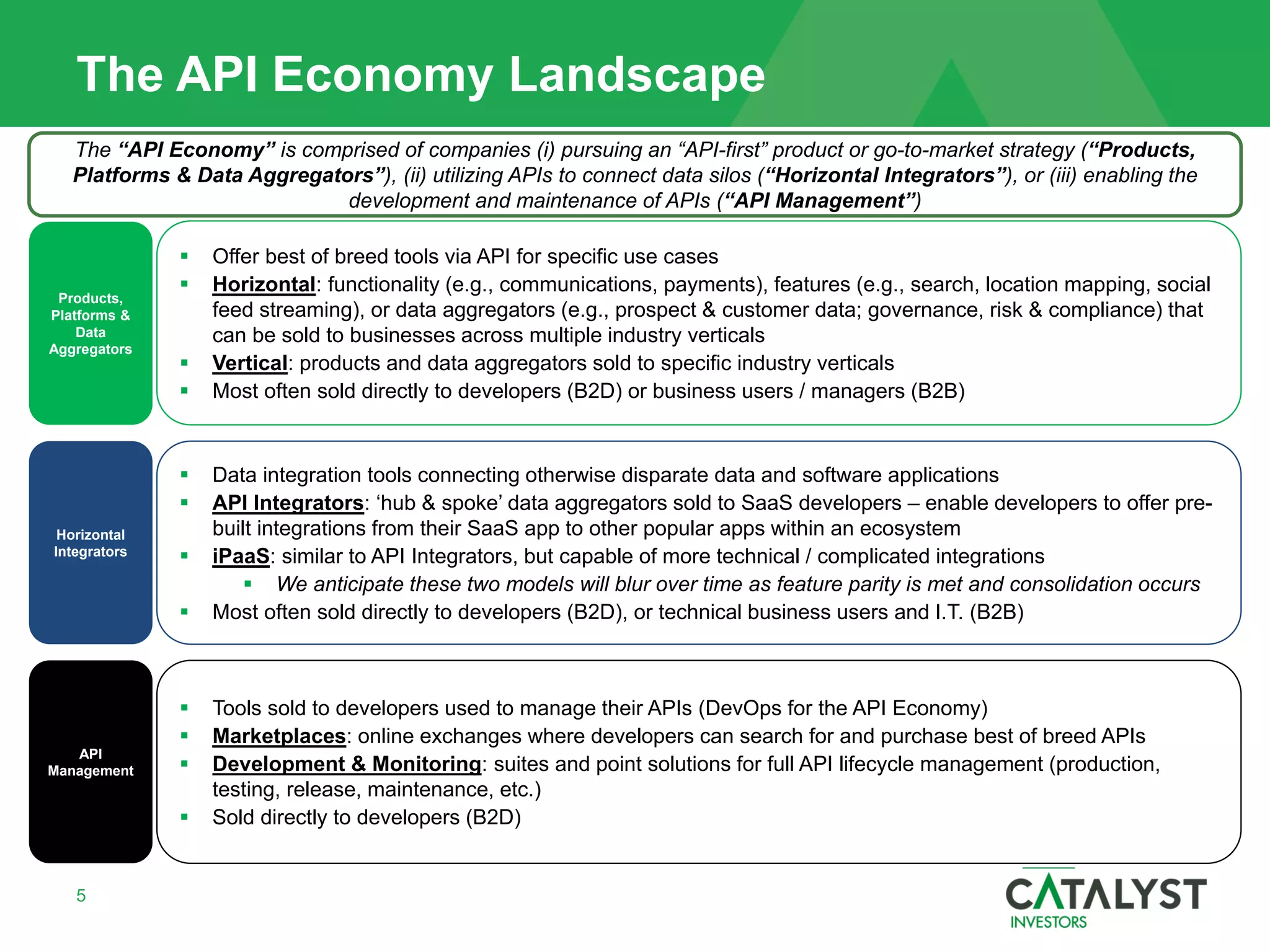

The document discusses the significant growth of the SaaS market, reporting an 800% increase in paid SaaS applications from 2010 to 2017, with the average company spending over $200k on approximately 20 applications. This rise has led to the emergence of the API economy, characterized by a 925% growth in public web APIs during the same period, as companies adopt an 'API-first' strategy to enhance connectivity between disparate applications. The document highlights different sectors within the API economy, including API management and development, which facilitate the integration and maintenance of these connections.