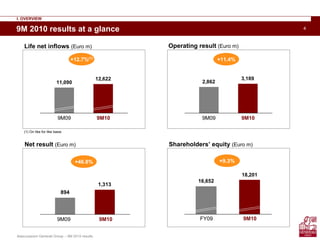

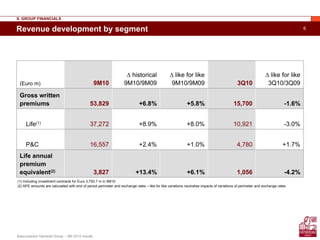

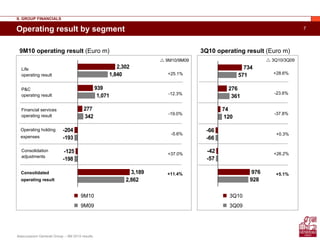

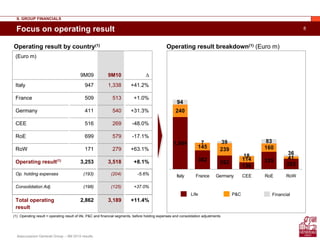

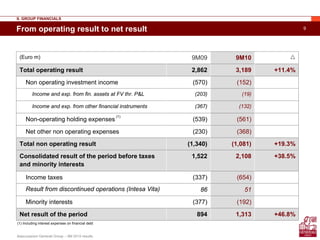

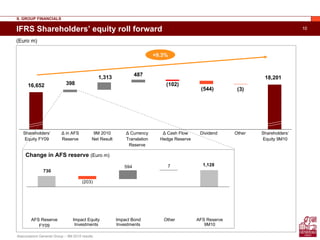

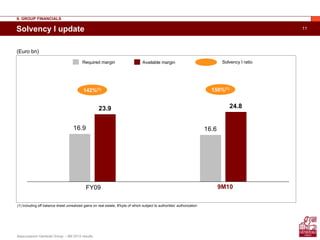

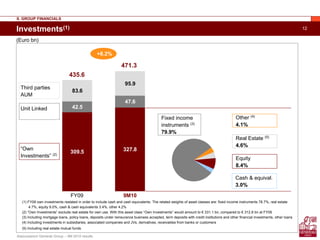

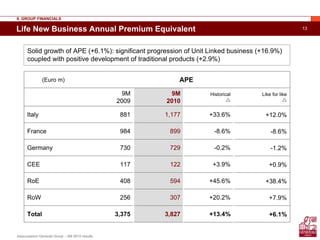

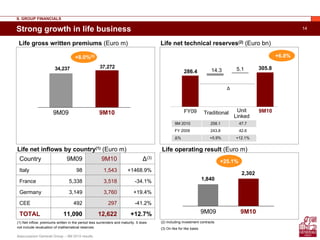

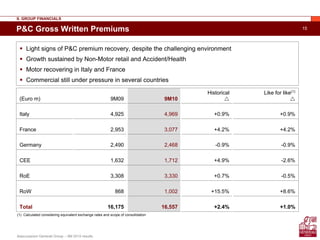

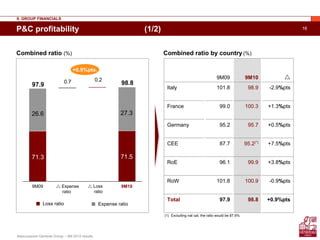

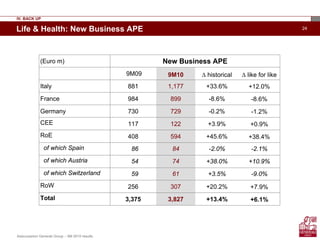

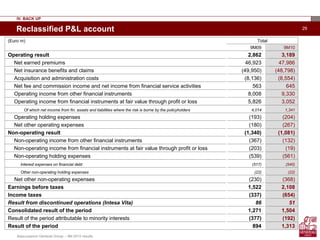

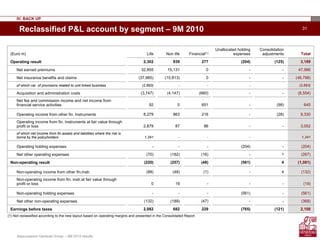

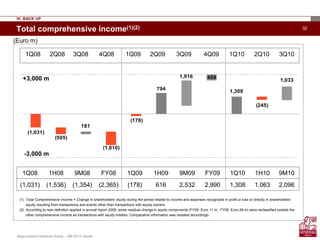

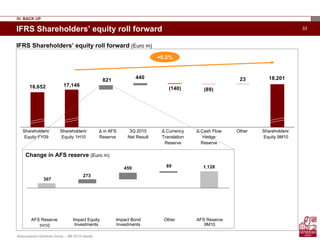

The Assicurazioni Generali Group reported strong results for the first nine months of 2010. Operating result increased 11.4% to €3.189 billion driven by growth in life insurance net inflows and premiums. Net income rose 46.8% to €1.313 billion. Shareholders' equity increased 12.7% to €12.622 billion reflecting higher unrealized gains on investments. The outlook for full year 2010 operating profit of €3.6-4.2 billion was confirmed.