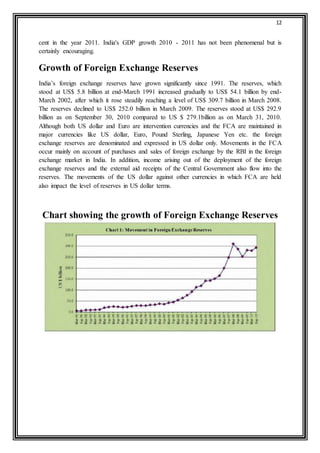

This document is a project report on globalization in India submitted by a student. It includes a certificate verifying the work, acknowledgements, table of contents, abstract, and sections on the introduction of economic reforms in India, strategies initiated, the process of globalization in India, and objectives of the study. The report provides an overview of India's economic liberalization and opening to globalization in the 1990s, the key policy changes introduced, and analyzes the impact and implications of globalization on the Indian economy.