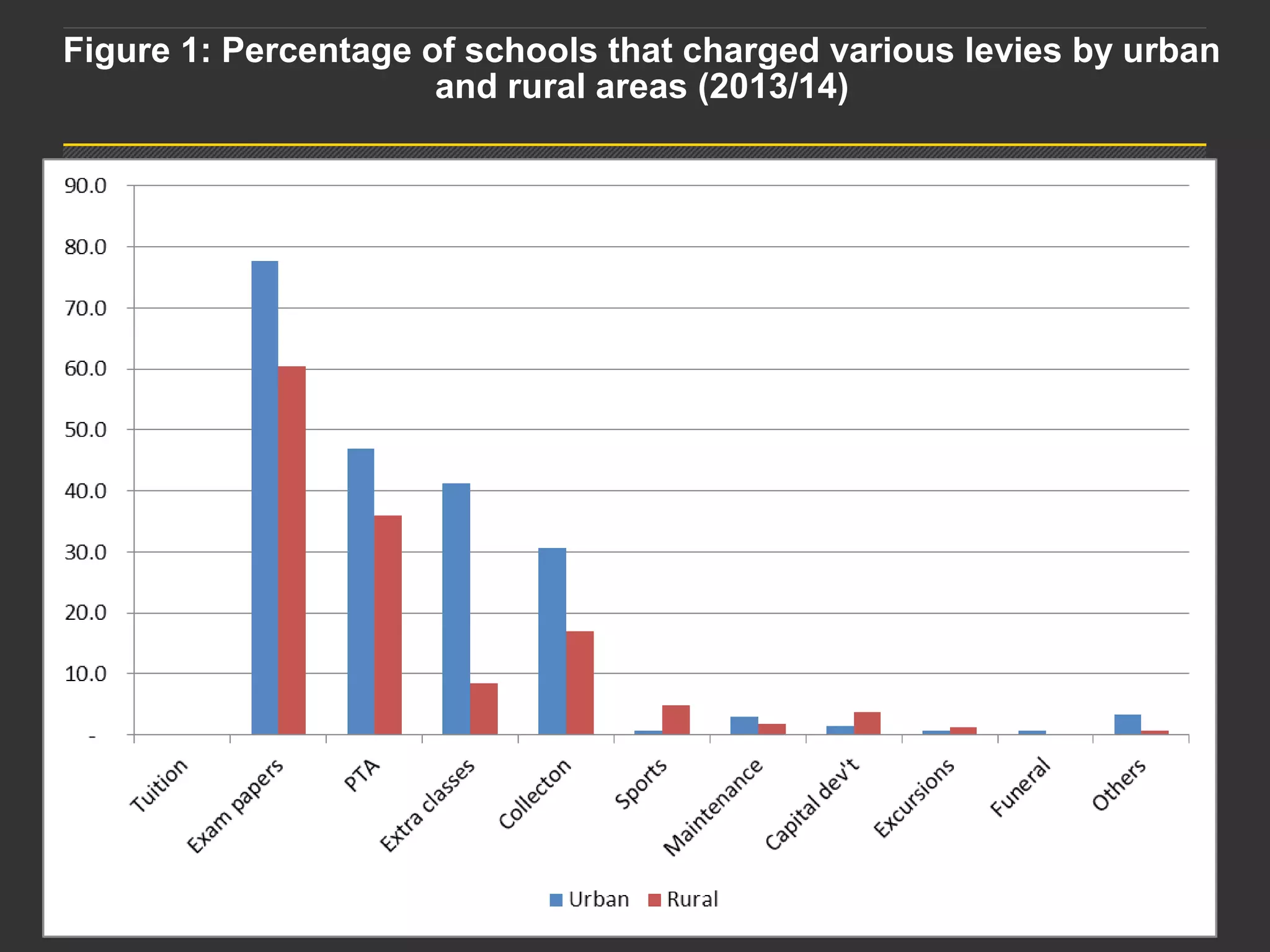

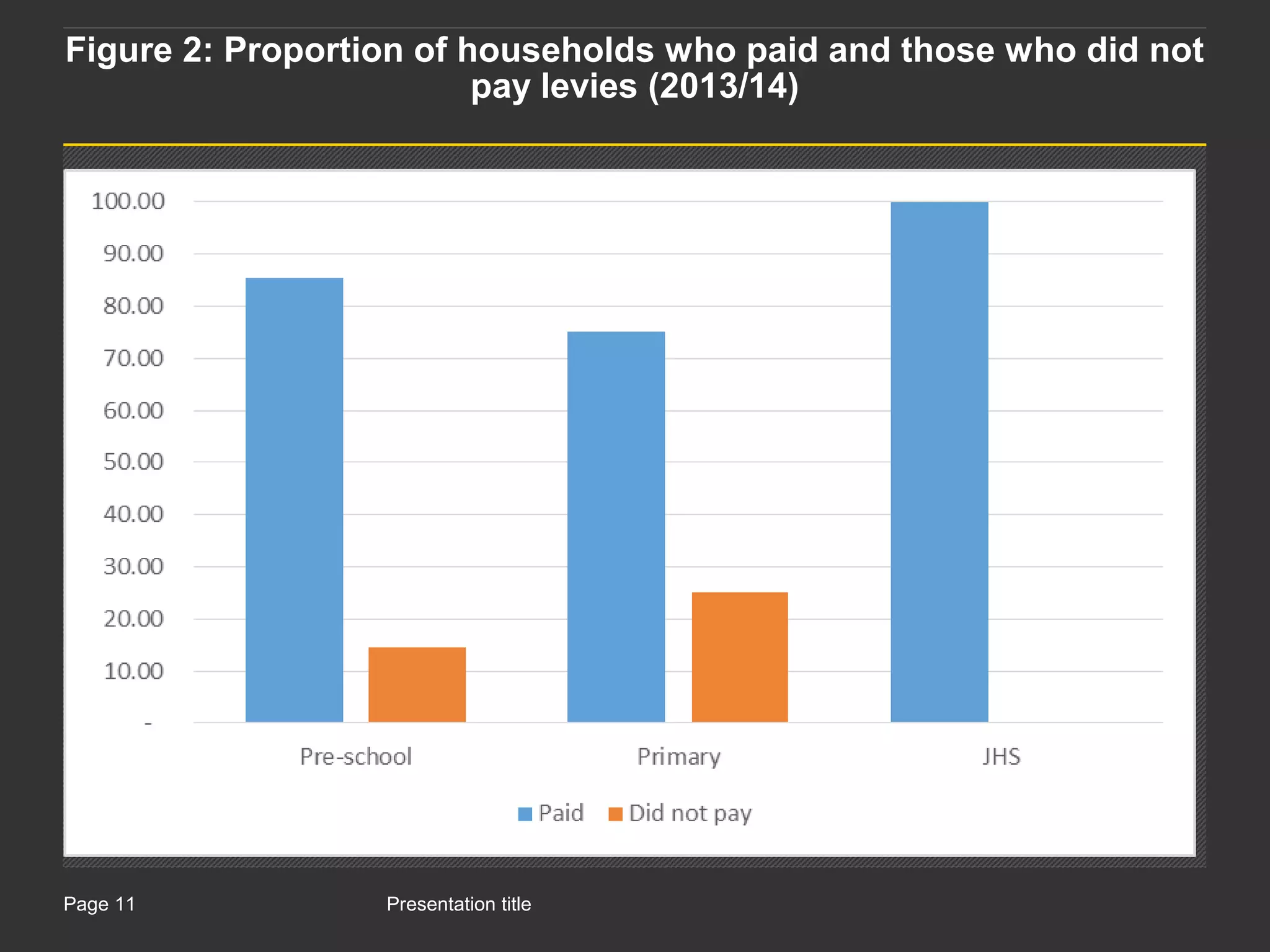

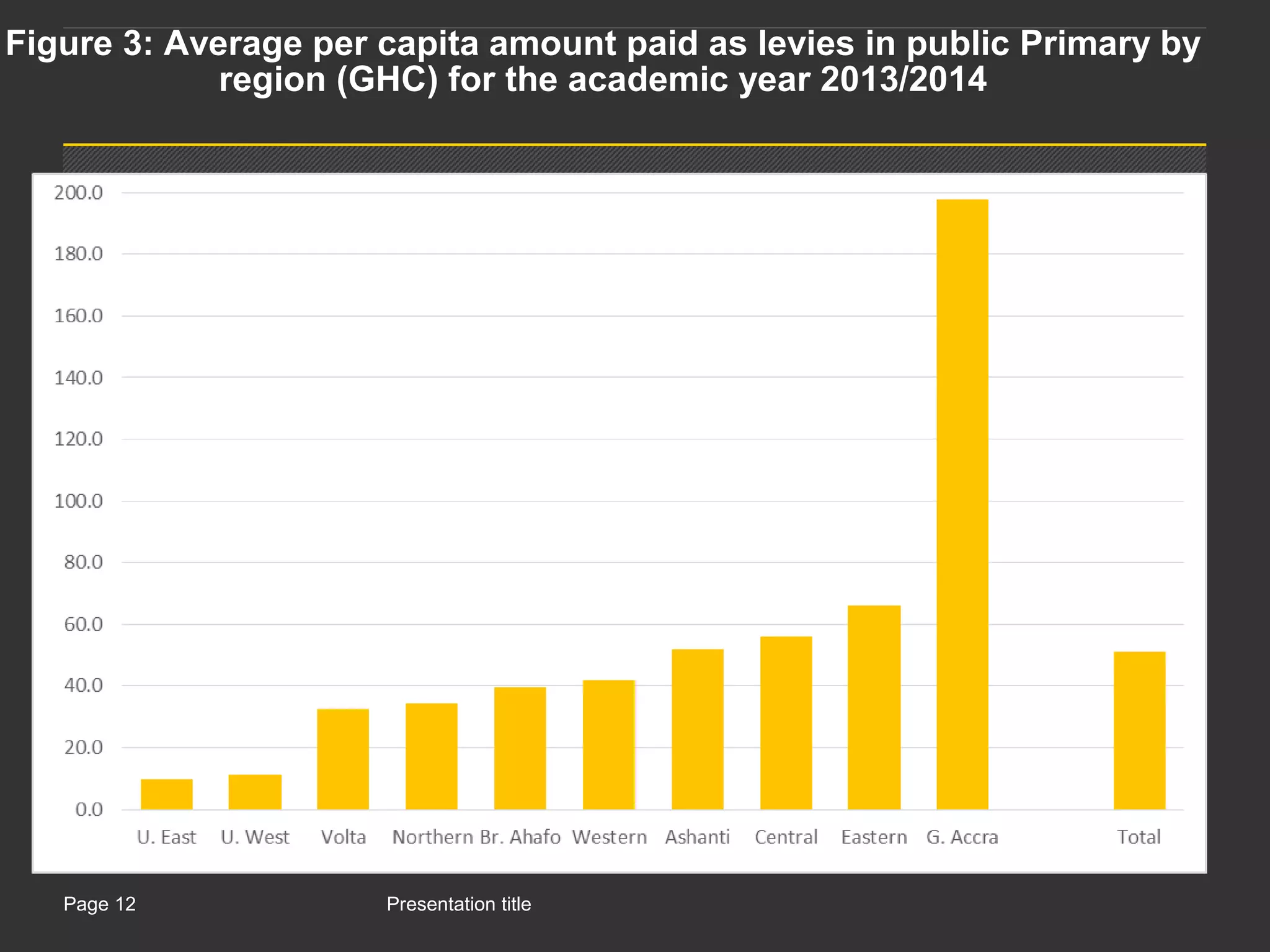

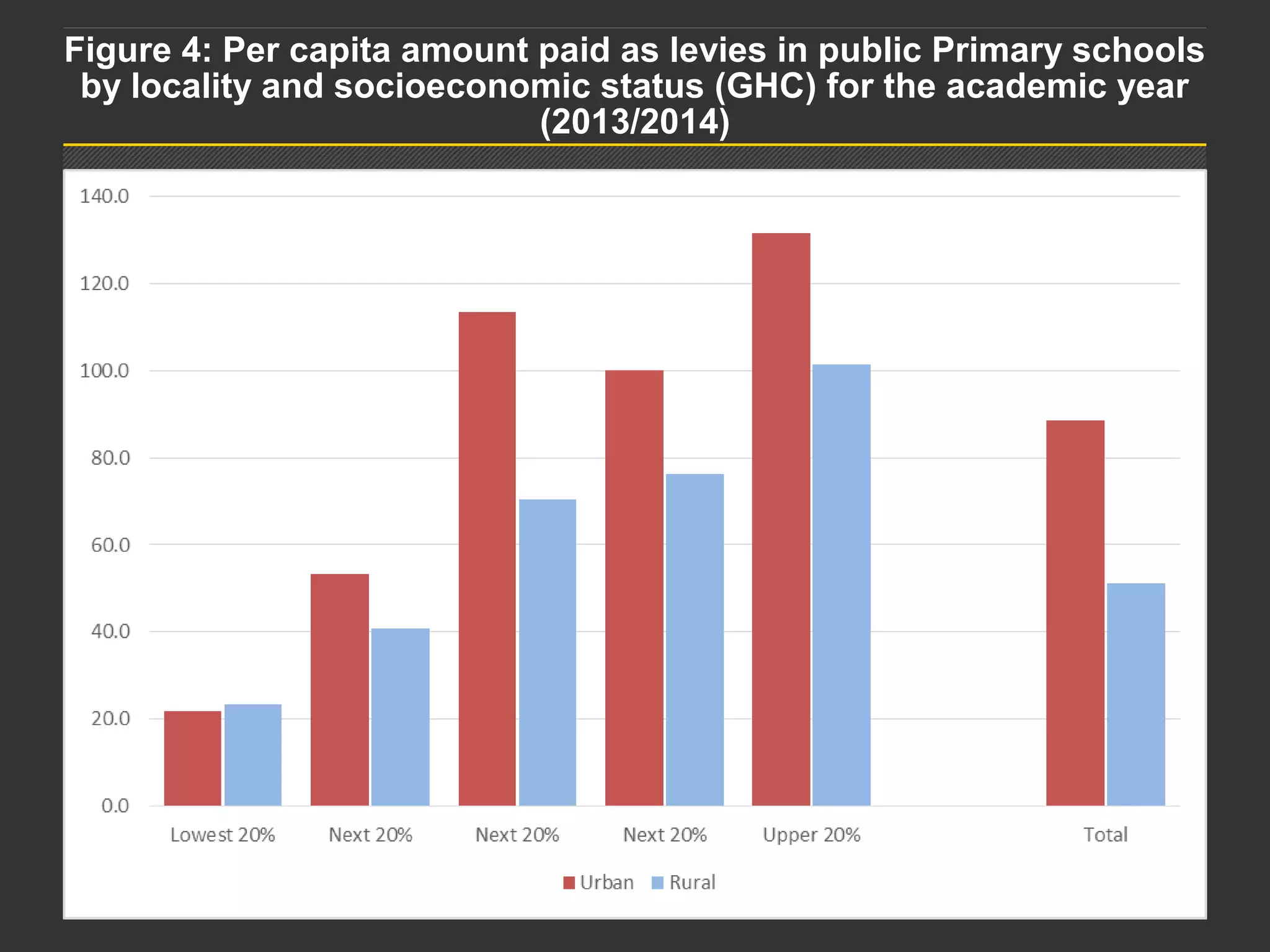

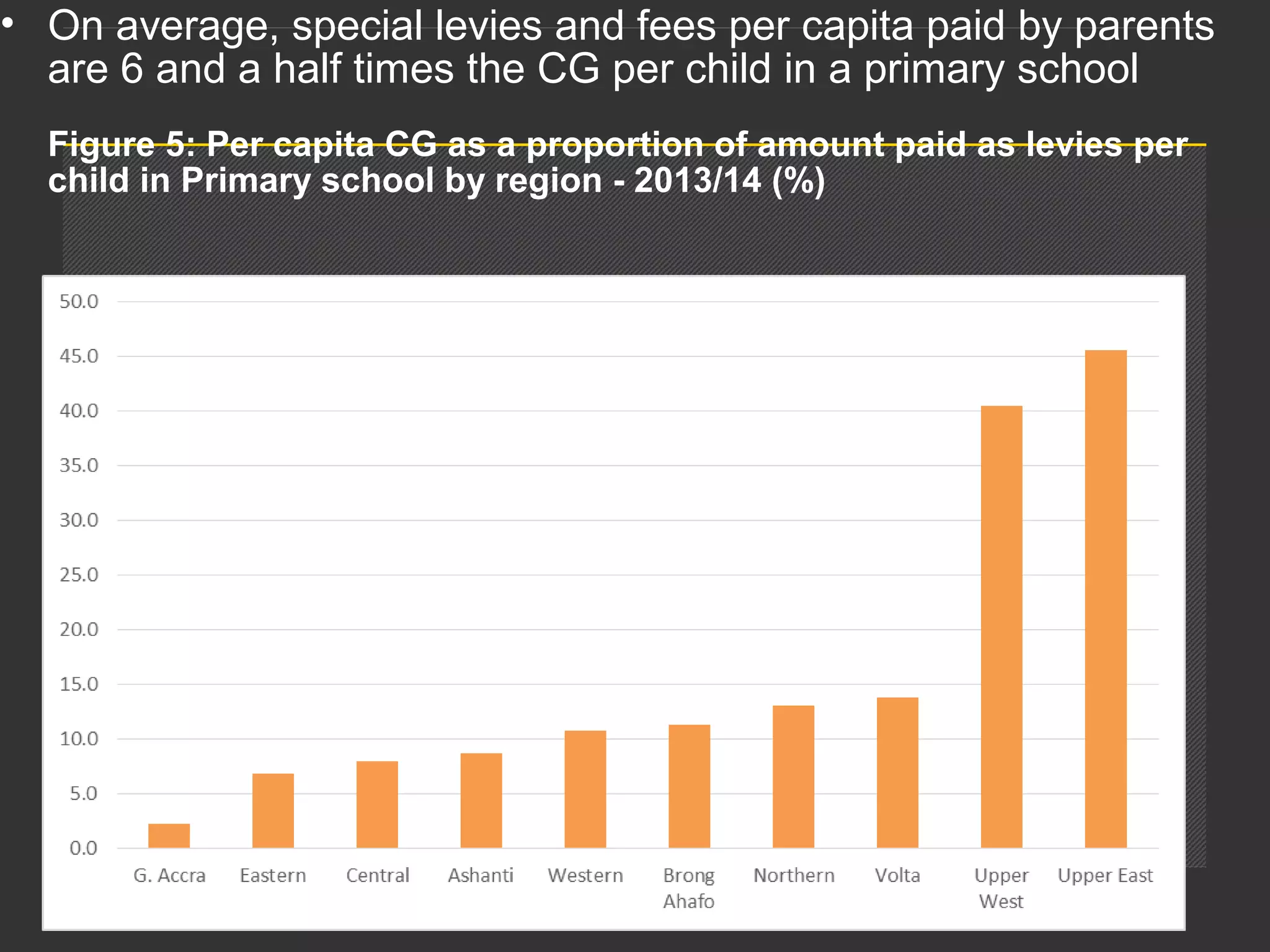

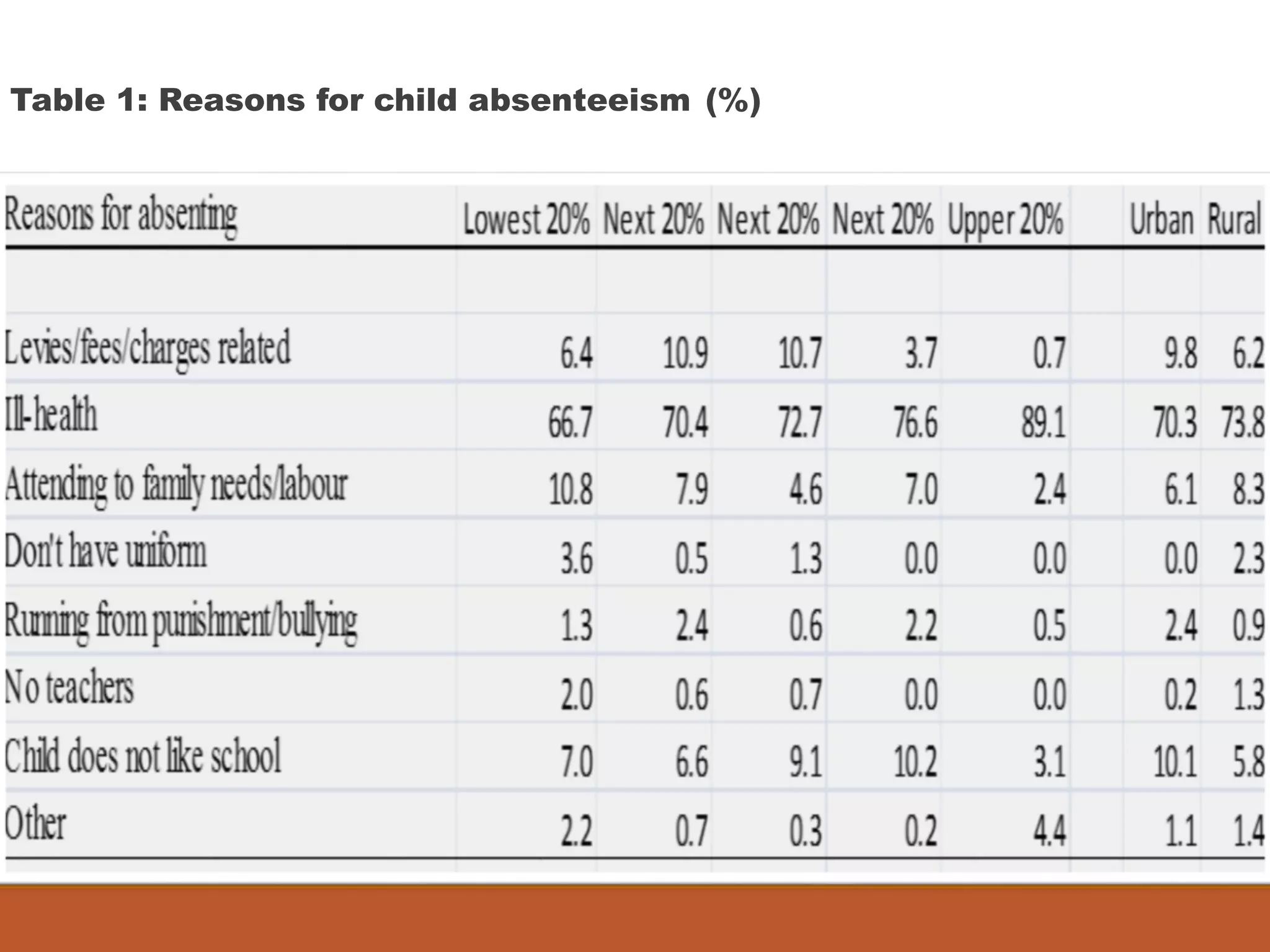

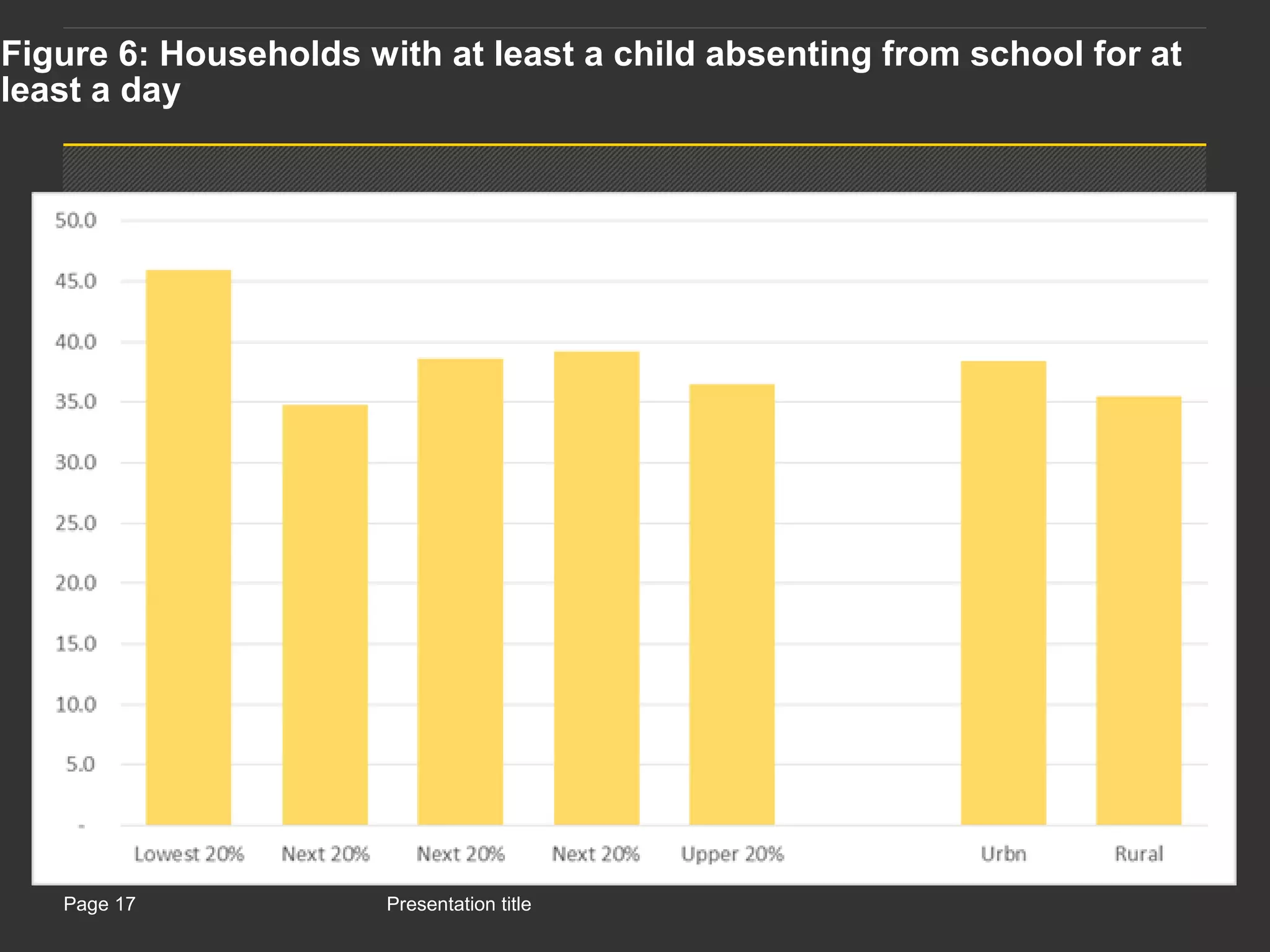

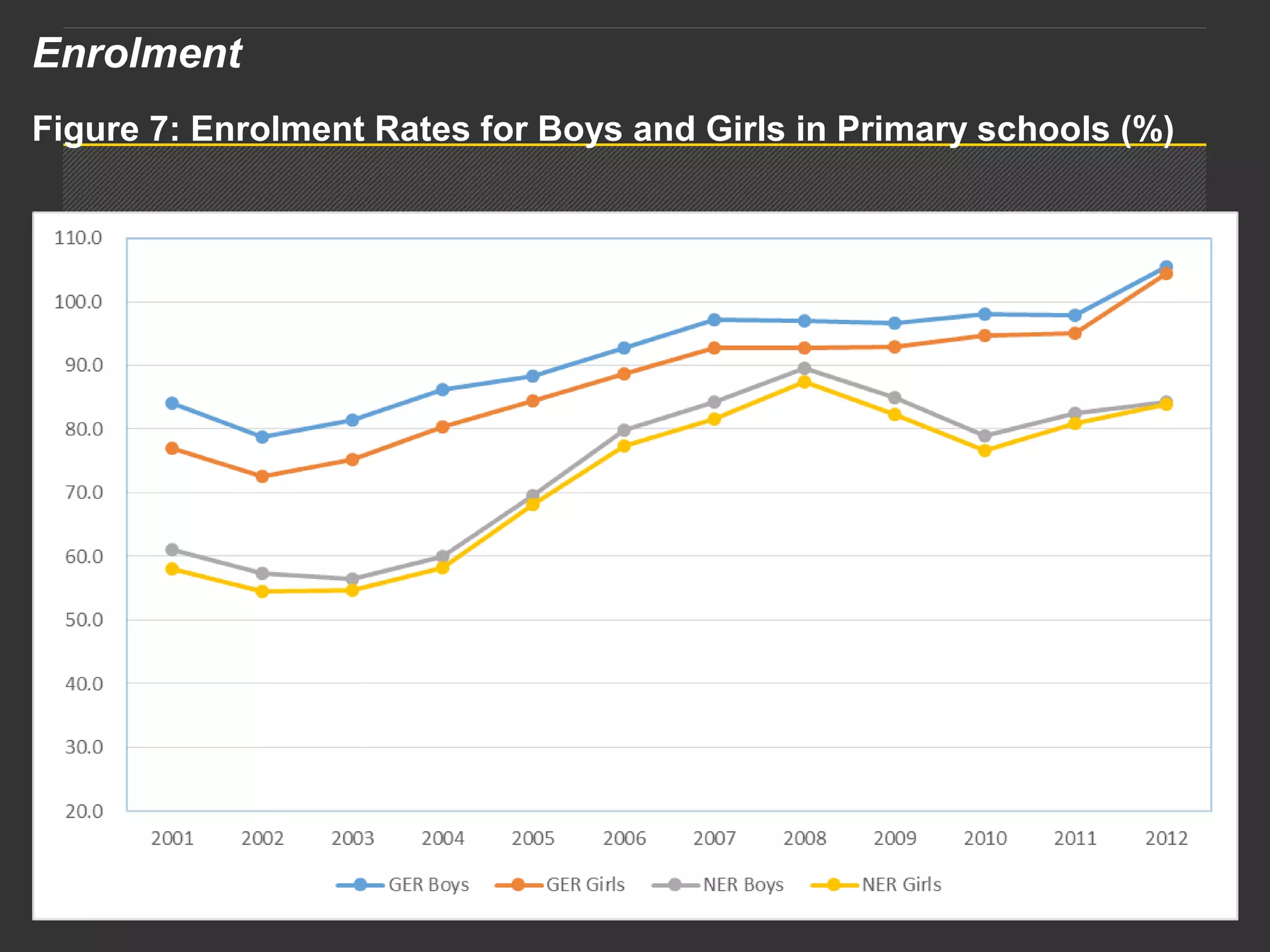

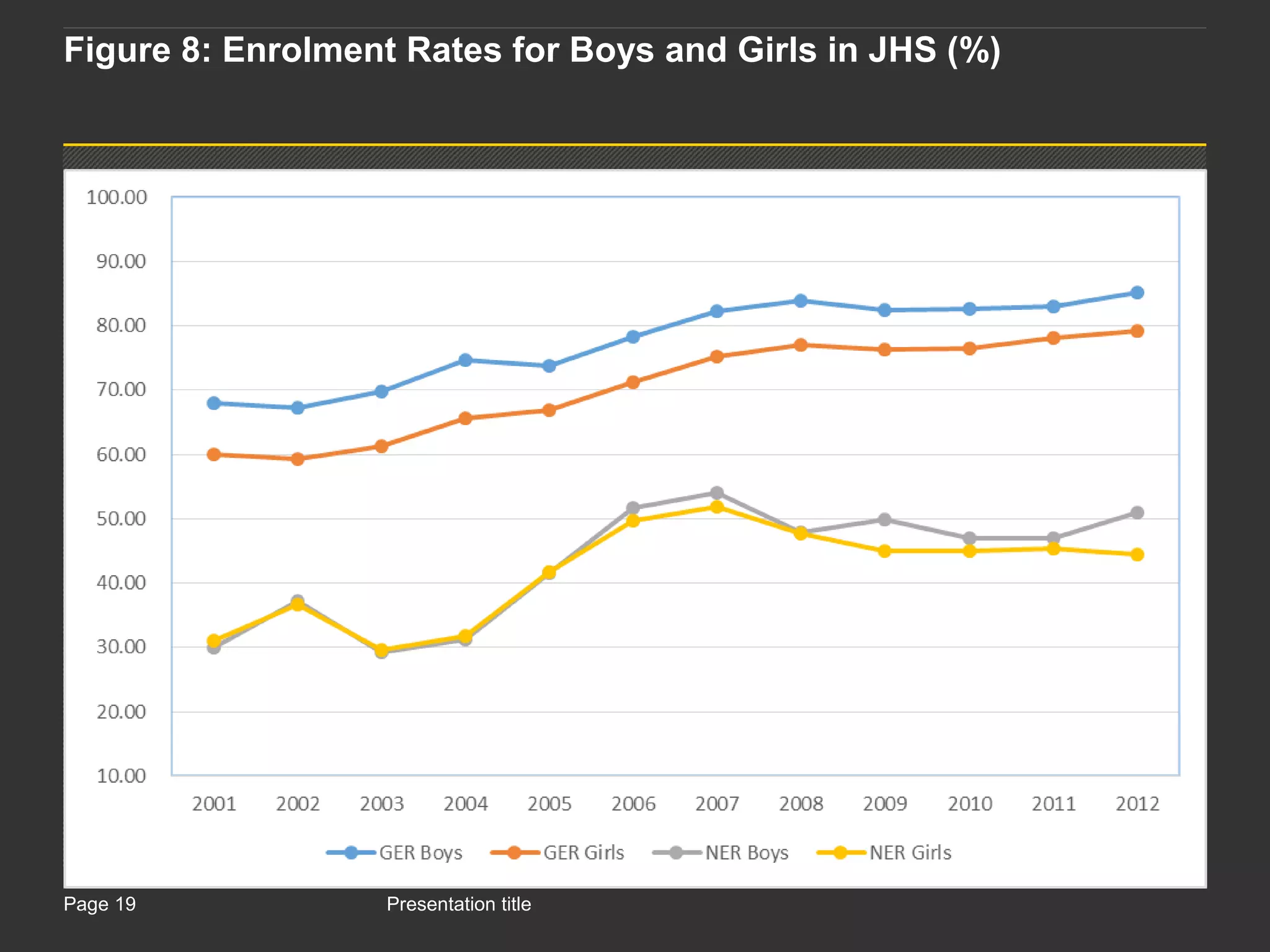

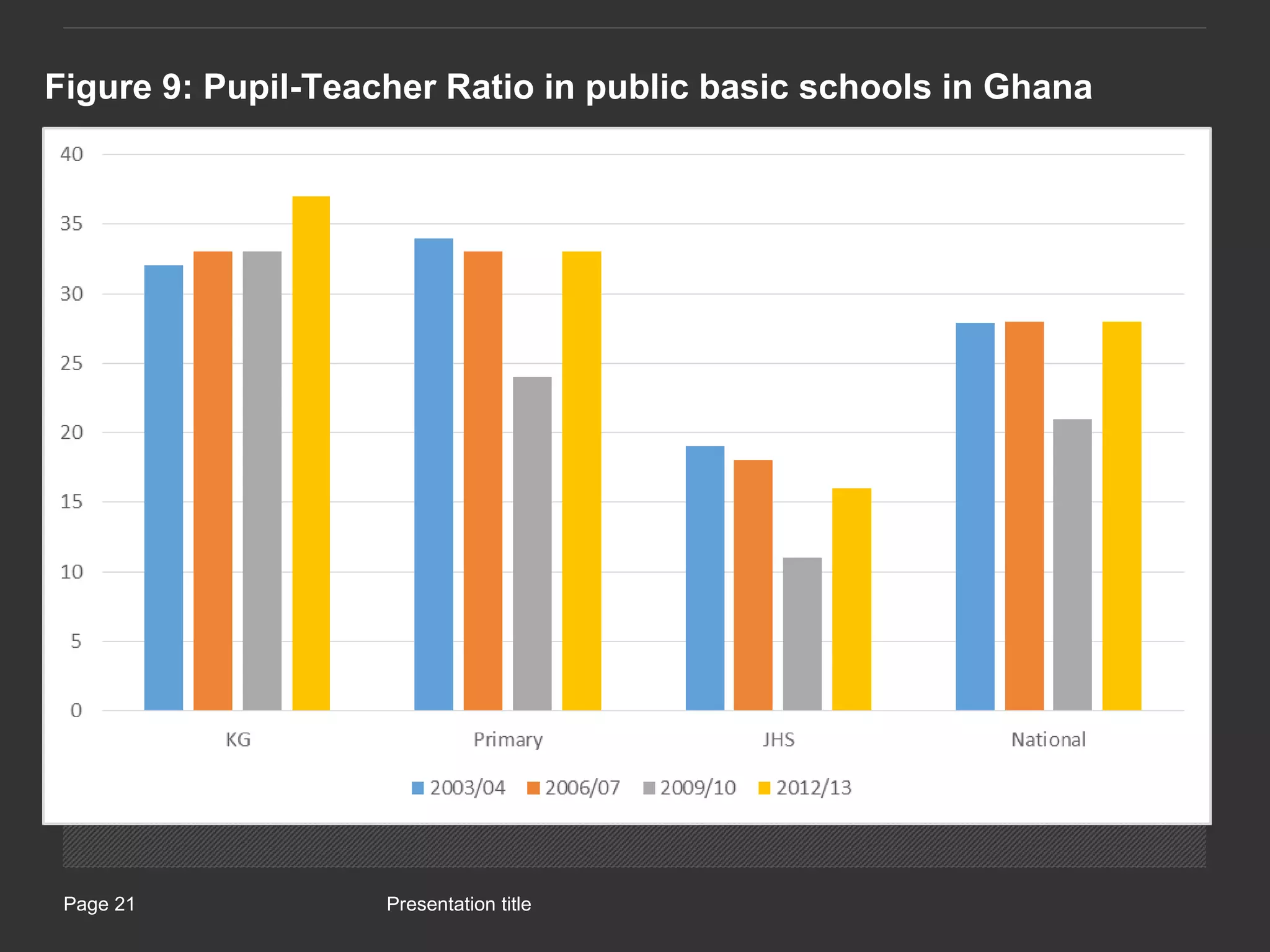

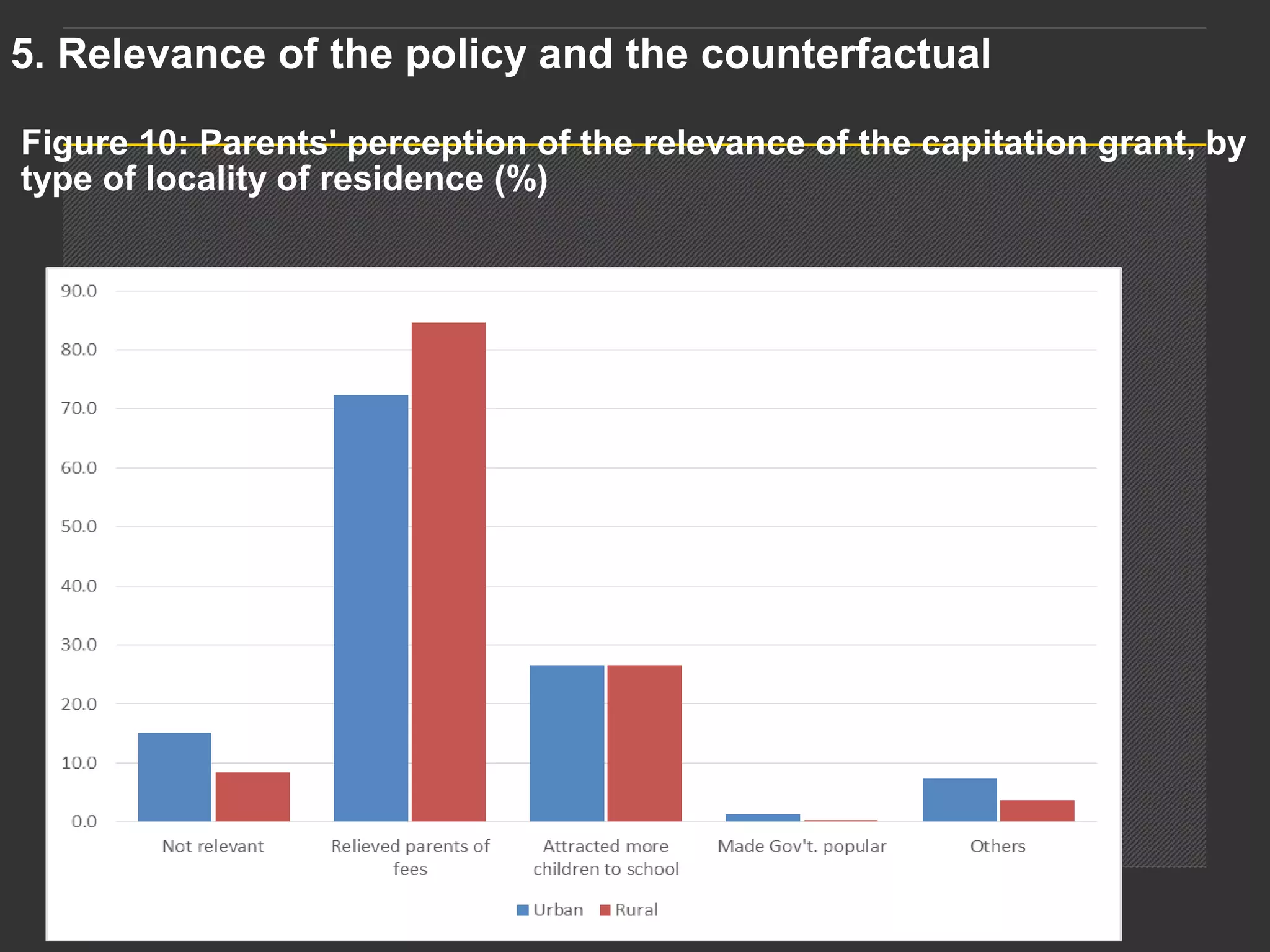

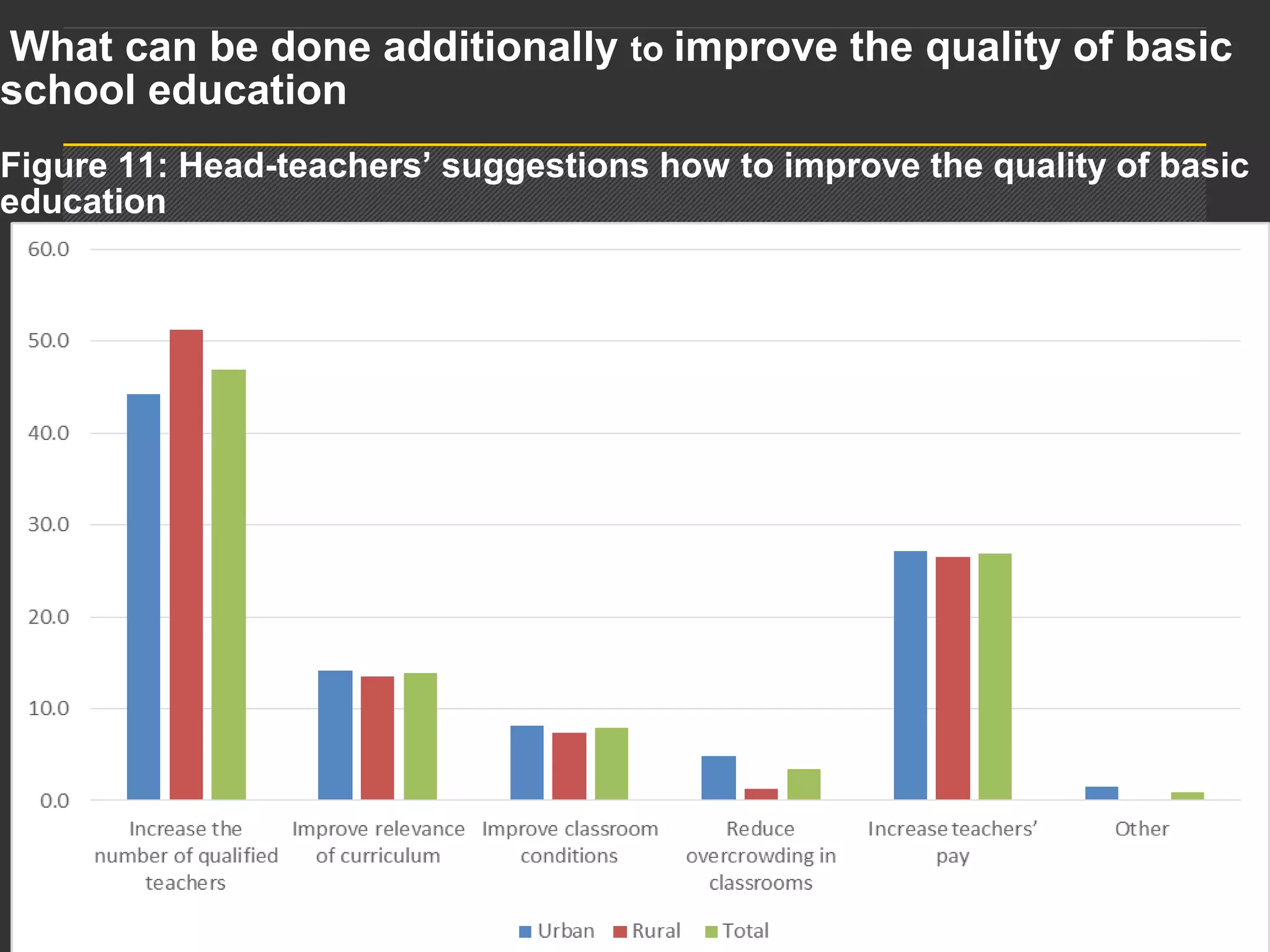

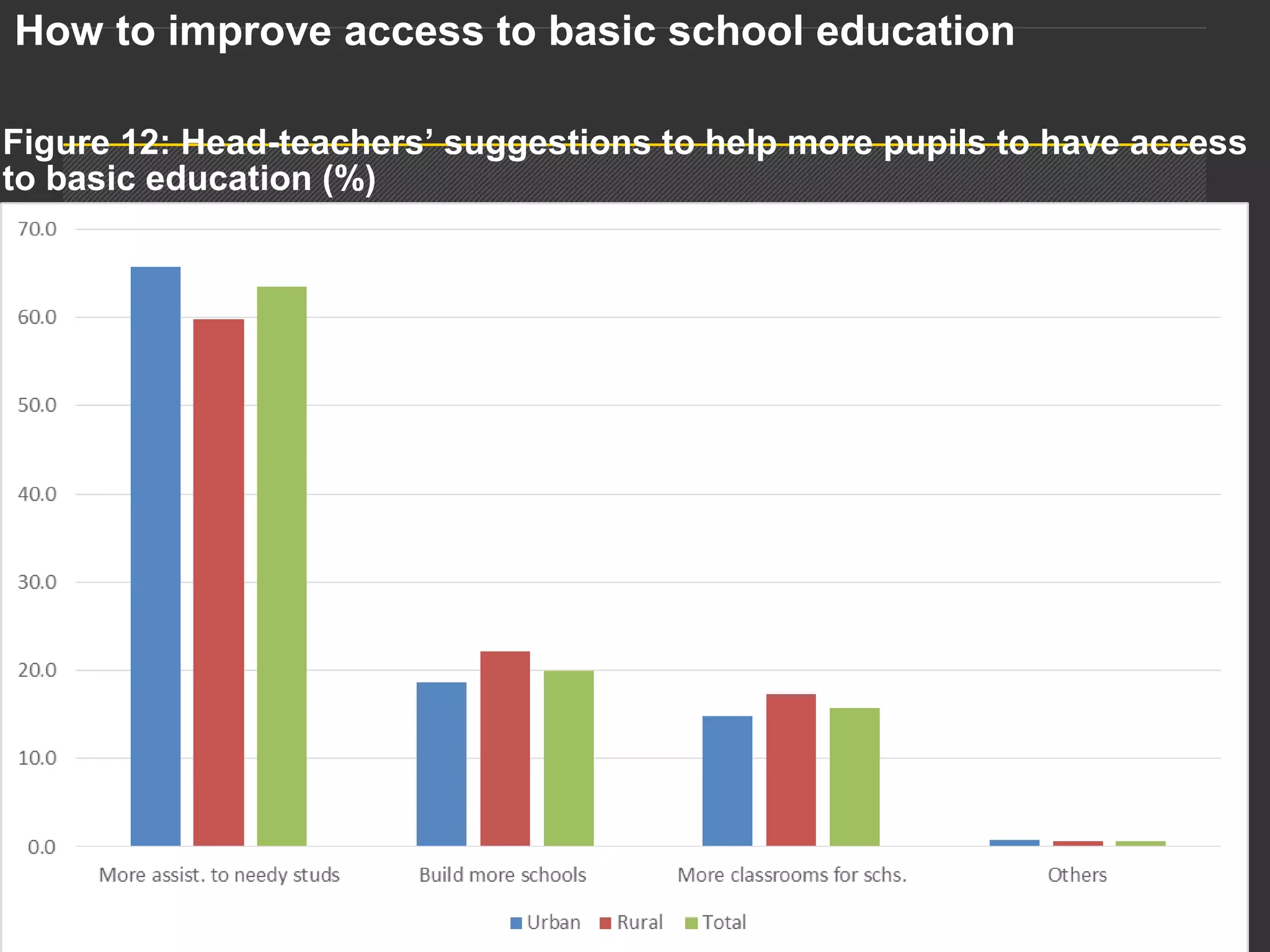

The document evaluates the school capitation grant scheme in Ghana, which aims to reduce educational costs and increase access to basic education. While significant progress has been made in eliminating official tuition fees, concerns remain regarding additional levies, enrollment rates, and overall quality of education. The report recommends improving timely access to funds and reducing bureaucratic hurdles to enhance the scheme's effectiveness.