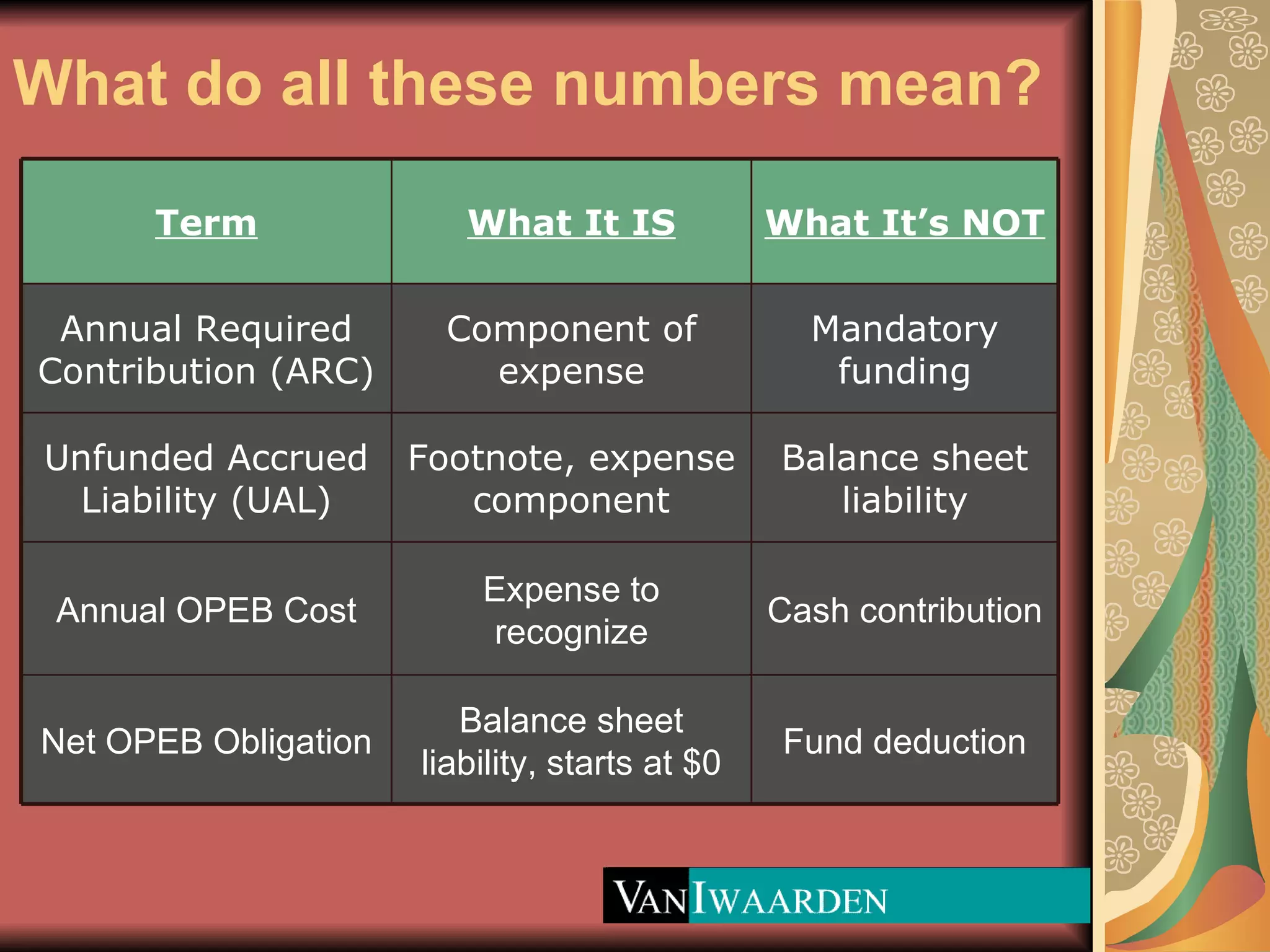

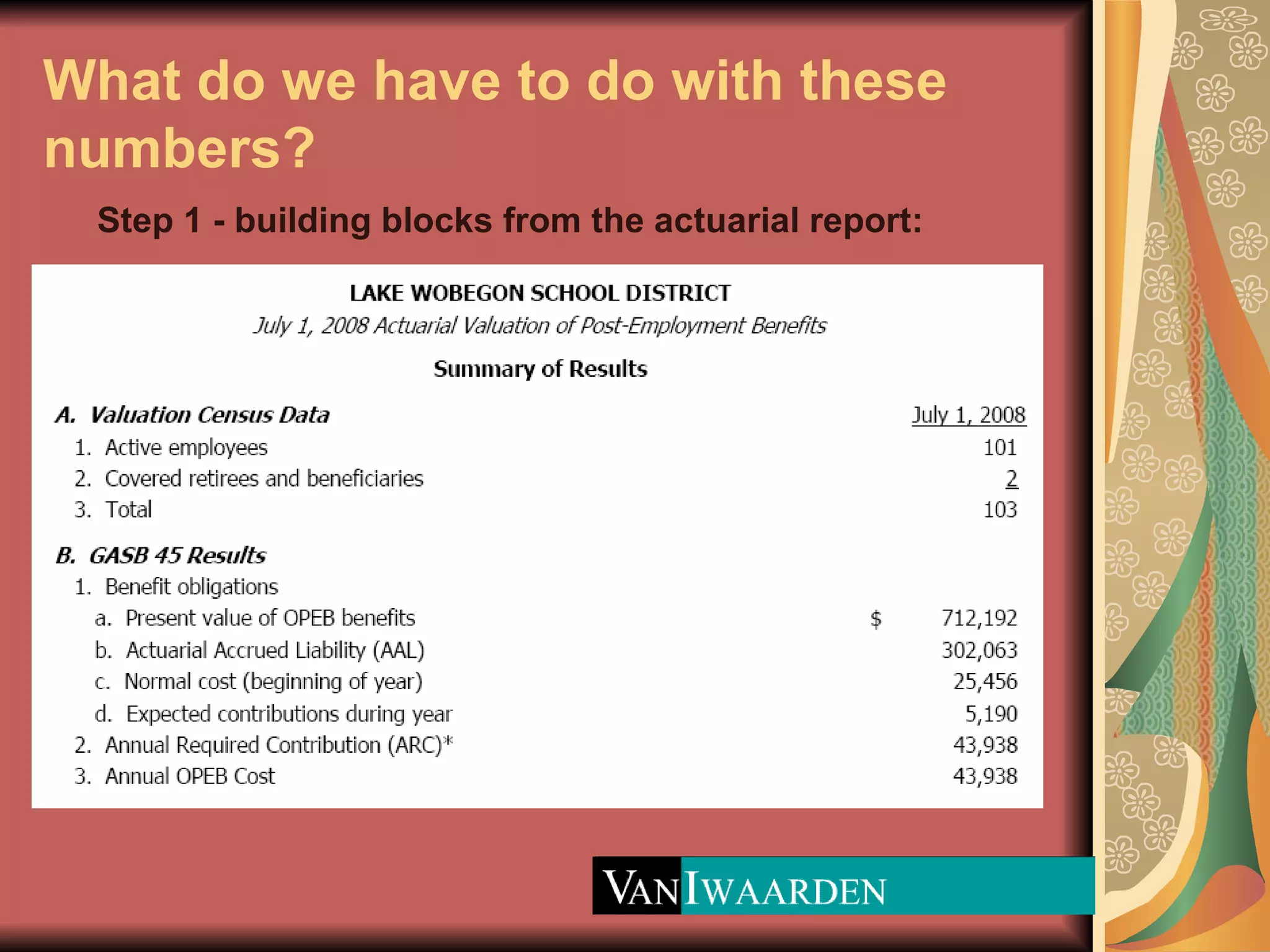

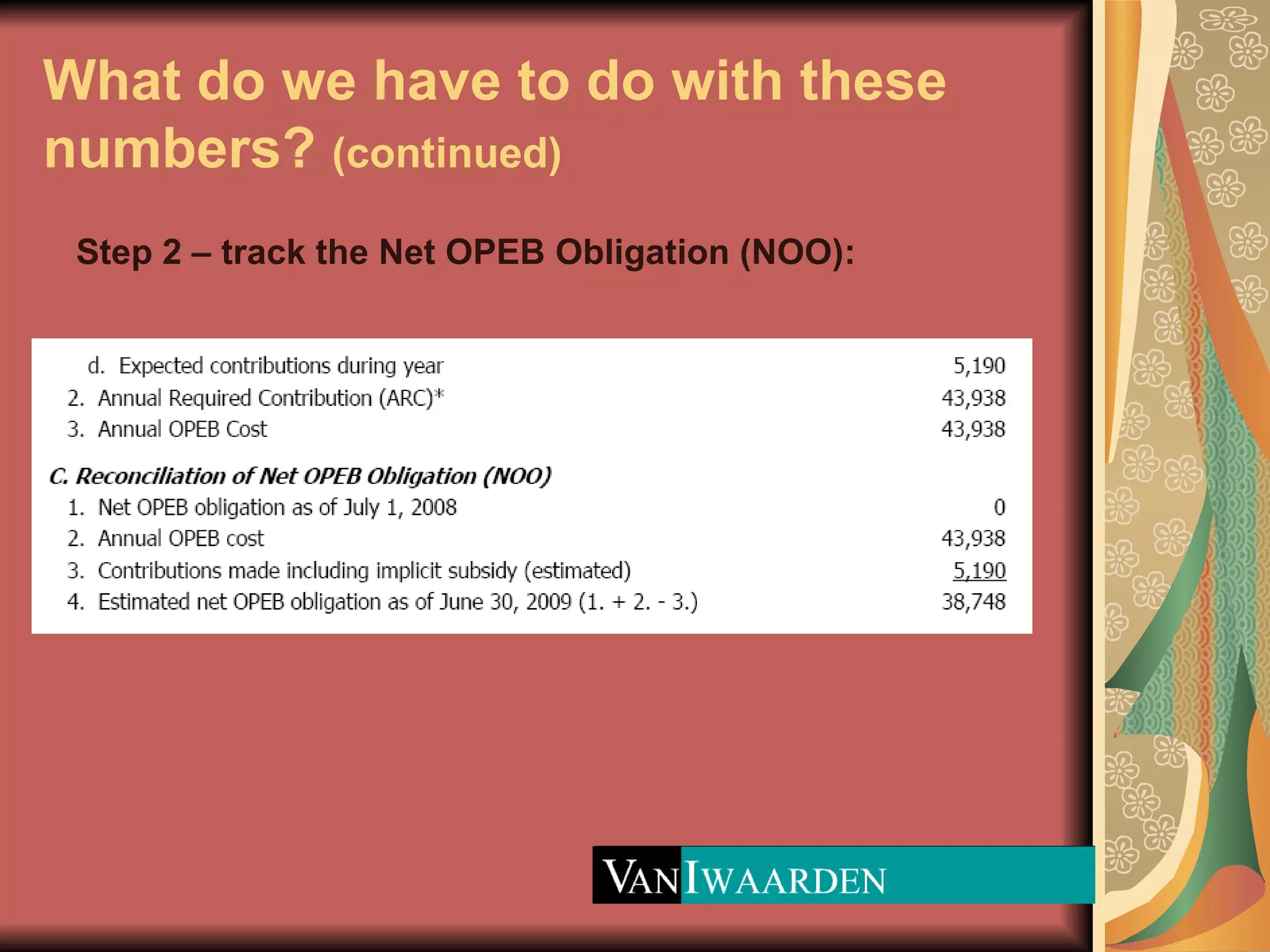

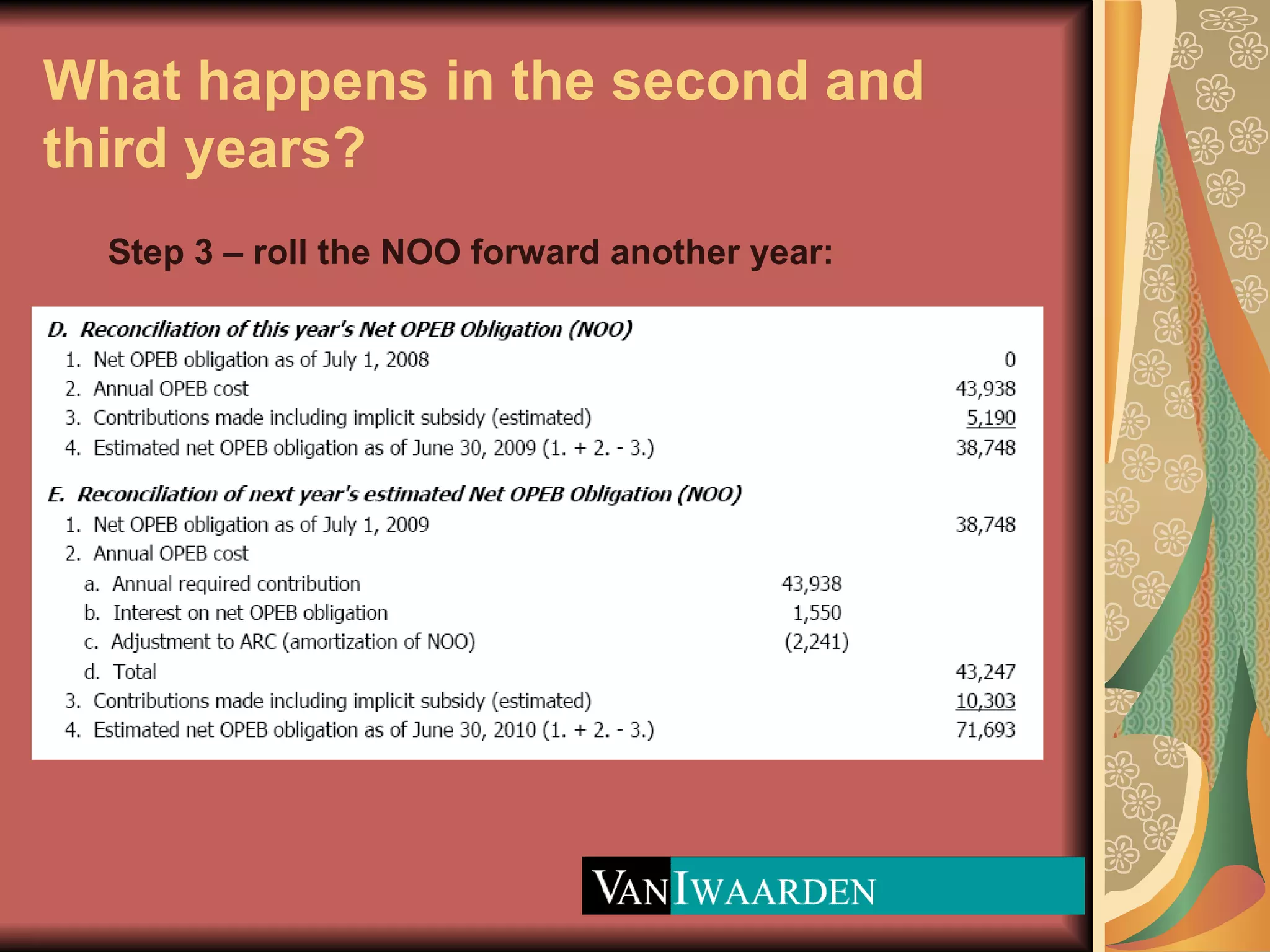

This document discusses strategies for addressing other post-employment benefits (OPEB) obligations. It outlines what various OPEB-related numbers mean, the steps that need to be taken to track OPEB obligations over time, and actions that can be considered to control OPEB costs such as tweaking benefits, funding plans, issuing bonds, and establishing defined contribution accounts. The document provides examples of how some municipalities have implemented cost control measures involving prescription drug plans, pre-funding, defined contribution accounts for new hires, and a combination of strategies.