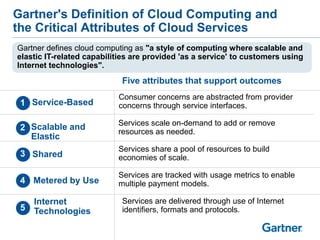

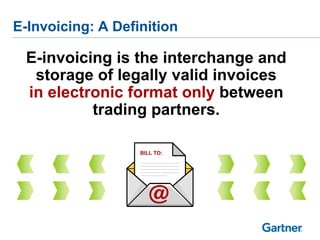

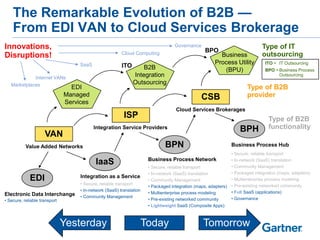

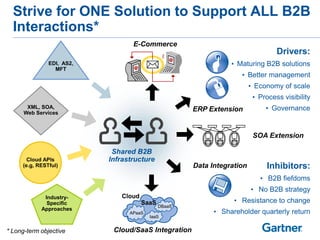

The document discusses the evolution of multienterprise B2B collaboration and e-procurement, highlighting e-invoicing as a significant driver of this transformation, particularly in Europe and South America. It outlines the increasing integration of cloud computing in B2B processes and forecasts a substantial growth in electronic invoicing, which is becoming a requirement across many jurisdictions. Additionally, it delves into B2B integration trends and the emergence of cloud services brokerages as intermediaries that enhance service consumption.