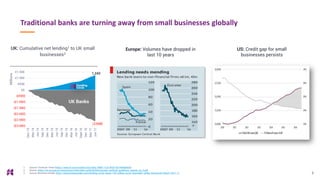

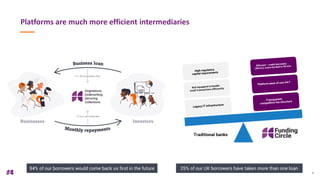

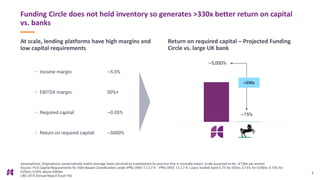

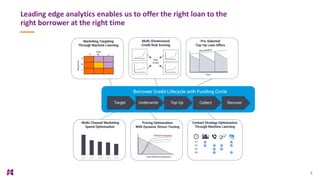

The document outlines the mission and activities of Funding Circle, a leading global lending platform for small businesses, which connects entrepreneurs with capital across Europe and Israel through various conferences. It emphasizes the inefficiencies of traditional banks in lending to small businesses and highlights Funding Circle's superior margins and analytics-driven approach for better customer experiences. The document also provides insights into Noah Advisors, a corporate finance boutique focused on the internet sector, detailing their successful transactions and expertise in connecting investors with opportunities.