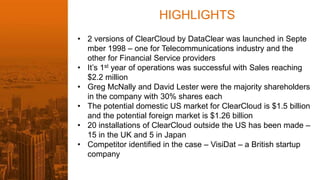

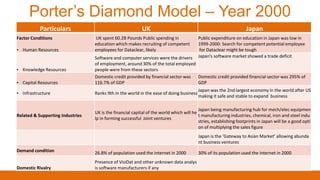

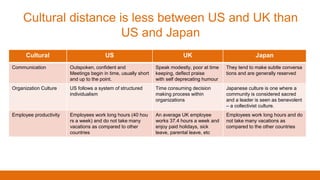

Dataclear's Clearcloud launched in 1998 has proven successful, but faces competition from UK startup Visidat, prompting a strategic decision on whether to expand internationally or strengthen the domestic market. The document explores market potentials, challenges, and suitable strategies, suggesting Dataclear should focus on domestic expansion before going global while preparing for future international opportunities. It emphasizes the importance of developing competencies and partnerships to support eventual international market entry.