The document summarizes the results of a survey on the 2012 global services industry outlook. Key findings include:

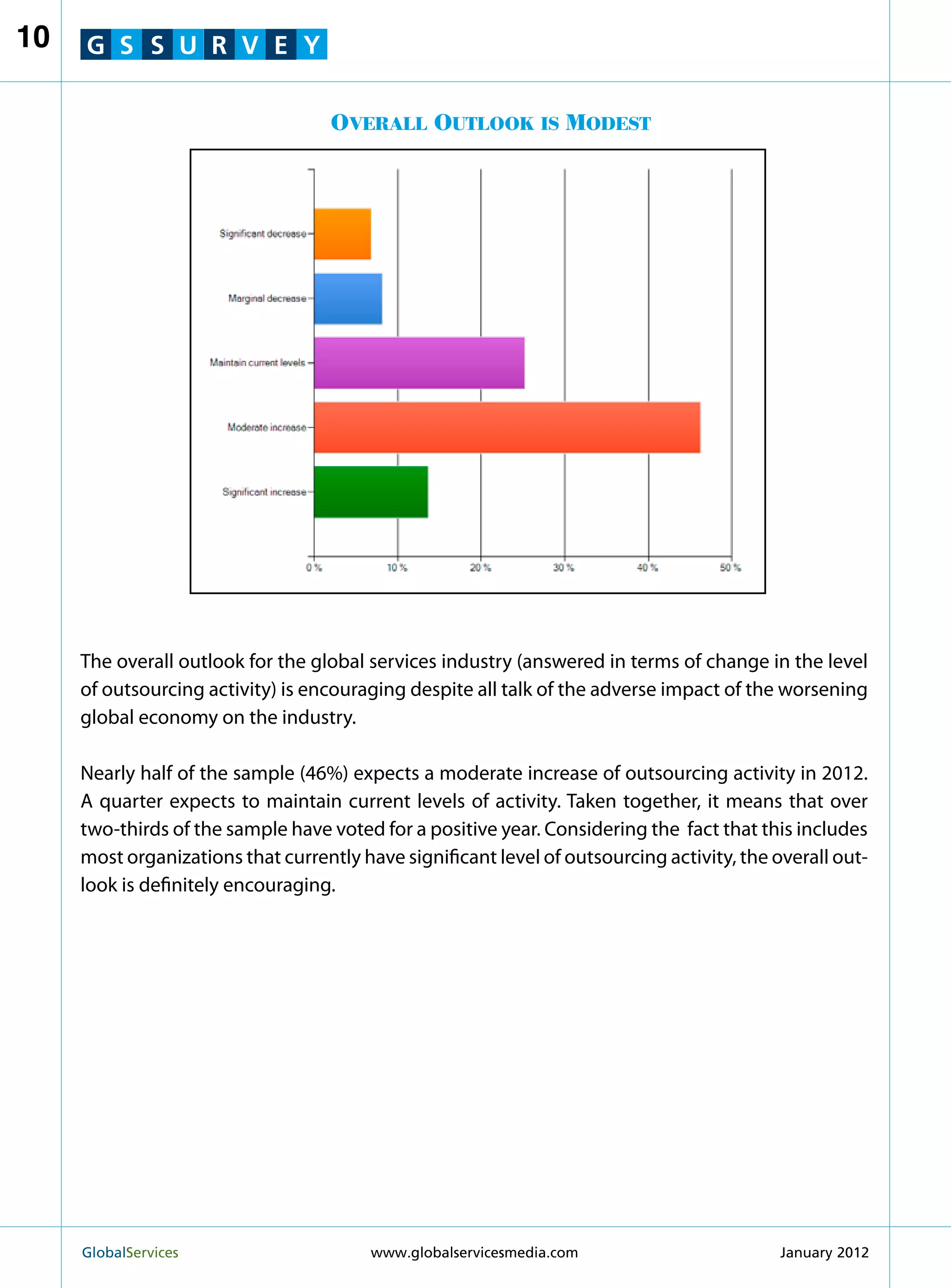

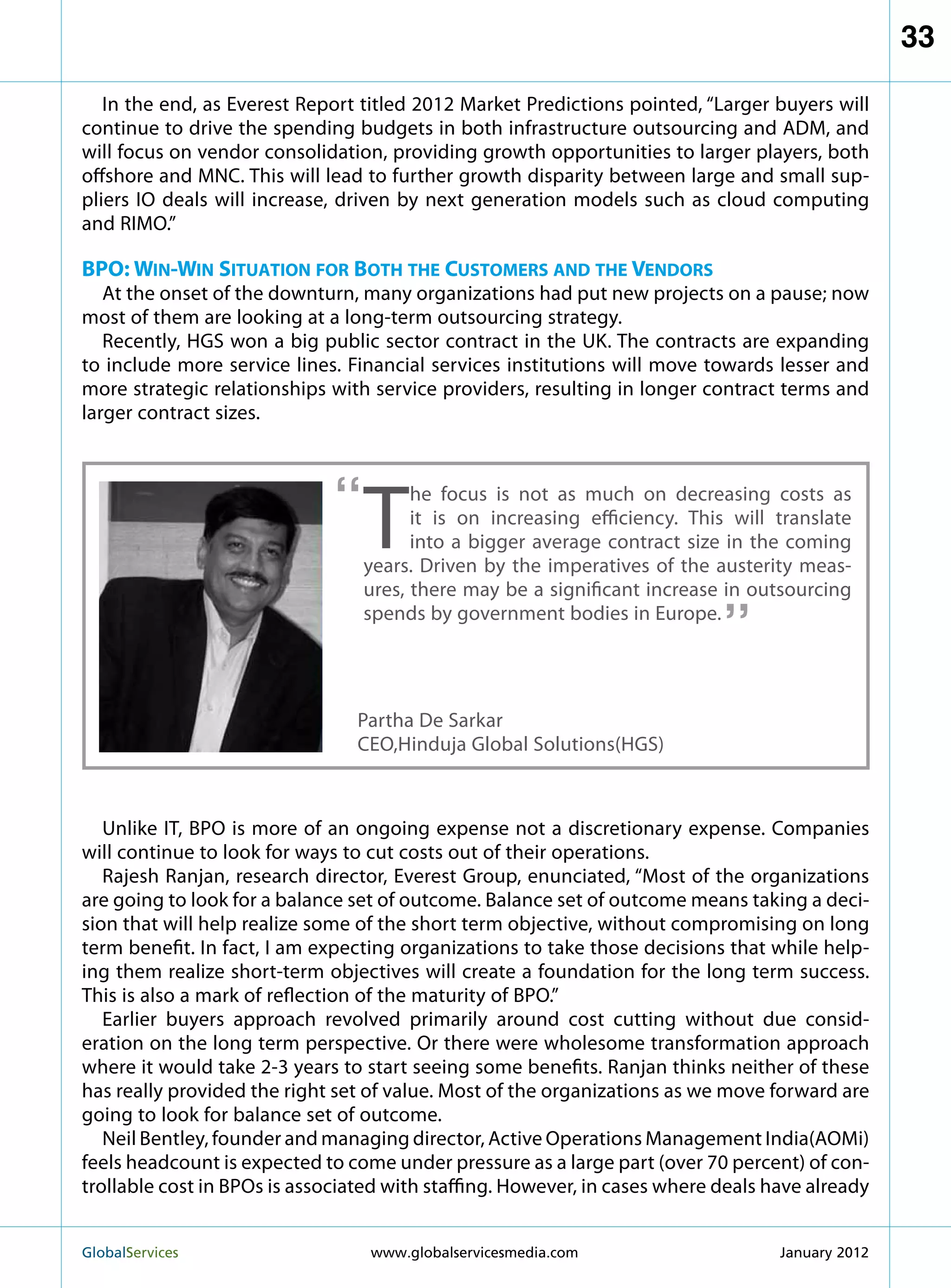

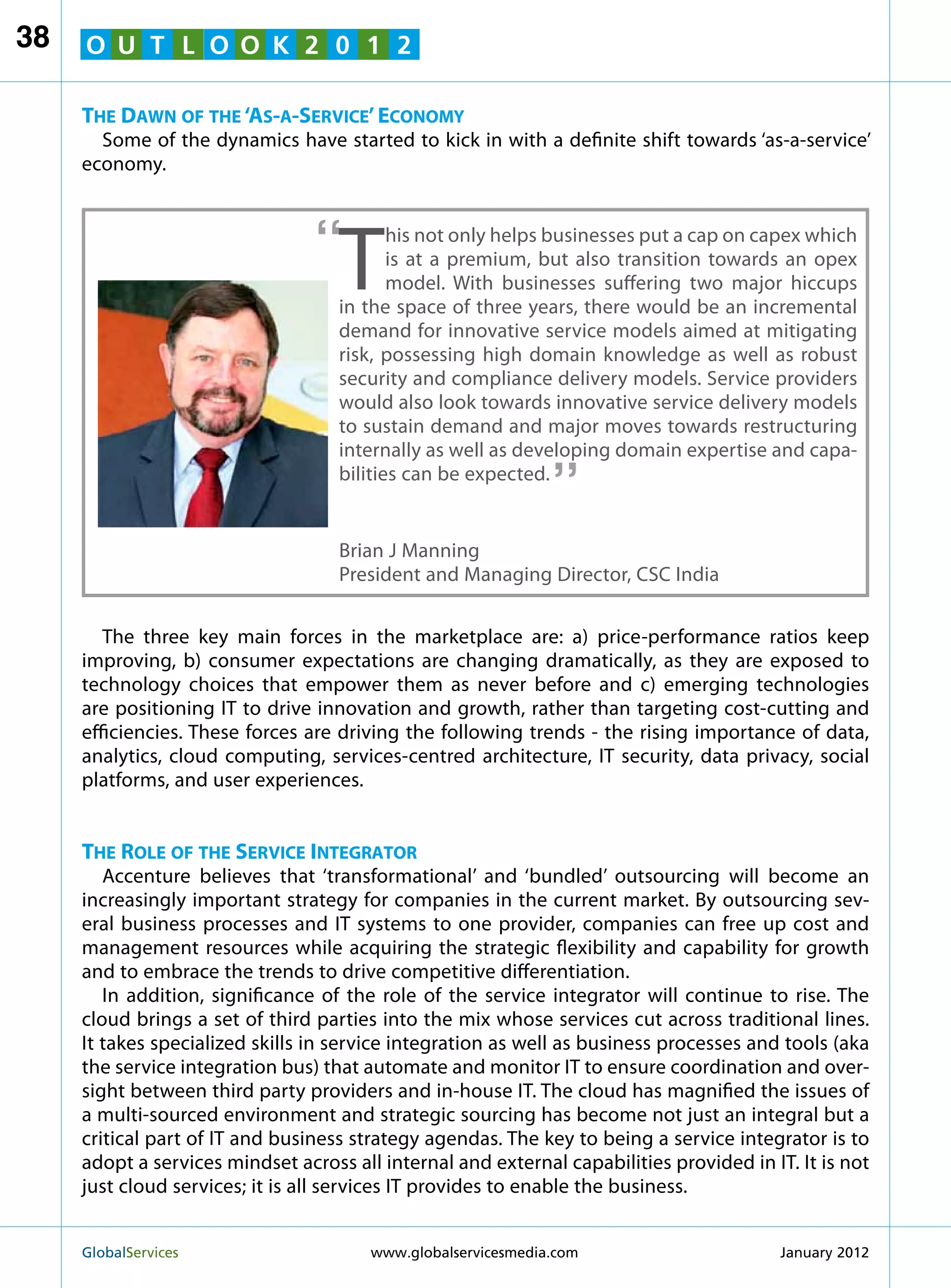

- Nearly half of respondents expect a moderate increase in outsourcing activity in 2022, while a quarter expect current levels to be maintained, indicating an overall positive outlook.

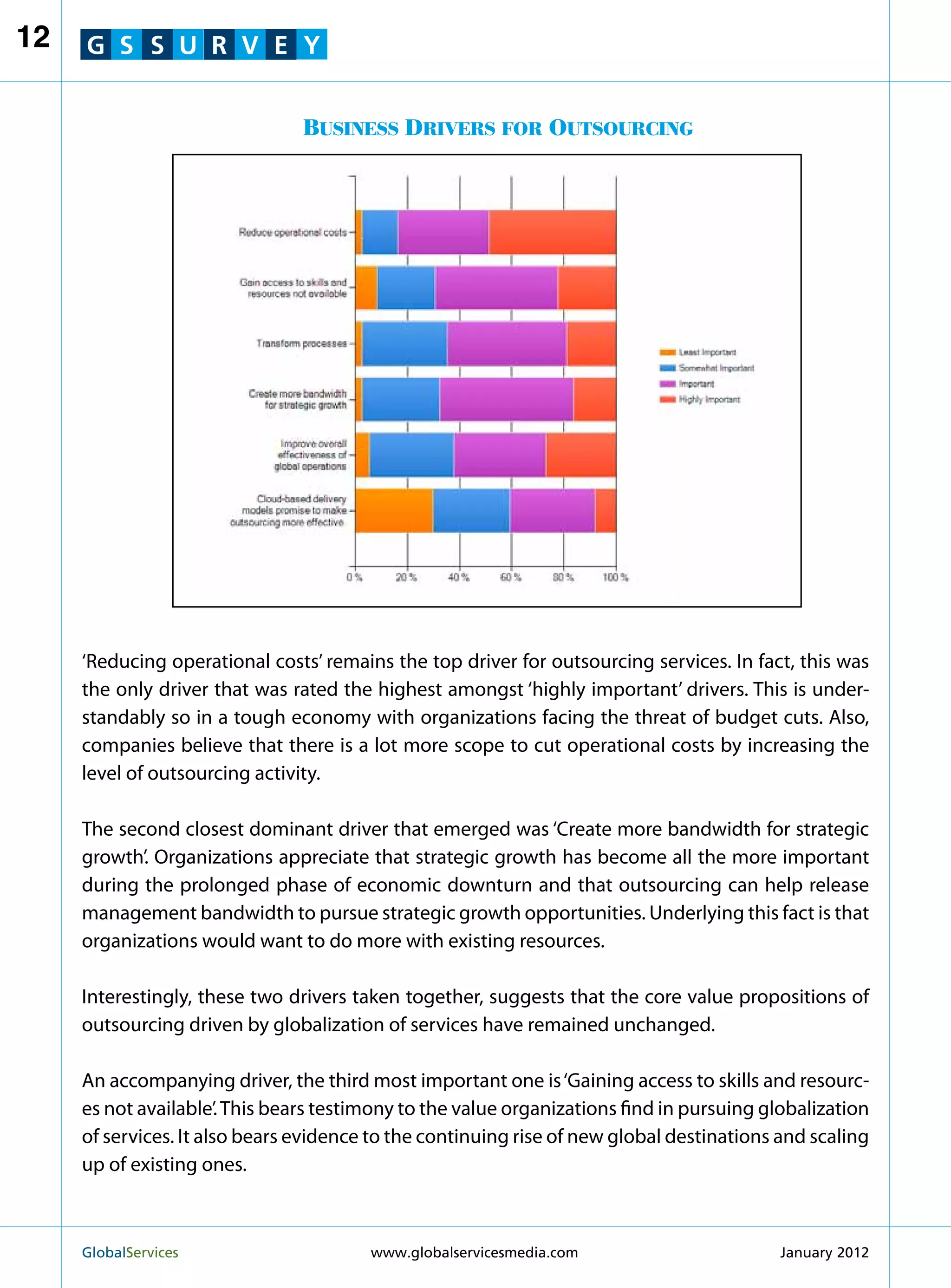

- Reducing operational costs remains the top driver for outsourcing. Creating bandwidth for strategic growth is also an important driver.

- The overall outlook is modest but positive, as reducing costs remains important but organizations also see outsourcing as a way to free up resources for strategic priorities.