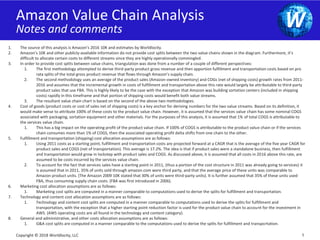

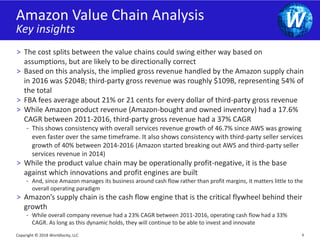

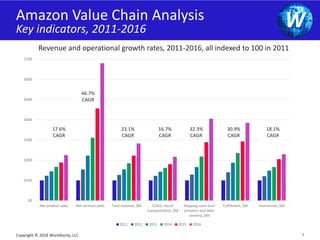

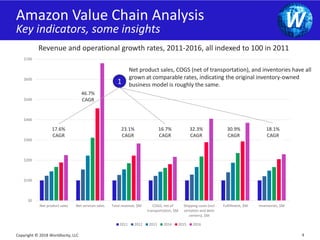

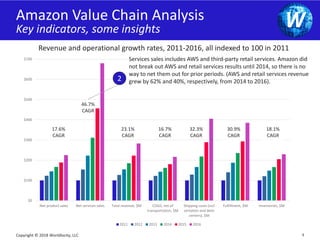

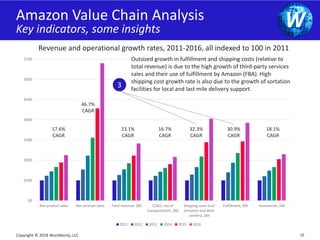

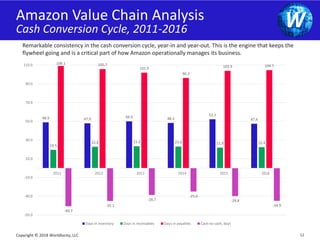

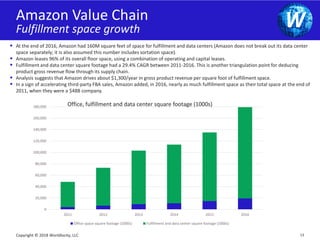

The document provides a value chain analysis of Amazon, highlighting its dual business model comprising retail product sales and various services, including AWS. It emphasizes that while Amazon operates at a loss in its traditional product sales, it generates profits through its services, resulting in a net operating profit of approximately 3 cents for every dollar sold overall. Additionally, it notes that Amazon's supply chain management significantly contributes to its cash flow and operational success, allowing for continuous investment and innovation.