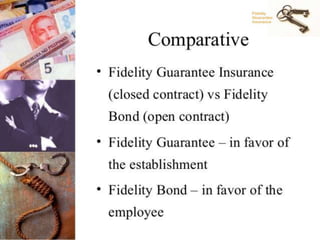

This document discusses two types of general insurance policies: fidelity guarantee and aviation insurance. It defines fidelity guarantee as coverage against financial losses caused by employee fraud, dishonesty or theft. It also defines aviation insurance as policies tailored specifically for aircraft operation and risks, covering public liability, passenger liability, aircraft damage while on ground or taxiing, and full flight coverage. The document provides details on coverage scopes, conditions and claim documentation requirements for both policy types.