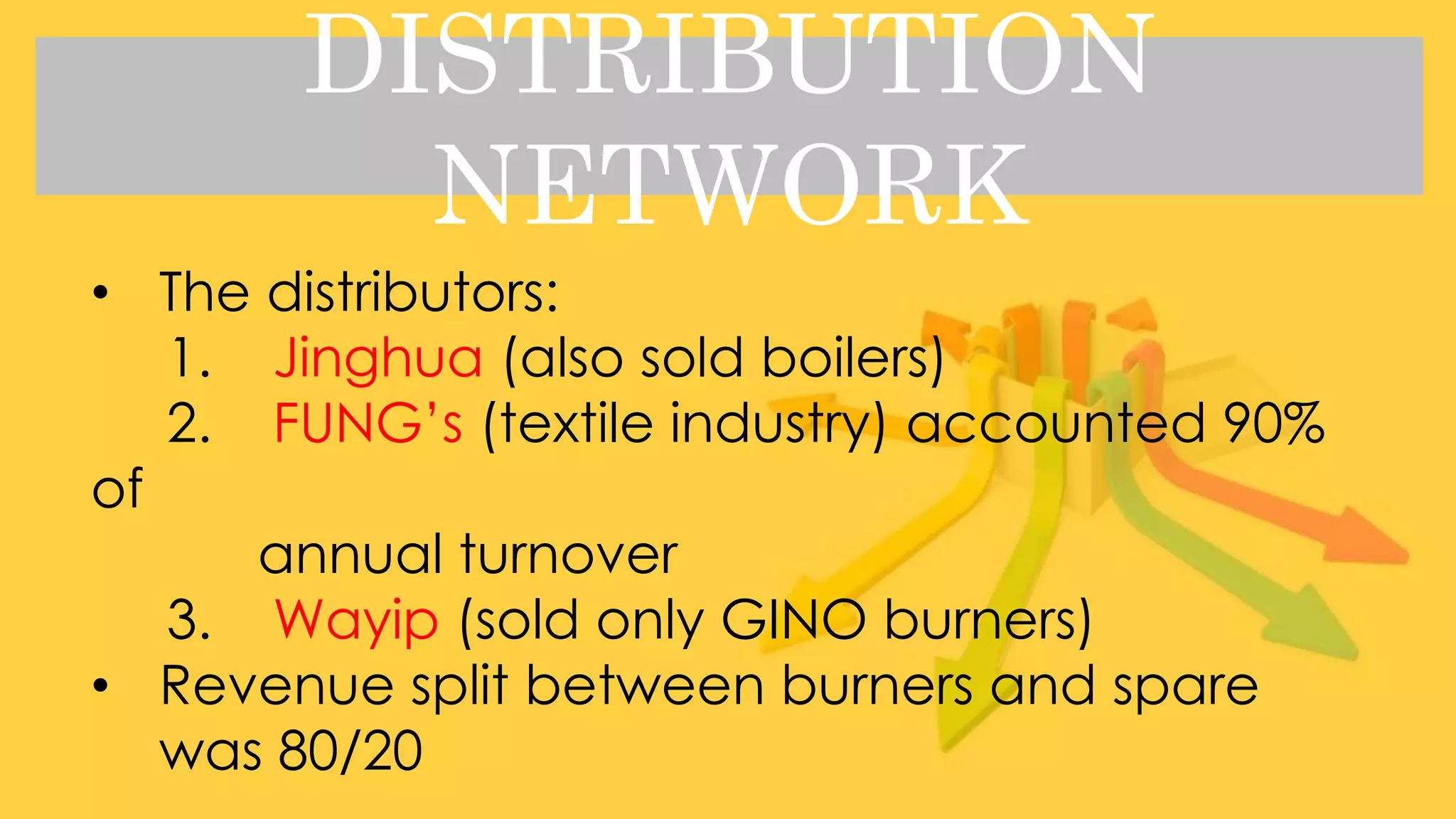

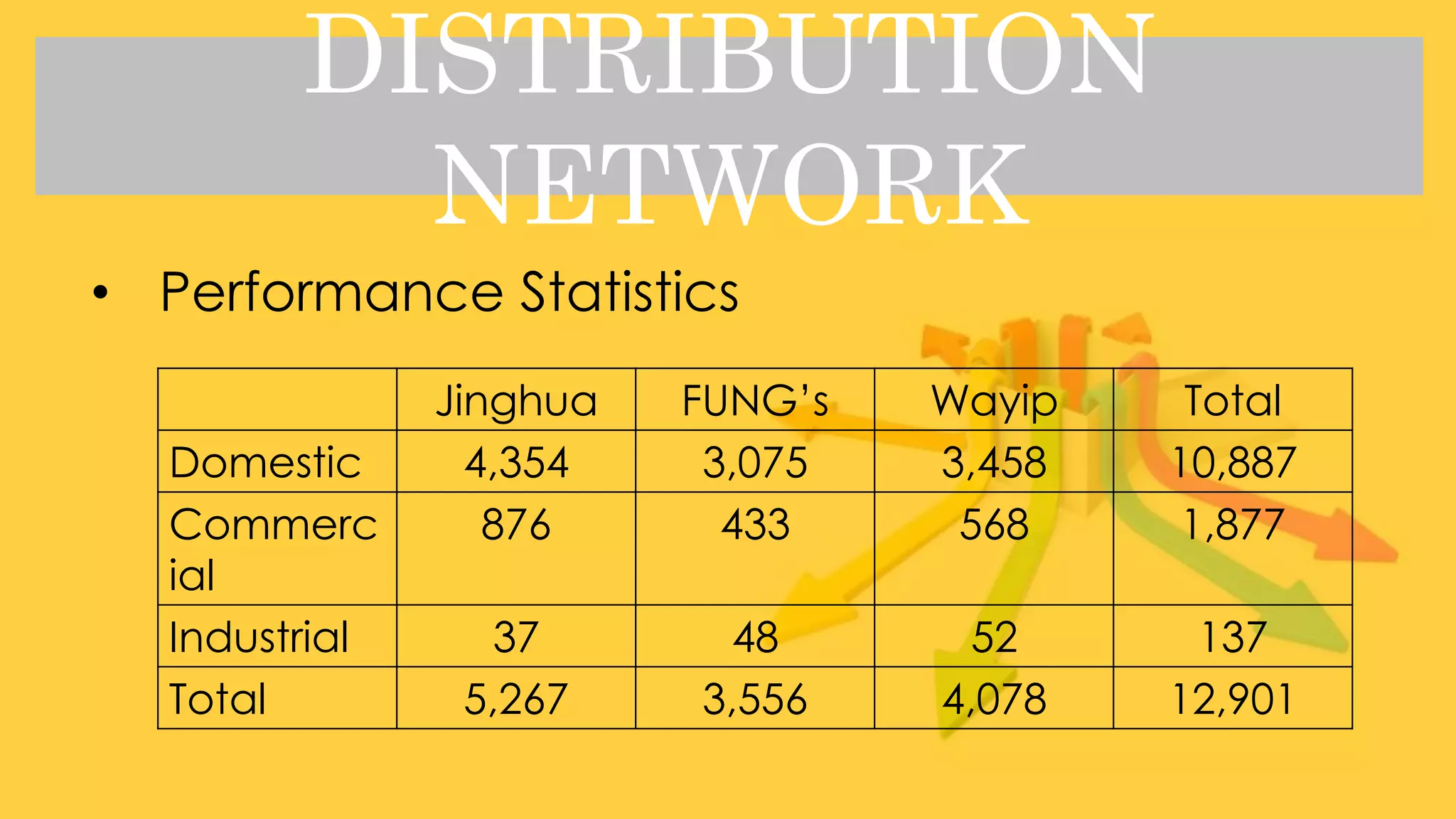

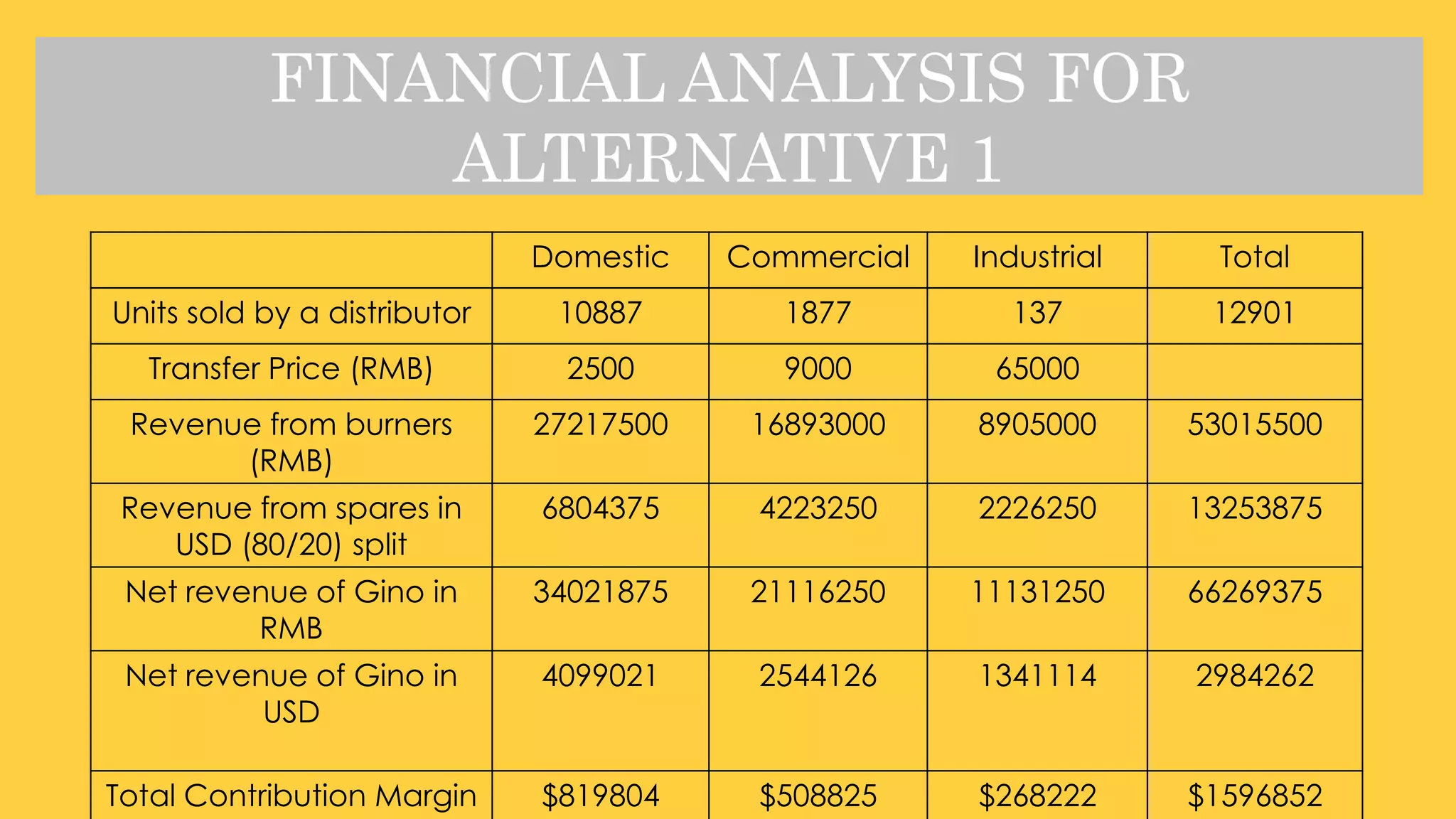

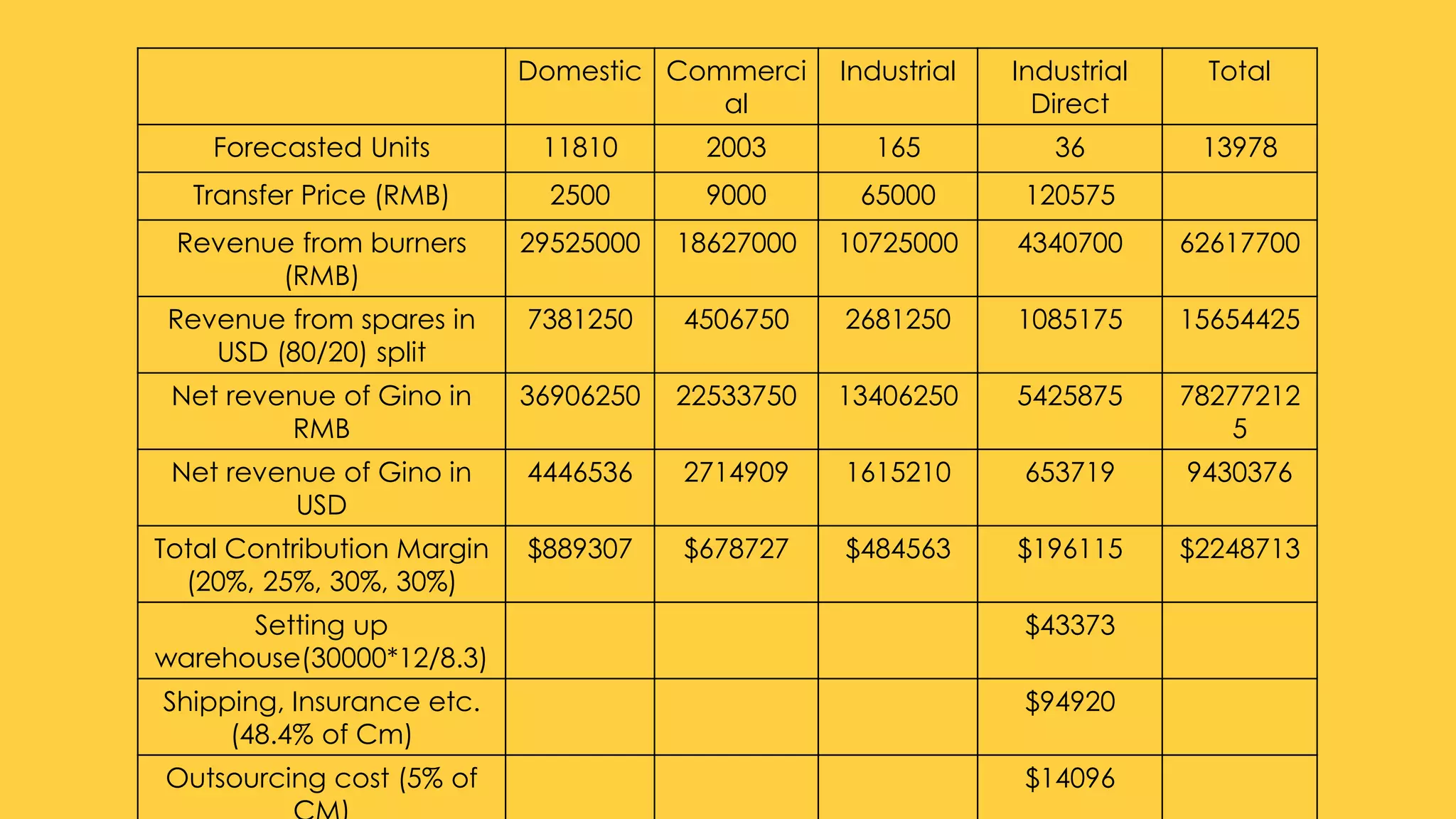

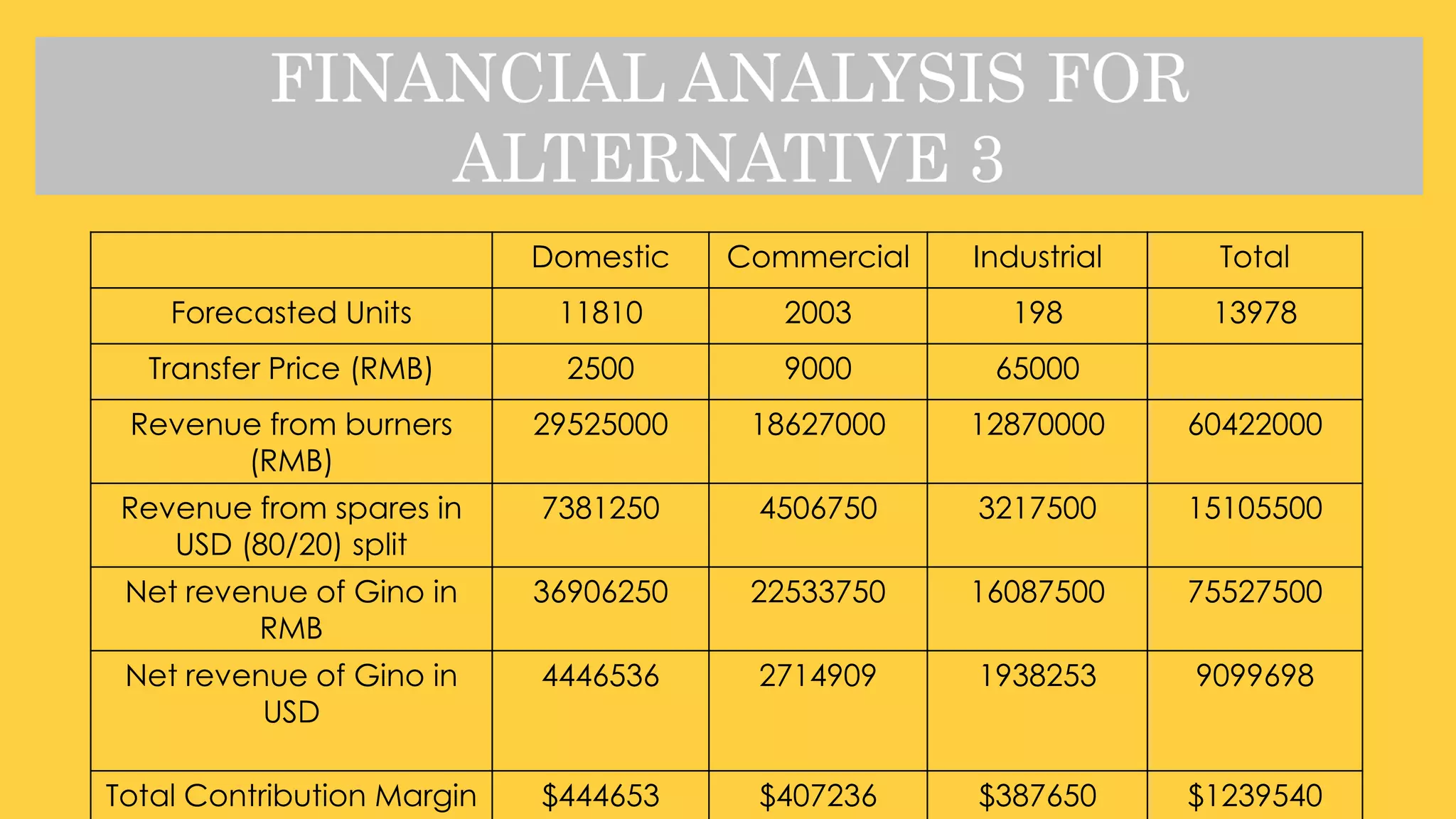

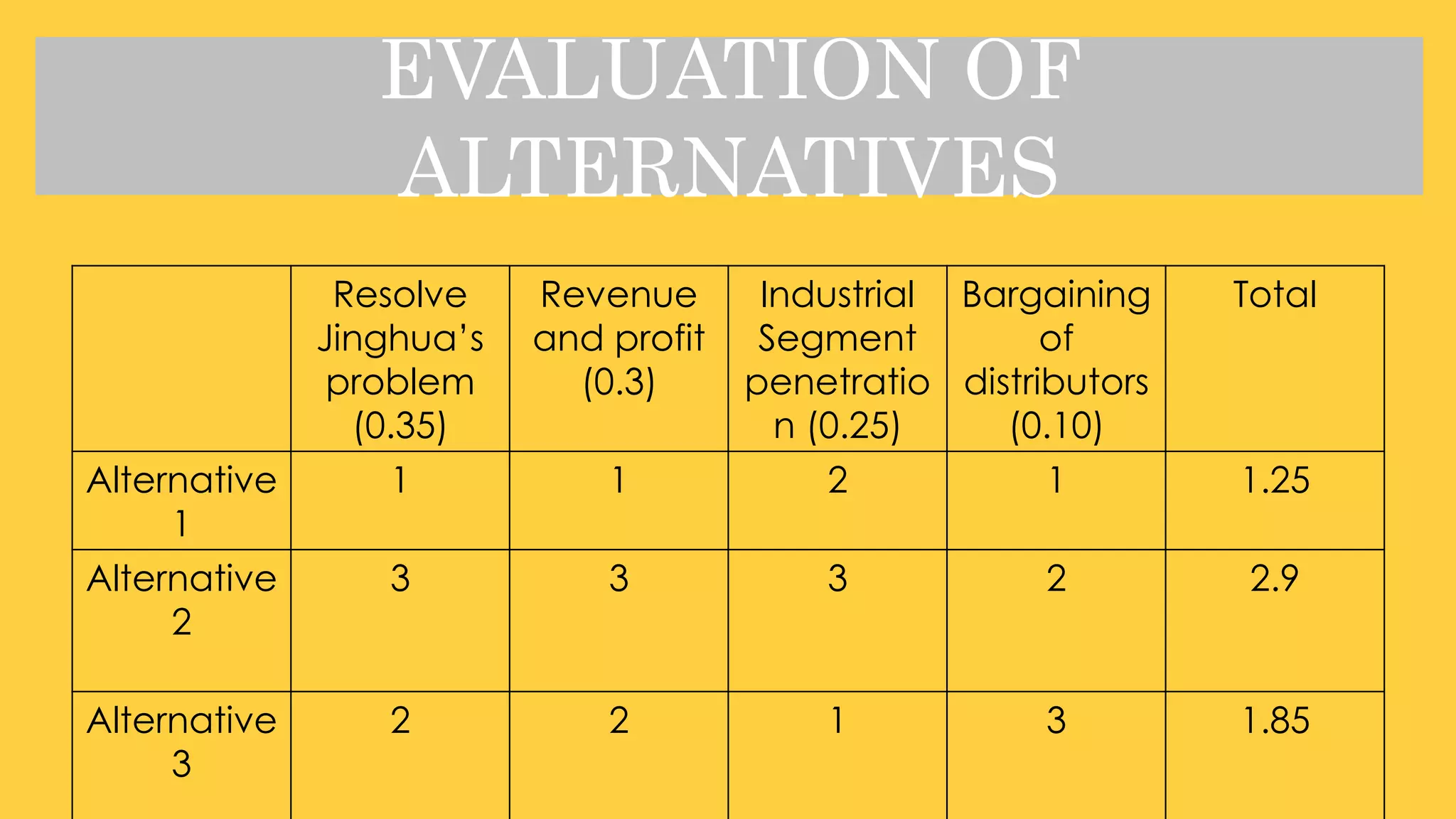

Gino SA is a leading burner manufacturer facing a strategic dilemma between accepting an OEM proposal from Feima or maintaining its established distribution channel through Jinghua, its largest distributor in China. The decision involves balancing potential revenue growth in the industrial segment against the risk of damaging distributor relationships. A financial analysis supports accepting the Feima offer as it aligns with Gino's long-term strategy and aims to increase annual sales while managing inventory efficiently.