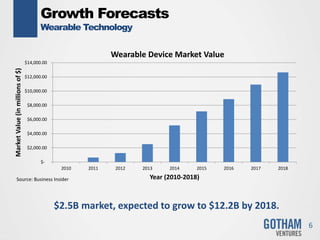

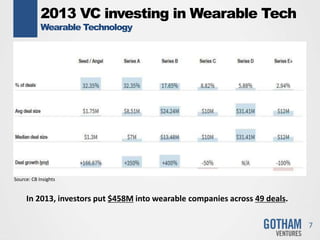

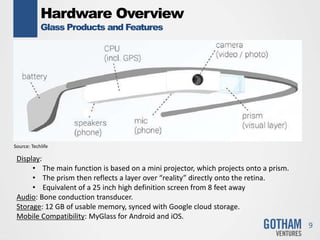

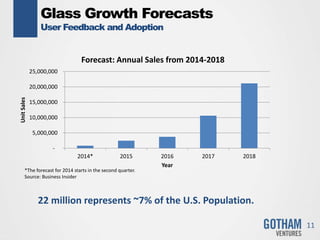

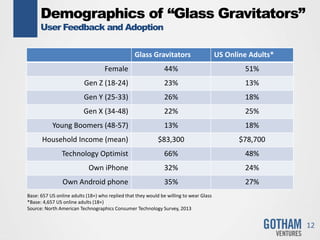

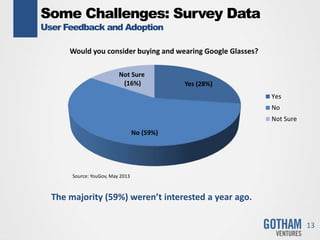

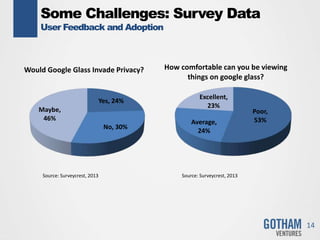

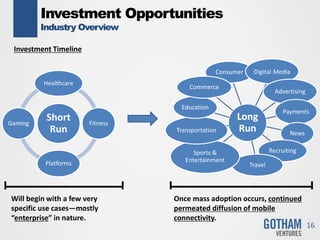

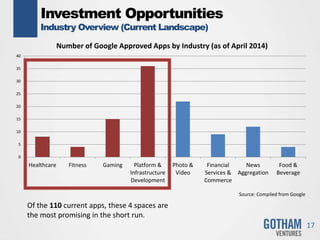

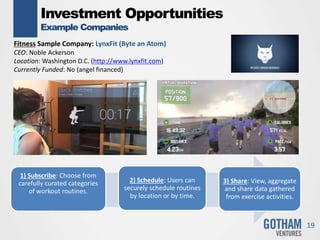

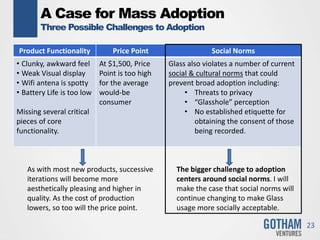

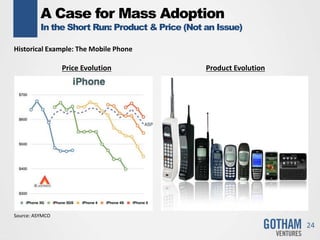

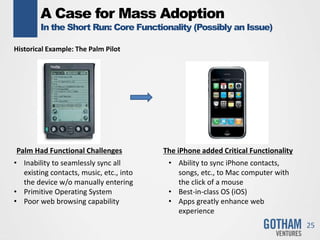

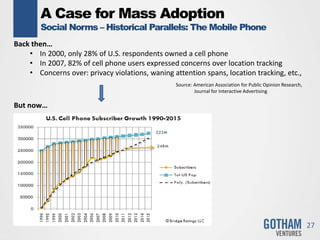

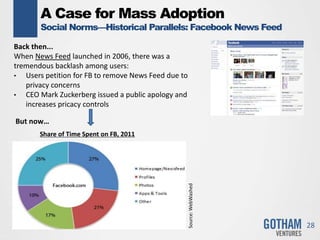

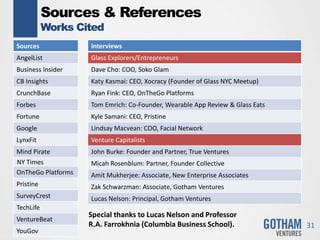

The document discusses trends in wearable technology like Google Glass, providing an overview of Glass products and features, user feedback and adoption forecasts. It outlines investment opportunities for Glass in industries like healthcare, fitness and gaming, and examples of startup companies pursuing those opportunities. Finally, it makes the case that while social norms around privacy and etiquette present challenges to mass adoption now, historical examples like mobile phones and Facebook suggest social norms can evolve to accommodate new technologies.