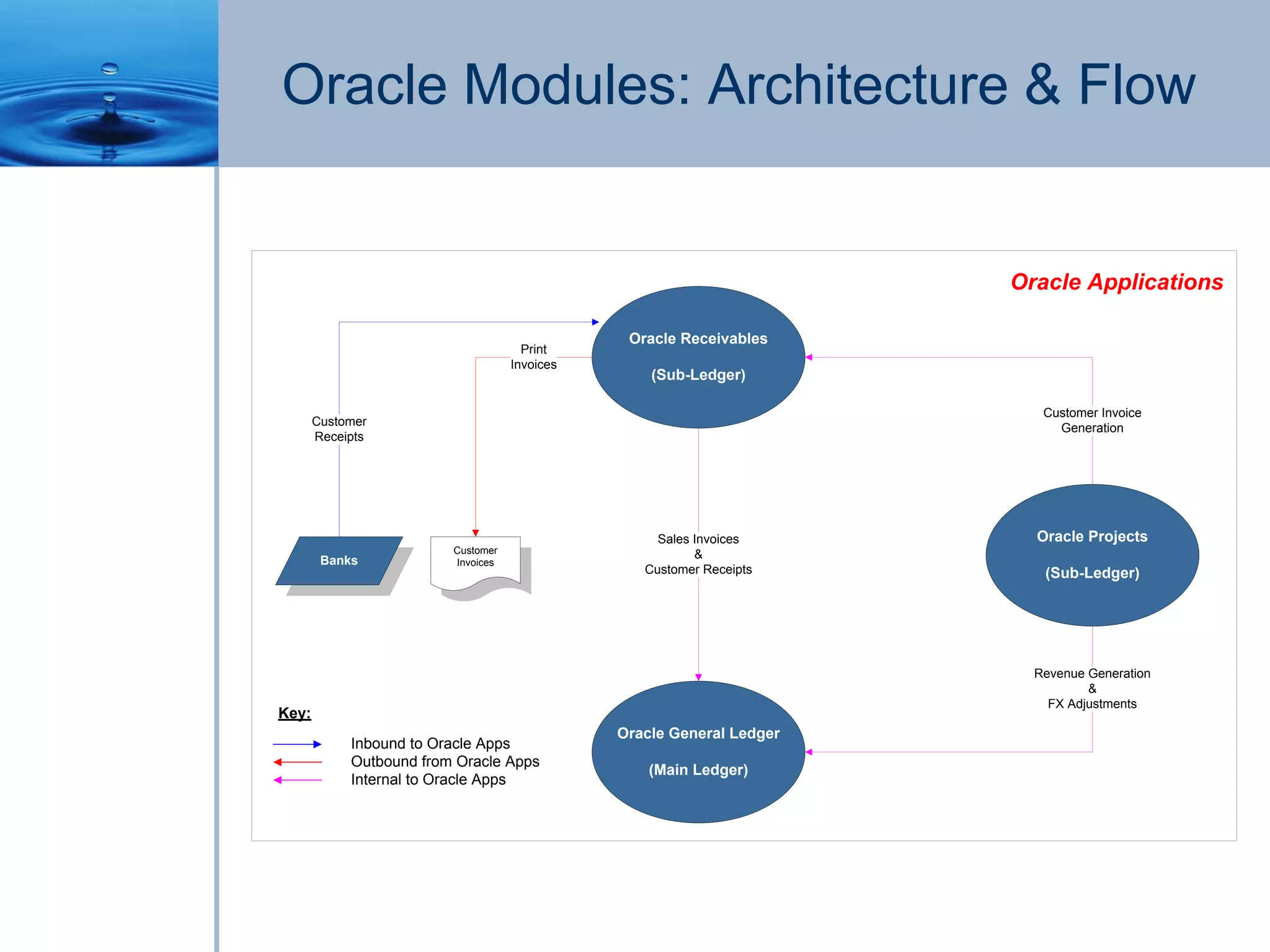

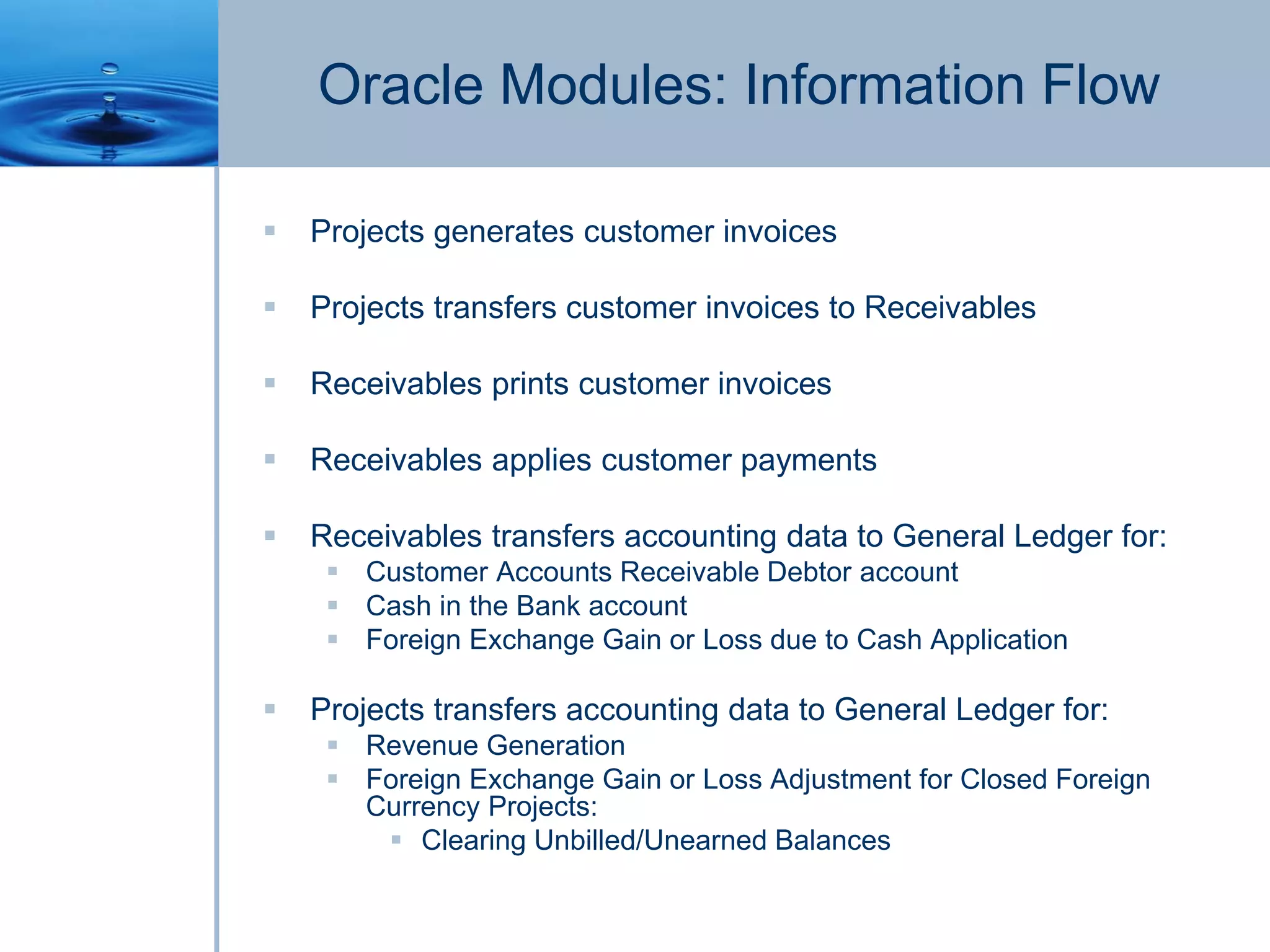

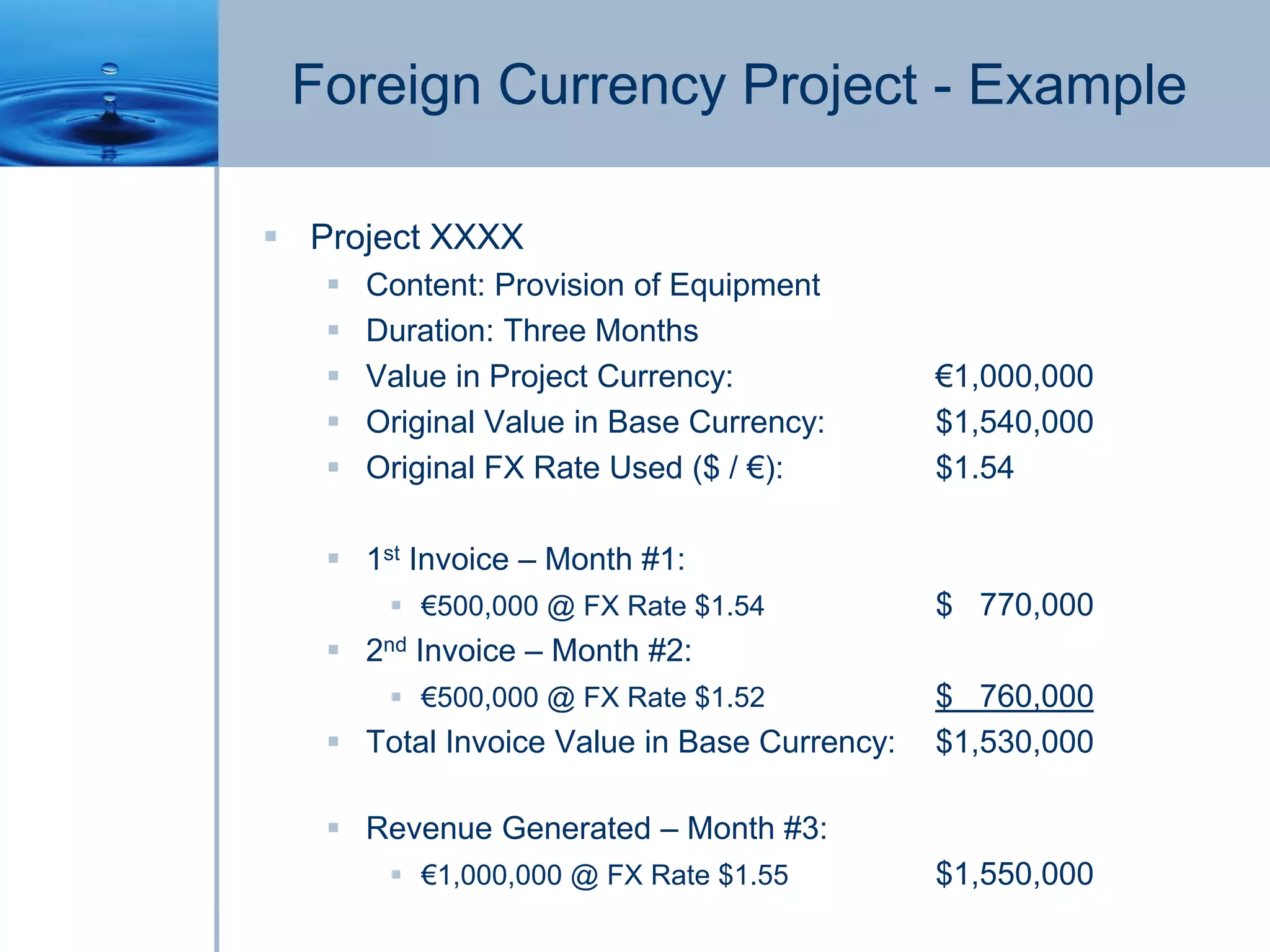

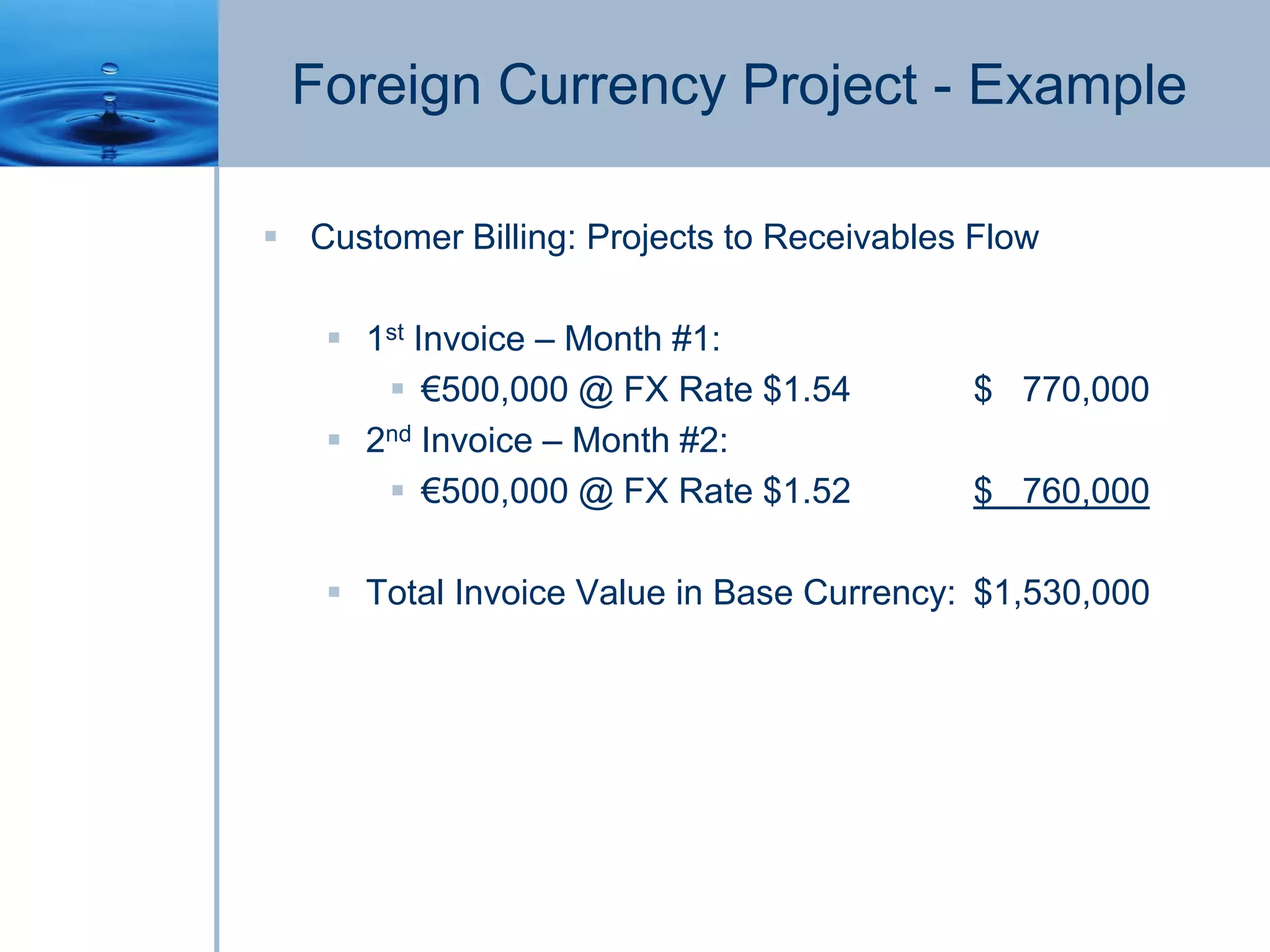

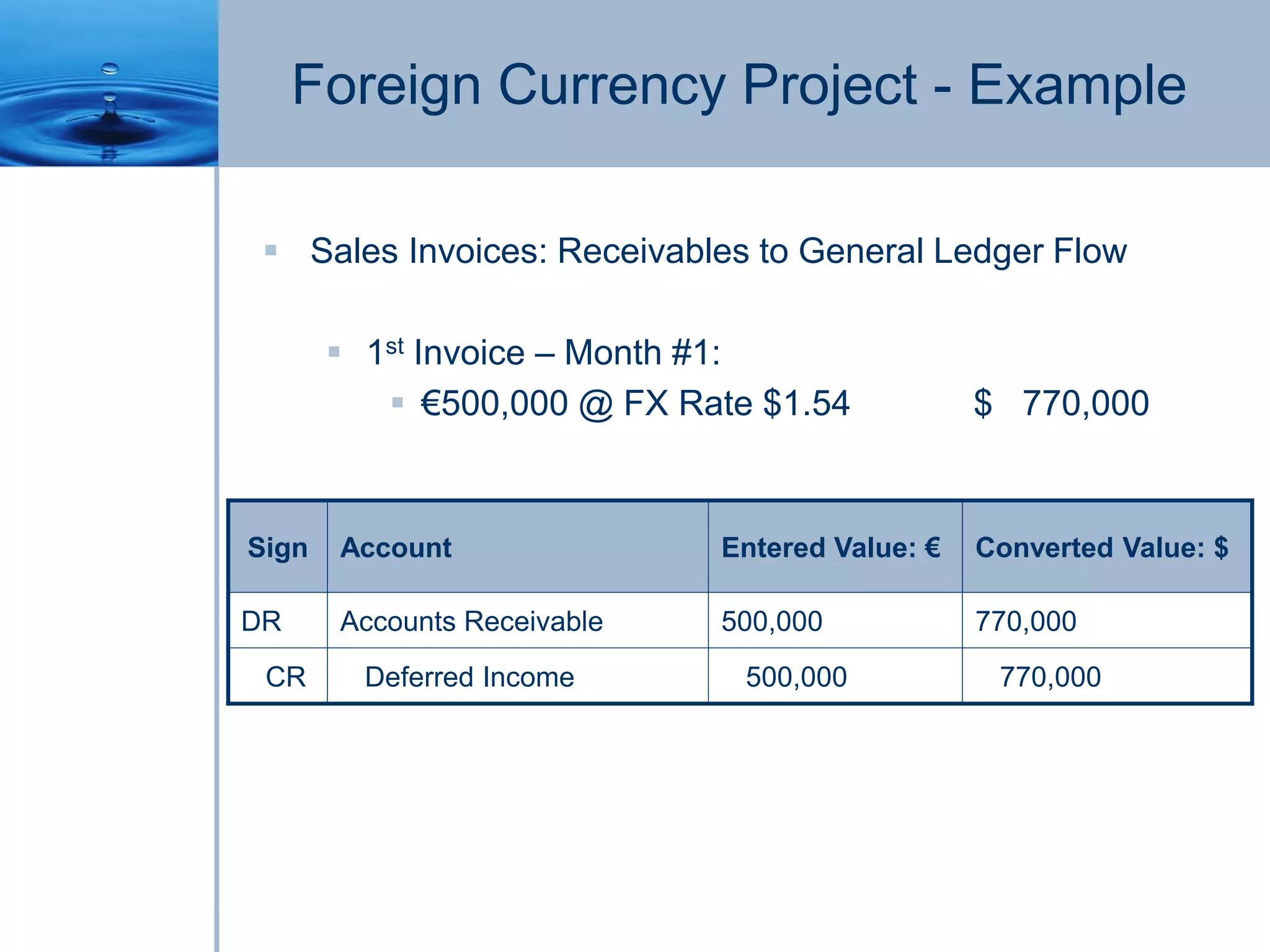

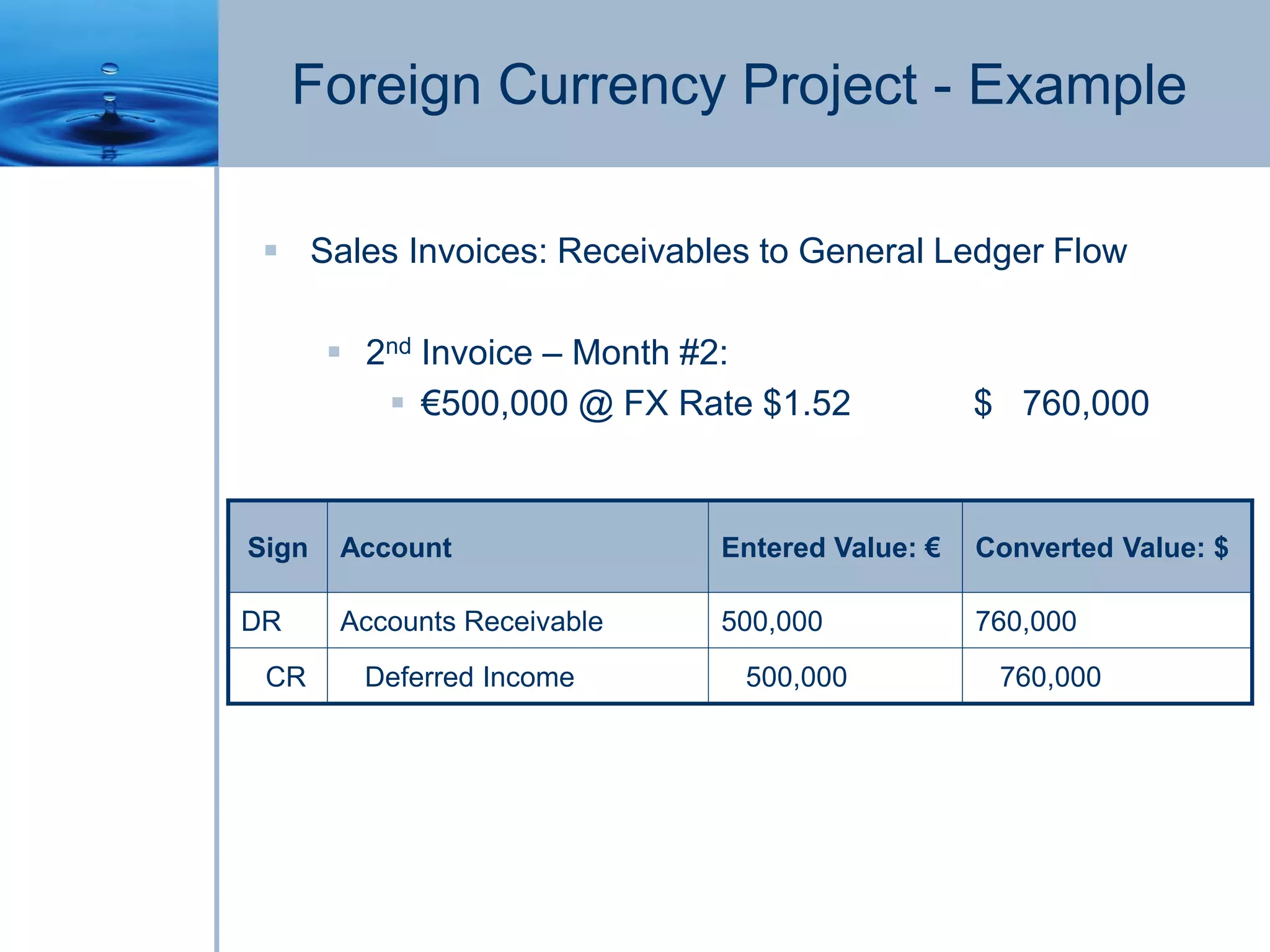

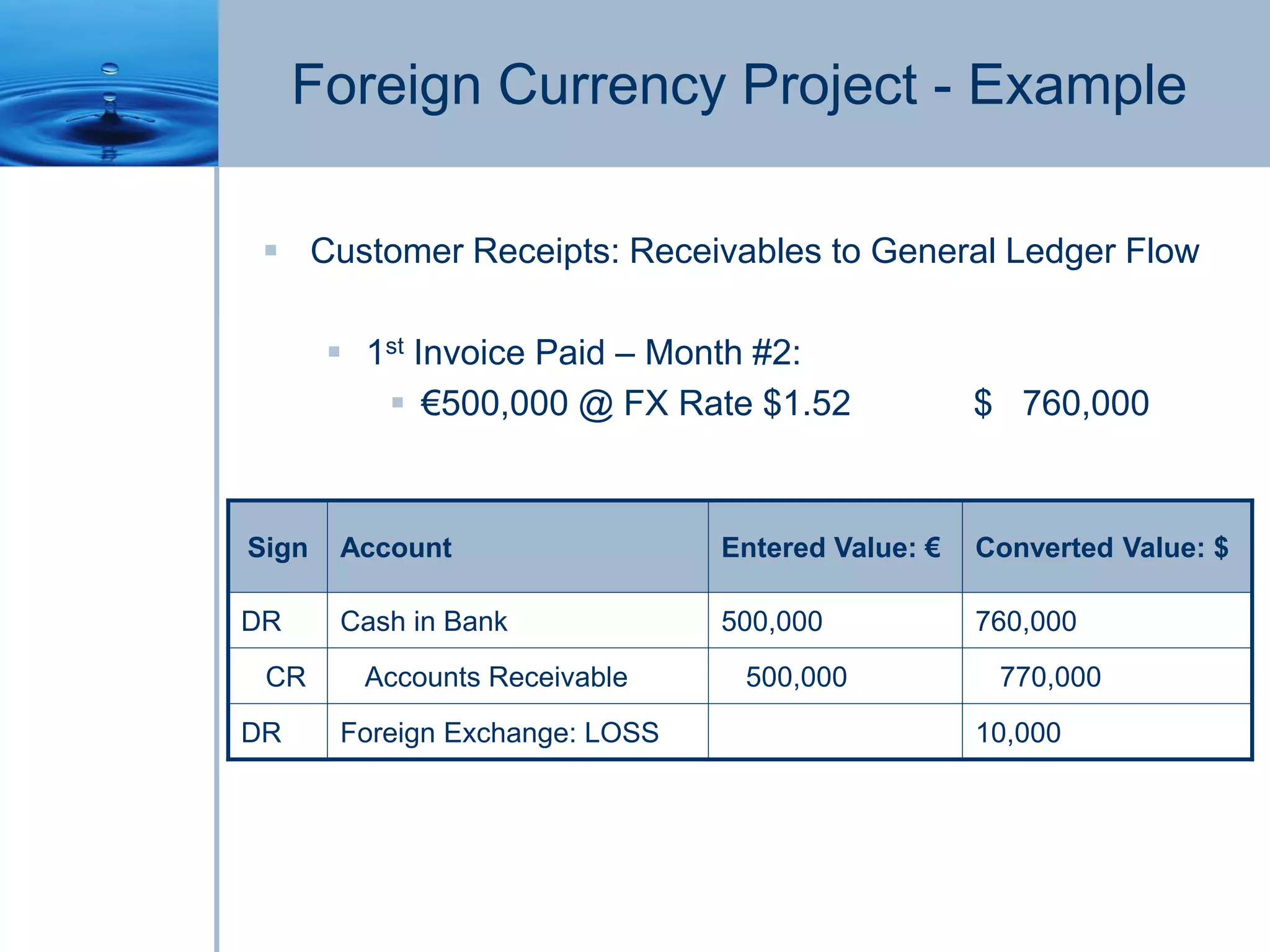

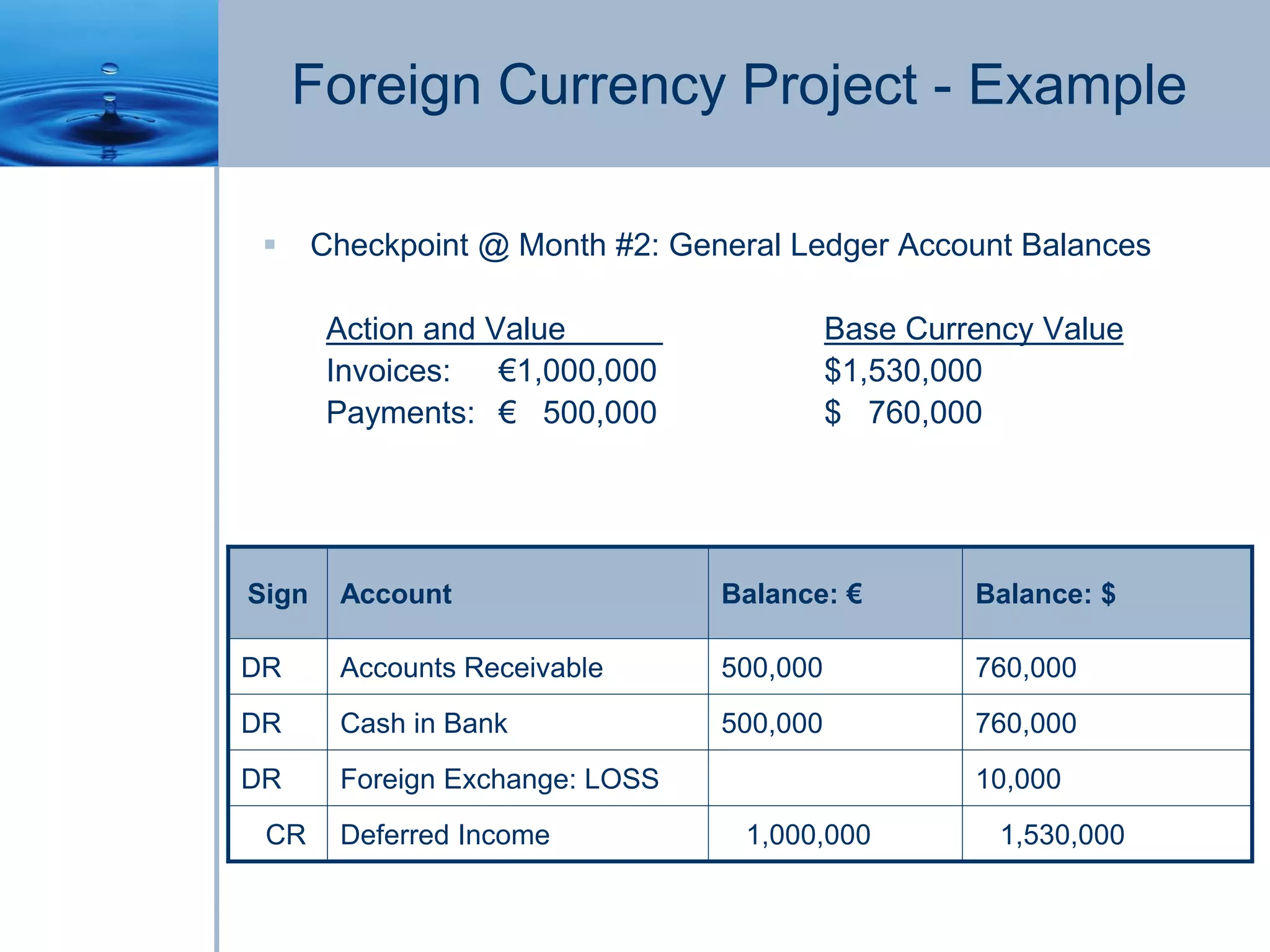

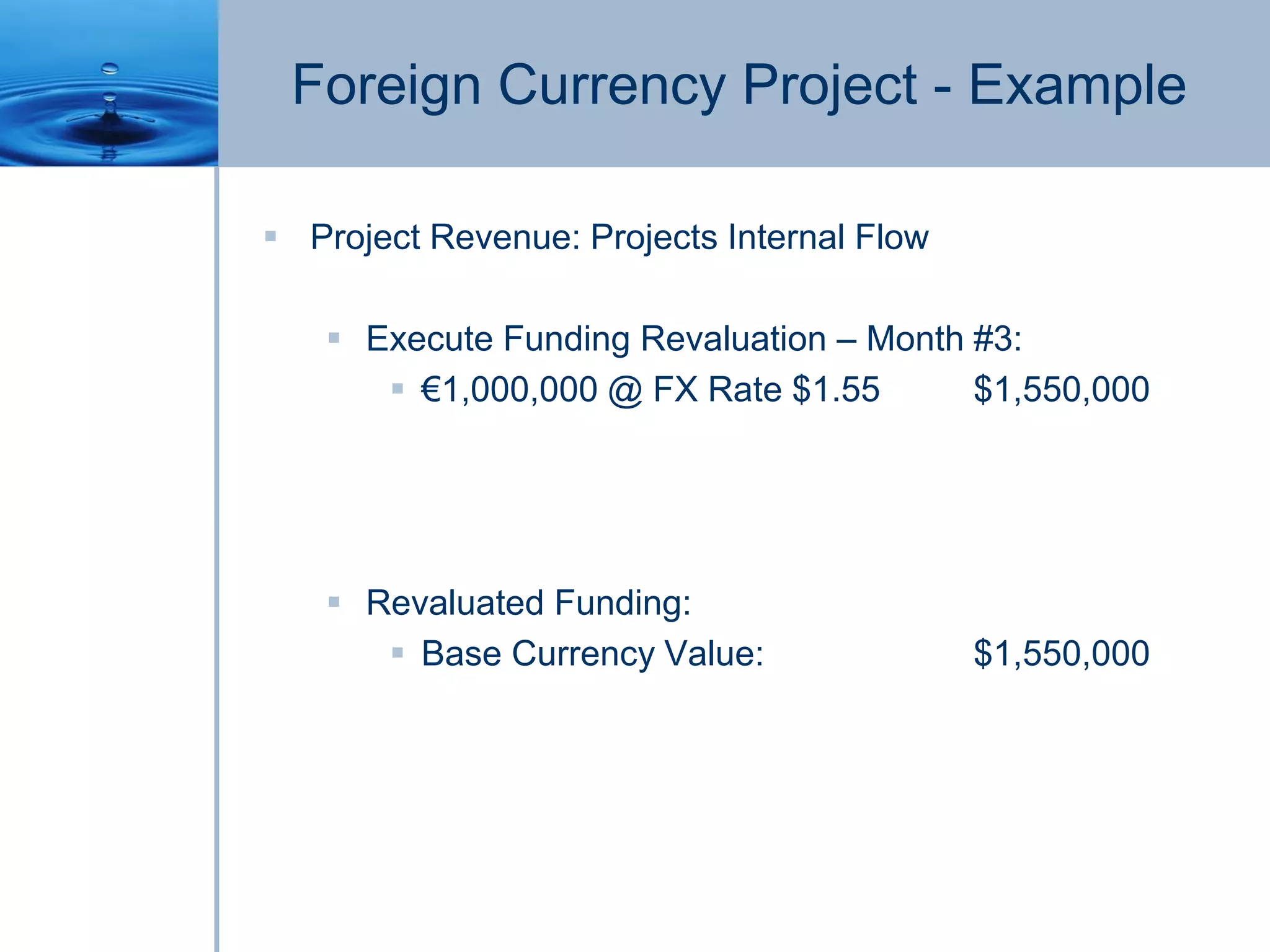

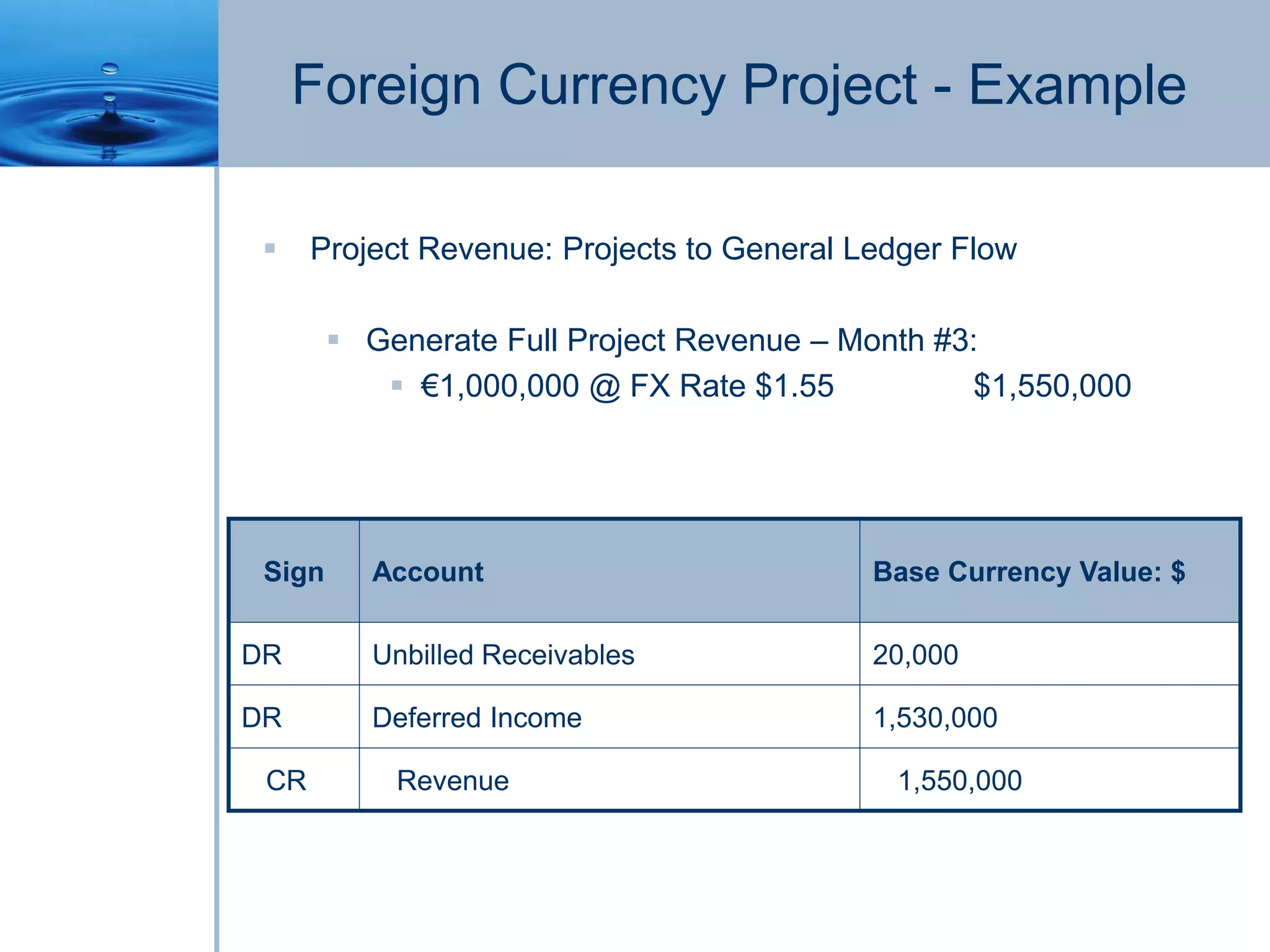

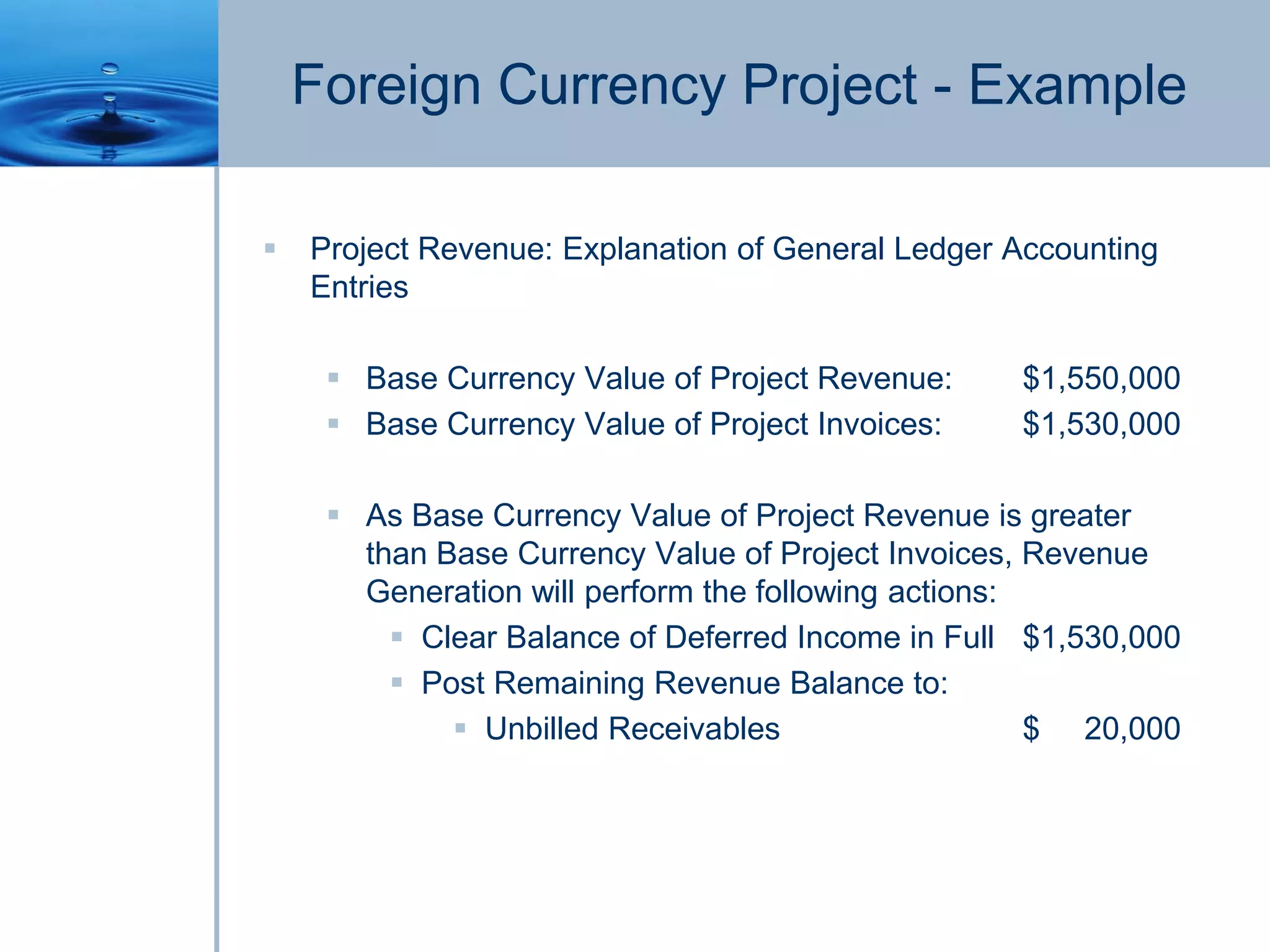

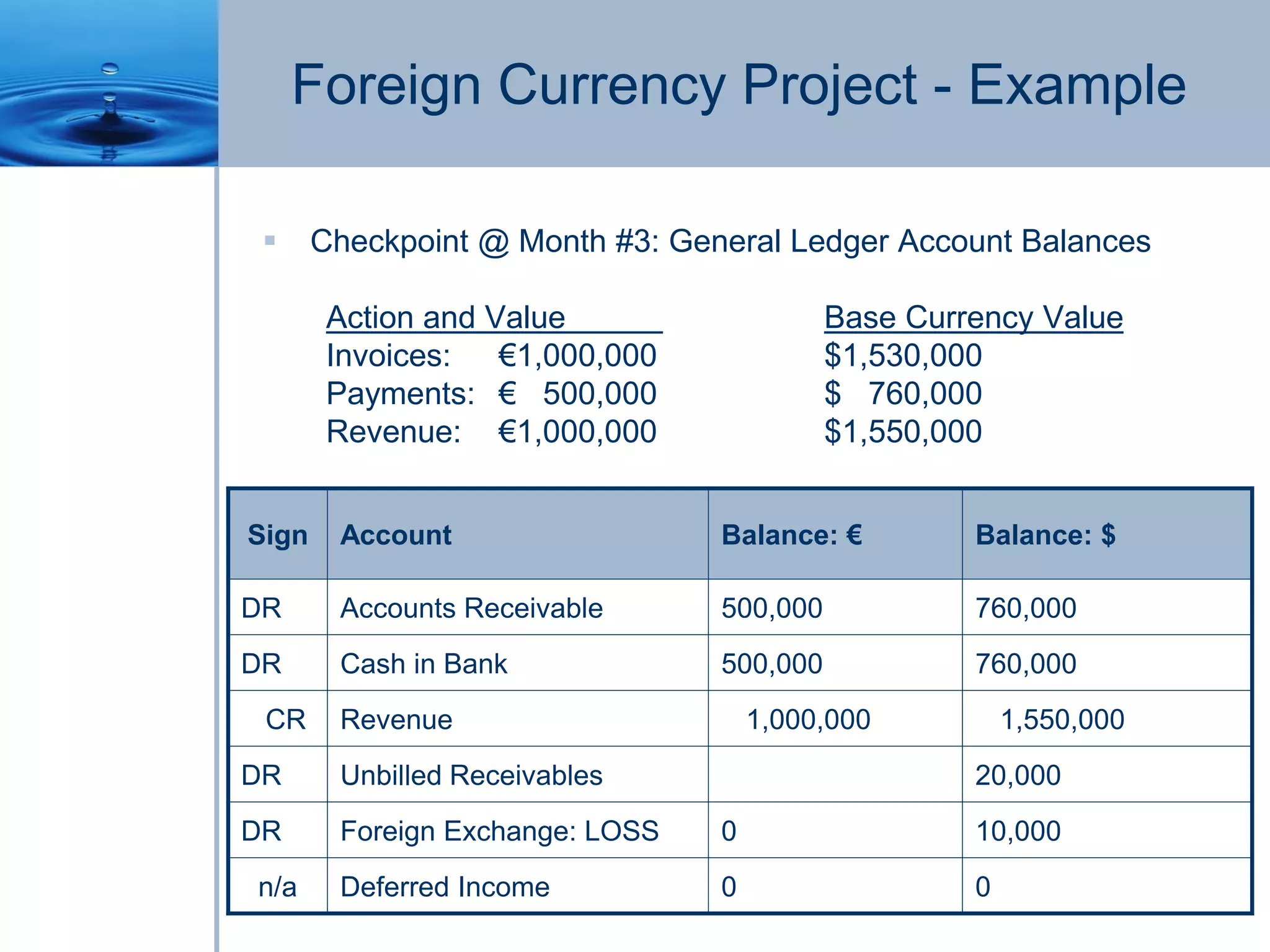

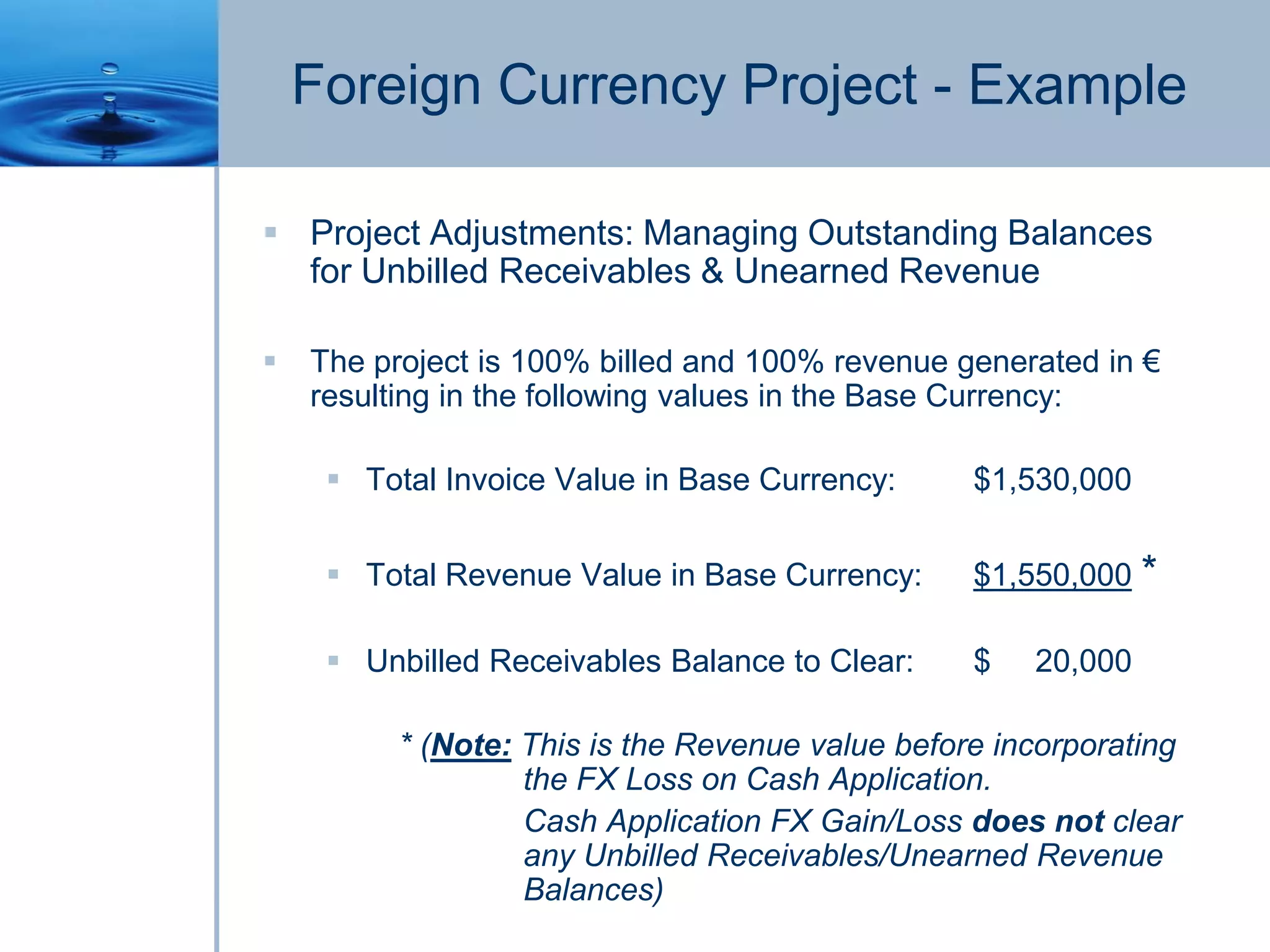

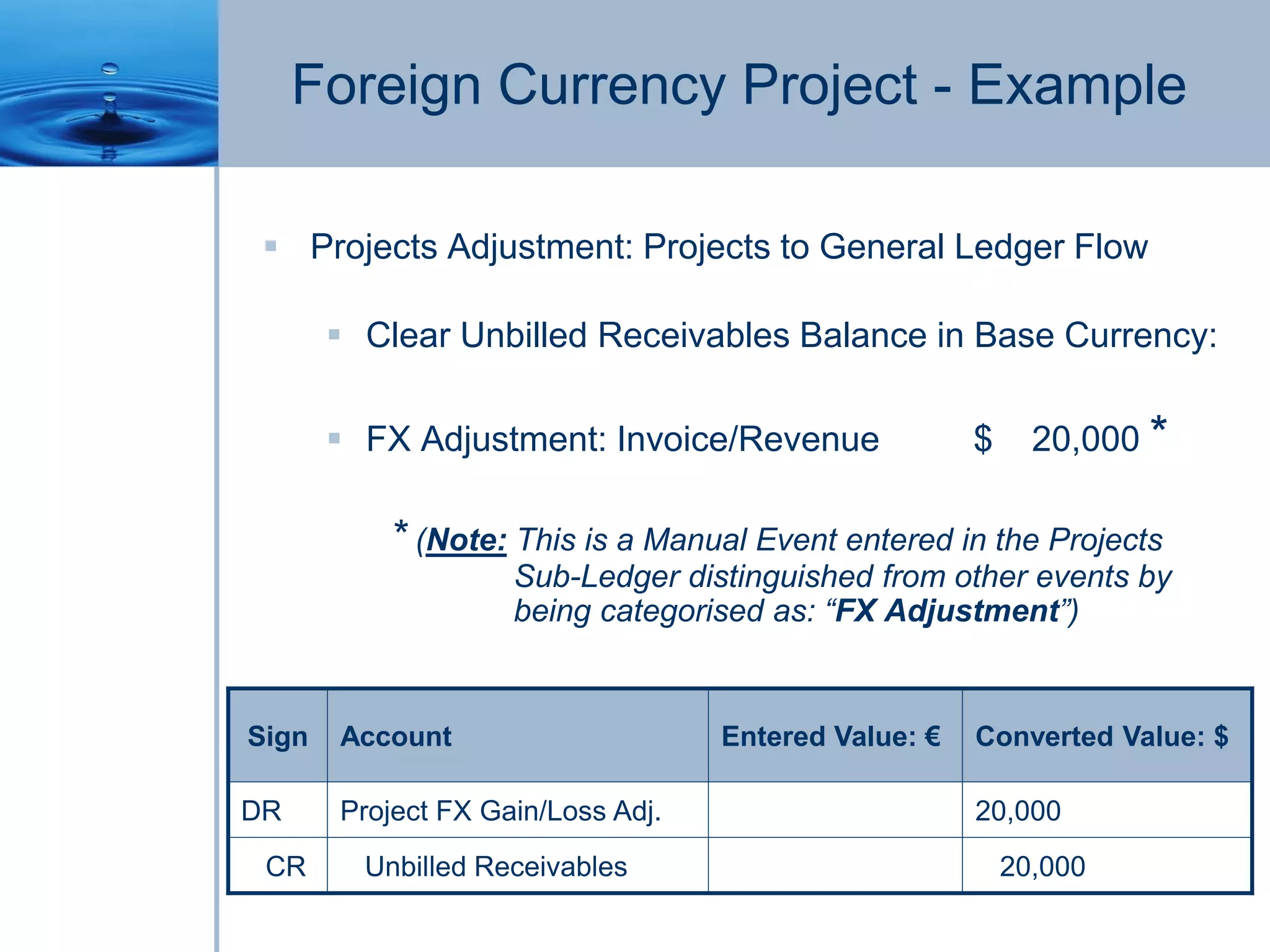

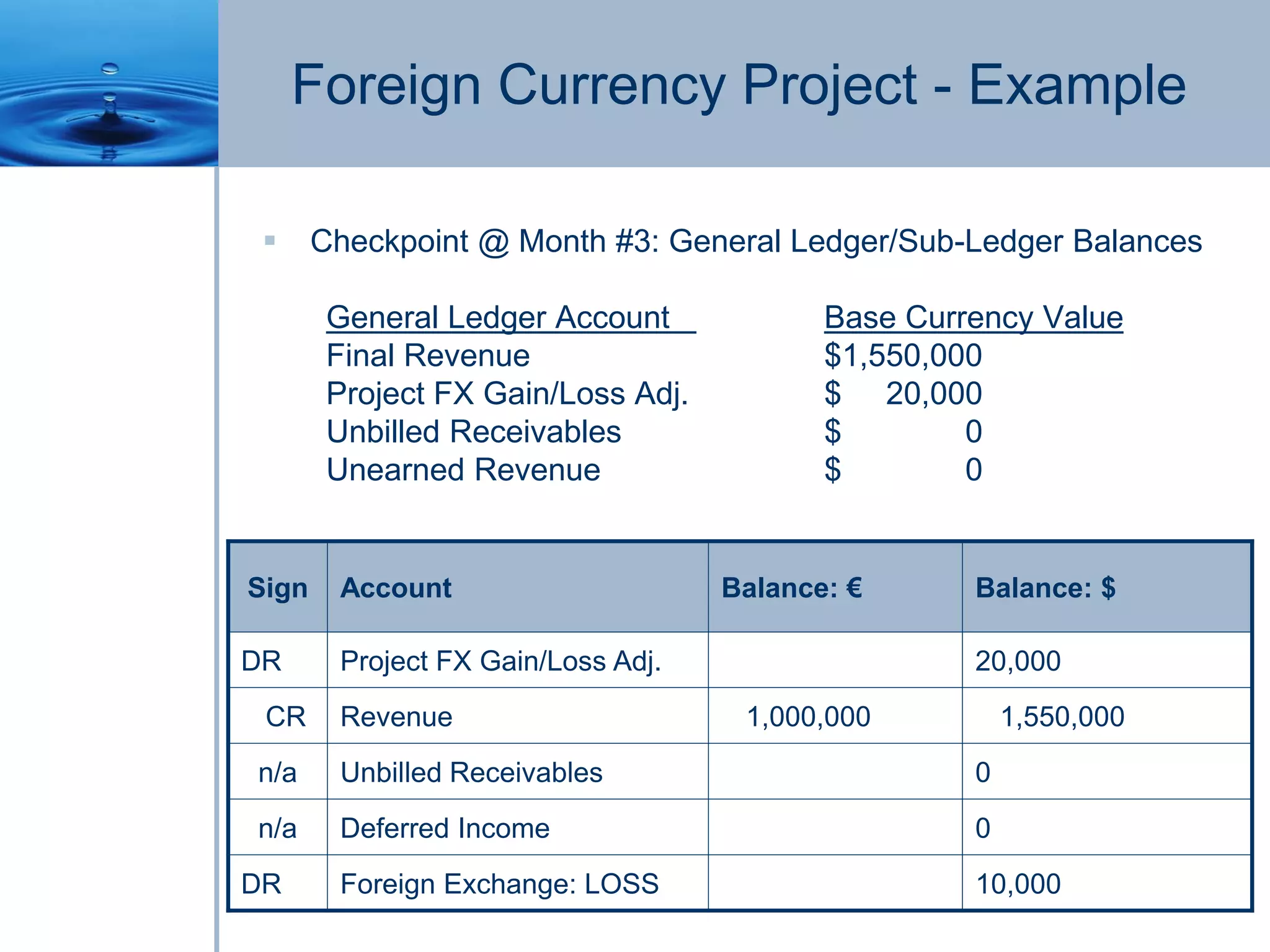

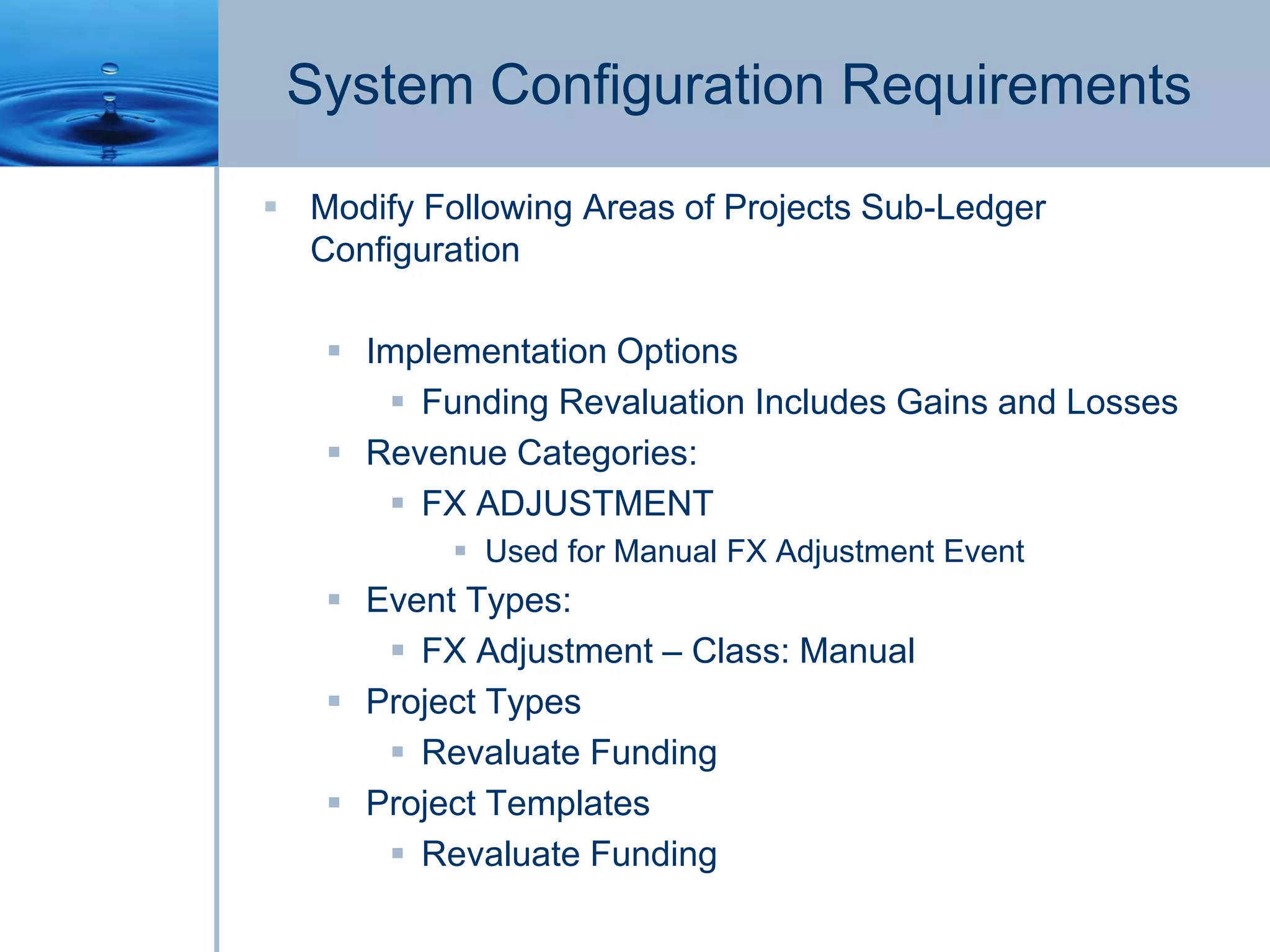

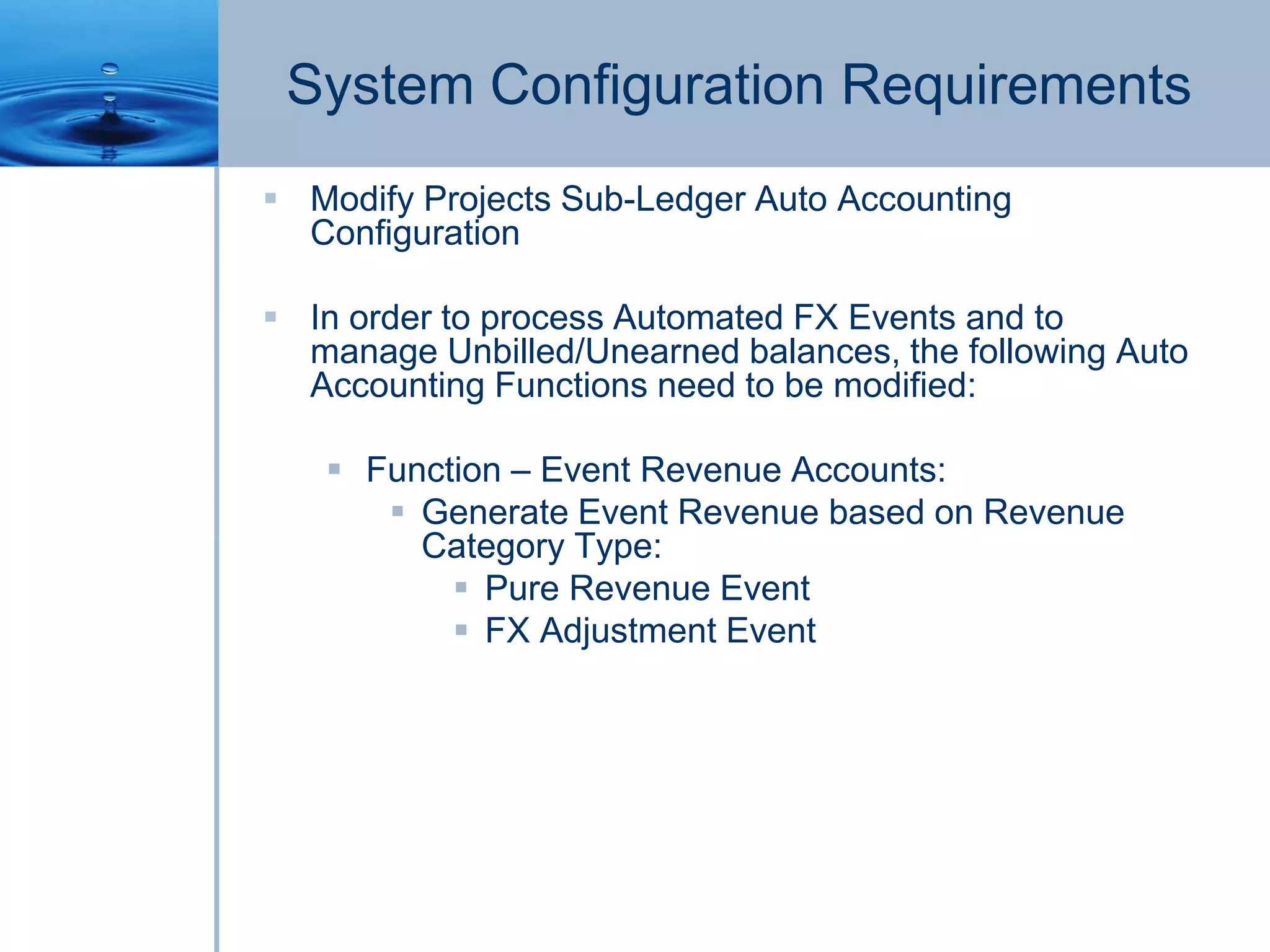

This document summarizes the key processes and accounting entries for managing foreign currency revenue in an Oracle projects implementation. It includes an example of a foreign currency project covering customer invoicing, revenue recognition, and clearing unbilled receivable balances. It also outlines the required Oracle modules, configuration changes to the projects and general ledgers, and information flows to support foreign currency revenue and accounting.