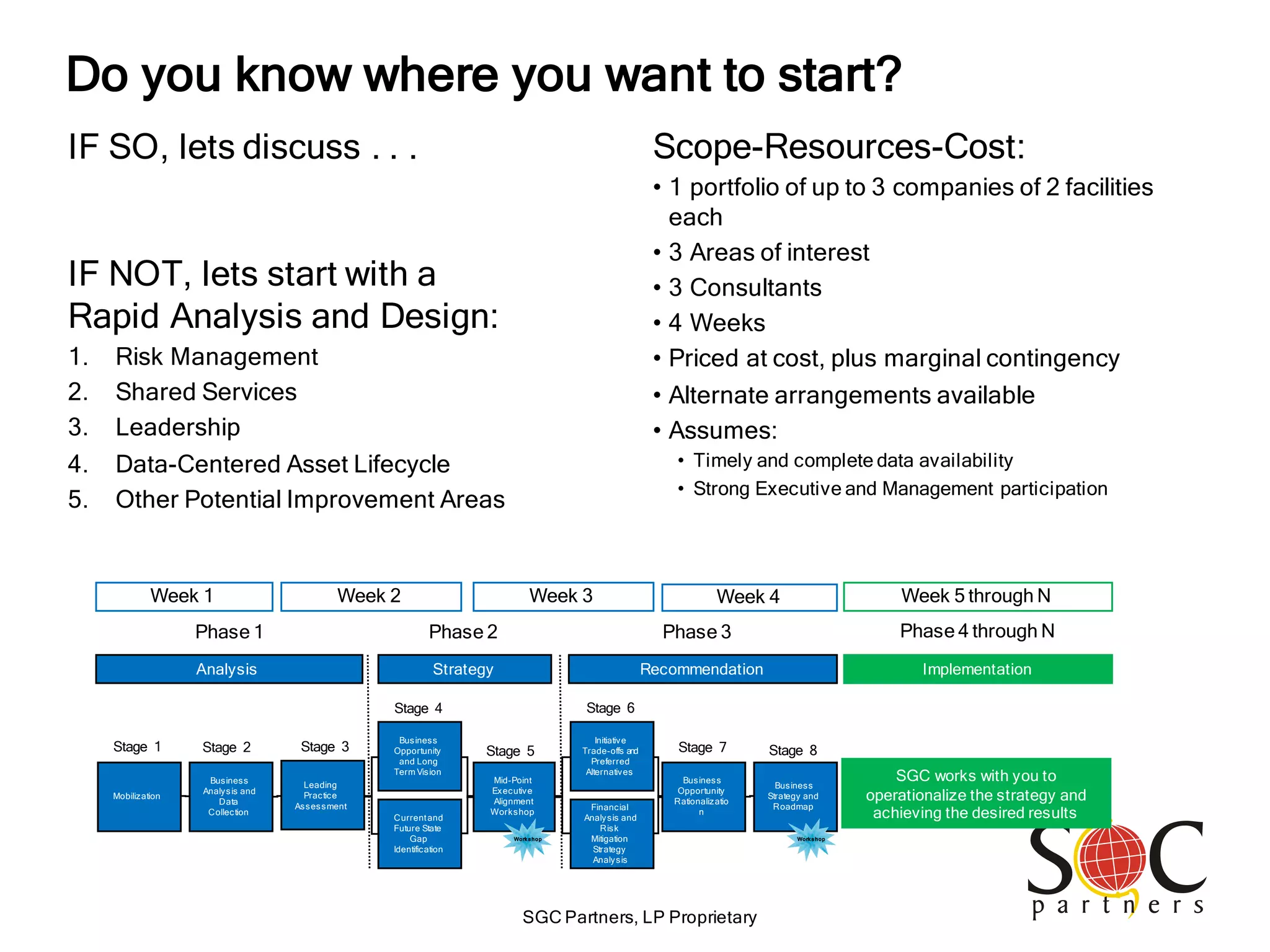

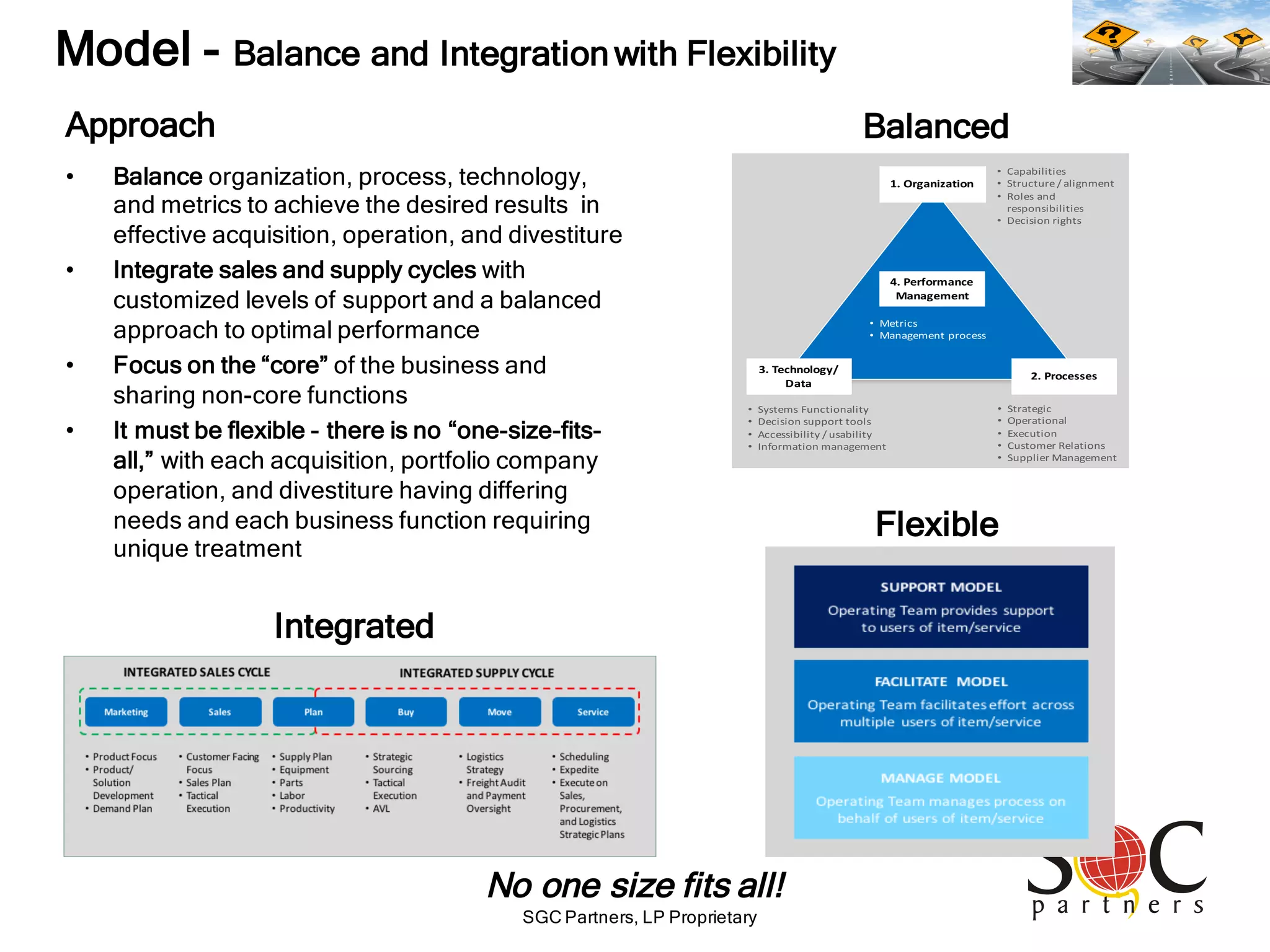

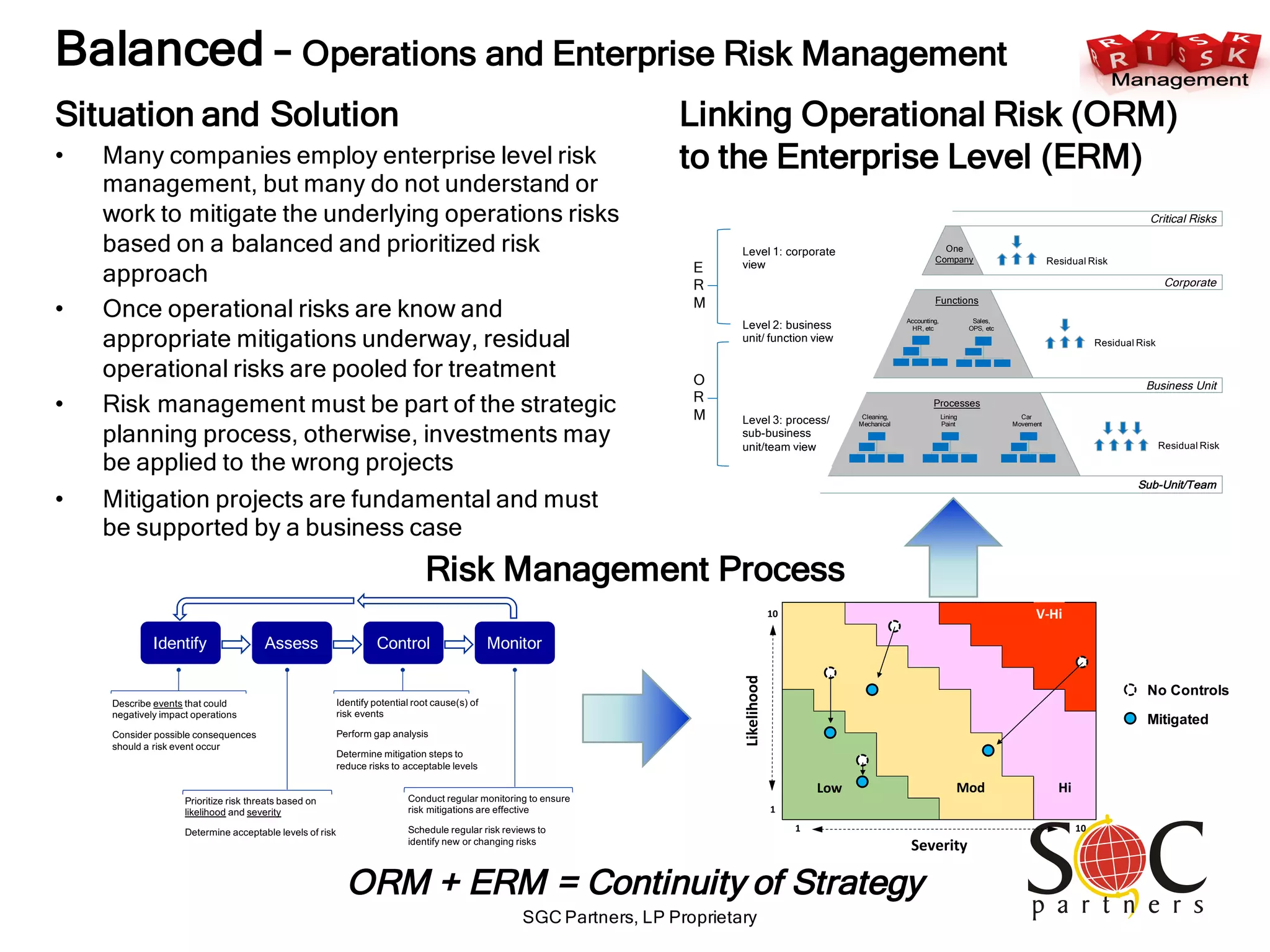

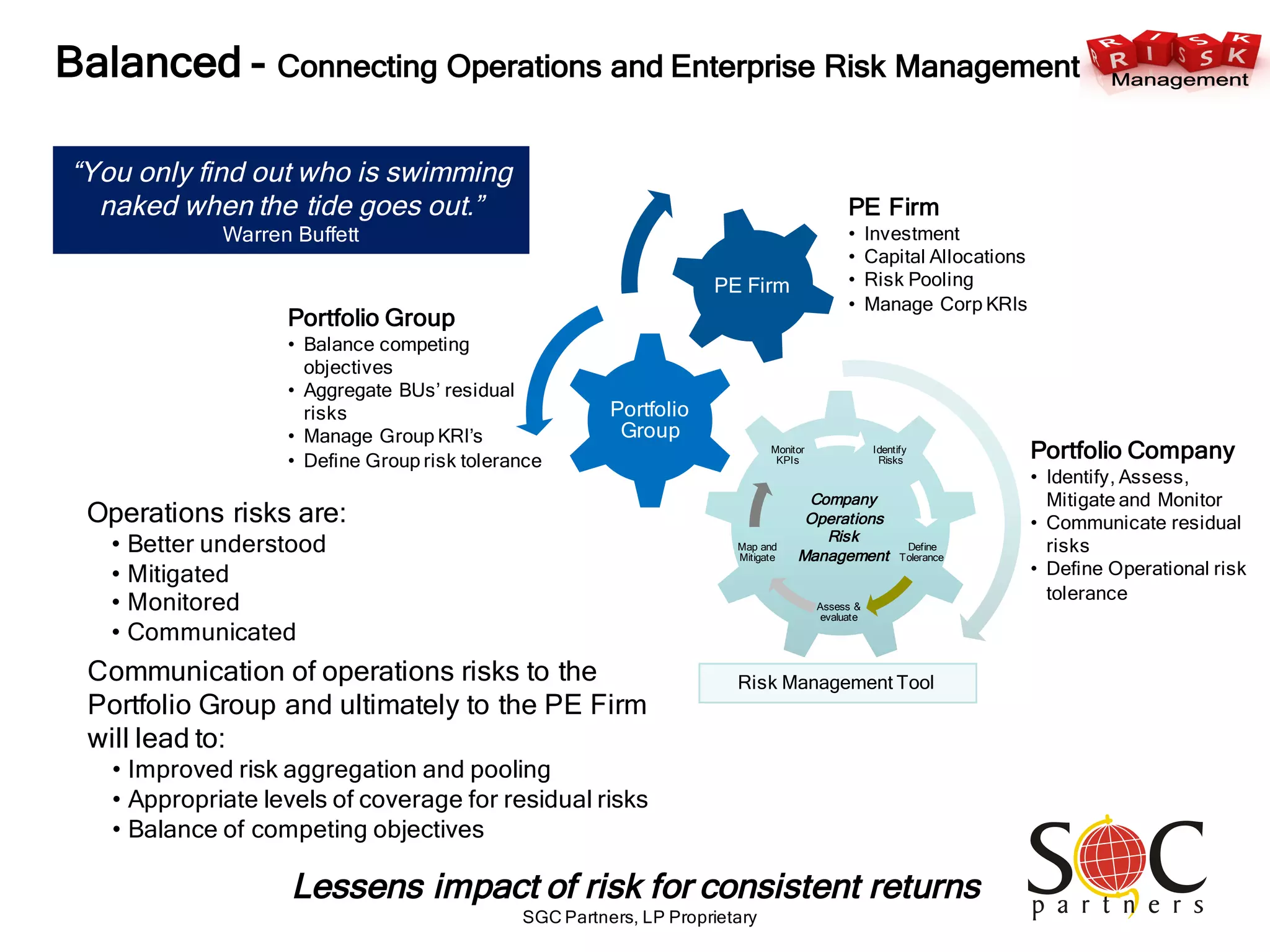

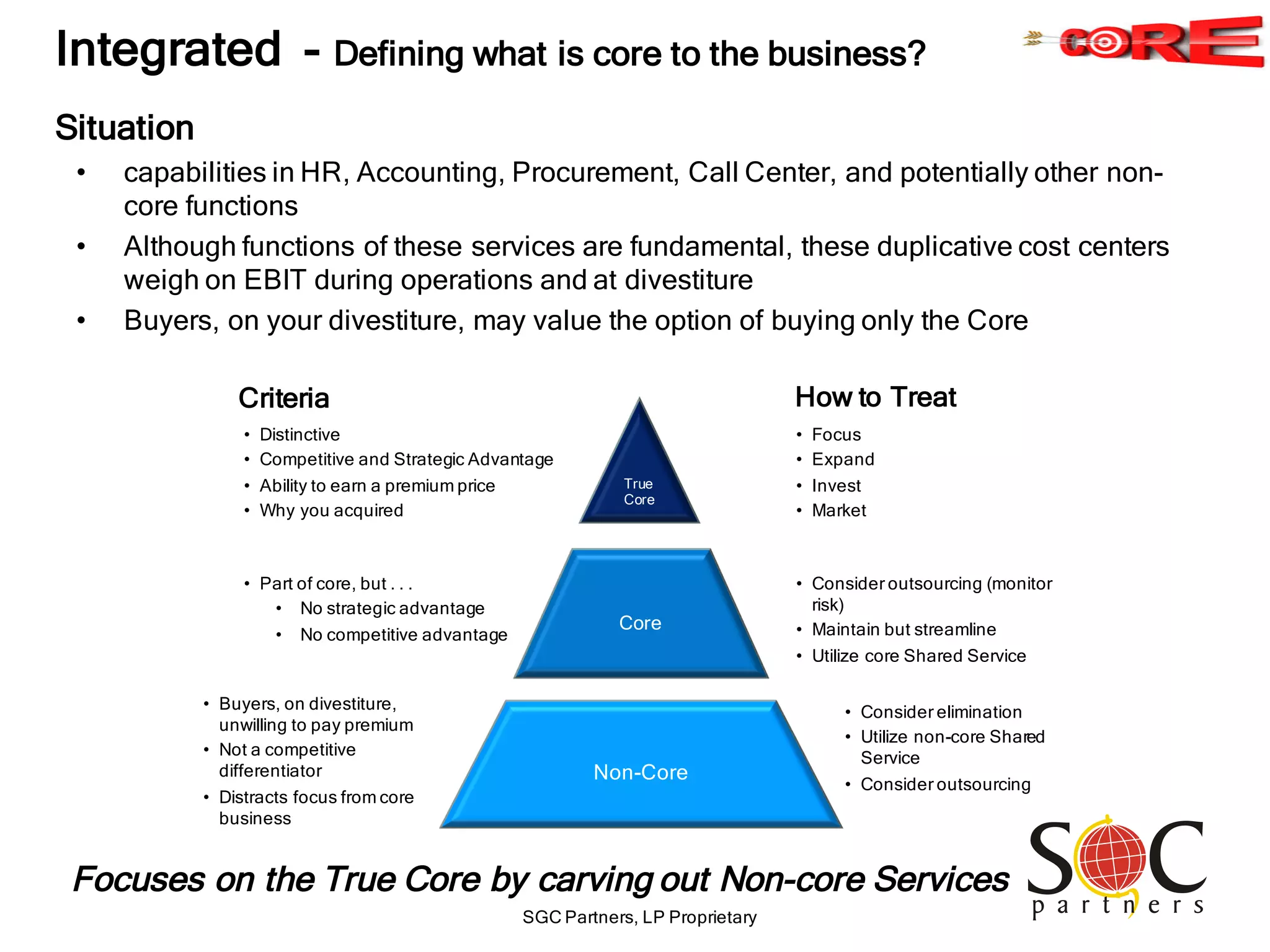

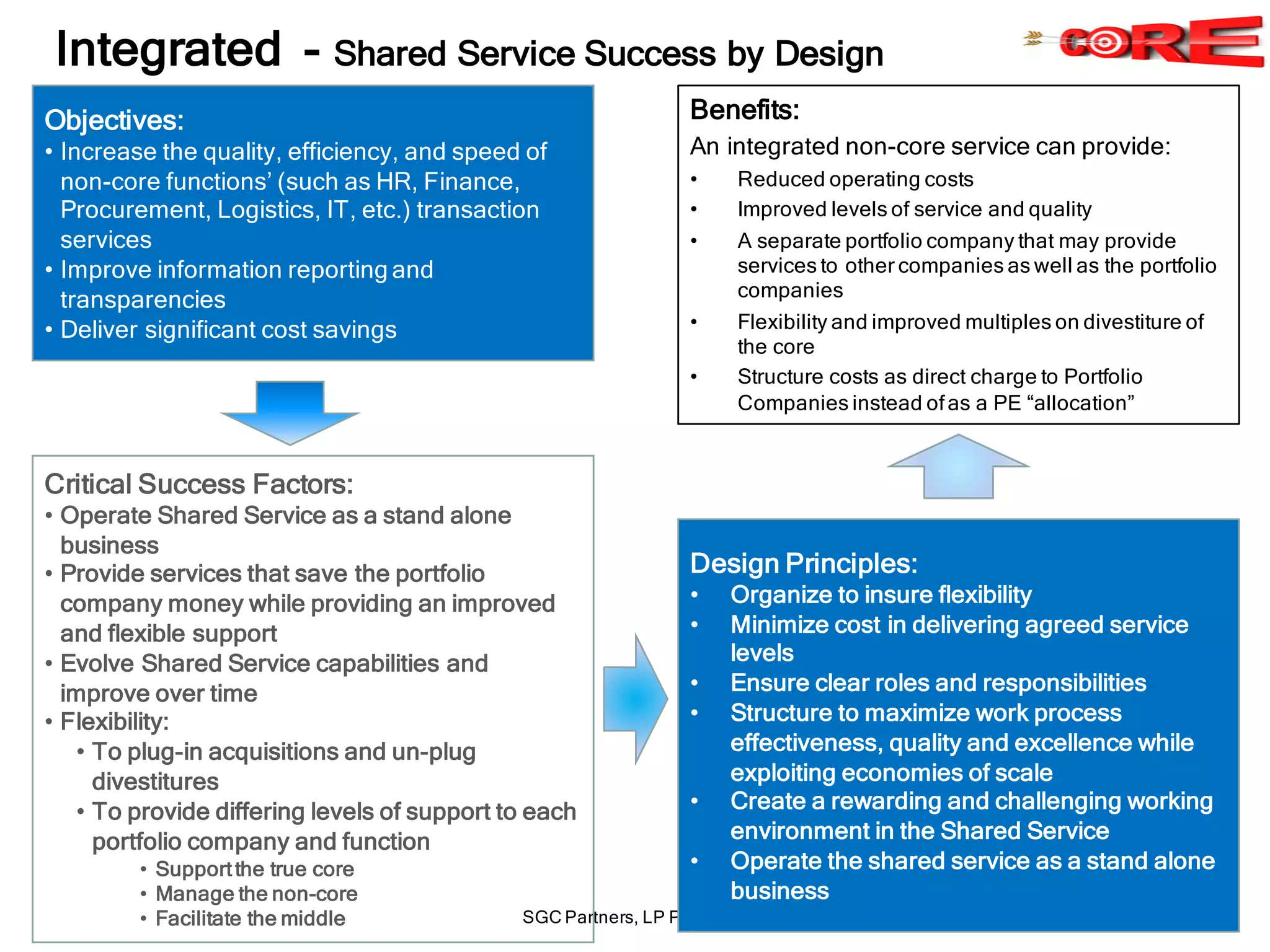

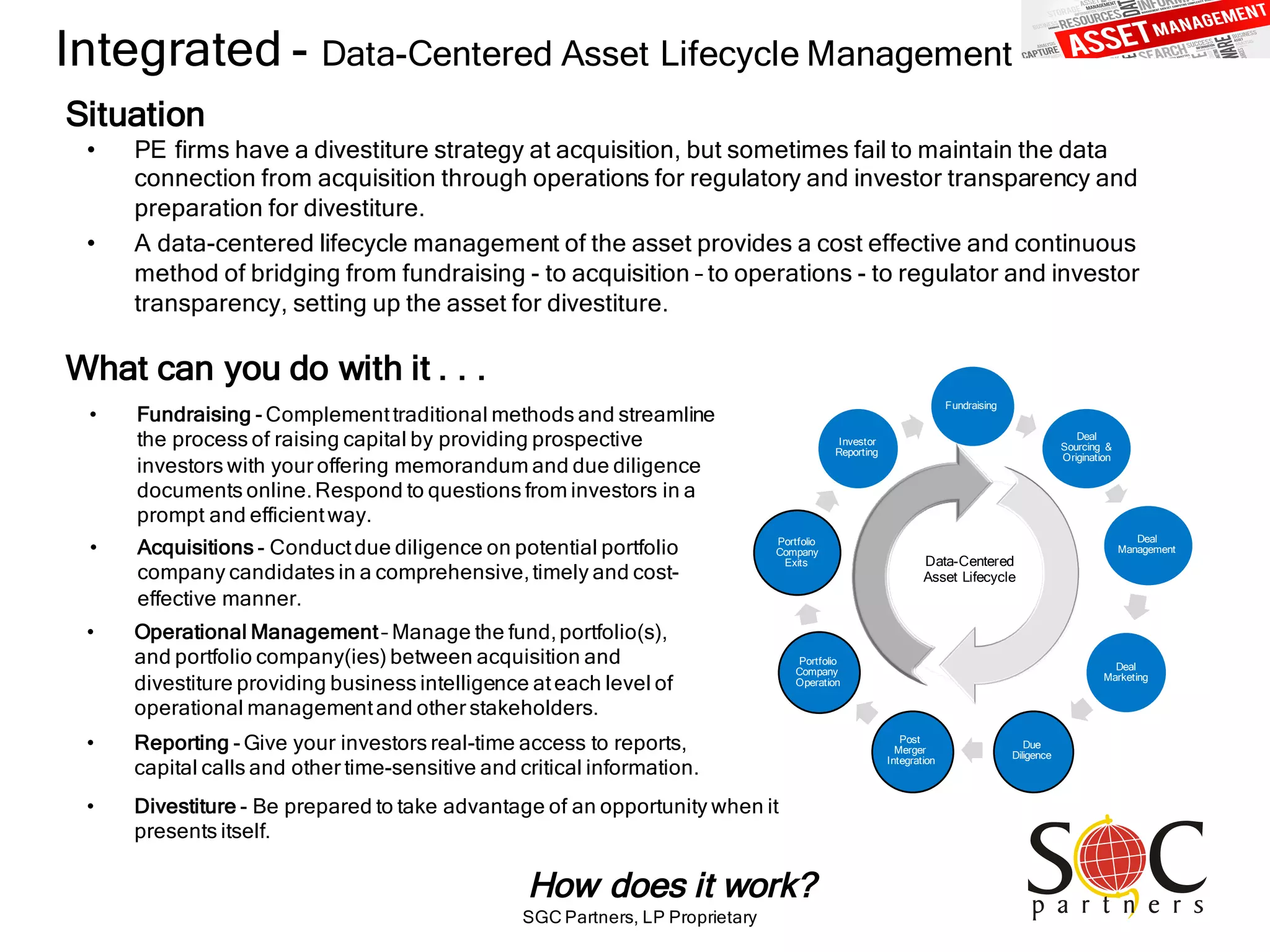

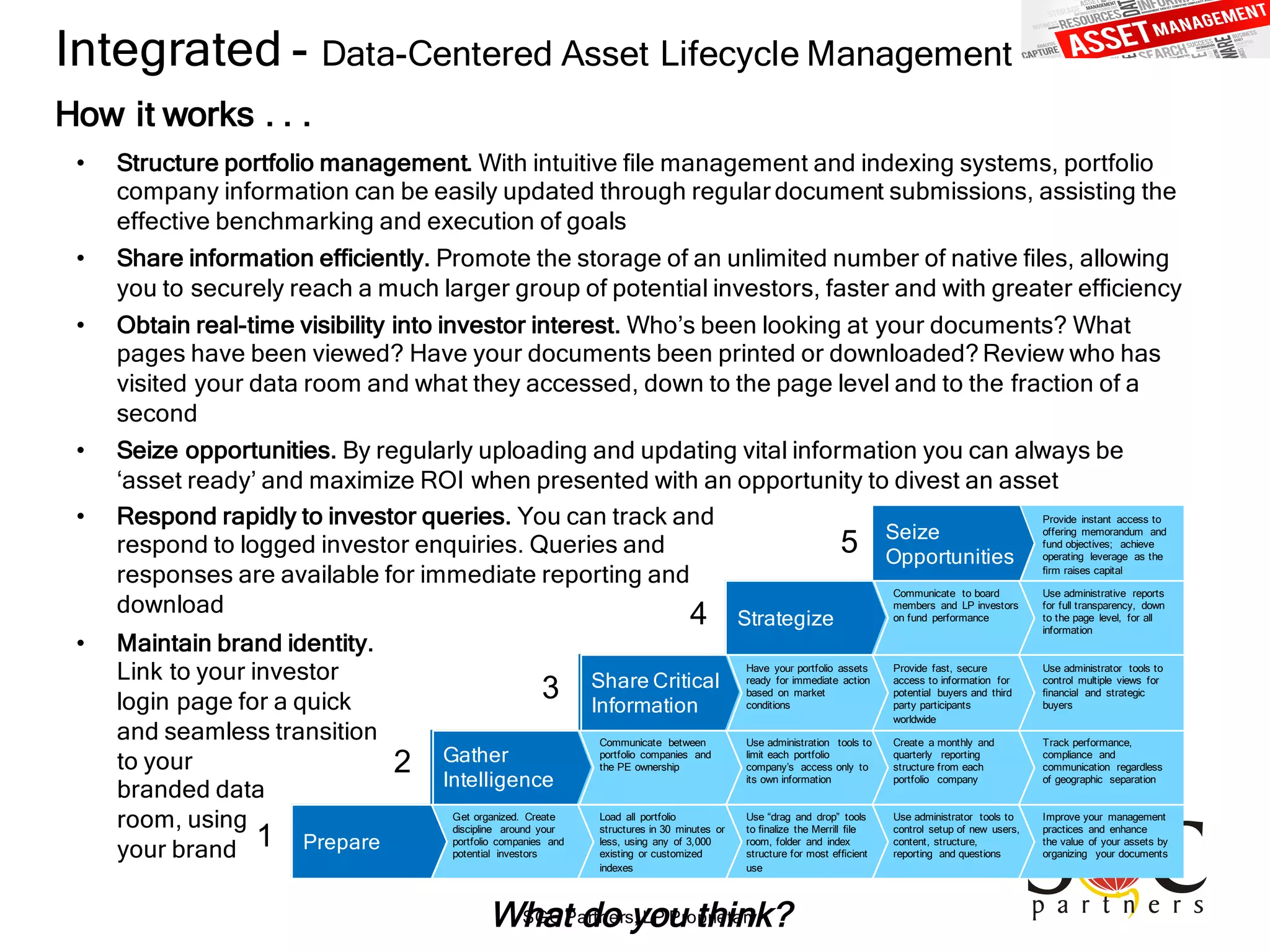

SGC Partners emphasizes the need for private equity firms to adapt to increasing transparency and regulatory demands while focusing on operational excellence to maintain competitive advantage. Key recommendations include a balanced approach to risk management, optimized leadership structures, and a data-centered asset lifecycle strategy. The document outlines major trends in 2016 affecting private equity, particularly regarding tax reform and capital availability as influenced by the presidential election.