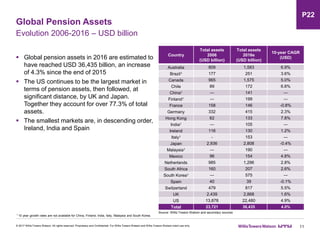

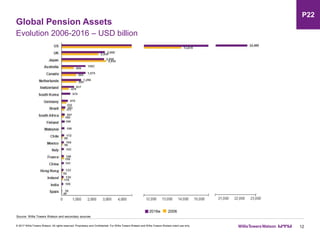

This document summarizes findings from the Willis Towers Watson 2017 Global Pension Assets Study. Some key findings include:

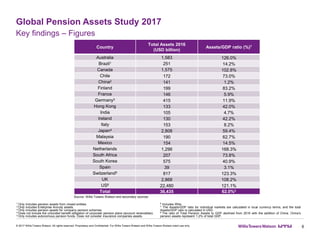

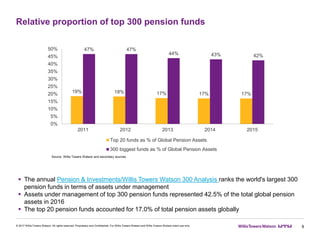

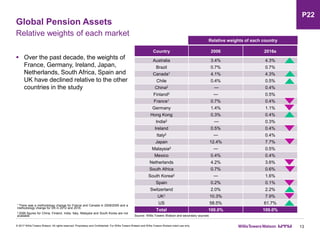

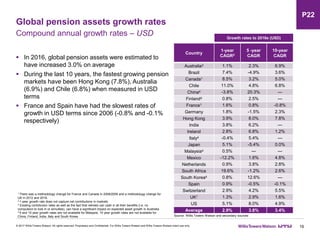

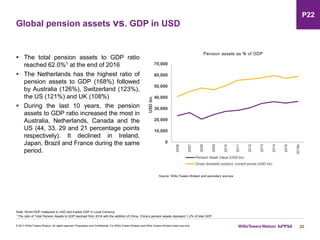

- Global pension assets reached $36.4 trillion in 2016, a 4.3% increase from 2015, led by growth in the US, UK, and Japan which comprise over 77% of total assets.

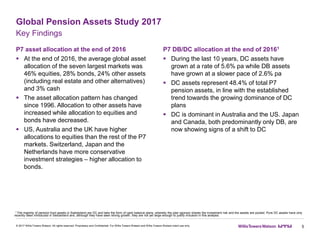

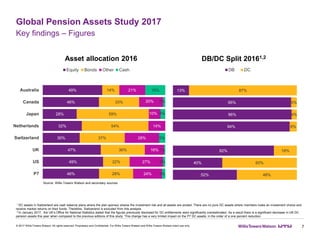

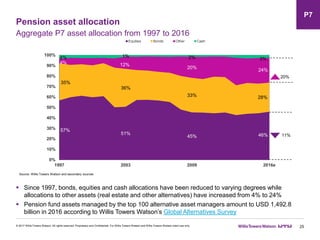

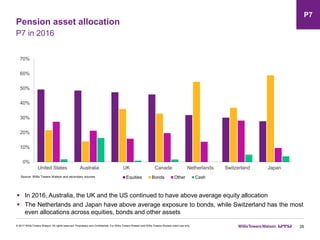

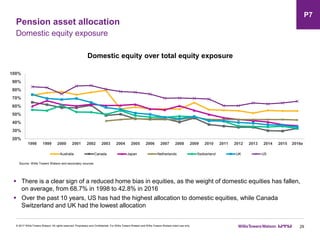

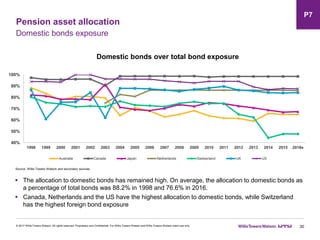

- The average asset allocation of the seven largest pension markets was 46% equities, 28% bonds, 24% other assets, and 3% cash.

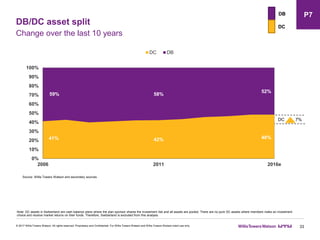

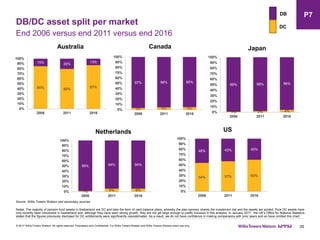

- Defined contribution assets have grown faster than defined benefit assets, now representing 48.4% of assets in the seven major markets.