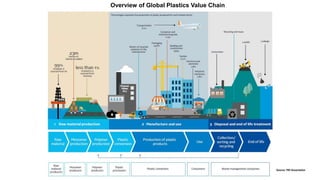

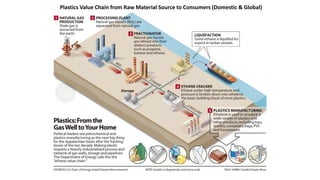

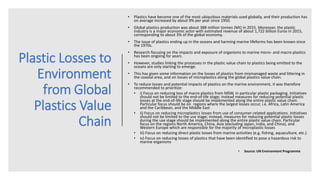

The document outlines the global plastics value chain, highlighting its complexity and the various sectors it impacts, as well as the significant economic role of the plastic industry, which generated about 1,722 billion euros in revenue in 2015. It emphasizes the environmental concerns associated with plastic waste, especially in oceans, and recommends initiatives to reduce both macro and microplastic losses throughout the entire value chain, focusing on high-loss regions. The document also details five primary plastic types that dominate usage, underscoring their recycling potential.