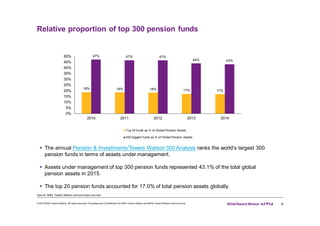

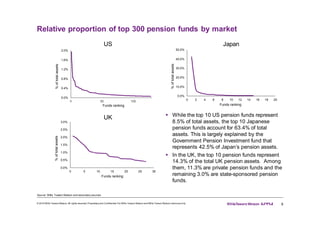

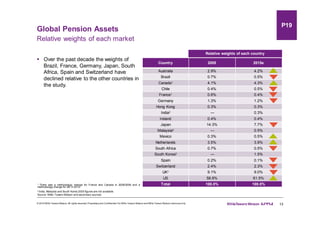

The 2016 Global Pension Assets Study examines 19 major pension markets, which collectively hold USD 35,316 billion in assets, reflecting a decline of 0.9% since 2014. Key findings indicate the US, UK, and Japan dominate asset allocation, comprising over 78% of total assets, with a notable shift toward defined contribution plans. The study also highlights changing asset allocations, trends towards conservative strategies in certain markets, and the significance of currency exchange rates in assessing asset growth.