Embed presentation

Download to read offline

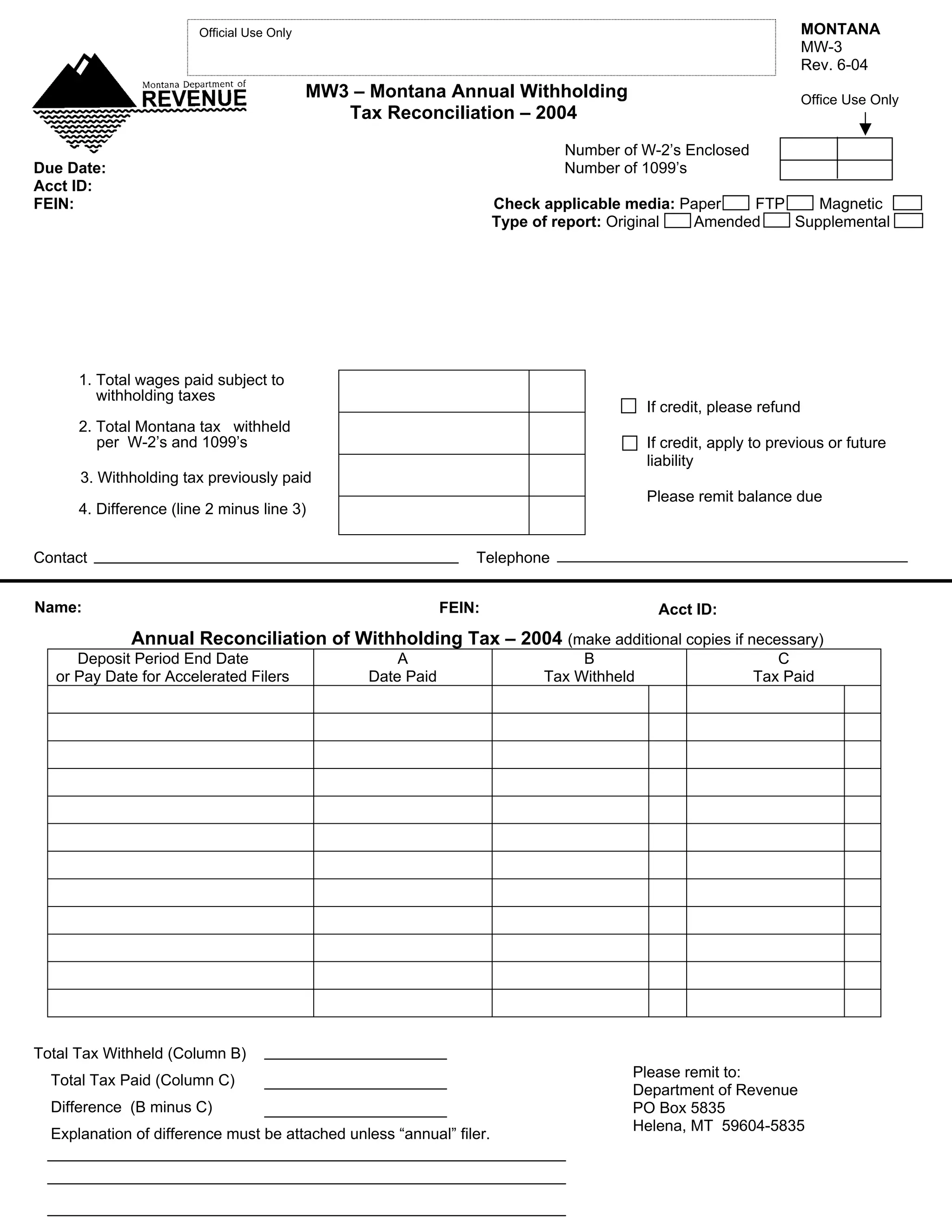

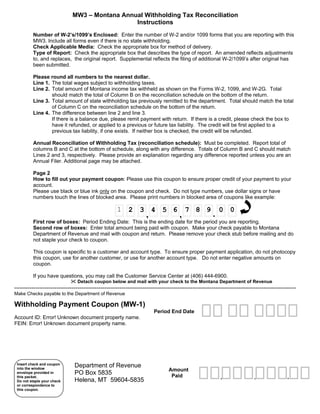

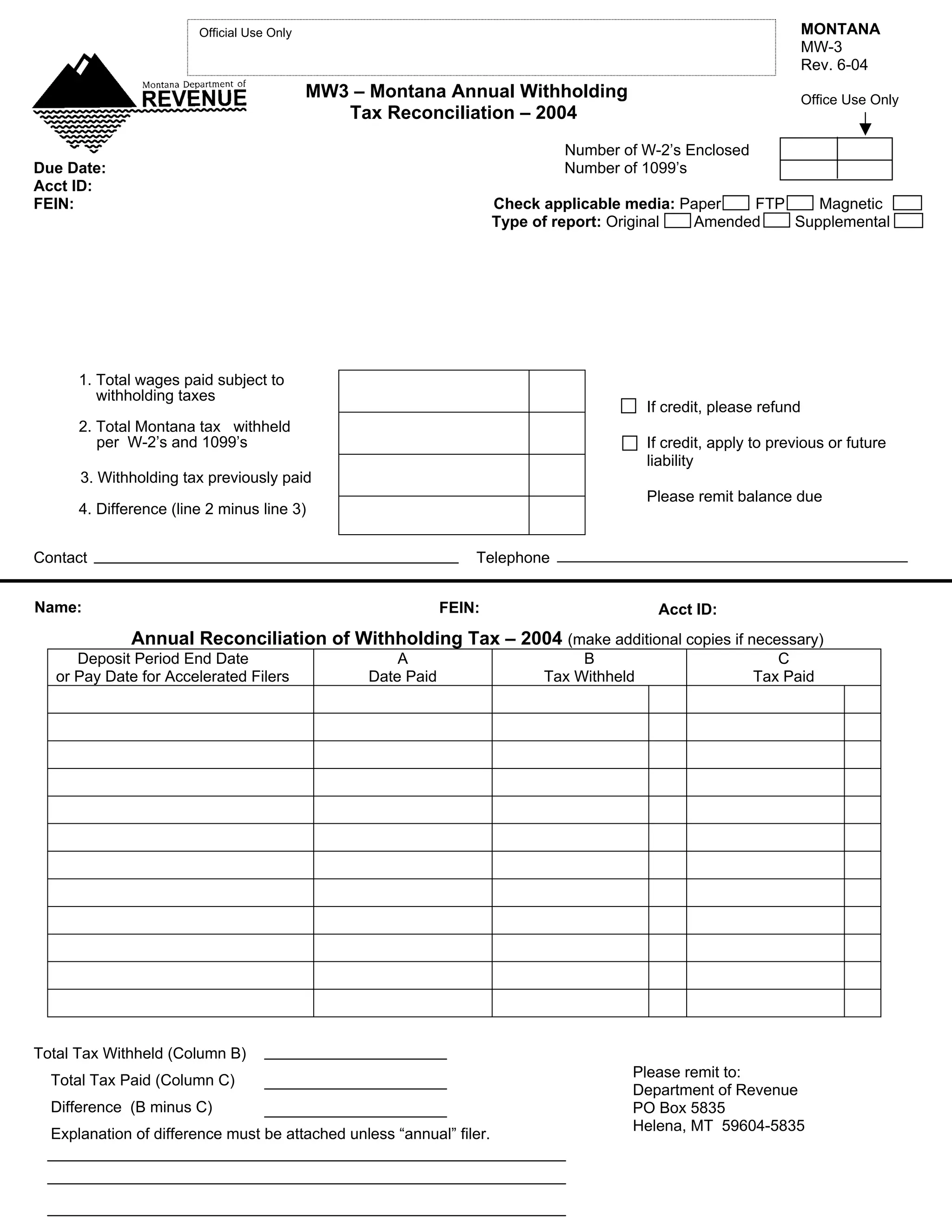

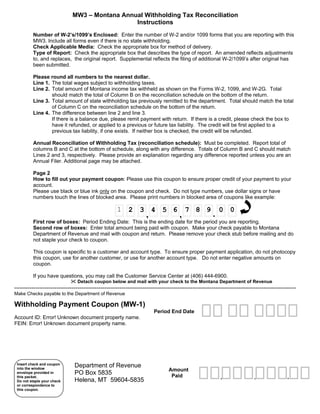

This document provides instructions for filing the Montana MW-3 annual withholding tax reconciliation form for 2004. Key details include: reporting the number of W-2 and 1099 forms enclosed, whether the filing is an original, amended or supplemental report, reconciling total taxes withheld against taxes previously paid, and providing payment or requesting a refund/credit on the remaining balance. A reconciliation schedule is included to detail taxes withheld and paid by deposit/payment period. Instructions explain how to complete all sections of the form and payment coupon correctly.