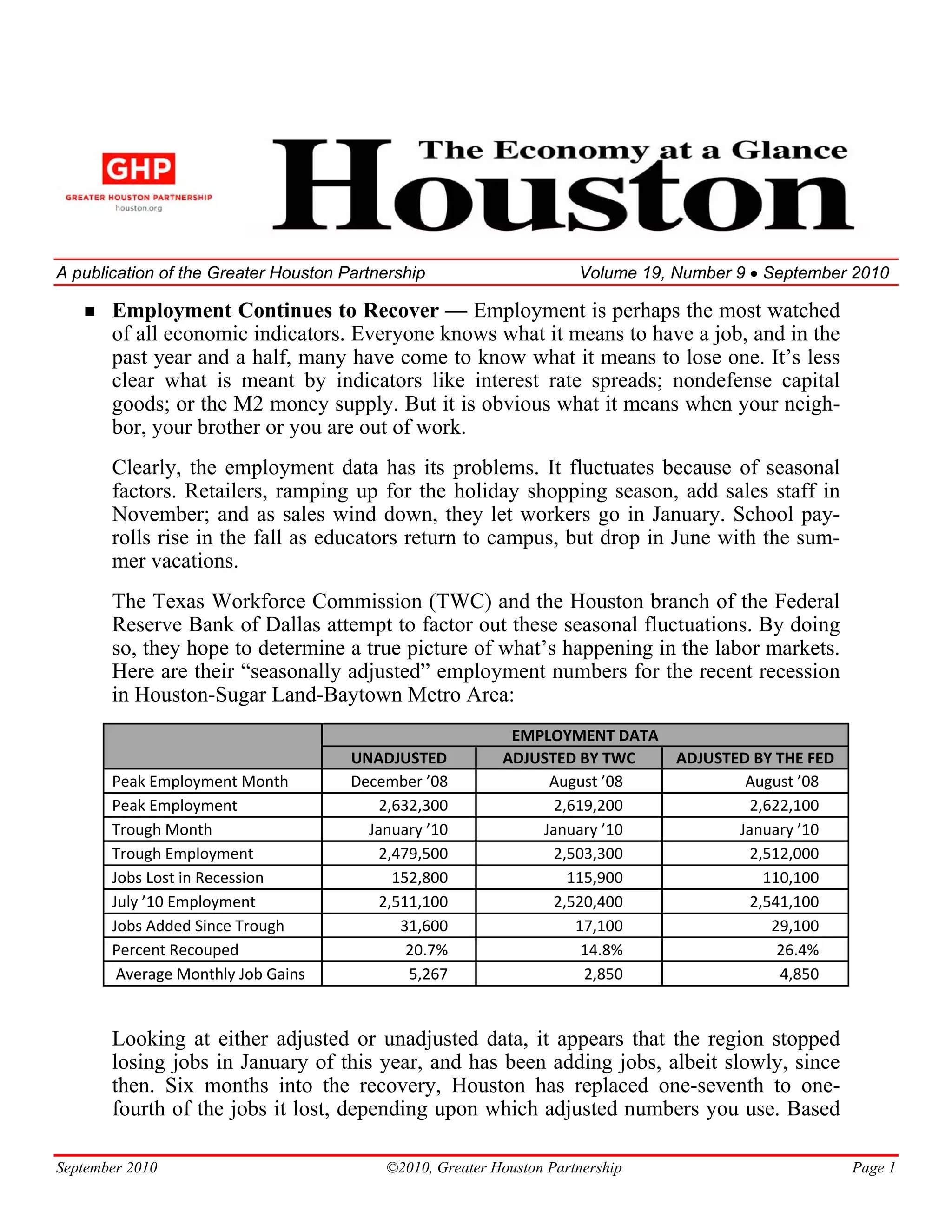

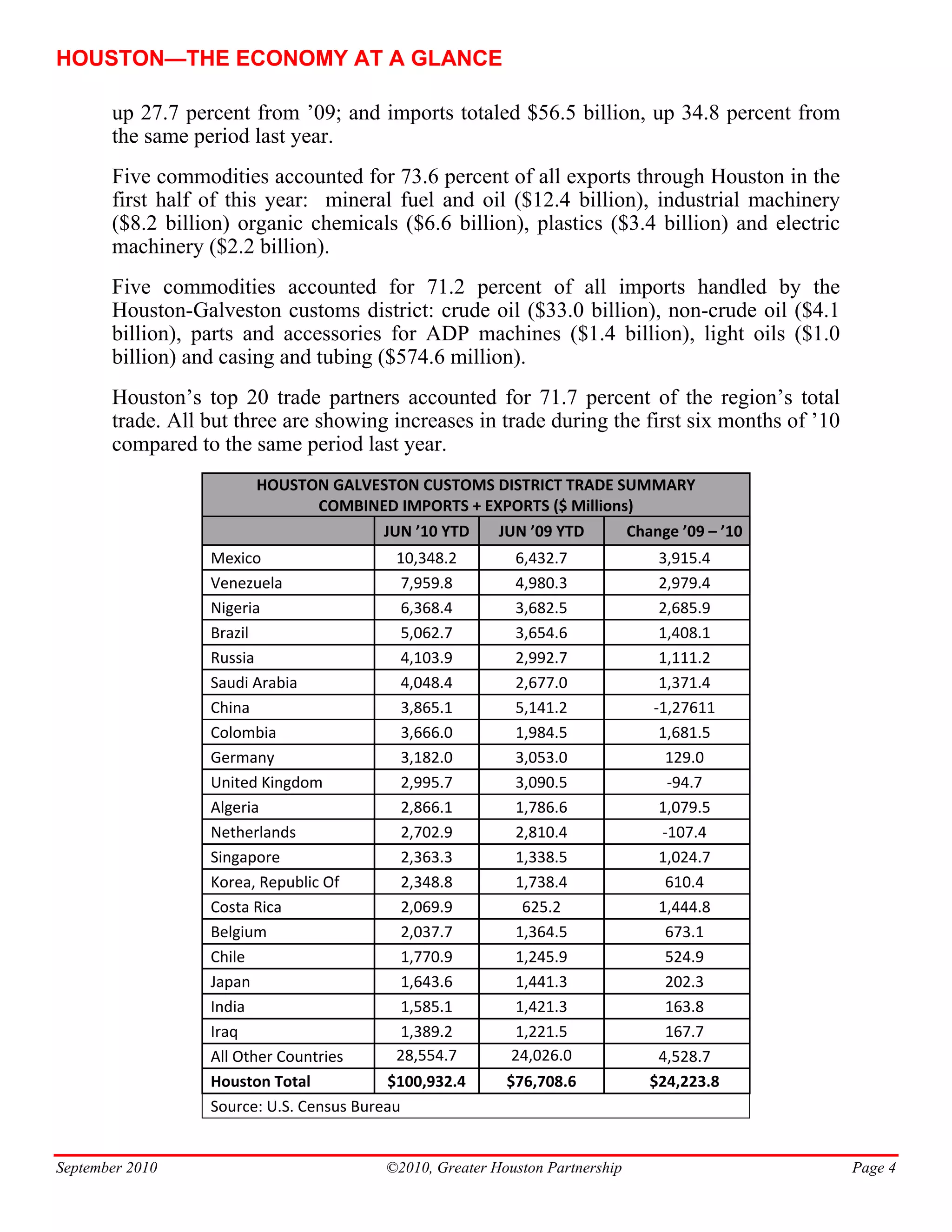

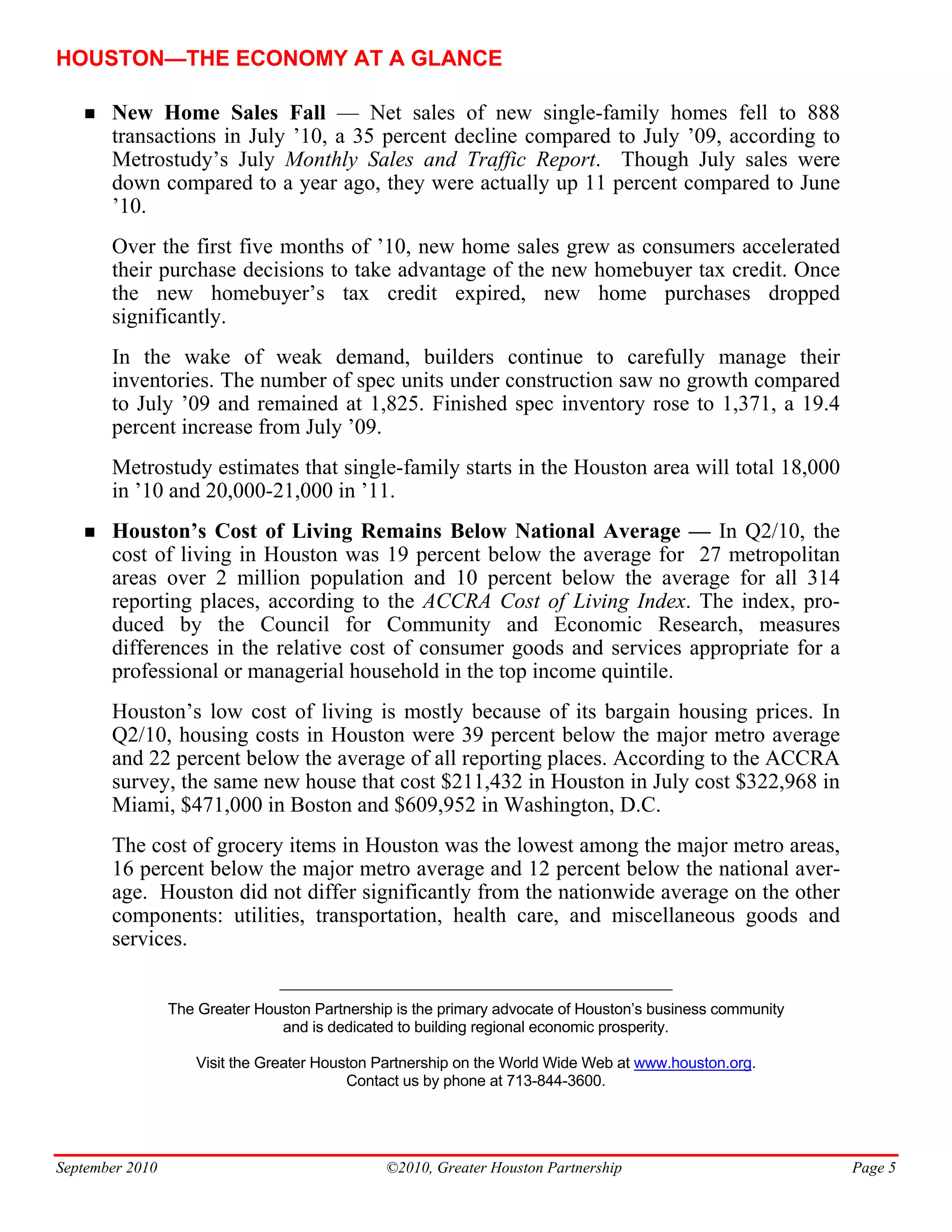

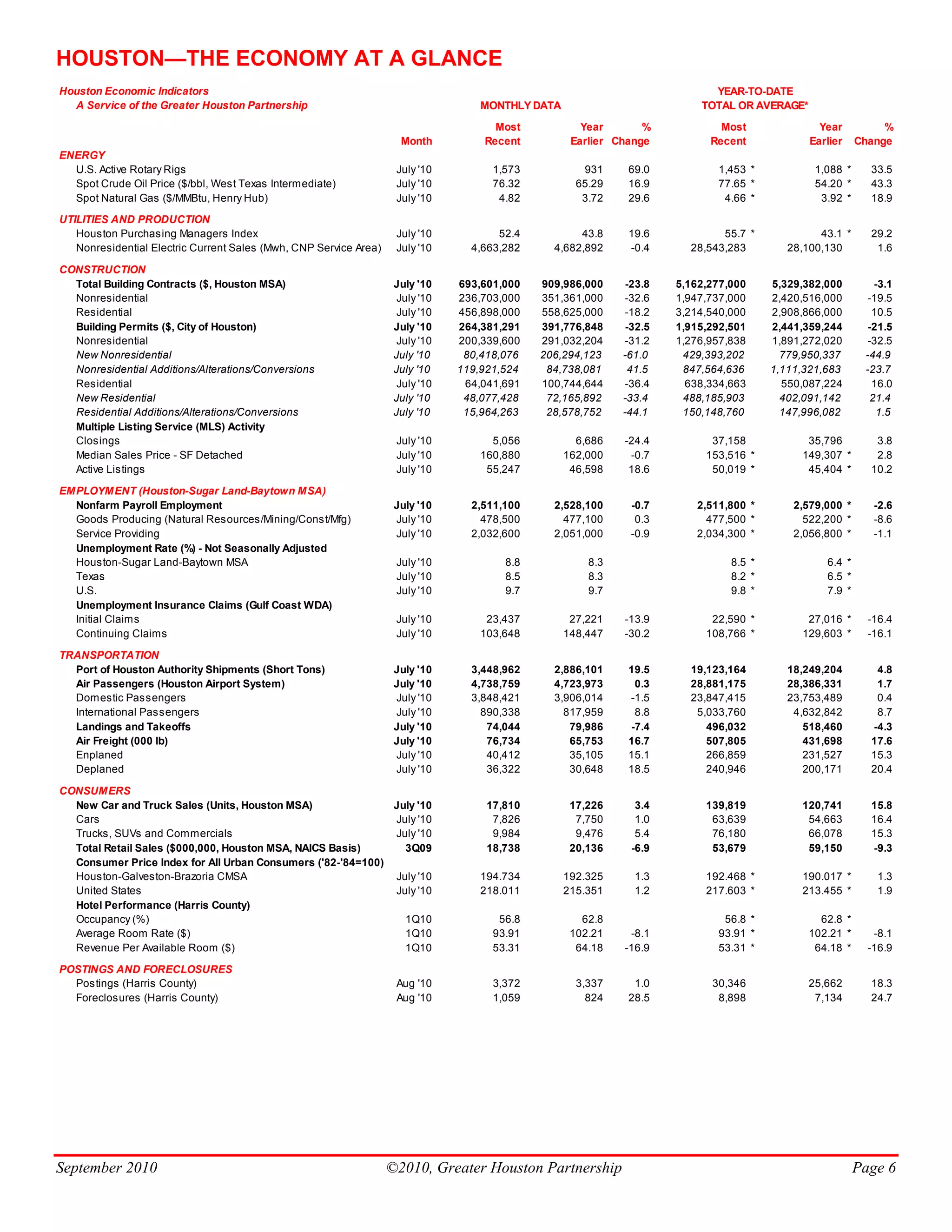

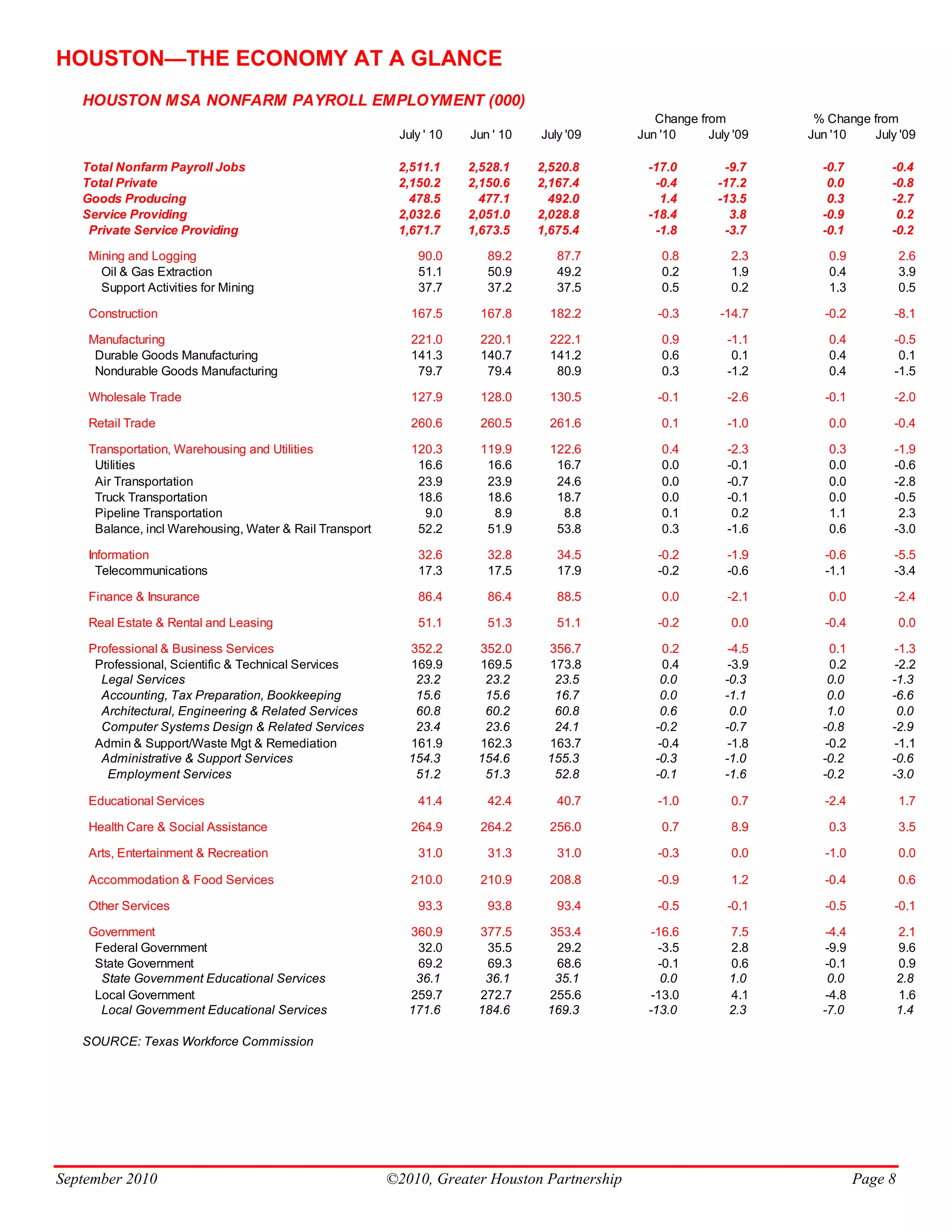

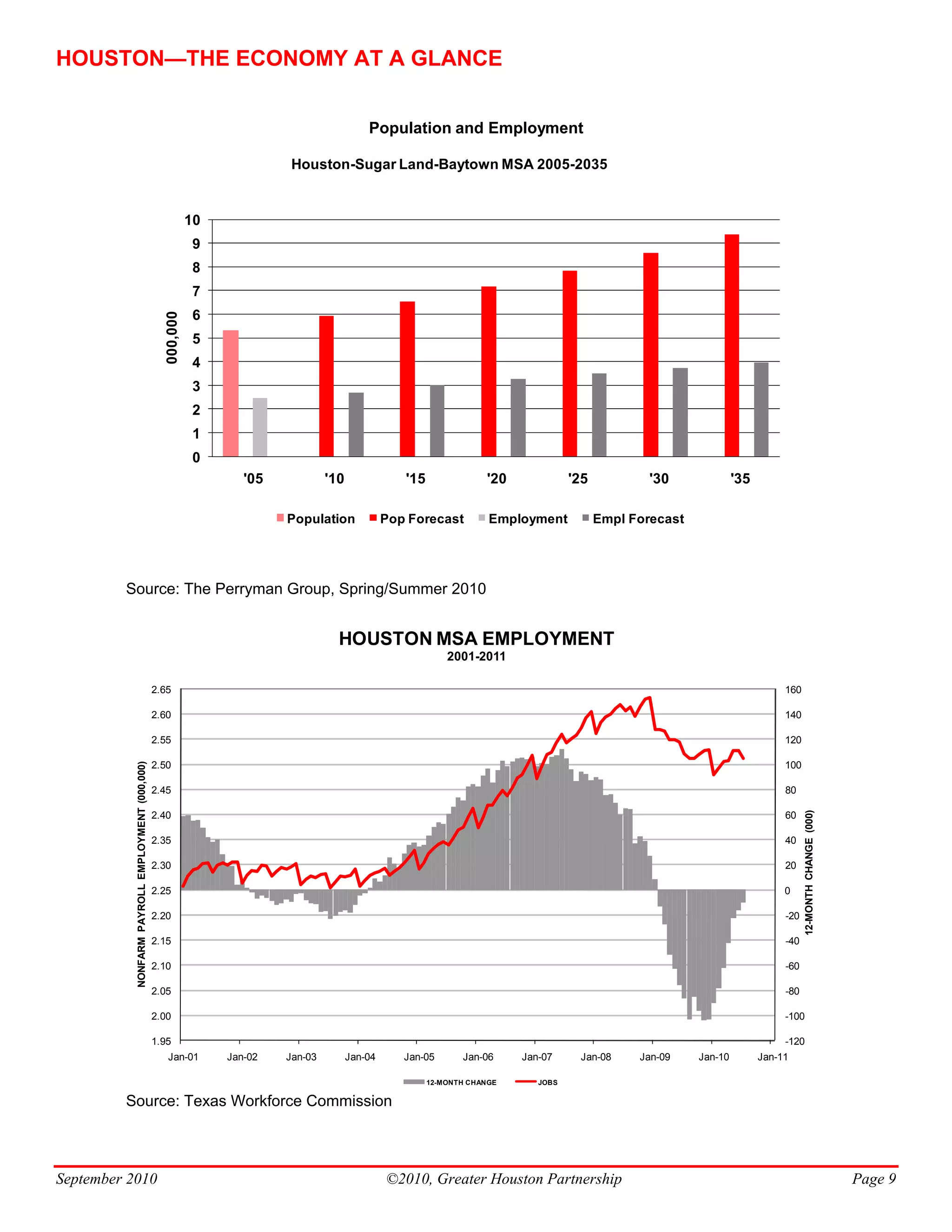

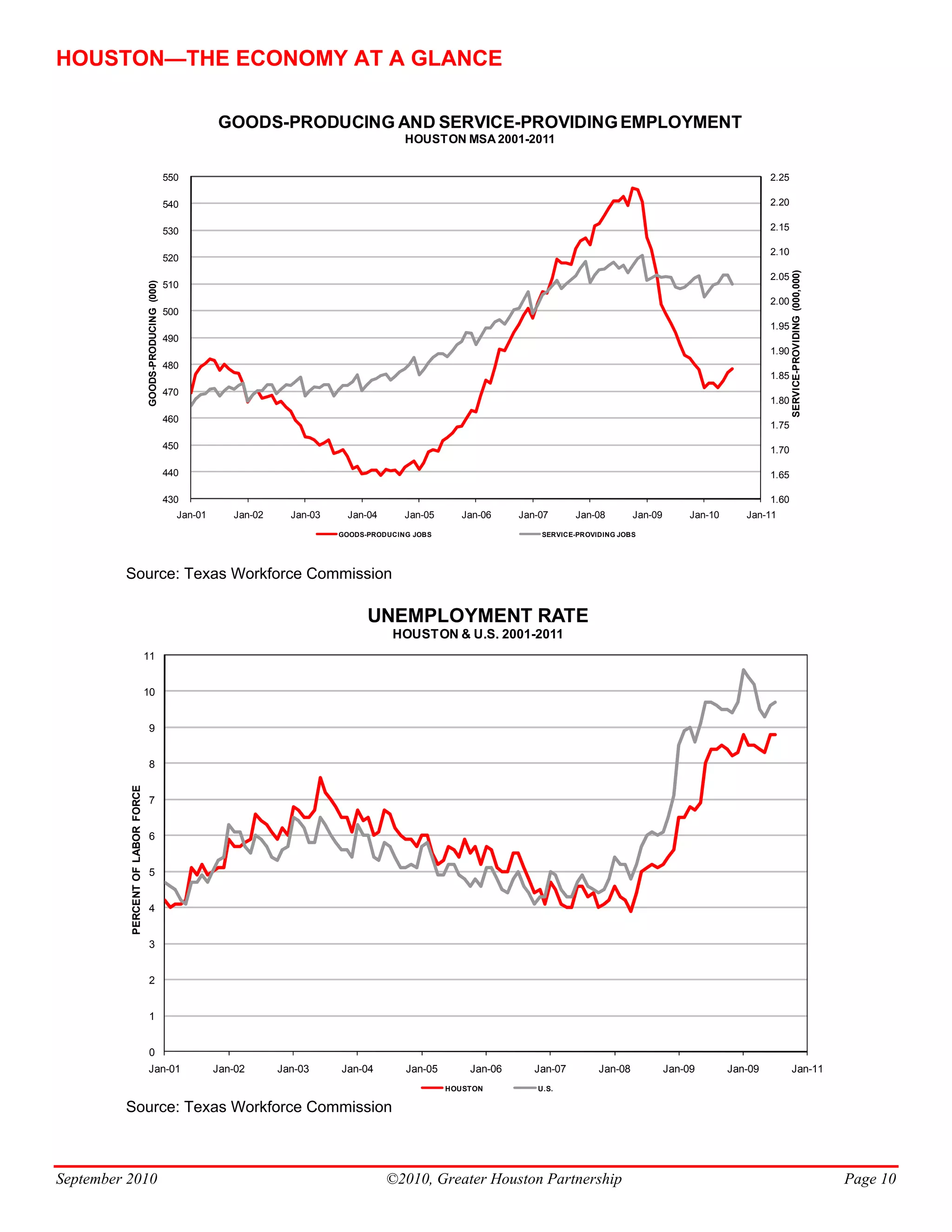

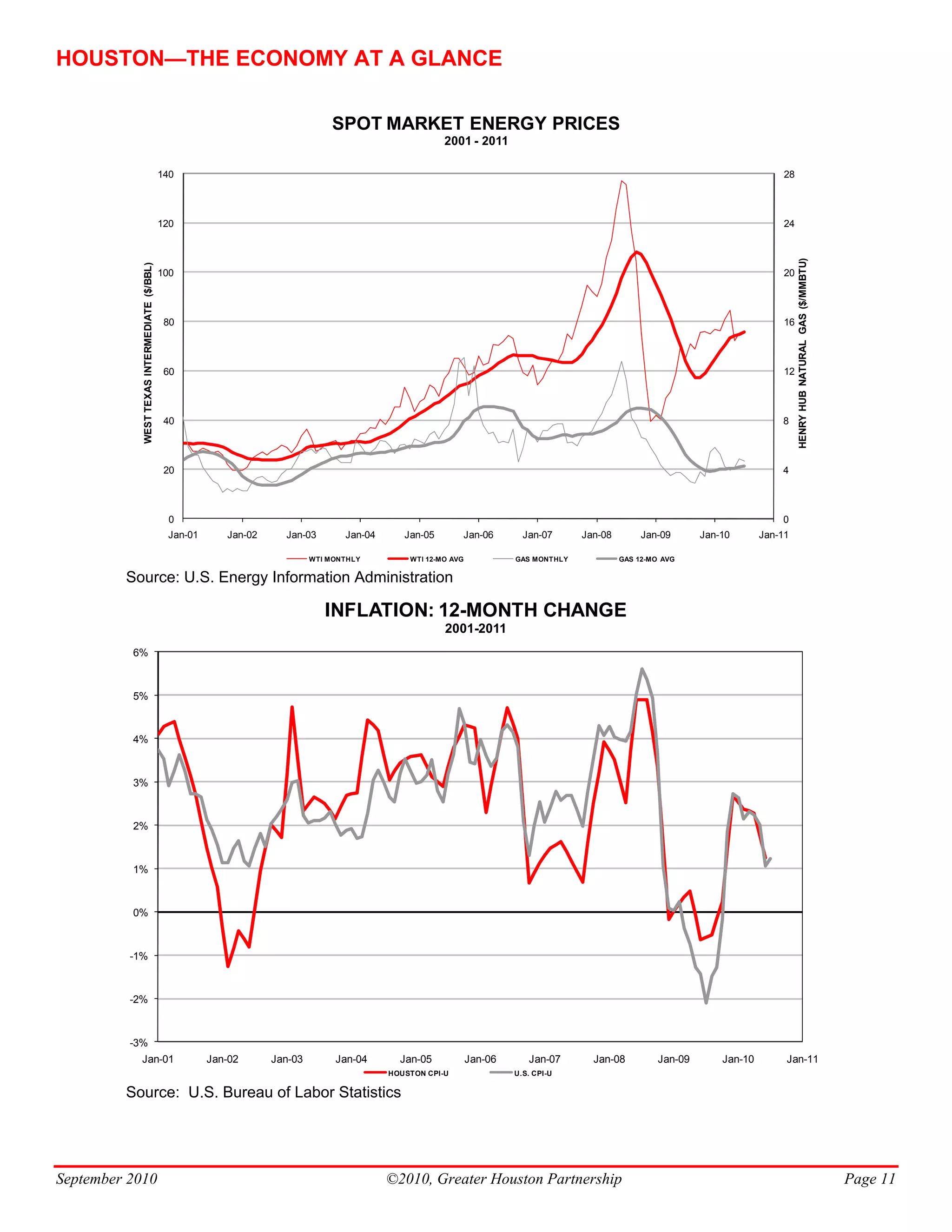

This document summarizes economic indicators for the Houston region. It finds that while the region is slowly recovering from job losses during the recession, employment has not yet returned to pre-recession levels. The energy and health care sectors have fared better than others during the downturn. International passenger travel at Houston airports is growing, driven by increases to Canada, Europe and the Middle East. International trade and oil and gas employment are also rebounding from declines in recent years. However, new home sales have fallen due to the expiration of federal tax credits for homebuyers.