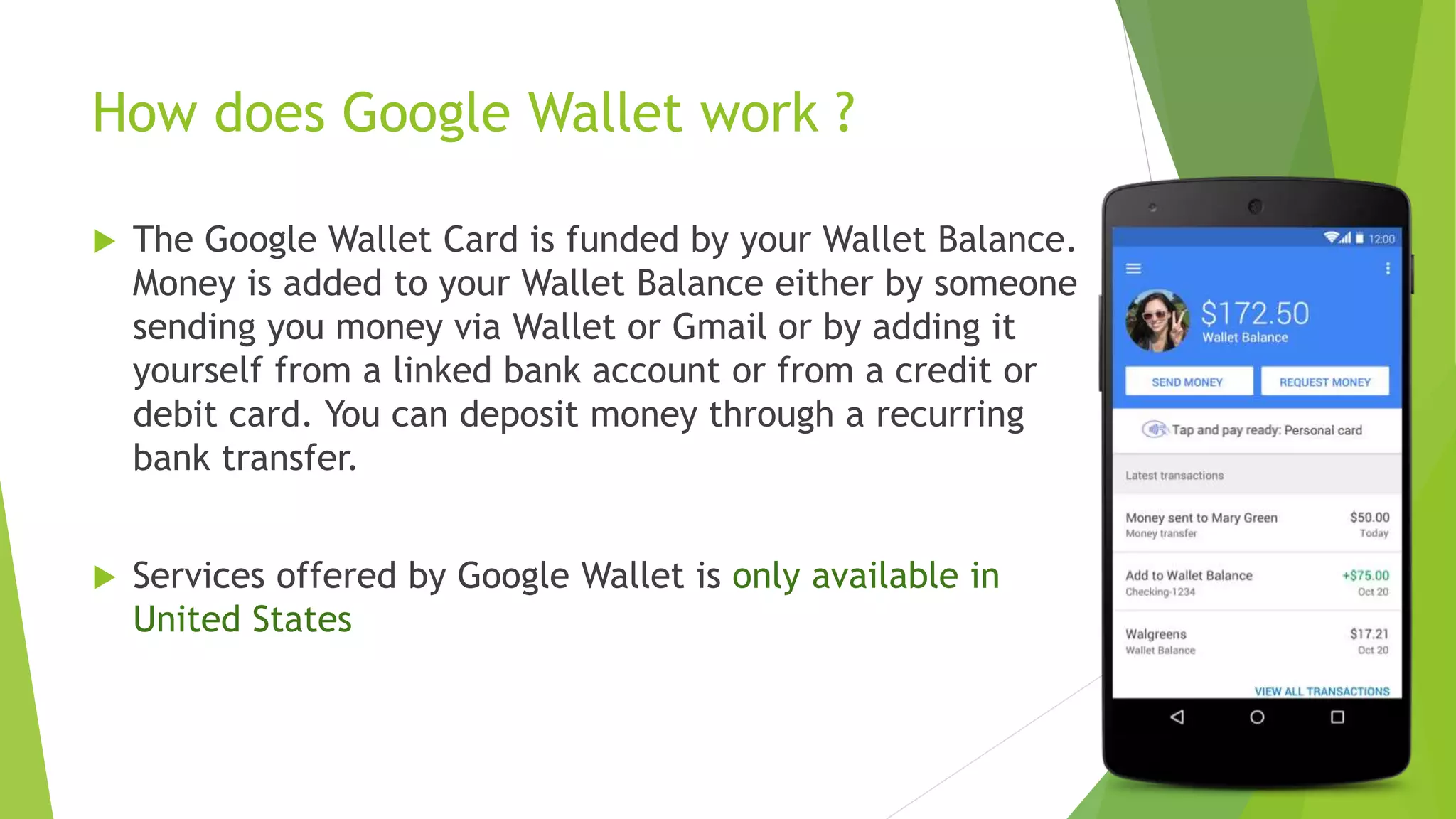

Google Wallet is a mobile payment system that allows users to store debit/credit cards and loyalty cards to make contactless payments through NFC. It was first released in the US in 2011. Google Wallet partners with many major merchants and works with over 300,000 payment terminals. While it initially only supported a few phone models, Google Wallet now works with popular phones like iPhones, Samsung Galaxy phones, and Google's Nexus devices. Google's business model is to offer sponsored ads to users through the app and make money this way rather than charging users or merchants fees.

![Device Availability

HTC One SV (running Android 4.1 or newer) on Boost Mobile

HTC One on Sprint

HTC One (M8)

iPhone

Motorola Droid RAZR MAXX HD on Google Play

Motorola Moto X

Samsung Galaxy S5

Samsung Galaxy Note II on AT&T, Sprint, US Cellular and Verizon

Samsung Galaxy S4 on Sprint, US Cellular, and Google Play

Samsung Nexus S 4G on Sprint

Asus Nexus 7 (2012 and 2013[Note 1] variations

Samsung Nexus 10](https://image.slidesharecdn.com/af9d8aee-3ecb-47a3-80fc-5630847ffb01-150213111813-conversion-gate01/75/Google-Wallet-Presentation-14-2048.jpg)