The document discusses:

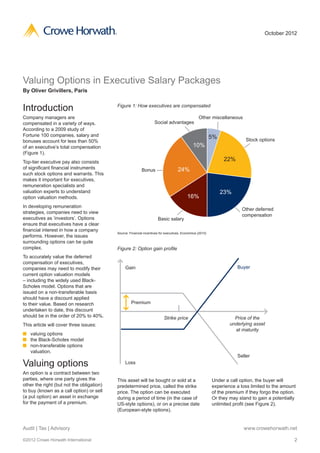

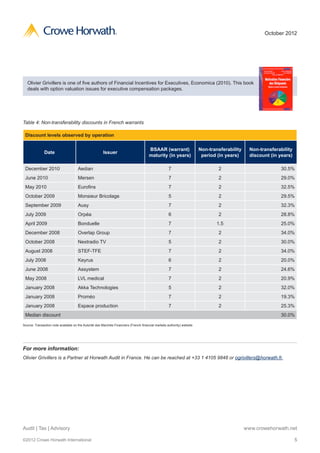

1) Valuing options that are part of executive compensation packages can be complex due to different valuation models. Options help ensure executives' interests are aligned with company performance but discounts may need to be applied for non-transferable options.

2) Selling non-core business lines can be challenging and require preparation. It discusses the importance of preparing financials, identifying key risks, resolving any legal or tax issues, and engaging advisors to help maximize sale value.

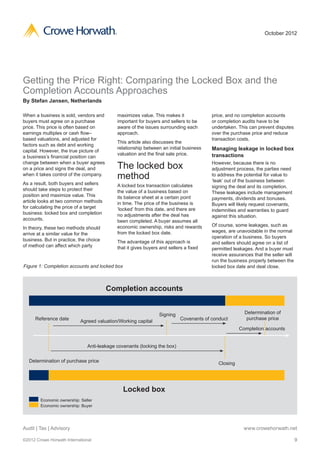

3) Settling on a sale price for a business involves comparing the locked box and completion accounts approaches. Locked box fixes the sale price at a historic date while completion accounts adjusts for events until closing.